NEOSYS Finance

NEOSYS Finance System FAQ

How do I allocate open item amounts in NEOSYS?

While entering a journal

While entering a journal entry in the ALLOC VCHS Column hit F7 Key and it will pop-up list of allocatable items. Allocate the amount with the correct voucher no. and amount and click on OK.

By Vouchers Allocation file

Once the journal is posted without allocation, you can only allocate from the Voucher Allocation Screen.

Go to Menu > Finance > Vouchers > Voucher Allocation. Enter the account number or hit the F7 key on the Selected Account(s) field and select the relevant account from the particular subsidiary chart. Click OK and the Voucher Allocation page will show.

If the account selected is a DEBITS outstanding type account (i.e. Trade Debtors), then all the allocable/unallocated CREDIT items (i.e. Receipts, Credit Notes etc.) will show up. Click on any item you wish to allocate Debit items against. After you click you will get a list of all DEBIT allocable/unallocated items which you can now select to be allocated against the CREDIT item you earlier selected.

In case you have a selected a CREDITS outstanding type account (i.e. Trade Creditors), then the opposite happens i.e. DEBIT items show first (Payments, Debit Notes etc) and if you click on any of these items you can allocate them against CREDIT outstanding items.

For accounts that have neither CREDIT or DEBIT type selected, the CREDIT items show first.

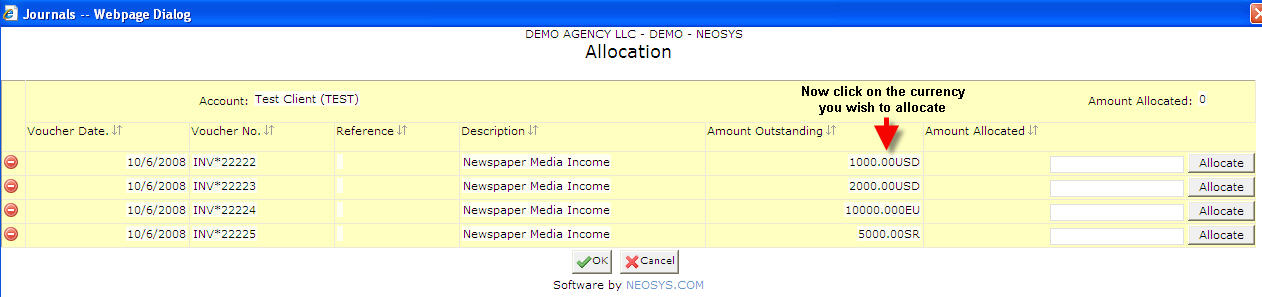

Why can I not see ALL allocable items in the Allocation screen?

Open item accounts with a lot of transactions might face this issue. The allocation screen cannot handle an unlimited number of entries so it shows the oldest first and omits the newest.

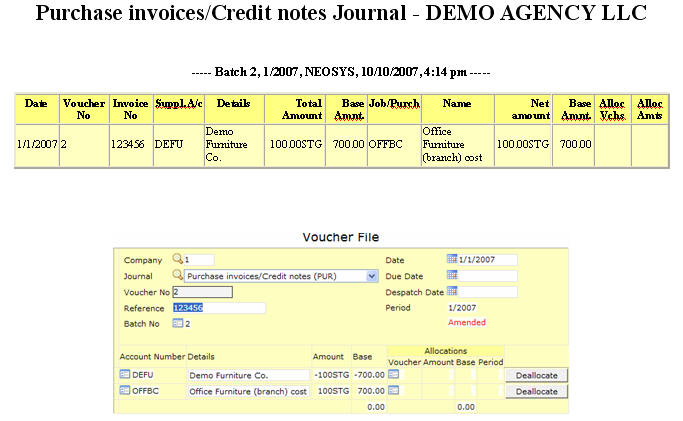

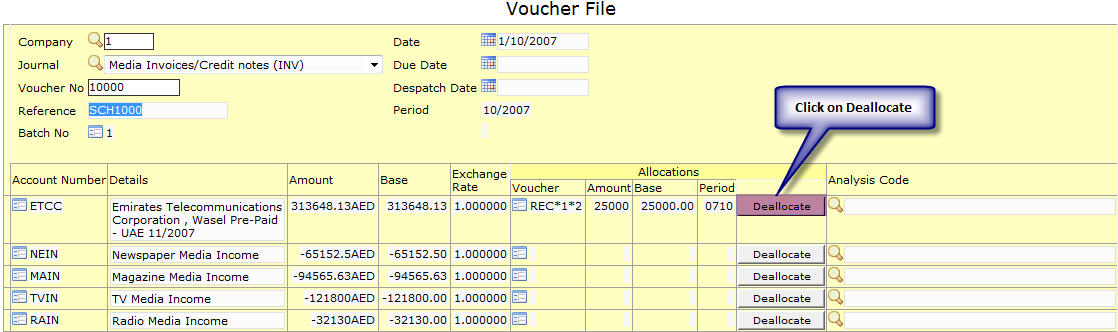

How do I deallocate already allocated vouchers?

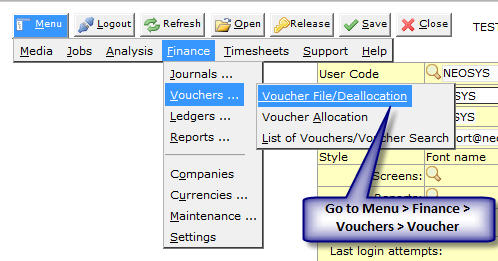

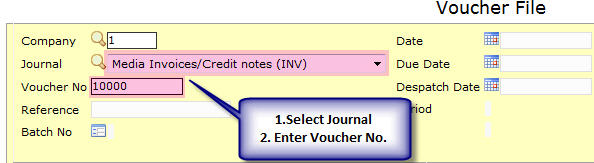

- Go to Menu > Finance > Vouchers > Vouchers file/Deallocation.

- Select the Journal type and enter the voucher number.

As you enter the voucher number system will show the all the vouchers allocated on the bottom right to that voucher. - Click on the Deallocation button.

- Select the Vouchers you want to deallocate and click OK.

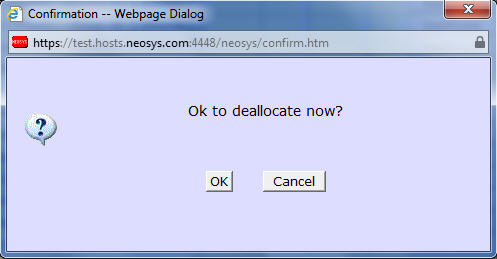

- As you click OK system will reconfirm your move by giving a pop up "Ok to deallocate now?" click on OK.

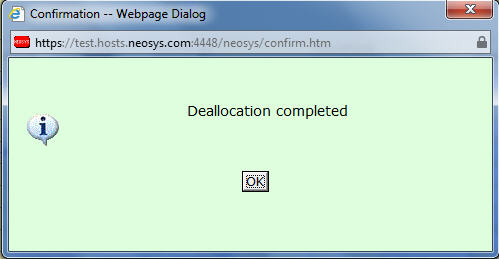

- You will see an another pop up "Deallocation Completed"

How do I enter supplier invoices for non media / non job items?

In due course of business you might need to purchase items which are not media nor job related.

The only way to enter this is:

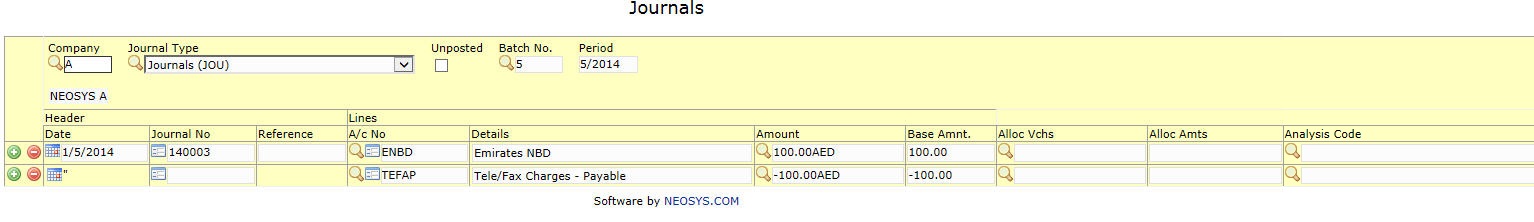

- Go to Menu > Finance > Journals > Journal Entry / Query.

- Select JOURNAL (JOU) type and enter the relevant purchase entry here.

How do I enter supplier credit notes for non media / non job items?

The only way to enter this is:

- Go to Menu > Finance > Journals > Journal Entry / Query.

- Select JOURNAL (JOU) type and enter the reversal / credit note entry (exact reversal of the supplier invoice you entered initially with the particular amount).

How do I cancel an already issued/posted Payment/Receipt?

There is no way to delete any journal in NEOSYS, especially the Payment Voucher, to maintain record for auditors.

If you need to cancel an already posted Payment/Receipt voucher:

- Deallocate any items which you allocated at the time of entering the voucher.

(This frees up the Payment/Receipt voucher to be allocated against a reversal entry and also frees up the allocated item (Supplier/Client Invoice) to be allocated against another voucher) - Do a reversal entry of exactly the same Payment/Receipt voucher and allocated the same to the actual entry. Thereafter you can enter the new Payment/Receipt.

What happens if I post the same supplier invoice twice?

NEOSYS allows the same supplier invoice to be posted in two different ledgers.

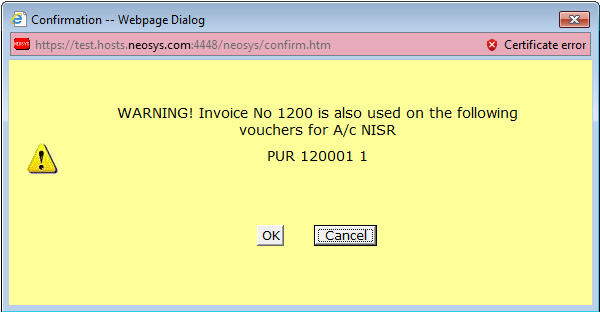

However, a warning message (shown below) is displayed, when you try to enter a purchase invoice number which is already existing in the same supplier a/c.

Can I allocate to unposted vouchers?

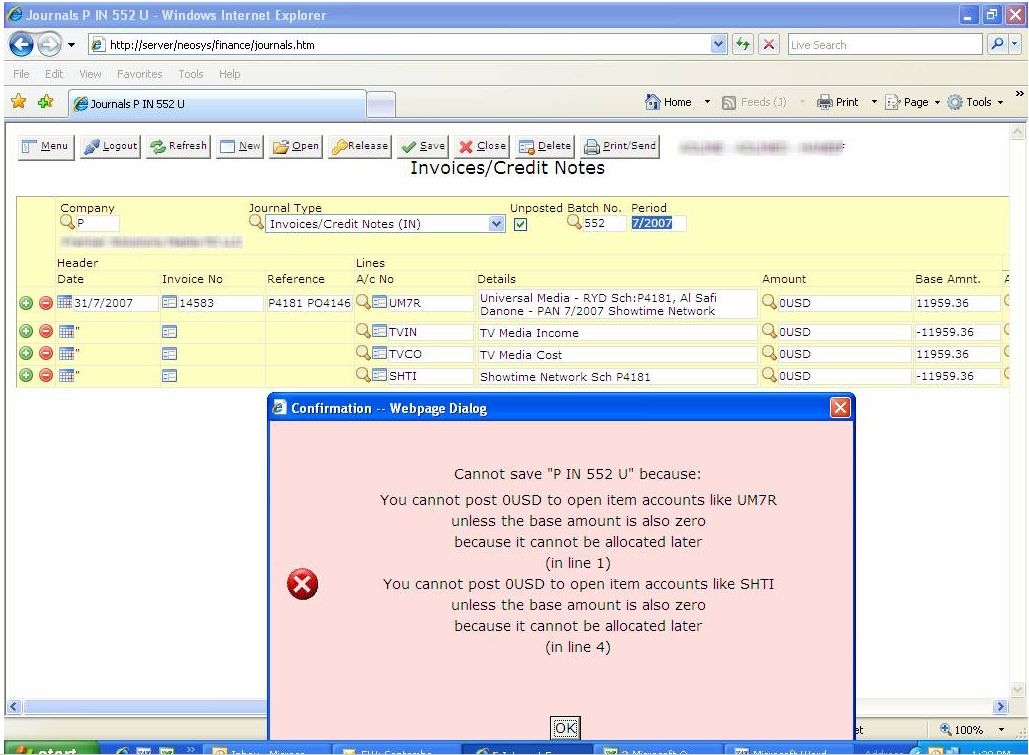

NEOSYS allows allocation to UNPOSTED vouchers (e.g. receipts to unposted invoices) but you can only save the batch (or receipts) as unposted until the unposted vouchers (invoices) have actually been posted.

While you are allocating you can see which vouchers are unposted because there is a * in the reference number. There is no way to avoid showing unposted vouchers at the moment.

Can I allocate vouchers within a batch?

Yes, you can allocate a voucher to another voucher which are in the same batch. In order to do so, post the batch and use the Voucher Allocation screen to allocate to the correct voucher. For example an Invoice and a Credit Note can be in the same batch and they can be allocated to each other after posting, via the Voucher Allocation screen.

Can I view a voucher file before the batch is posted?

Yes, you can view voucher files by saving a journal batch as unposted/unposted without validation, then clicking on the link in the Voucher column.

This will open the voucher that the system wants to generate. The actual voucher number will not be generated until the batch is posted.

If a journal batch cannot be saved due to an error, then you can save the batch by choosing "Save as Unposted Batch WITHOUT VALIDATION" option, then view the voucher file and possibly find the cause of the error.

How do I sort the Journal Audit Report according to Invoice Number?

The journal audit report is ordered as per the date and time of posting as per audit rules. Hence It cannot be sorted on any other fields.

If a simple list of invoices is required then please use the list of invoices from the media or job invoice menus. (See List of Invoices)

How do I amend / repost journal entries?

Posted entries cannot be modified except by NEOSYS under certain circumstances.

NEOSYS has a policy not to do corrections to postings except in special circumstances.

- Corrections to opening balances and opening items since those are a once off issue.

- Amendments requested by top management for exceptional adjustment of accounts that cannot be handled in any other way

- Vouchers are missing from posted batches. See Missing vouchers in posted batches

General errors in postings such as the financial period, account number and amounts must be corrected by reversal and correct journals.

The repercussions of granting permission to edit/repost journals would be as follows:

- NEOSYS Financial Module can no longer be trusted if postings are subject to modification

- It is not common practice to do such manipulations

- It can lead to possible errors in numbers

- Staff can become complacent and careless while posting entries and frequently ask for this permission

So, restricting users from editing/reposting journal entries promotes a more healthy and vigilant working environment where users verify each journal entry before posting it which effectively leads to good accounting practices.

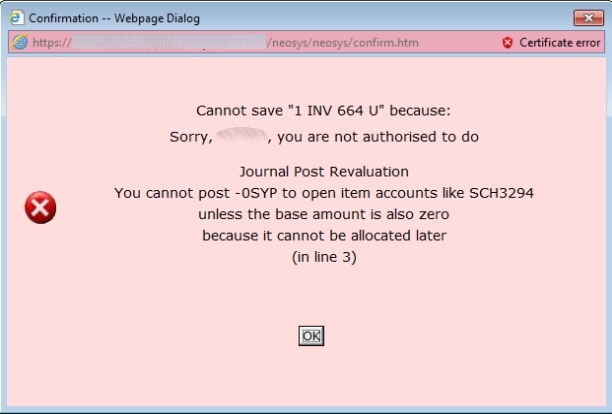

The NEOSYS software for reposting journals appears to but does NOT work for posting which have already been allocated. It creates cross check balance errors in the open item accounts. To avoid this, any allocations can be de-allocated ESPECIALLY when the account number is being changed or the amount is being reduced or the currency changed.

The following information can be changed by authorised users even after posting. In the Voucher File and therefore on the detail ledger account/statement: Date, Due Date, Despatch Date, Reference, Details, Analysis Code and allocation. See What can I change in the finance voucher after posting?. Unfortunately the journal printout is unchanged by any amendments and remains as it was entered.

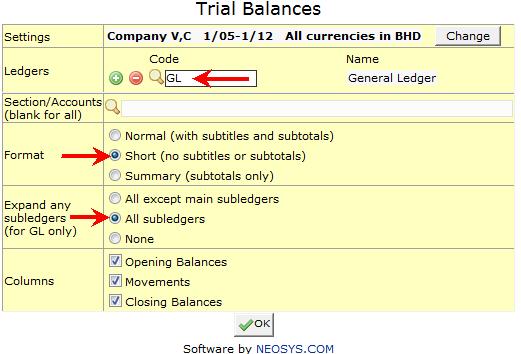

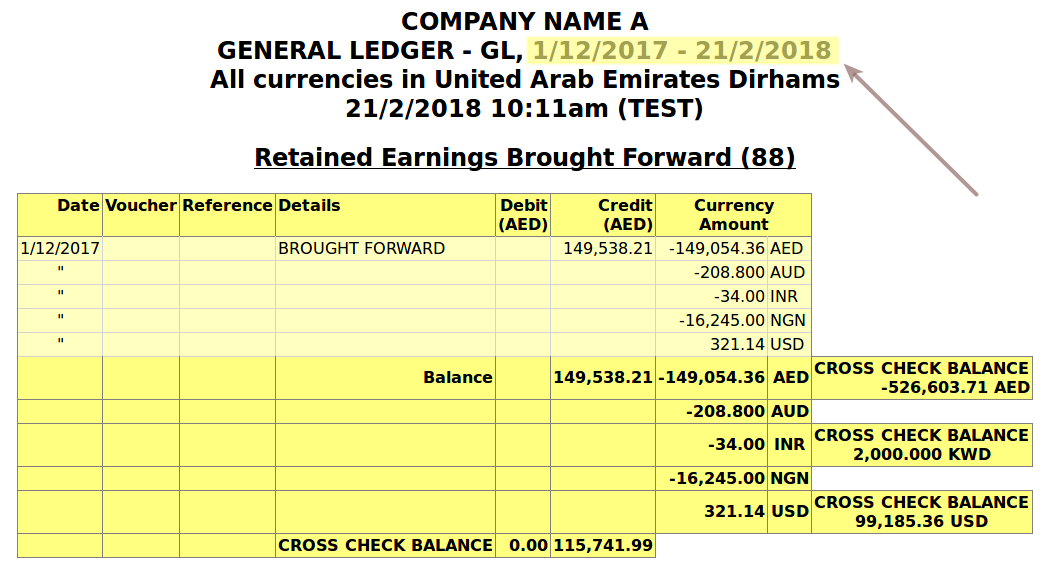

How do I print all accounts in one trial balance?

To print all accounts in a single trial balance you must print the General Ledger (GL) and select SHOW ALL SUBLEDGERS option. You can also make use of the SHORT VERSION option.

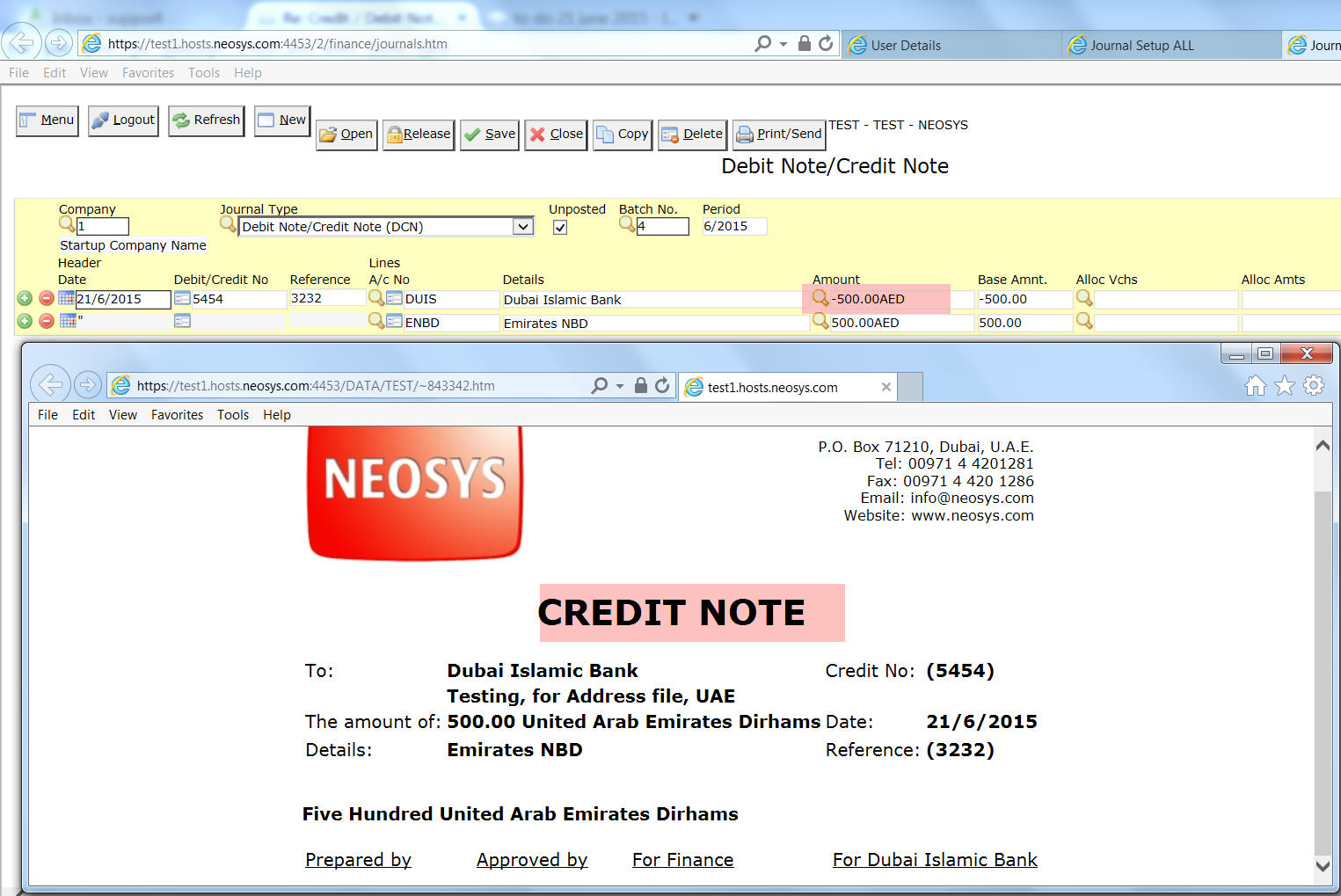

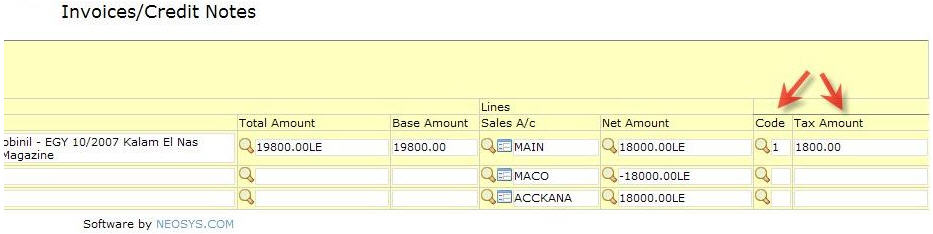

How do I issue Debit/Credit Note in Finance?

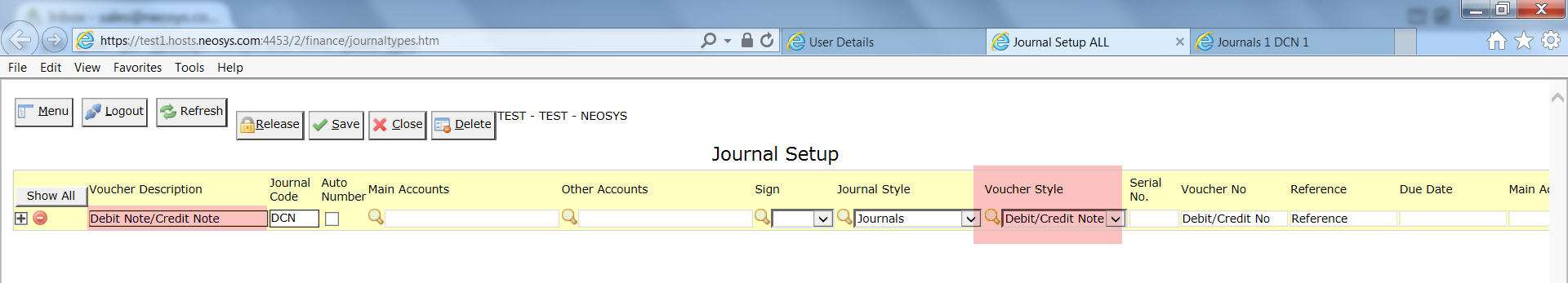

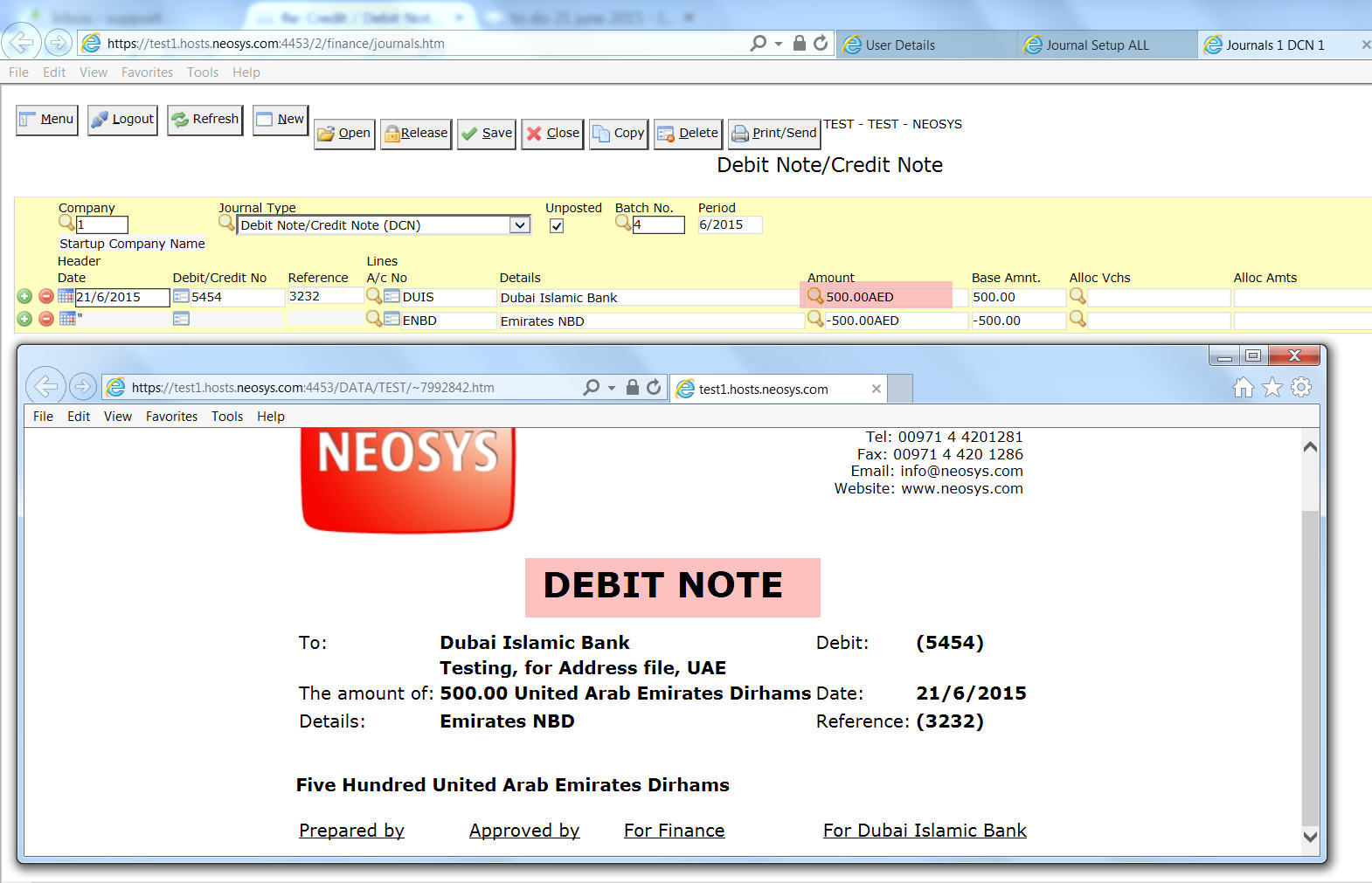

In Journal Setup, enter Voucher Description as "Debit/Credit Note" and select voucher style from the drop-down menu as "Debit/Credit Note". The "/" entered in the Voucher Description is used to give two alternate names for the same heading depending on whether the main account is debited or credited.

For example, for a voucher entered for this journal type, when the main account is DEBITED, when you click on the Print/Send button, the document generated will say "DEBIT NOTE".

Similarly, when the main account is CREDITED, when you click on the Print/Send button, the document generated will say "CREDIT NOTE".

The same trick is used for "Invoice/Credit Note", ie, simply enter Voucher Description as "Invoice/Credit Note" and select voucher style from the drop-down menu as "Debit/Credit Note". Depending on whether the main account is debited or credited, the Journal Print document will show either "Invoice" or "Credit Note" as the heading.

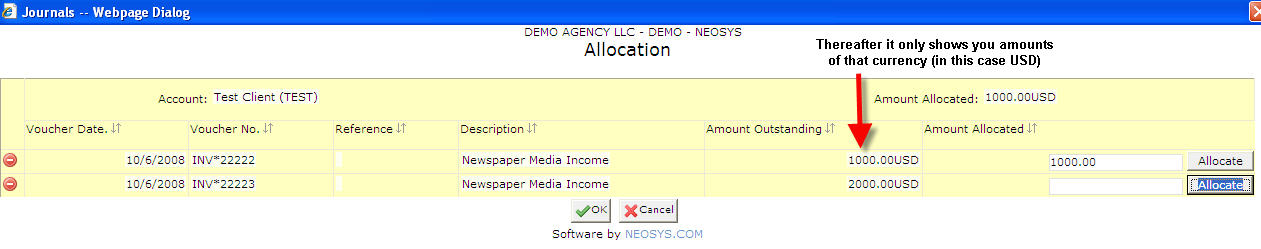

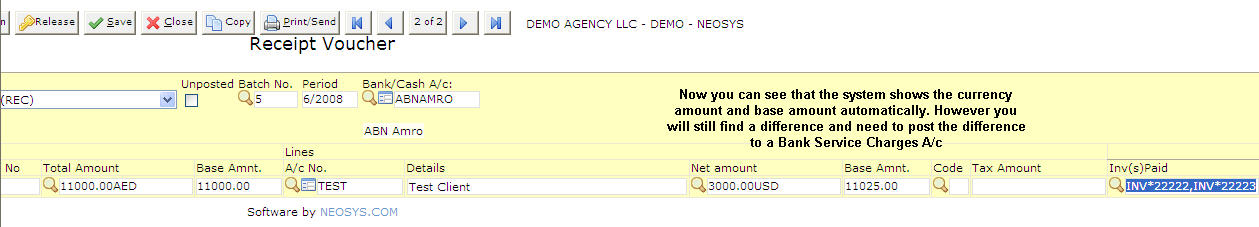

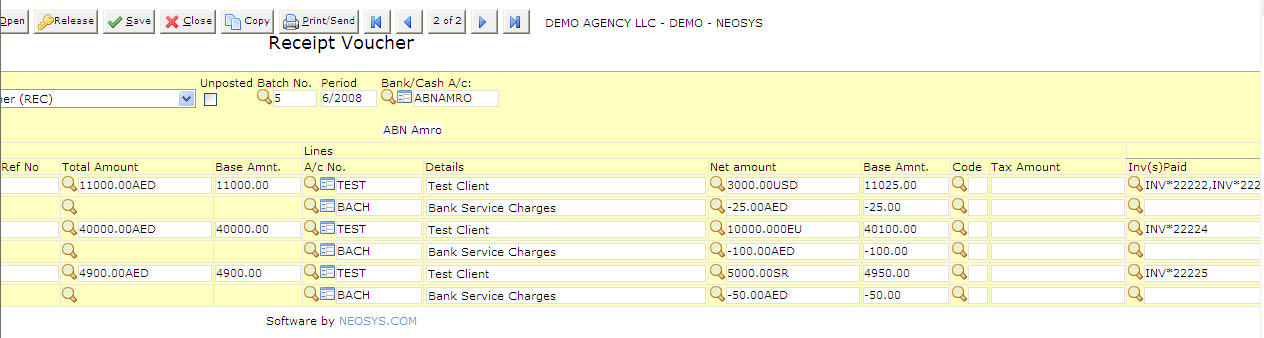

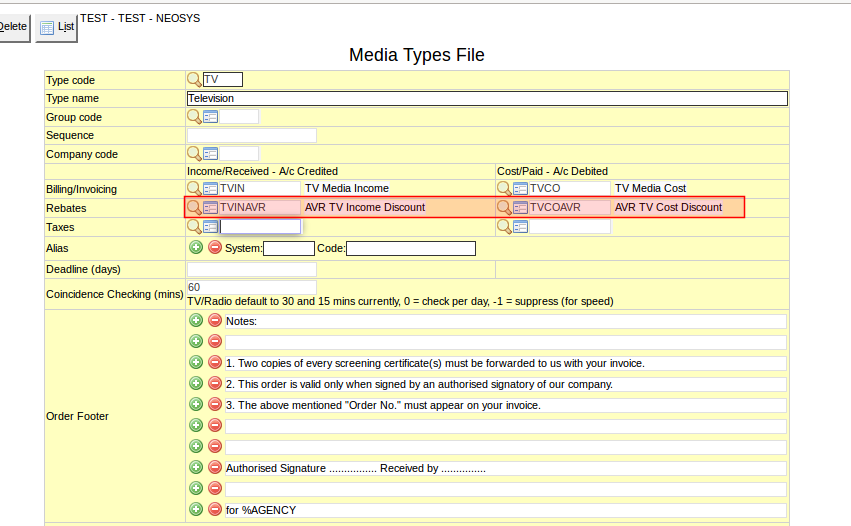

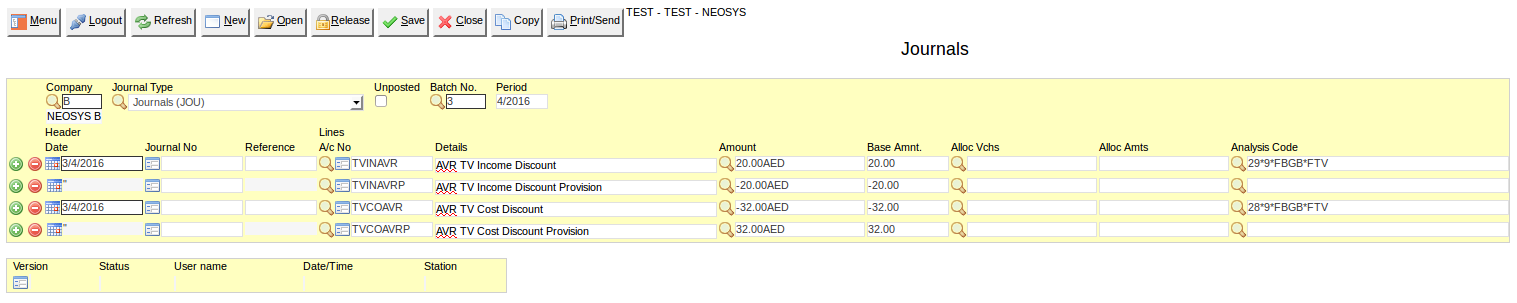

How is revaluation handled in NEOSYS?

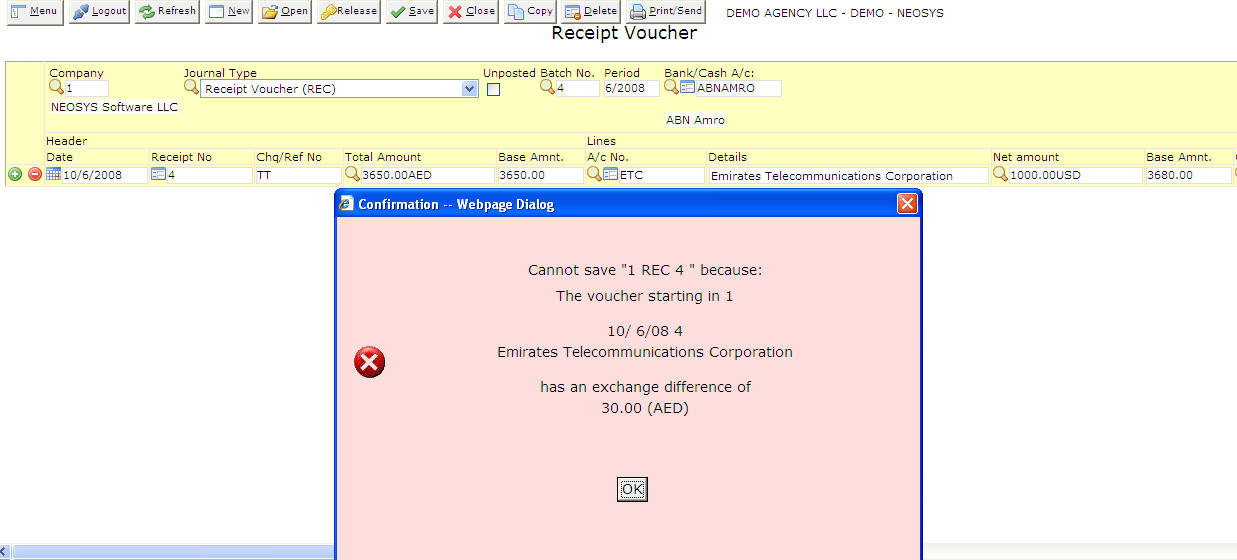

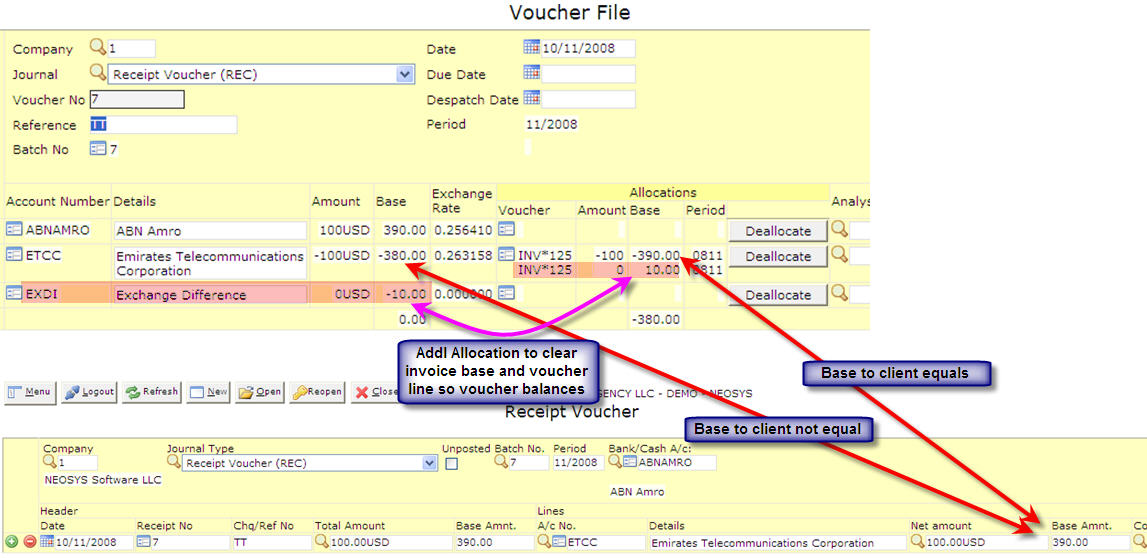

When a voucher is allocated, NEOSYS automatically checks if there is a difference in base amounts and records the exchange difference by either creating/posting a revaluation voucher or amending one of the vouchers to record the exchange gain/loss.

When does NEOSYS automatically create and post a revaluation voucher?

A Revaluation voucher is created when a user allocates two posted vouchers using the 'Voucher Allocation' feature.

When does NEOSYS amend the latest voucher to record the exchange gain/loss?

Vouchers are amended when a user allocates one or many posted vouchers to a unposted journal within the 'Journals' screen.

Which period will the revaluation voucher be posted into?

The RV voucher is posted into the same period as the allocation period. There are three options in Voucher Allocation page to set the allocation period.

- 'Current period' - The allocation and RV voucher will use the current calendar period.

- 'Use Settings from above' - The allocation and RV voucher will use the latest period from the range of periods set in the Settings. For example, if range is 1/2020 - 12/2020, the RV voucher and allocation will use 12/2020.

- 'Backdated as far as possible' - The latest voucher period out of the two vouchers will be used by the RV voucher. However, if that period is closed, then use next open period. For example, if a JOU batch is posted in 1/2020 and the corresponding REC in 2/2020, then the allocation period used will be 2/2020. If the periods have been closed till 3/2020 in Finance, then the RV voucher would be posted into the next open period, 4/2020.

What is the “RV” allocation without a voucher number that shows in the Voucher File?

An allocation stating RV without any voucher number is caused by a revaluation process on open item accounts.

Revaluation of open item accounts is performed by calculating the base adjustment on each outstanding foreign currency item and posting ONE RV voucher PER ACCOUNT for the total. The RV voucher is allocated to the individual vouchers but unusually the voucher number does not show. The system was initially designed this way in order to avoid a potentially very long list of allocations on RV vouchers.

The lack of voucher number makes it hard to verify the allocation is correct, however you can trust that it is correct if the usual chain of checks and balances provided by the principle of the double entry proves the whole system is ok.

It is planned to change NEOSYS to show RV voucher numbers in all cases.

Why does voucher allocation show nothing to allocate when there are debits and credits on the account?

In some abnormal circumstances there may be items outstanding on an account which have base amount outstanding but no currency amount outstanding. NEOSYS allocation procedure works only on outstanding currency amounts so these items cannot be allocated.

Solution: Run the revaluation program. Its job is to amend the outstanding base amount to agree with the outstanding currency amount at the prevailing exchange rate. Since the outstanding currency amount is zero, it will amend the outstanding base amount to be zero also.

Why is a revaluation journal posted in the prior year when I allocated some vouchers in the prior year?

It doesn't matter what time and date is on the clock when the allocation is done since you could be be working on 2017 accounts in 2018 and this is normal practice of course.

It matters what SETTINGS and options you choose when doing the allocation.

The allocation is done in a certain period, and any revaluation journal required and generated due to that allocation, is generated in the same period.

Note that the allocation/revaluation period cannot be up to the closed period in the Company File, so allocated vouchers in a closed year will be allocated/revalued in the first open period - or the open period that you select.

Which accounts can be revalued?

Revaluation is only performed on foreign currency tangible assets and liabilities accounts, which are subject to changing exchange rates and have a value and therefore can be revalued.

Tangible assets and liability accounts represent real value such as debtors, creditors and bank accounts.

Whereas P&L accounts are merely totals of historical movements, they do not represent any asset or liability that has a value and therefore cannot be revalued.

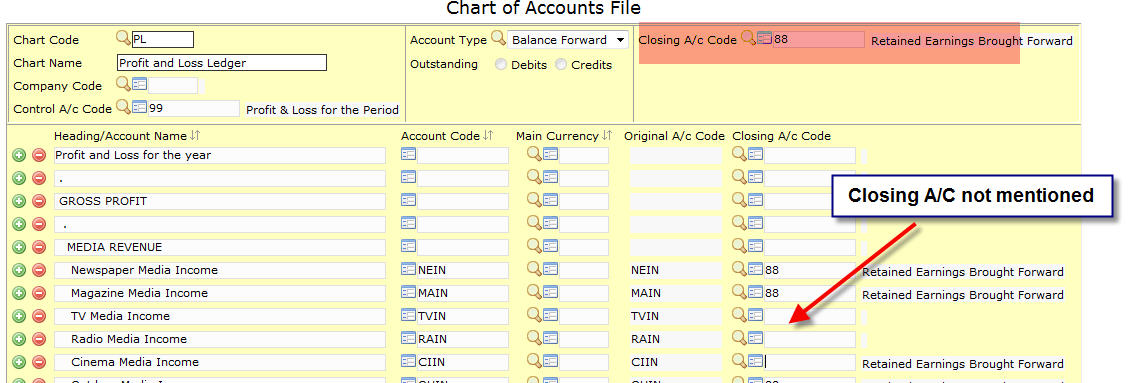

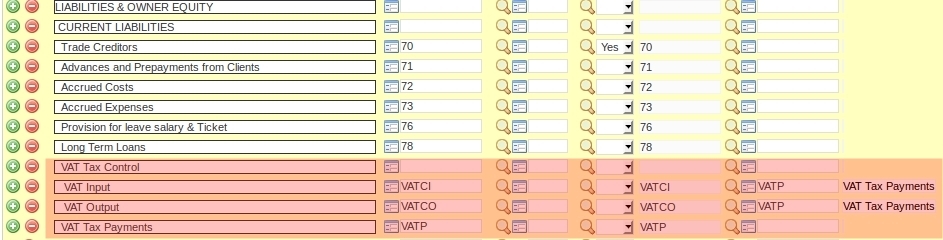

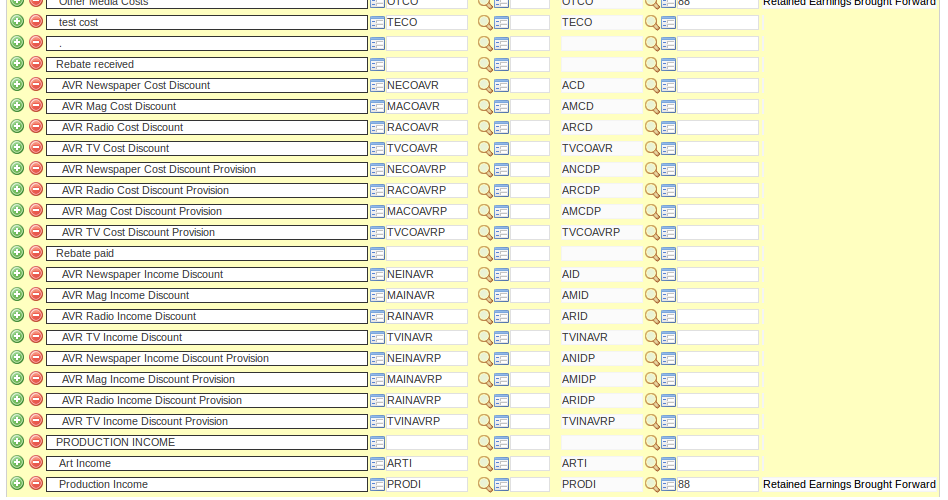

Why is closing account missing for some Profit & Loss accounts?

Retained Earnings account is the "closing account" of all the P&L accounts. This is a real account in the master chart of accounts.

If the closing A/C code is mentioned in the closing A/C field then all accounts under that ledger will automatically take the closing A/C detail even if the closing A/C code is not explicitly mentioned in each account.

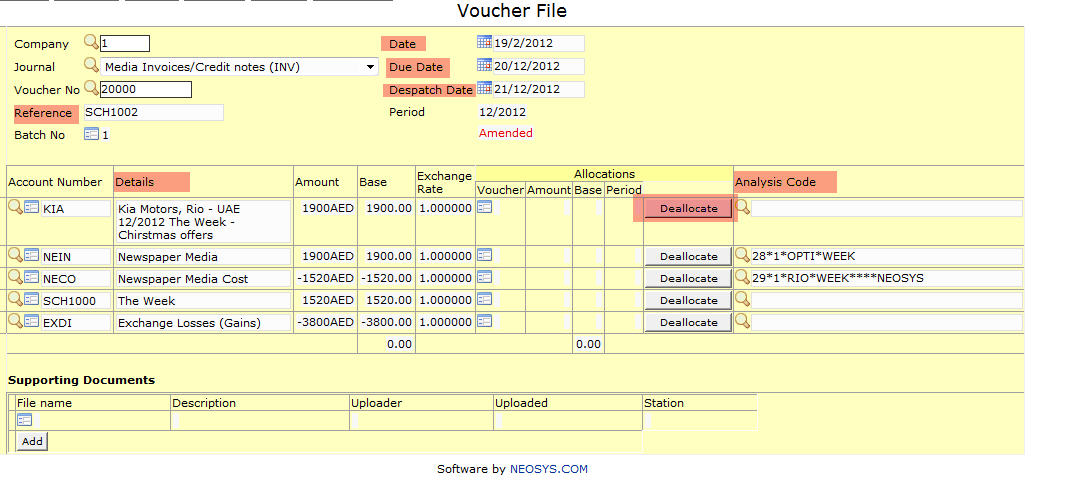

What can I change on the finance vouchers even after posting?

Finance users can amend various fields in Voucher File after the entry is posted. On saving the changes Amended will appear on the voucher file.

Following fields can be amended: - Reference, Date, Due Date, Despatch Date, Details, Deallocate and Analysis Code.

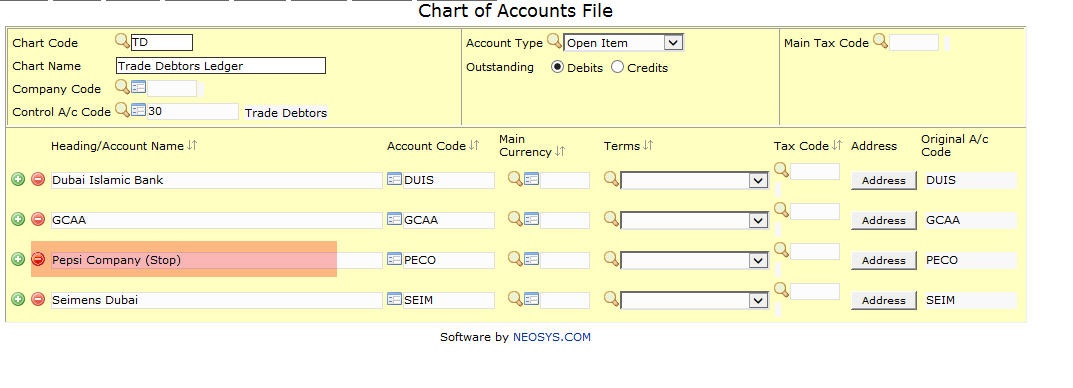

How do I stop users from posting journal entries to an Account in Finance?

Adding "(Stop)" on an account line in Chart of Accounts stops users from posting journal entries to the stopped account. If users wish to post journal entries to a stopped account remove "(Stop)" from the account line in Chart of Accounts. Users can take ledger printout for stopped accounts.

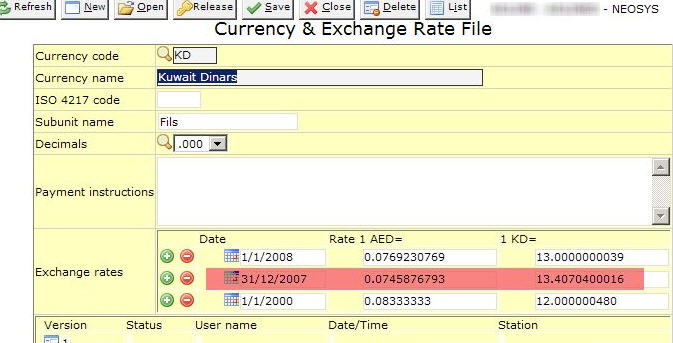

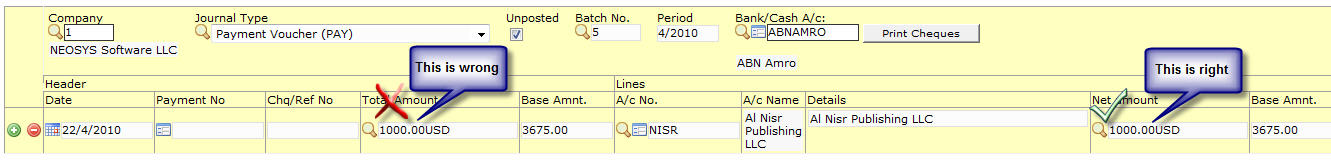

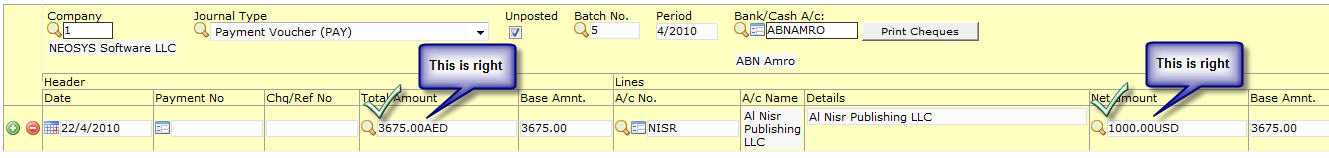

How does NEOSYS handle base and real currency balances?

The easiest way to understand NEOSYS is to imagine that it keeps completely separate double entry accounting systems for each currency and consolidates them on the fly to produce reports and ledgers for all currencies consolidated. It is easy to use NEOSYS menu settings to print reports and ledgers for individual currencies - ignoring all other currencies, or for all currencies consolidated - which is the default.

Every NEOSYS journal line has a currency code and amount. Each journal line also has (in parallel to the currency code and amount) the base currency equivalent amount of the currency amount. The base currency equivalent amount can be considered to be our best "valuation" of the currency amount when expressed in terms of the currency of our base currency.

In most cases the operator only has to enter the currency code and amount and the NEOSYS system uses its internal semi-static exchange rate files to determine the base currency equivalent amount or "value". In some cases however, for example, if there is no standard semi-static internal exchange rate for a currency, the operator is required to enter the base currency equivalent amount/value.

NEOSYS keep the base currency balance separate per currency and consolidates them on the fly to produce consolidated reports for "all currencies converted to base currency".

NEOSYS treats journals in the currency of the base currency as just another currency and not as some special currency. For example, if the base currency happens to be USD then NEOSYS can tell you a) the balances of each currency converted to USD separately b) the balance of all currencies converted to USD c) the balance of real USD excluding all other currencies. This is particularly useful when the base currency is not the main operational currency of the system.

Why does NEOSYS Exchange Gains/Loss account not agree exactly with my auditor's parallel system?

If a client finds that the Exchange Gain/Loss account balances as per another parallel system is not in agreement with NEOSYS then they must sit and reconcile the two and notify NEOSYS support of anything that they discover is wrong in NEOSYS so that can fix it - otherwise we remain confident in NEOSYS without proof to the contrary.

In general:

- Locate the incorrect transactions: Take a ledger account of the Exchange Gain/Loss account in order to locate the incorrect transaction. Open the voucher that made this entry and look at all the base conversions on that voucher. If the exchange rate used was wrong, that could be the reason for the discrepancy.

- Try running the NEOSYS revaluation program on the journals menu. This will ensure that the NOMINAL base currency balance in all accounts is in exact agreement with the REAL currency balance in those accounts

- Rounding rules can be different in different systems so that may account for 1 or 2 cent differences per transaction and this can can add up to greater differences in total.

What do I do if I am not happy with the balance of an account?

The balance of any account is, under all circumstances, simply the arithmetic total of the journal lines posted to it, therefore self evidently, if you are not happy with the balance of an account, you must use one of the options on the NEOSYS JOURNAL MENU to post additional journal lines until the total of the journal lines for the desired account gives the balance that you desire for the account. There is no way to amend the balance of an account other than using one of the NEOSYS JOURNAL MENU options to post additional journals.

Why can I not adjust the balance of one account only?

In order to understand why this is not allowed you need to know the fundamental and unbreakable rule of double entry accounting

THE ARITHMETIC TOTAL OF THE BALANCES OF ALL ACCOUNTS MUST AT ALL TIMES BE EQUAL TO ZERO

In NEOSYS, the rule of double entry accounting is applied separately per currency. Therefore the total of base currency must equal zero at all times and the total of each individual currency must be zero at all times.

Given the above rule, adjusting the balance of one account alone is not allowed because it would break the rule ... because (obviously) it would result in the arithmetic total of all account balances no longer being zero.

The effect of the rule is that you cannot ever adjust the balance of one account without simultaneously making an equal and opposite adjustment in some other account or accounts.

What if I cannot determine any account to make an opposite adjustment into?

The opposite account is often some kind of a "write off" or "exchange gain/loss" account but it could be to any account depending on the case. Think long and hard about it and if you are still not clear then you must consult an accountant to help you determine which account to use.

Note that for NEOSYS revaluation journals the "exchange gain/loss" account, defined in the Company File, is used automatically as the opposite adjustment account.

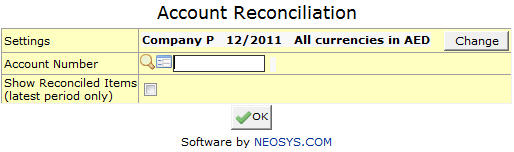

How to correct wrong currencies present in NEOSYS reconciliation reports

NEOSYS reconciliation is strictly per currency amounts posted and does not provide any base currency reporting therefore any false currency balances (eg USD posted into an EUR bank account) must be corrected by journal.

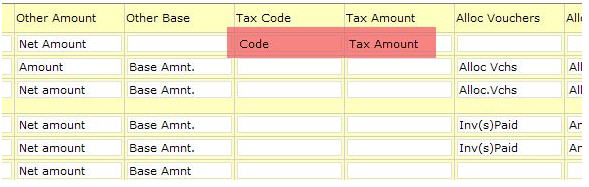

Why is VAT column not appearing in journal entry page though it has been set up in Journal Setup?

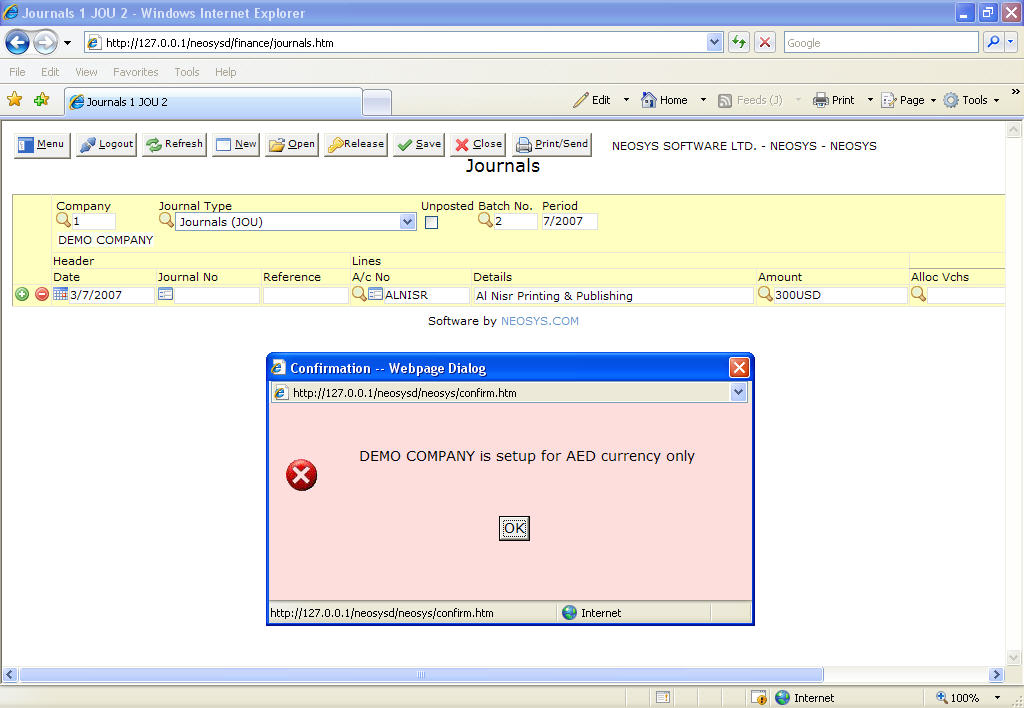

It is necessary to put Tax Reg. No . on the Company File in order to get the VAT column in the journal entry page.

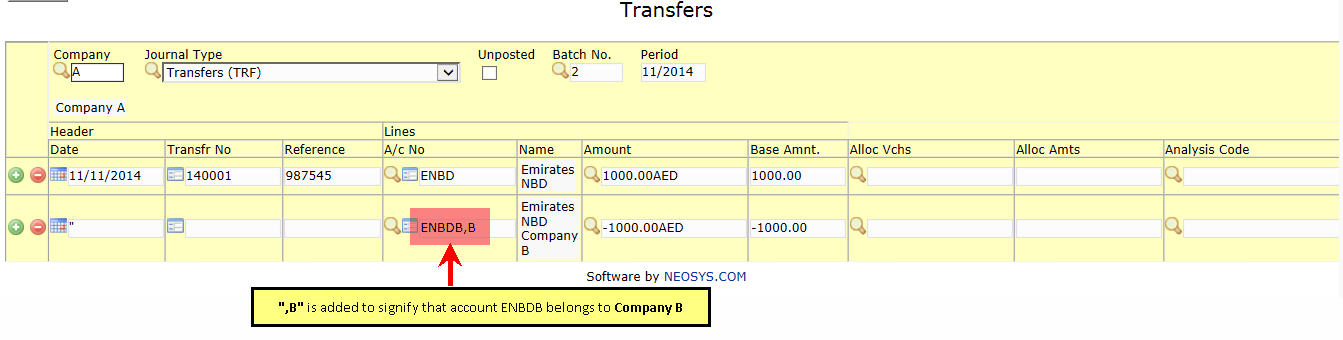

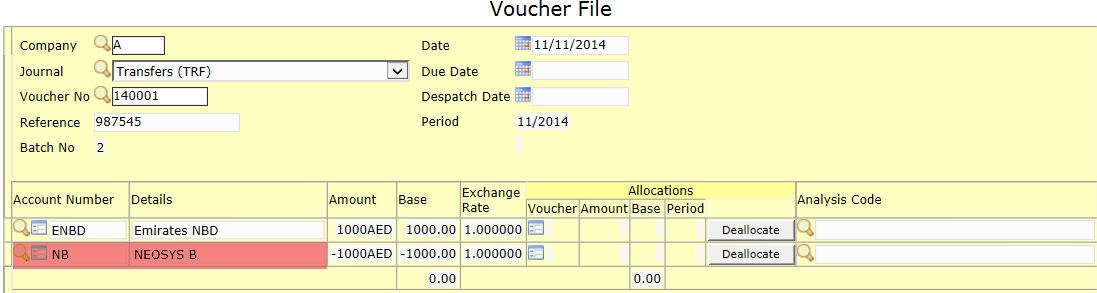

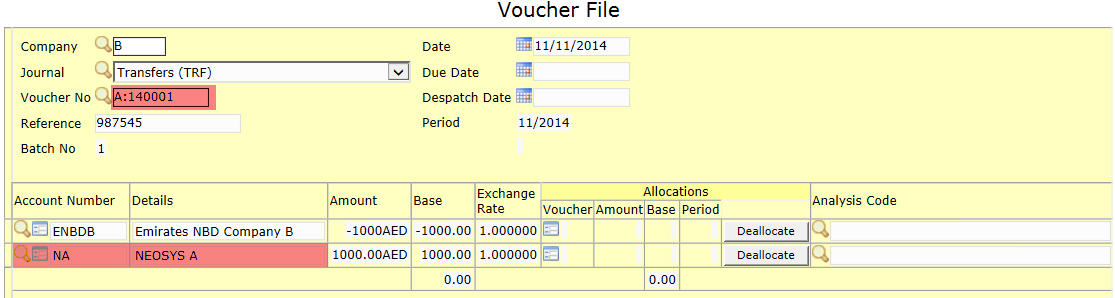

Why do VAT amounts stay in originating company accounts?

The VAT amount, in an intercompany posting, will remain in the originating company account and only the NET amount will be posted to the other company.

This ensures that when you print/export the journals for one company, the total of the VAT column agrees with the VAT report for that company, this helps make auditing easier.

Also if you issue an invoice for company X then even if, for example, you post the income of that invoice to another company, the VAT on the invoice still has to be shown under the company of the invoice.

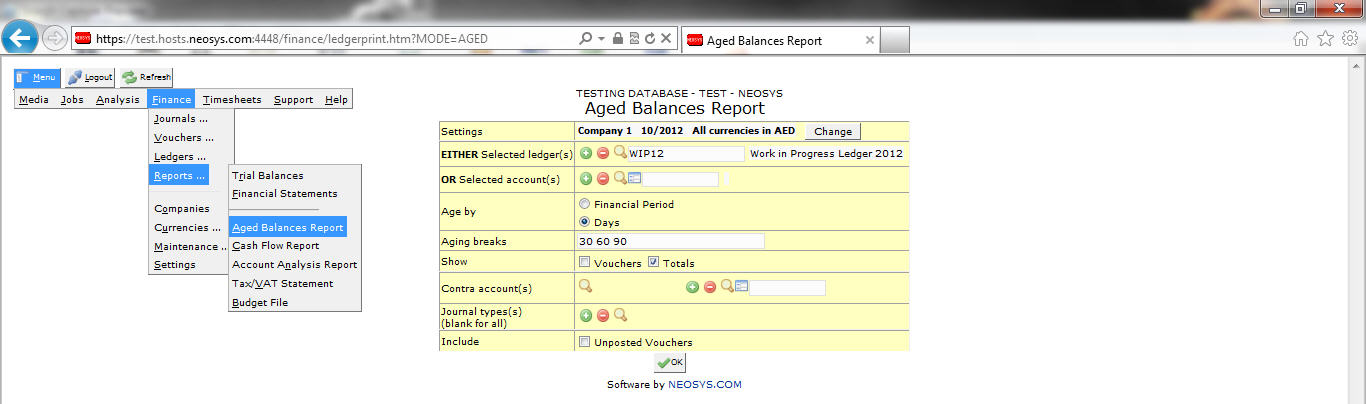

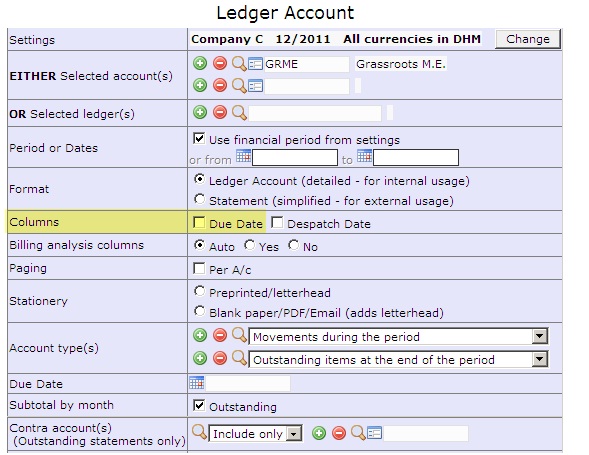

How do I get a break down of the WIP/ACCRUAL?

If you want a break-down of a control account you look in the subsidiary ledger. (This is the whole point of having a subsidiary ledgers in the first place)

If the subsidiary ledger happens to be open item ledger like client/supplier/wip/accrual then you can use the NEOSYS AGED BALANCE REPORT which can show you the breakdown either per account or per open item/translation

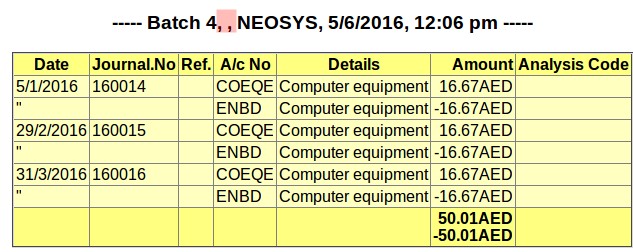

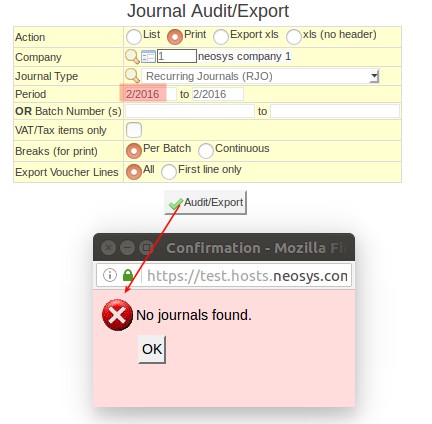

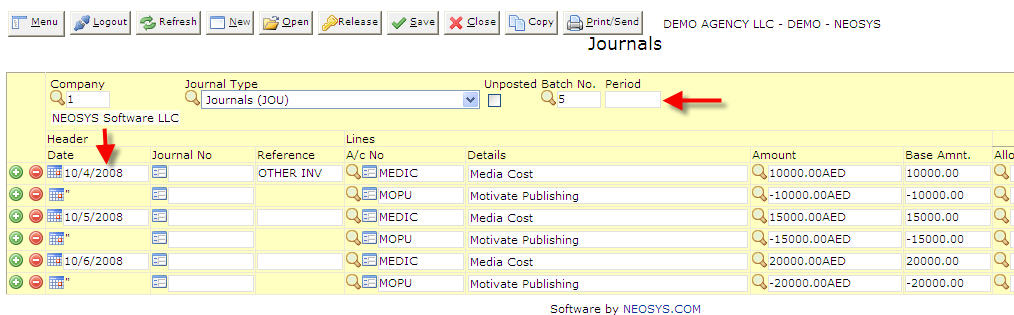

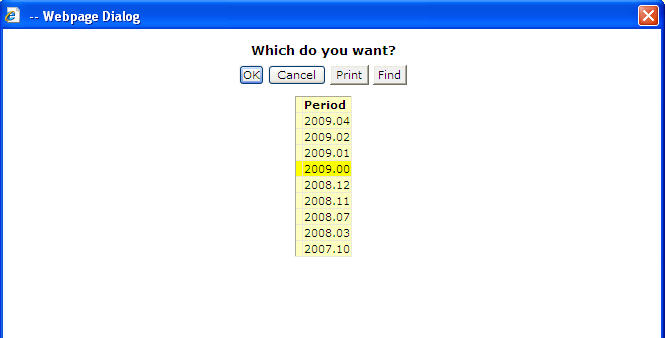

Why am I unable to find/print journal batches created using Recurring Journals?

Journal batches created using Recurring Journals Table do not have a period in the batch heading because multiple periods may be posted in the same batch. For such batches, only the period of the first voucher in that batch (in the case of recurring journals this is the earliest period in the batch) will be shown in any journal batch lookup.

In order to lookup or print such batches you need to enter the earliest period in that batch in the period filter. This holds true for any kind of batch lookup or printing like Journal Audit/Export, List of Unposted Journals etc.

For example, the heading of Journal Audit/Export print shows batch number and the period as blank (highlighted in the below screenshot) for a journal batch created using Recurring Journals Table.

The batch shown above contains an entry for period 2/2016. But if 2/2016 is entered in the period filter in Journal Audit/Export, this will give an error message "No journals found." as shown below. This is because there is currently no Recurring Journal batch whose earliest period is 2/2016. The earliest period of the batch shown above, i.e. 1/2016 must be entered in the period filter.

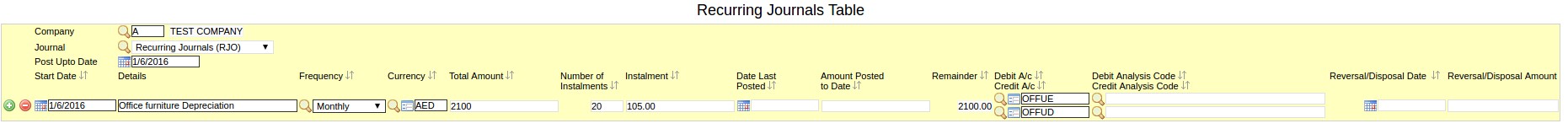

How to do depreciation using Recurring Journals

Recurring Journal entries can be used to post depreciation periodically.

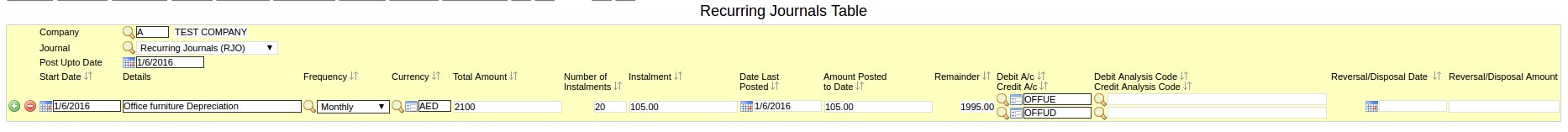

As shown in the example below, Start date can be set as the beginning of a month. Details field will carry the description of the Asset. Frequency and Number of Instalments can be set as per company policy. Depending on the Total amount and Number of Instalments NEOSYS automatically calculates the Instalment and Remainder amounts.

Debit the Depreciation Account (PL ledger) and credit the Accumulated Depreciation Account (Fixed Assets Ledger).

On posting the Recurring journal other field details (Date Last Posted and Amount Posted to Date) appear automatically.

Before Posting

After Posting

Why is ledger printout truncating account name from voucher details field

If the account name is mentioned in the details column of the voucher, the system will automatically drop the account name from the details column while taking the account's ledger printout. This is done because there is no need to show the same account name over and over on all rows of the report when the account name is already mentioned in the report heading.

Using NEOSYS Finance System

OLD VERSION Special:PermanentLink/6014

Importing Accounts and Addresses

WARNING: You should trial out importing in test database first.

Before you start importing anything make sure that you use the clearing procedure to clear down any old data first.

You can either have accounts and addresses columns in a single file or separate files. Whichever way you go, importing accounts and addresses is a two step process and addresses can only be imported after accounts.

The import file must be in tab delimited text format and its name must be a maximum of eight characters with no spaces and a three character extension.

The import is done in the NEOSYS maintenance mode using F5 and all NEOSYS listening processes must be shutdown.

ACCOUNT columns

- ACCOUNT NO - required, alphanumeric plus "/" or "-" characters only.

- ACCOUNT NAME - required

- LEDGER CODE - required, must exist in Chart of Accounts File

- ACCOUNT TERMS - optional positive integer days to to pay 0 for Cash, 30, 60, 90 etc

- CURRENCY CODE - optional, must exist in Currency File

- TAX CODE - optional, must exist in Taxes File

ADDRESS columns

- ACCOUNT NO - required, must preexist in a chart of accounts

- ACCOUNT NAME - required

- ADDRESS - required, should be up in one column containing to four lines in quotes and separated by cr/lf characters

OR four columns "ADDRESS 1" ... "ADDRESS 4". - COUNTRY - required, no restrictions

- TEL - optional, free format so you can put multiple numbers and comments, appears on statements and forecast of payments.

- EMAIL - optional (ditto)

- FAX - optional (ditto)

- COMPANY REG NO - optional

- COMPANY TAX NO - optional

In the following example the account and address data columns exist in a single file called ACCOUNTS.TXT.

Importing Accounts

First verify that accounts can be imported and correct any errors before proceeding.

IMPORTX D:\ACCOUNTS.TXT ACCOUNTS

Actually import the accounts with the C option (Create).

IMPORTX D:\ACCOUNTS.TXT ACCOUNTS (C)

Option O can be used to overwrite (destroy!) existing records. Use with extreme caution and at your own risk.

Use NEOSYS, Finance, Ledgers, Chart of Accounts to check that the above has created accounts in the expected chart of accounts.

Importing Addresses

First verify the addresses can be imported and correct any errors before proceeding. Can only be done after importing the accounts.

IMPORTX D:\ACCOUNTS.TXT ADDRESSES

Actually import the addresses with the C (Create) option.

IMPORTX D:\ACCOUNTS.TXT ADDRESSES (C)

Option O can be used to overwrite (destroy!) existing records. Use with extreme caution and at your own risk.

Migrating Data from old system to NEOSYS

Strategy

In the process of migration, we are not going to import all the previous year's finance data as this would be near to impossible to replicate each receipt, payment, journal etc. which was done in the past. Moreover there is no way you will discard your earlier finance package immediately because it contains some critical information which will be required by auditors in the years to come. Hence in your old system you will close the books on a particulate date and generate a detailed balance sheet with closing items and balances which will be imported into NEOSYS as opening items and balances. This is the best way to move to a fresh, specialized finance package like NEOSYS and is an accepted practice for migrating to new finance packages.

Preparation of information which needs to be imported for Finance

First step is to close your books in the old finance package on a particular date. It is not necessary that you have to wait till your year-end closing date to migrate to NEOSYS and can rather just mid way during the year or anytime depending on your choice decide to move to NEOSYS and you will still be able to do your year-end closing absolutely perfectly.

For example if you decide to move to NEOSYS from 1st of May, 2009; you will close your books (after invoicing and entering all transactions up-to 30th April, 2009) and generate a balance sheet on 1st May. The balance sheet should have the following information:

- For each client – an outstanding statement (all items o/s for the client and not just a balance)

- For each supplier – an outstanding statement (all items o/s for the supplier and not just a balance)

- For all other account heads – (eg Furniture, Bank Balance etc) just a balance per account head

This information will be entered into NEOSYS as Opening Items and Opening Balances. For more information on this refer to Entering Opening Balances & Items

Preventing posting in prior years and periods

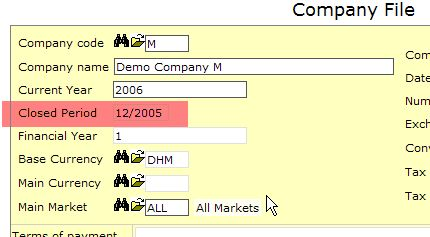

In the company file you can change the closed period to whatever you want. You have to do this on each company separately.

Anybody who can update the company file is allowed to change the closed period except that reopening prior year and periods can be further restricted by placing locks on the following tasks in the Authorisation File

In the Authorisation File, tasks section:

Consolidating Reporting

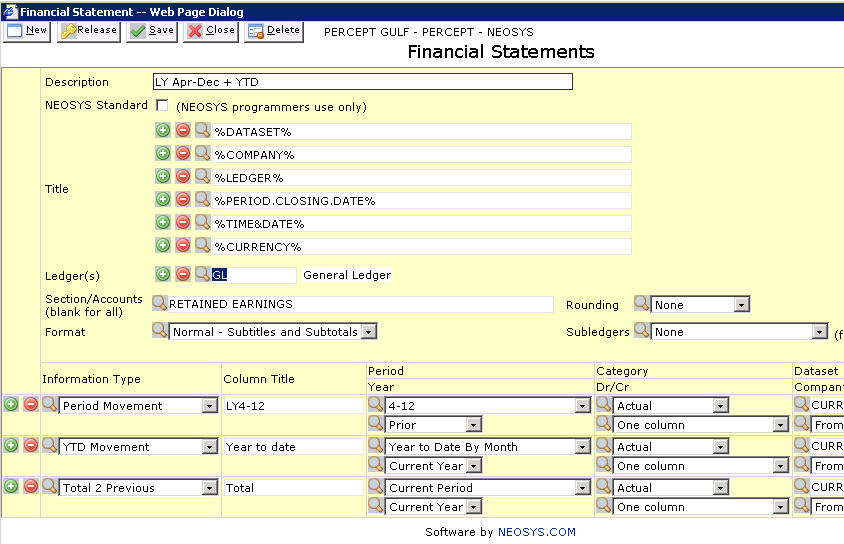

Consolidating Financial Statements

These are Trial Balances, Profit and Loss, Balance sheets etc showing balances, movement etc per account.

Data is always aggregated and never shows any individual transactions.

Differing account numbers between datasets can be handled by using NEOSYS mapping procedure.

Technically these reports just require inter-database access to the NEOSYS BALANCES file

Works in NEOSYS now

Consolidating Billing Analysis Reports

These are reports of total billing, costs etc by client, supplier, type and market etc.

Data is always aggregated and never shows any individual transactions

Technically these reports just require inter-database access to the NEOSYS ANALYSIS file and reference files.

Doesnt work in NEOSYS now but it will be eventually

Consolidating Ledger Statements

These require access to individual transactions and are unlikely to be provided by NEOSYS in the future since they can be done happily within a database.

If a client wants a separate database to do their own thing then there is this price to pay. NEOSYS does not support all three consolidations because there is too little demand to justify the programming when there is an alternative for the client.

Performing Essential Maintenance of NEOSYS Finance Module

Clearing Open Items

On systems with heavy loads of transactions on open item accounts, it is essential to do the NEOSYS maintenance task of "Clear Open Items" on the Finance, maintenance menu every month, clearing up to three months prior except that you should not clear up to 31/12/XXXX of the previous year, until you have closed XXXX and taken final statements of outstanding items as at 31/12/XXXX. Failure to do this for a long period of time would lead to "Cross Check Balance" errors. Although we may NOT clear open items up to date 31/12/XXXX until you have closed the year XXXX, we CAN definitely clear open items until 30/11/XXXX without closing the year XXXX i.e. we clear open items until the penultimate month of the year.

Opening a new financial year

Before you can enter any financial journals into a new year, either posted or unposted, you have to perform the "Open New Year" process on the NEOSYS Financial Maintenance menu. Opening the new year does not close the old year and you can continue to work in the old year as well as the new year at the same time without any restriction. You can continue to get all financial statements for the old year as if the new year had not been opened.

Contrary to common practice with many financial packages, it is possible and best practice in NEOSYS to open the new year immediately on the 1st January. Therefore you can post into the new year immediately and get up to date accounts without a break and without relying on temporary manual accounting systems for essential accounts like banks.

To restate this, in NEOSYS, opening a new year has nothing to do with closing an old year.

Closing a financial year

Closing a year in NEOSYS prevents anyone from posting further entries into it regardless of their level of authorisation

However, authorised staff can reopen closed periods and years temporarily if further postings are required, eg. posting some final year-end auditors journals. Closing is therefore a convenient "switch" which can be closed and re-opened at will if a user has sufficient authority.

Closing is done by entering or changing the "Closed Period" on the Company File. Opening the new year does not automatically close the old year.

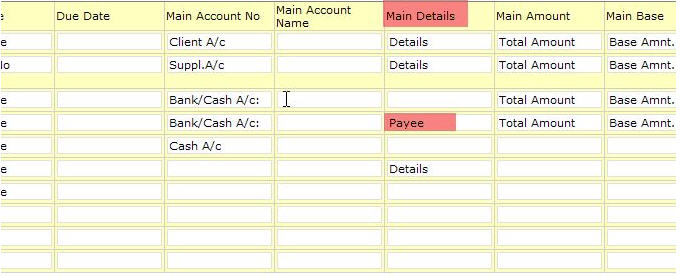

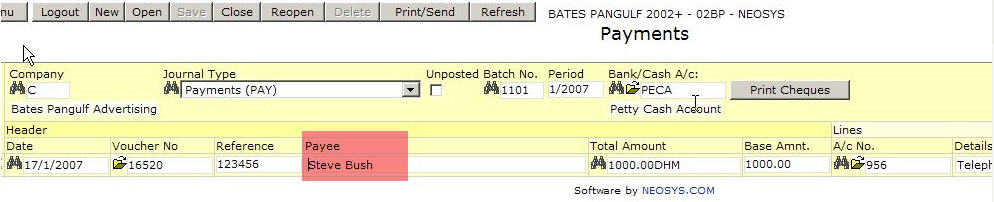

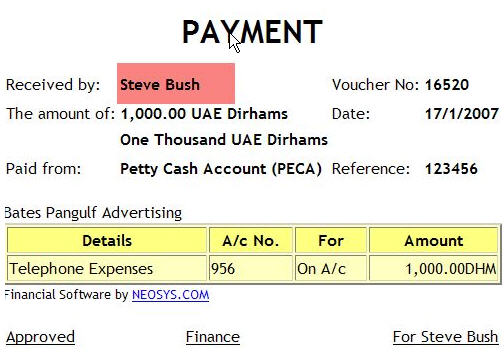

How to enter and get payee name on payment vouchers

One needs to be able to enter the exact payee when the account name is not the payee. This is usually the case when generally posting to an expense or asset account and not for creditors.

To be able to enter the exact payee on payment vouchers data entry, in Journal setup you have to specify some title for the "Main Details" column of the Payments Journal (hidden off to the right of the the Journal Setup screen).

then you will be able to enter Payee in the Payments journal ...

and get whatever you enter on the payment voucher ...

Automatic Details on Ledger Account

There is a simple concept in NEOSYS that allows the details on ledger accounts to come automatically. This can considerably reduce the amount of typing on Journal data entry.

The idea is that the details or account name on the other side of the voucher are interesting information. Each account therefore refers to the other.

If you do not want the automatic details concept then simply enter precisely the details you want to show on the account on each line of the voucher.

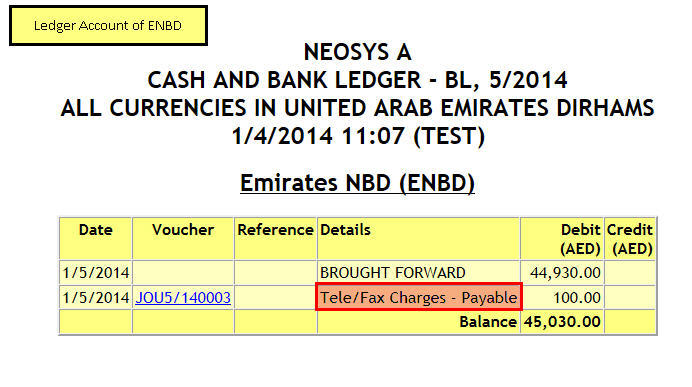

Put simply, if you credit bank account 1 and debit expense account 2 telephones then if there are no specific transaction related details entered on the journal then the details on the ledger account of bank account 1 shows the name of the expense account 2 - telephones and the details on the ledger account of the expense account 2 telephones shows the name of the bank account 1 as shown in the screenshots below.

In order for this trick to work, simply leave the account name in the details column and do not change it. If you do change it and want to get back to the original state then either blank the details so the account name returns or retype the account name precisely.

Note that NEOSYS puts the account name in the details column by default in Journal Entry screen. Since it is pointless to show the account name in the details of the same account then NEOSYS suppresses it on the ledger account. Therefore if you leave the account name in the details and add nothing, it is as if you put no details in the journal data entry. So if you add no details NEOSYS puts on the ledger account the details of the other account.

Vouchers with 3 or more lines

NEOSYS defaults to assuming that the FIRST line of a voucher is considered to be the main posting and all the other lines are "contra" or "bifurcations" of the first. Virtually every voucher falls into this ONE MAIN+ONE OR MORE CONTRAS concept.

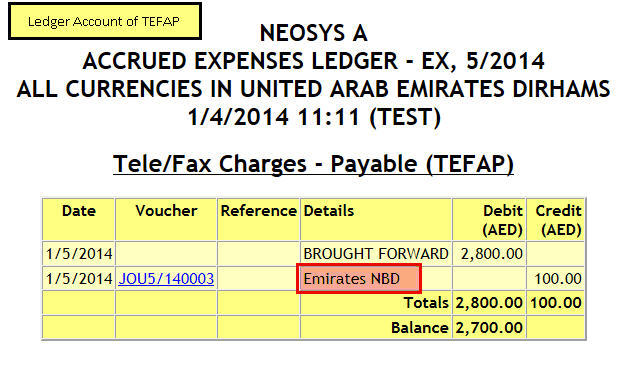

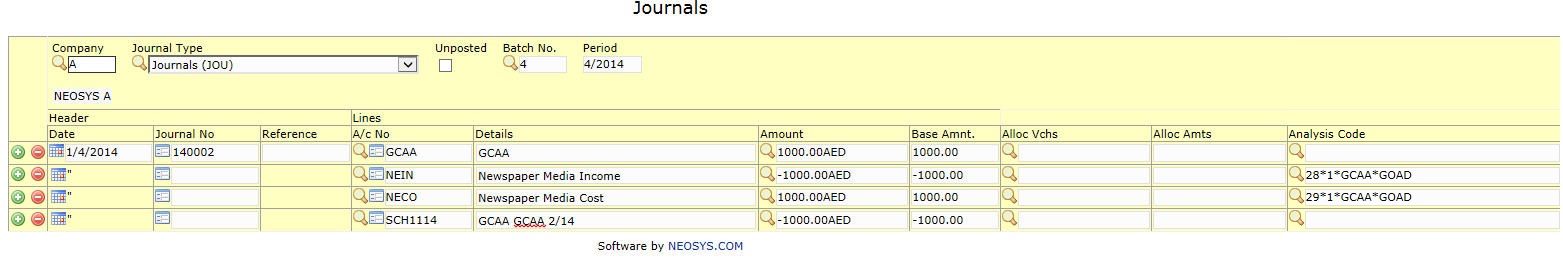

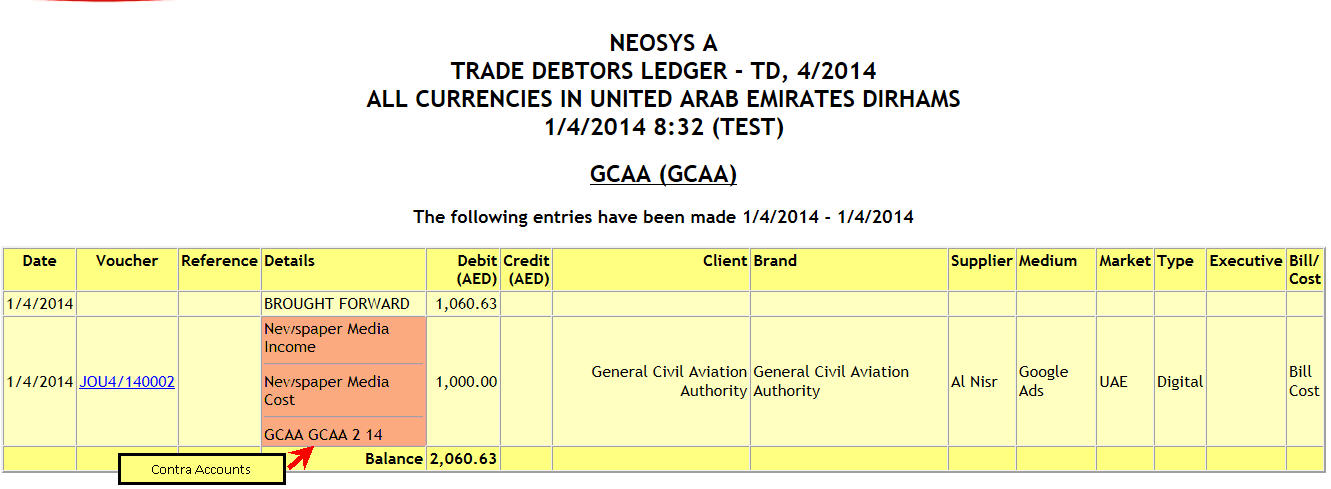

Therefore, if you debit account 1 and credit/debit accounts 2, 3 and 4 then on account 1 the names of accounts 2, 3 and 4 will show as shown in the screenshots below. On accounts 2, 3 and 4 only the account name of account 1 will show.

Warning: Forget any concept of always putting the debits first followed by credits. When entering general journals of more than one line make sure that you put the "main" account first followed by the balancing debits/credits, regardless of whether it is debit or credit.

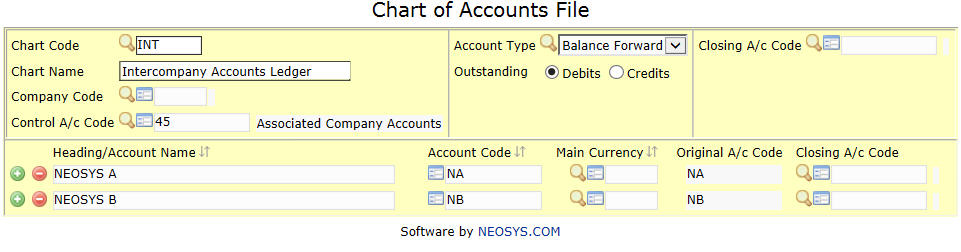

Chart of Accounts

Understanding the Chart of Accounts

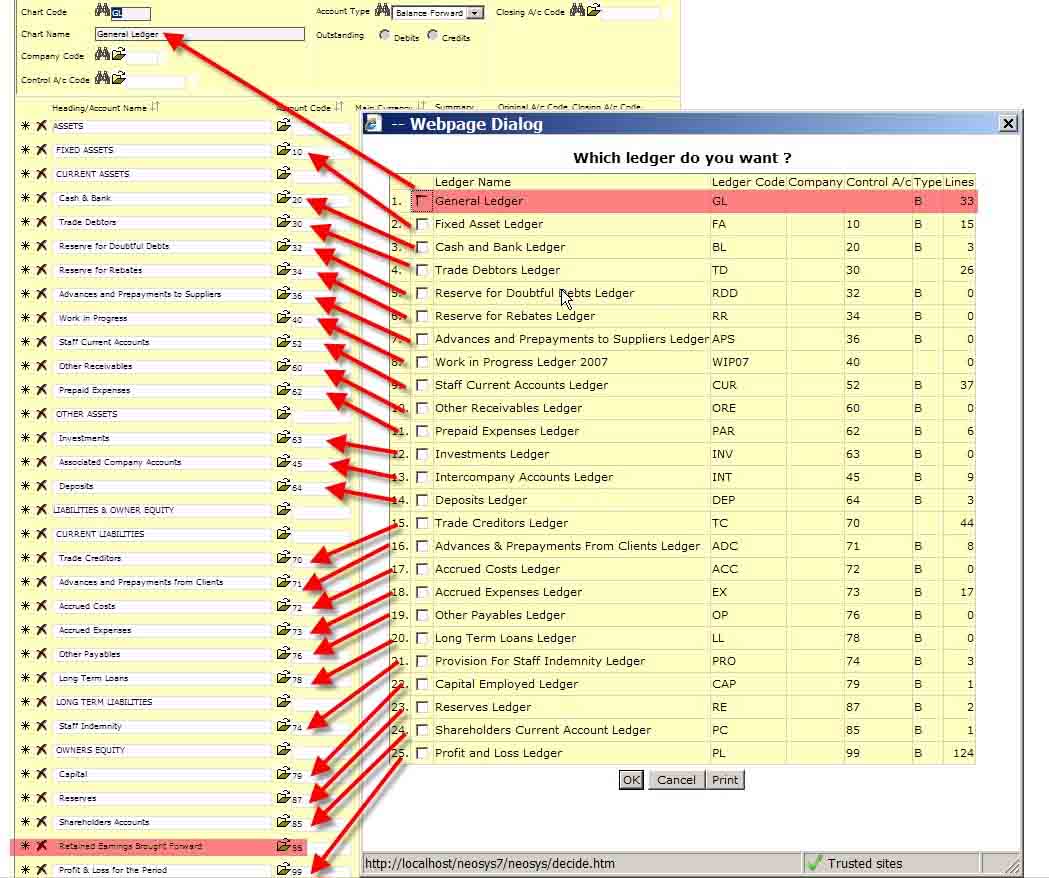

Here you see the chart of accounts for the GL ledger underneath and an almost perfect one to one correlation with the popup list of charts (ledgers)

You need to deeply understand this in order to grasp the beautiful simplicity of having one master chart of accounts (GL) which contains only control accounts which are represented by a series of subsidiary chart of accounts which contain the actual accounts that you can post to. You cannot post to control accounts.

Check for yourself that the control account of each ledger matches to one account in the GL account. Only one ledger in the list of ledgers (charts) has no control a/c and this is the master or top level chart of accounts (GL).

There needs to be one real (ie not control account) account in the master chart of accounts and this is called retained earnings brought forward. This account is the "closing account" of all the P&L accounts.

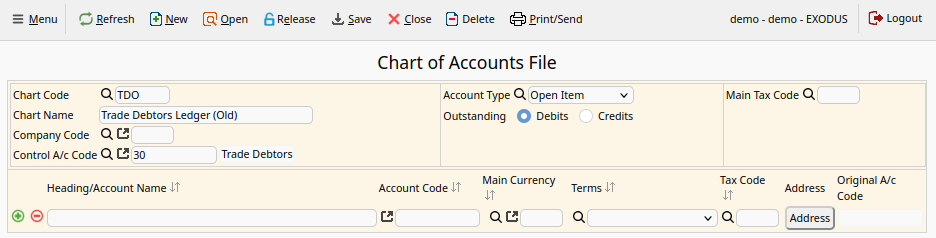

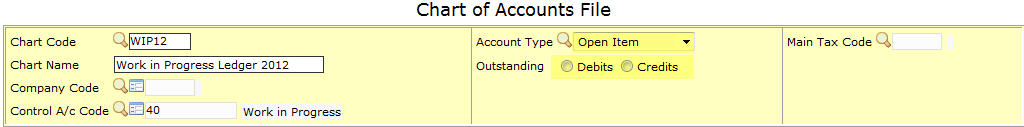

Outstanding

This can only be entered for charts with Account Type: “Open Item”. It has no meaning for balance forward accounts.

Select either “Debit” or “Credit” to indicate, for the accounts in this chart, whether either unallocated debits or credits are to be considered as invoices for the purposes of aged balances reports and allocation. Items of the opposite sign (e.g. unallocated payments or credit notes) will be totaled in the “Unallocated” column.

For asset ledgers, like Accounts Receivables and Clients, “Outstanding” should be “Debit” since outstanding unpaid invoices are debits.

For liability ledgers, like Account Payables and Suppliers, “Outstanding” should be “Credit” since outstanding unpaid invoices are credits.

If left unspecified, NEOSYS tries to determine the sign automatically by checking if the chart code is listed in the “Main Accounts” column of the Journal Setup for journals of type “Sales Invoice” or “Purchase Invoice”.

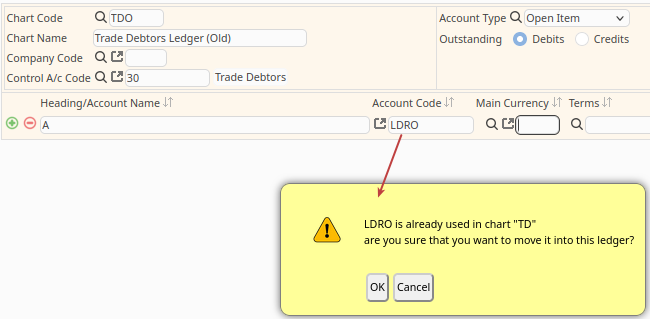

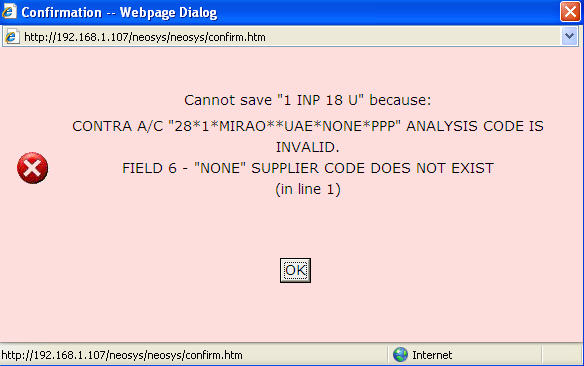

Moving Accounts between subsidiary charts

You can only move accounts between charts which have the same control account.

A workaround in this case is that you will have to create a new account and create a journal to move the balance from the old account to the new account. To prevent any future postings on the old account add the word <stop> with the <> brackets to the old account AFTER you do the journal.

Financial Years and Periods

Configuring Start of Year and Financial Periods

Nearly all NEOSYS clients financial year follows the calendar year (1st January to 31st December) but there are a few that are different eg 1st April to 31st March, 1st July to 30th Jun etc.

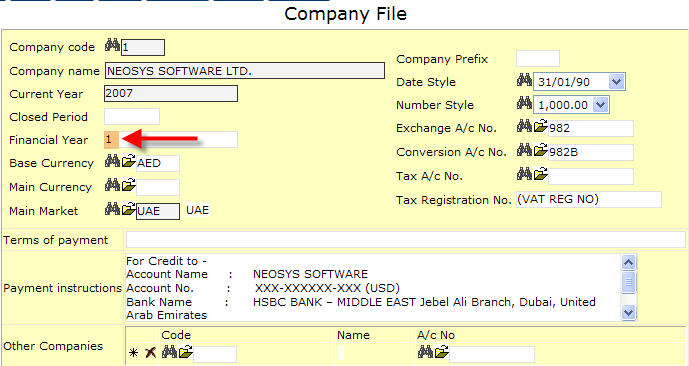

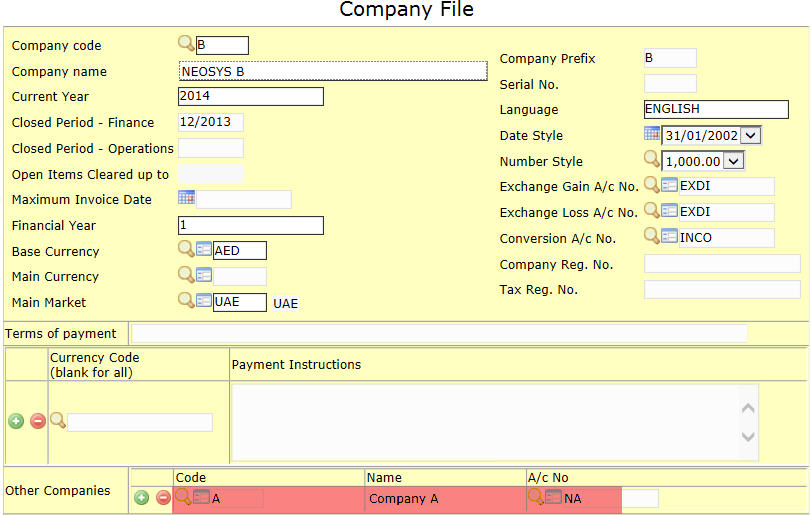

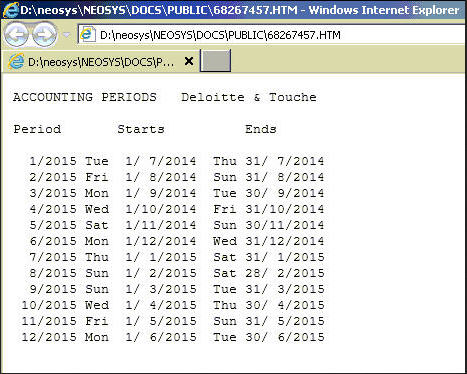

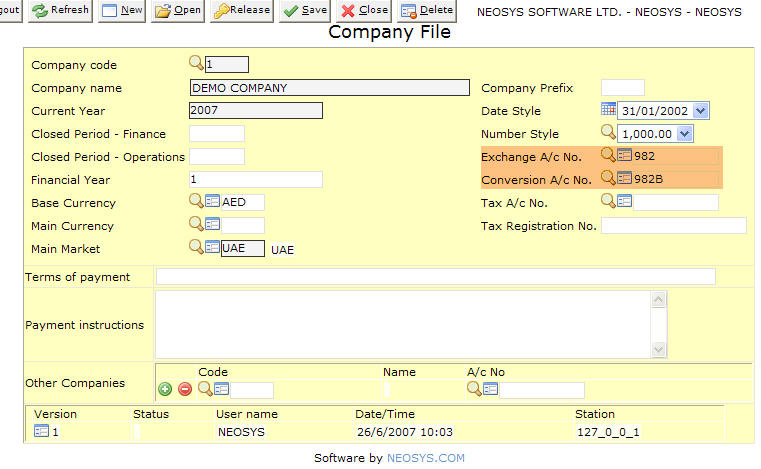

The configuration of Financial Periods are done in the Company File under Finance

In the above screen the financial period has been set to 1 which means January to December. In case the company follows the April to March financial period, than it would be set to 4. You can configure this to start at any month (i.e. 1=Jan, 2=Feb etc)

Using Financial Periods

We always need to remember and inform clients that the PERIOD referred to in the finance system is always a financial period. (all examples are taken wherein the current financial year is 2007)

For eg:

Period 1/2007 would be January/2007 in case the financial period is Jan to Dec. Period 1/2007 would be April/2007 in case the financial period is Apr to Mar Period 10/2007 would be October/2007 incase of financial period Jan to Dec Period 10/2007 would be January/2007 incase of financial period Apr to Mar

Also if you are posting opening item journals for the previous financial year, note the following:

Period 12/2006 would be December/2006 incase of financial period Jan to Dec Period 12/2006 would be March/2007 incase of financial period Apr to Mar

How to Open New Year

Management approval is mandatory to proceed

To open a new year, go to Menu > Finance > Maintenance > Open New Year.

Select the company for which you wish to open the new year.

Now select the desired year from the drop-down list and click on "View Logs". This would show a log that contains information about when the last new year was opened and by whom, etc.

Now click "Open New Year" and follow instructions.

Entering Opening Balances & Items

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS

A suspense account is required in most of the following procedures. This account will end up as zero at the end of the procedure. NEOSYS support will generally create an account called "Suspense Account" with account code "ZZZ999" and place it somewhere in the General Ledger or Profit and Loss Ledger.

General Ledger/Balance Sheet

You do not have to enter the opening balances before starting to use the system. You can enter them later.

You may enter provisional opening balances and later enter opening balance adjustments.

GL opening balances do not need to be entered when starting up a new company since new companies dont have any opening balances.

It is very easy to get confused and end up with a suspense account balance if you do not keep a clear head. Accountants know than you cannot have only one error in a trial balance so if you end up with a balance in the suspense account at the end of entering opening balances then you can be sure that it means you have an error somewhere else.

Closing Balances

First acquire a closing trial balance from the old system. Ideally it should be in spreadsheet format to enable checking and control.

Use a calculator or spreadsheet to ensure that the closing trial balance totals to zero. It is rare but not unknown that closing trial balances do not actually balance so this should possibility should be eliminated. You may choose to postpone this check and only do it if needed because you cannot get the NEOSYS system opening balances to balance to zero after completing all the stages of entering opening balances.

Preparation

If the NEOSYS account numbers are not the same as the old system account numbers, add a column to the closing trial balance to represent the NEOSYS account number as follows.

For each account in the old GL/BS identify the corresponding new account(s) in the new NEOSYS GL chart of accounts:

If two or more old accounts match to the same GL account in NEOSYS then put the new NEOSYS account number more than once. Do not club them together; leave them as separate lines so they can be reconciled more easily. The balance of the new account will be the total or net of the old accounts.

If an account in the old GL/BS is split into two or more new NEOSYS GL accounts then you must decide the amounts and create two or more lines in the closing trial balance. The old account number will be duplicated and the new NEOSYS account number will be different.

Posting

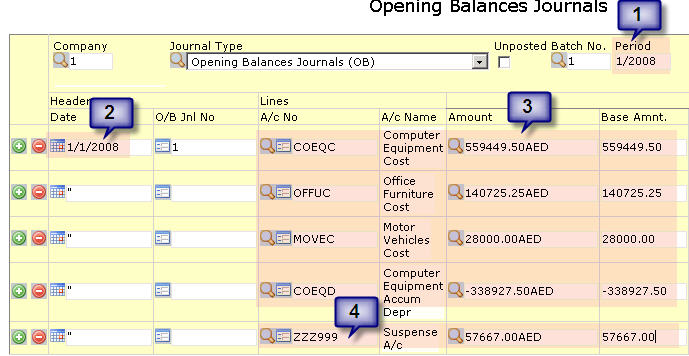

Create a single NEOSYS Opening Balance Journal (OBJ) with one line for each line in the prepared old closing trial balance.

Such a journal can be clearly be very easily reconciled to the old system. The journal and the new GL/BS will clearly balance since the total of all accounts in a GL/BS is always zero according to accounting rules.

The financial period of the journal MUST be 1/9999.

The journal date should be 1/1/9999 where 9999 is the current financial year.

Post the closing balances from the prepared closing trial balance.

OBJ Journals do not show as movements on the ledger accounts so if you post two opening balance journals to the same account, you will see the net balance in the account.

Control Accounts

You are NOT allowed to post directly into control accounts in NEOSYS. Whenever you are blocked from doing so when entering the Opening Balance Journal, enter the NEOSYS standard Suspense A/c number (ZZZ999) INSTEAD of the NEOSYS control a/c number.

The balance in the ZZZ999 account will be reversed by the entry of the opening balances of the subledgers described elsewhere. Once all the subledgers have their opening balances or items entered and all is 100% correct then the ZZZ999 account balance will be zero.

Quick Option

In practice, nearly all of the accounts in the standard NEOSYS chart of accounts for GL are control accounts. Therefore, since control accounts opening balances are all posted into A/c ZZZ999, you may save time on data entry by clubbing them together into a single journal line (or if not 1, at at least not exactly one line per control A/c).

This is NOT recommended unless you are very familiar with the whole process and have the closing balances in a spreadsheet to make the clubbing together easy - for the following reasons:

- It is harder to reconcile the journal to the source closing balances because you will not have one line per GL/BS account.

- It easy to accidentally club and post NON-control accounts balances into the ZZZ999 suspense account - leaving those accounts WITHOUT an opening balance and the suspence account WITH a pending balance.

Subsidiary Balance Forward Ledgers

Balance Forward Ledgers are for example Bank Ledger, Sundry Payables/Receivables, Staff Loans Ledger etc.

You can, but probably do not want to, treat Clients/Receivables & Suppliers/Payables as balance forward accounts since you would not then be able to get a statement of outstanding items.

For each Balance Forward ledger, create a single Opening Balance Journal with one line per account and an additional contra/closing entry/line to the Suspense A/c (ZZZ999). The additional line must agree with the balance of the ledger in question and can be used as a control check before posting that all the other accounts/amounts have not been mistyped.

The period of the Opening Balance Journals should be the first new accounting period. The journal date does not matter as these do not show as movements (unless you are posting opening balances" on open item accounts) but you are advised to put the first date of the journal period.

Regardless of the period within a financial year that opening balances are posted into NEOSYS always updates the opening balances of the financial year. If you are starting in the middle of the year this doesnt really make any difference.

If you are starting in the middle of a year then for the P&L ledger you might prefer to post a normal Journal instead of an Opening Balance Journal and into one of the old periods in order that the entry shows as a movement of the year instead of an opening balance for the year. This makes no difference to the closing balances of the P&L accounts, but some financial report may be specifically designed to show movements during the year which would exclude exclude opening balances.

Subsidiary Open Item Ledgers

For open item accounts you should enter opening items if you want to see all the outstanding items one by one on the statement but if you want to have a single outstanding item as the total sum of all then you can enter opening balances only. Therefore entering both opening items AS WELL AS opening balances is not necessary and this will create DOUBLE opening balances if you do.

According to the well known NEOSYS rule, entering any journal in a prior year results in the opening balances of the following years being updated. Therefore the entering of opening items in the last period of the prior year when setting up the system will clearly result in the opening balances of the current year being created.

Entering open balances may be done for selected accounts. It is quicker to startup and saves work of entering all the opening items one by one. But then the opening items are not visible in NEOSYS and all you can see is one lump sum as a single outstanding item representing all outstanding items. In this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients.

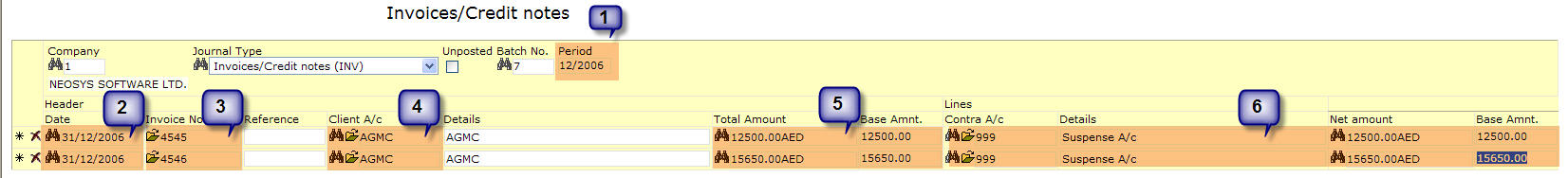

Alternatively, you can Enter Outstanding items as follows

- Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). Press F9 to make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED.

- Enter 1 Batch of outstanding invoices in the Invoices Journal for all the smaller/remaining a/c's with relatively few items. No check is possible unless all accounts for one ledger are in one batch then Press F9 to check if total matches open balance of the ledger.

- Enter batches of receipts and/or payments for any unallocated payments and receipts.

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. Refer to Opening Items entry

Posting of foreign currency items and accounts

Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL.

What are Opening Balances?

Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system.

For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account.

How to enter Opening Balances

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below:

- Enter period 1 and the year that you are interested in. Putting any other period but 1 makes no difference since NEOSYS always puts them in period 1.

- Put date 1/1 of the same year. Since opening balances DONT show as entries on the account it doesnt matter what you put here.

- Enter all the account numbers for one ledger (eg bank accounts) into one batch/journal voucher, putting a - (negative sign) for credit balances.

- The last line of the journal voucher "closes" the balance of the journal to the Suspense Account which usually is ZZZ999 or 999. You can check that the last line agrees with the total balance of the ledger before posting to ensure that no mistakes have been made.

- Repeat the above steps for each ledger that has to be opened.

There are some special considerations for posting the opening balances of the General Ledger:

- For control a/c, replace the a/c number with that of the Suspense Account. This is because NEOSYS will not allow you to post the control a/c balances directly because the control a/c balance will be posted automatically from the postings to the accounts in its subsidiary ledger.

- Remember that it is not neccessary that all accounts in the GL is a control a/c and the above step applies only to control a/c.

- For non-control a/c in the GL, enter the a/c number.

- There is no closing line since the total of the General Ledger A/c is zero if it properly balances.

What are Opening Items?

When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding (unpaid) items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening items are unpaid invoices and perhaps a few unallocated receipts or payments.

Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology.

How to enter Opening Items?

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Enter the ORIGINAL invoice date for each invoice (not the closing date of the prior period as shown in the example)

- Enter each invoice details i.e. the invoice number

- Select the Client/Supplier account

- Enter the invoice amount

- The contra account must be the suspense account which usually is ZZZ999 or 999.

- Is it advisable to stop and post the batch once per large account because you can then check that the batch total agrees with the balance of the account to prevent mistakes before posting.

Working of Inter Currency Conversion

-- NEOSYS SUPPORT --: NEOSYS, behind the scenes mostly, keeps a complete double entry trial balance and set of accounts for each currency independently.

there is an interesting concept that should perhaps illustrate something to you

you know how double entry book keeping stops accountants from making mistakes

by ensuring that if they do make a mistake than they make TWO mistakes

eg fail to enter correct income amount .. then the client account is also wrong

-- CLIENT --: yes

-- NEOSYS SUPPORT --: double entry accounting works by implementing a CONTROL

control means checking versus something else

In NEOSYS the same trick is done with currency

NEOSYS keeps TWO sets of double entry books

one in pure currency per currency

and one in pure base currency per currency

complete two sets of books for the whole company

in parallel

many financial software systems do not keep separately balancing double entry accounts per currency and lack this secondary control that is present in NEOSYS

in order to do this NEOSYS ensures that in every journal voucher, not only the base currency amount balances but so does every currency on the transaction balance to zero

-- CLIENT --: thats in the current system

ok

-- NEOSYS SUPPORT --: this is any company using NEOSYS and trading in currency

well the currency books can be checked versus the client/supplier/bank etc

then NEOSYS revaluation checks that the base books agree with the currency balances AT THE LATEST RATES

and and discrepancy is chucked into the GAIN AND LOSSES account somewhere in the P&L where it causes a lot pain if wrong because it hits profit/loss

-- CLIENT --: aha. ok

-- NEOSYS SUPPORT --: initially there are a lot of queries about NEOSYS generating exchange gains and losses

but in the end NEOSYS has always proved to be correct

in some companies which are not sophisticated currency-wise, the currency books and the base currency books are never really compared

this allows their finance team to DEAL ONE WAY WITH THEIR CLIENTS IN ANOTHER WAY WHEN REPORTING TO THEIR MANAGEMENT

client/suppliers/banks only care about currency

boss/management only care about base currency since they want ONE set of reports eg balance sheet and profit and loss that represents the whole picture of all currencies

accountants must be schizophrenic.

on one hand they have to deal with real currency with their clients/suppliers/banks ... and the base equivalent is IRRELEVENT to operations

and on the other hand they have to prepare reports to management/shareholders in pure base currency ,,, and the currency amount is IRRELEVENT to management/sholders

NEOSYS facilitates this necessary schizophrenic view but at the same time meticulously ensures that the two alternative views are reconcilable

-- CLIENT --: i get the concept

-- NEOSYS SUPPORT --: many accounting systems are only double entry in the base currency books

ie if you add up all the foreign currency from all the accounts .. it doesnt balance

in many financial systems, currency is just a comment except on accounts like client/supplier/banks

in NEOSYS we make sure that each and every currency is also balanced to zero using double entry accounting

this why if you debit one currency and credit another currency then you see NEOSYS adding two extra lines to REVERSE the currency amounts ... either into exchange gains and losses if the base amounts are not the same ... or to the special NEOSYS account called "Inter-currency Conversion"

four line voucher where you expected to see only two lines that you entered

imagine this ...

you can ask for NEOSYS financial reports for any single currency that you like and it will focus solely on transactions and balances for that currency you chose

ignoring all the other currency transactionsx

so not only does NEOSYS keep complete parallel double entry books for currency and base separately

it also keeps a separate set of books for each currency"

by default, NEOSYS presents all currencies to you as a consolidated position so you think you have one set of books

if you transact in 10 currencies ... NEOSYS keeps 20 separate books of accounts

each currency has a balancing set of books in currency amount and its base amount

-- CLIENT --: yes. 10 in the base and 10 in the foreign currency

same set

ok

-- NEOSYS SUPPORT --: so NEOSYS DOESNT MIX CURRENCIES AT ALL DEEP DOWN

as you would expec, NEOSYS will prepare financial reports for all currencies consolidated

that is the default reporting option but it isnt a fixed part of the system

in a NEOSYS client whose base currency is AED, in settings you can select USD only and option: UNCONVERTED

then you will see a SLICE of the company which is purely USD transactions

and the two sides of that slice are the USD amount and the base equivalent of those USD transactions alone.

-- CLIENT --: ok.

i noticed this while investigating ledger printouts in multi-currency

-- CLIENT --: when you send statements to clients from NEOSYS it will print the currency slices separately without any base currency showing

clients a) don't case about your base currency and b) expect to see a separate statement for each currency that they deal in with you EVEN IF YOU PUT ALL CURRENCIES INTO A SINGLE NEOSYS ACCOUNT

a common error that accountants new to NEOSYS make is to assume that you must open separate accounts for each currency that a client or supplier deals in

a true multi-currency accounting system like NEOSYS allows mixed currencies in one account number but automatically gives multiple statements for each currency that is discovered in the account at the time of preparing the statement

this ISOLATION of currencies from each other is the reason why you CANNOT ALLOCATE ONE CURRENCY TO ANOTHER DIRECTLY in NEOSYS

you cannot use USD receipt to pay off AED invoices directly

however you can happily post one currency into the bank and a different currency into the client in a single transaction

Intercurrency conversion WITHOUT gain/loss - Intercurrency Conversion Account

-- CLIENT --: ok. so while posting receipt we have to calculate the equivalent for the client and enter it and the actual amount to the bank.

-- NEOSYS SUPPORT --: Yes. NEOSYS doesnt insist that you balance the currencies in a single voucher since it will happily reverse everything into the exchange gains and losses or inter currency conversion a/c

-- NEOSYS SUPPORT --: bank a/c +1000USD (+3670base) client a/c -3670AED (-3670base) .... and NEOSYS adds two more voucher lines Intercurrency conversion account -1000USD (-3670) and Intercurrency conversion account +3670AED (+3670base)

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

and NEOSYS adds

3. Intercurrency conversion account -1000USD (-3670)

4. Intercurrency conversion account +3670AED (+3670base)

q1. what is the total amount of USD posted

q2. what is the total amount of AED posted

q3. what is the total amount of base currency posted to the intercurrency account (ie its balance after the above transaction assuming it was 0 to start with)

-- CLIENT --: the client account should be -1000USD (-3670base) . right?

-- NEOSYS SUPPORT --: no, The client account is credited in this example with -3670AED (-3670base)

in the above transaction we have decided to do a currency conversion for the client in order to pay off some AED invoices

presumably the clients account has some AED invoices to pay off

this is a receipt so we are increasing our bank balance by 1000USD and decreasing the amount the client owes us by 3670AED

we decide or agree with the client how much AED to give to the client in return for their payment of USD

we are acting as a currency exchange broker for the client

in the example given, we are converting the clients USD to AED at our standard accounting rate therefore there are no exchange gains and losses

This does not have to be the case though. We could have a agreement that USD receipts will be used to pay off AED invoices at some other rate

DR +bank

CR -client

-- CLIENT --: right, but doesnt he client a/c also have to be in USD?

-- NEOSYS SUPPORT --: no need and remember we already debited the client with some AED invoices in AED.

The USD is certainly information available on the receipt voucher but the entry on the clients account is formally AED.

-- CLIENT --: ok. got it.. sorry. you cannot use USD receipt to pay off AED invoices

-- NEOSYS SUPPORT --: you COULD do a two step process if you really want the USD to show as an entry in the client account but three entries would show in the end as follows:

ie credit the clients account with 1000USD as a first step

and then CONVERT the USD to AED in the clients account like this

1. client a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

this is a currency conversion transaction on the clients a/c

crediting and debiting the same a/c

no change in the base currency on the second stage (assuming we are not charging him an exchange commission)

but all this doesnt answer the questions I posed initially

-- CLIENT --: q1. what is the total amount of USD posted - 1000 USD to the Bank and 1000 USD to the Intercurrency conversion account

-- NEOSYS SUPPORT --: total means TOTAL .. not a list

single figure

-- CLIENT --: its only 1000 USD which gets posted

-- NEOSYS SUPPORT --:

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670)

4. Intercurrency conversion account +3670AED (+3670base)

what is the total USD posted

arithmetic total

-- CLIENT --: 2000USD

-- NEOSYS SUPPORT --: those DR/CR mean something, the + and - are a clue

-- CLIENT --: zero?

-- NEOSYS SUPPORT --: yes

what is DR1000 and CR1000 or in other words +1000 + -1000?

-- CLIENT --: 0

-- NEOSYS SUPPORT --: 0

double entry booking keeping

q2 and 3 should be easier now you understand that by total we mean simple arithmetic totals

-- CLIENT --: q2. what is the total amount of AED posted - 0 again

-- NEOSYS SUPPORT --: yes

double entry bookkeeping

-- CLIENT --: q3. what is the total amount of base currency posted to the intercurrency account - 3670

-- NEOSYS SUPPORT --: nope

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670base)

4. Intercurrency conversion account +3670AED (+3670base)

-- CLIENT --: 0

-- NEOSYS SUPPORT --: yes

how do you feel about those answers

-- CLIENT --: the intercurrency conversion account is used as the contra account for the first 2 entries

-- NEOSYS SUPPORT --: q1. what is the total amount of USD posted .. answer zero

doesnt that feel strange to you?

sure the answers are arithmetically clear .. but if they dont feel strange then you missed the point

how is it possible to receive 1000USD yet the total posted into the books is zero ...

yet if you received 1000USD and put 1000USD against the clients account you would happily accept that according to double entry booking keeping that the total posted would be zero

-- CLIENT --: thats the principle of double entry accounting right?

oh. ok

-- NEOSYS SUPPORT --: basically intercurrency accounting in NEOSYS is turned into single currency accounting using an account called the "intercurrency conversion" account if the base amounts agree

or "exchange gains and losses" if the base amounts do not agree

we have to invent something called ICC (get it?) in order to reduce all multicurrency transactions to combinations of single currency transactions

-- CLIENT --: ok.

-- NEOSYS SUPPORT --: what seems like a complexity in the voucher turns out to have radically simplifying effect on the books

ie every currency will balance independently and can be viewed as standing alone from all other currencies

-- CLIENT --: ok

in case you had to directly post the USD to the client as well?

-- NEOSYS SUPPORT --: i gave the answer in detail already ...

-- CLIENT --:

1. bank a/c +1000USD (+3670base)

2. client a/c -1000USD (-3670base)

-- NEOSYS SUPPORT --: this can easily happen if you dont know what invoices the 1000USD is for ... so you dump it into the account as an unallocated credit to be sorted out later

-- CLIENT --: right. and do the journal to convert it to AED

-- NEOSYS SUPPORT --: all that happens thereafter is that you do the ORIGINAL voucher ... but the first line is the client a/c instead of the bank a/c

look back at the original transaction and subsitute mechanically and ponder the result

you can think that the client is your banker by the time of this second voucher

-- CLIENT --: you mean debit the client?

-- NEOSYS SUPPORT --: first voucher you debit (+) the bank

second voucher you debit (+) the client in the first line

look back at the original transaction and subsitute mechanically the bank for the client and ponder the result

-- CLIENT --: why would you debit the client if you receive the payment?

this is the next voucher after payment received?

-- NEOSYS SUPPORT --: yes

in case you credit client with 1000USD and LATER decide to use it to pay off AED invoices

LATER means another voucher to

a) convert the currency in the account - remove 1000USD and give them 3670AED

b) presumably to allocate all in one go

-- CLIENT --:

1. client a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670base)

4. Intercurrency conversion account +3670AED (+3670base)

-- NEOSYS SUPPORT --: right

-- CLIENT --: perfect

-- NEOSYS SUPPORT --: exactly

the ICC lines appear to confuse unless you keep a clear mind that in base they have NO effect and are just there to ensure that each currency individually balances to zero all the time

-- CLIENT --: ok

Intercurrency conversion WITH gain/loss - Exchange Gain/Loss Account

-- NEOSYS SUPPORT --: if you are fairly clear on this I can tell you the more usual case where the base DOESNT agree exactly due to bank charges etc

-- CLIENT --: yes. i have began to understand this more

-- NEOSYS SUPPORT --: we would like to post this ...

1. bank a/c +1000USD (+3670base)

2. client a/c -3700AED (-3700base)

NEOSYS will add this:

3. GainLossA/c -1000USD (+3670base)

4. GainLossA/c +3700AED (+3700base)

all NEOSYS does is notes that the total base was not exacly zero therefore is doesnt want to do the old method of reversing into the Intercurrency Conversion A/c because the rule is that the ICC a/c base amount must always be zero (and not show in the financial reports which are base currency)

and it reverses them into a different a/c ... the famous Exchange Gains and Loss A/c

to grasp the significance of this you have to ask yourself the same three questions as before ...

which are:

q1. what is the total amount of USD posted

q2. what is the total amount of AED posted

q3. what is the total amount of base currency posted to the EXGA (ie its balance after the above transaction assuming it was 0 to start with)

-- CLIENT --:

3. GainLossA/c -1000USD (-3670base)

4. GainLossA/c +3700AED (+3700base)

right?

-- NEOSYS SUPPORT --: yes sorry

-- CLIENT --: q1 - 0

q2 - 0

-- NEOSYS SUPPORT --: yes ... cannot be anything else according to double entry rules

but the answer to q3 is very interesting

-- CLIENT --: q3 - 30 AED ?

-- NEOSYS SUPPORT --: read the question exactly

-- CLIENT --: yes. i have

-- NEOSYS SUPPORT --: the answer is 30base

-- CLIENT --: yes. i said 30

sorry. i didnt say 30base

-- NEOSYS SUPPORT --: you said 30 AED

-- CLIENT --: and presumed the base was AED

ok

-- NEOSYS SUPPORT --: you must never confuse the two

there is REAL AED and there is base that happens to be AED

the total AED posted to EXGA is 3700

the total base posted to EXGA is 30

so the answer is completely different

-- CLIENT --: ok

-- NEOSYS SUPPORT --: when we are talking about base we never mention its "sex"

we can say either 30 base or 30 "equalent in AED"

but never 30 AED because that sounds like we are talking about real chinkable AED coins

anyway the answer is as you say, 30 base

-- CLIENT --: ok

-- NEOSYS SUPPORT --: so in the case of multicurrency transactions where the base adds up to zero .. we get entries that have no effect on the consolidated base currency books

but in the case of multicurrency transactions where the base DOESNT quite add up to zero ... the NEOSYS "I DONT LIKE THIS SO I AM GOING TO REVERSE IT ALL" methodology neatly ends up with the DIFFERENCE showing in EXGA a/c although it is effected by TWO lines (+ and -) instead of a single 30base entru

the NEOSYS method of showing exchange gains and losses as a PAIR of entries in the EXGA a/c allow you to analyse the SOURCE of exchange gains and loss BY CURRENCY!

-- CLIENT --: ok

-- NEOSYS SUPPORT --: the one line exchange gain loss method a) hides the source currency of gain loss and b) means that currencies dont balance per currency

so NEOSYS method although apparently more complex has always eventually been proved an advance over the average accounting system which doesnt keep isolated slices of books for each currency

-- CLIENT --: ok.

Processing Post-dated Cheques

How do I process Post-dated Cheques RECEIVED in NEOSYS?

Setting up for PDC Received

Decide where the pdc assets are going to appear in the GL. Normally they will appear somewhere in current assets.

If you wish to age and list individual outstanding PDC then you need to create the account in an open item ledger like the Accounts Receivable or Documents Receivable.

Create an account “Postdated Cheques Received” in one of the following charts. You can create one a/c or one per client.

- Accounts Receivable Chart

- Cash and Bank Chart (not advisable because cannot be open item and therefore cannot be allocated)

- Documents Receivable/PDC Received Chart

Recording the Receipt

When postdated cheque is in hand:

Journal: Receipts Period: Current Date: Actual Date on Cheque (future) Debit: Postdated Cheques Received A/c (maybe one a/c or per client) Credit: A/R or Client A/c (may be allocated to invoices)

Recording the Deposit

When postdated cheque is deposited:

Journal: Receipts Period: Current at time of deposit in bank Date: Date deposited in the bank Debit: Bank A/c Credit: Postdated Cheques Received A/c (maybe one a/c or per client)

How do I process Post-dated Cheques ISSUED in NEOSYS?

Setting up for PDC Issued

Decide where the pdc liabilities are going to appear in the GL. Normally they will appear somewhere in current liabilities.

If you wish to age and list individual outstanding PDC then you need to create the account in an open item ledger like the Accounts Payable.

Create an account “Postdated Cheques Issued” in one of the following charts. You can create a single account for all PDC, or one per supplier/payee.

- Accounts Payable Chart

- Cash and Bank Chart (not advisable because cannot be open item and therefore cannot be allocated)

- Documents Payable/PDC Issued Chart

Recording the Receipt

When postdated cheque is delivered to recipient:

Journal: Payments Period: Current Date: Actual Date on Cheque (future) Credit: Postdated Cheques Issued A/c (maybe one a/c or one per supplier/payee) Debit: A/P or Supplier A/c (may be allocated to invoices)

Recording the Clearing

When postdated cheque is cleared/reconciled:

Journal: Payments Period: Current at time of clearing in bank Date: Date cleared in the bank Credit: Bank A/c Debit: Postdated Cheques Issued A/c (maybe one a/c or one per supplier/payee)

Handling Exchange Losses & Gains

NEOSYS posts all exchange gains or losses automatically. Users cannot enter amounts into this account but it is not needed since the system will post it.

We advise against posting exchange gains and losses manually because technically the currency amount on such transaction is zero. Users can just post currency amounts and let the system work it all out.

In one NEOSYS voucher, users may debit in one currency and credit in a different currency. The base amount will usually not agree by a small amount and the system will add a third line to the voucher to make the base currency balance. The account on the third line will be the Exchange Difference account.

NEOSYS knows a lot about currency conversion so with some patience, you should be able to learn how it works in NEOSYS. Alternatively, this can all be done manually but it is prone to user error.

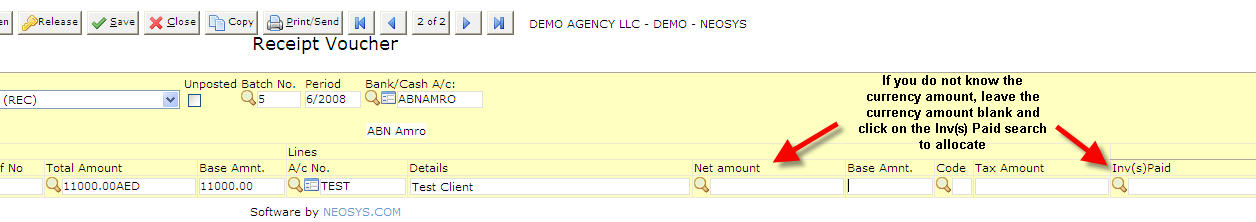

Exchange Losses & Gains on receipts from Clients

Receipts are valued at the value of the invoices that they pay off. By value we mean the base equivalent is calculated from the invoice instead of from the usual currency file exchange rate or any manual attempt.

Note that the base amount (to the client / account) on the journal will be different than what it is in the voucher file or the ledger printout.

The journal shows the same exchange rate as to the amount in the bank account which is usually the exchange rate in the exchange rate file unless the user has overwritten the base rate, which would be unusual.

Losses on Receipts

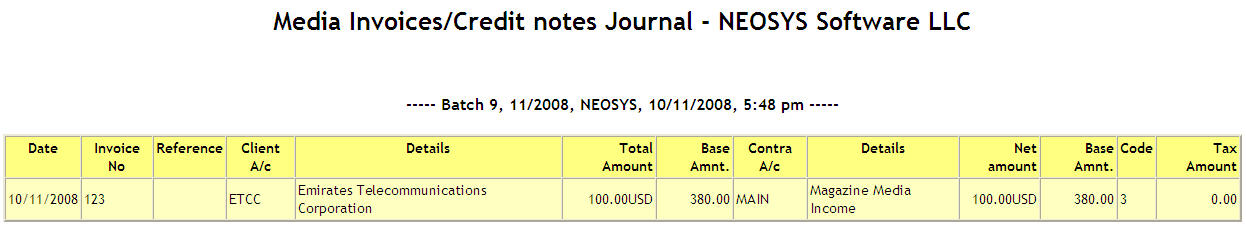

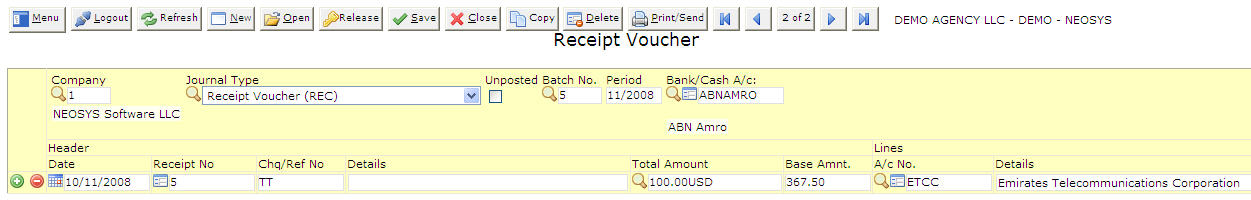

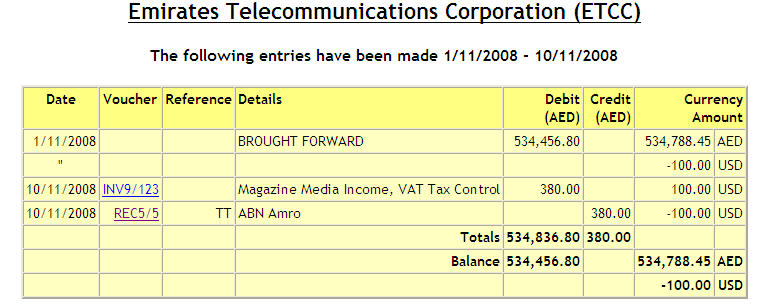

Invoice was issued for 100 USD / 380 base amount

Receipt was issued for 100 USD / 367.50 base amount

However when posted, the ledger printout shows that the amount recorded in the client account is 100 USD / 380 base amount

If you look at the voucher, you can see that the difference of 12.50 base amount shows as a Debit to the EXDI (Exchange Difference) A/c.

Note: In case of receiving 50% of the currency amount (eg 50 USD / 183.8 base amount) it takes the base amount to the client which is 50% of the value of the invoice (50 USD / 190 base amount). It will follow the same procedure and the amount to the client will be proportionate to the amount of invoice allocated.

Gains on Receipts

Invoice was issued for 100 USD / 380 base amount

Receipt was issued for 100 USD / 390 base amount

However when posted, the voucher shows that the amount recorded in the client account is 100 USD / 380 base amount and the overpayment of 10 base amount is posted as a debit to the EXDI a/c.

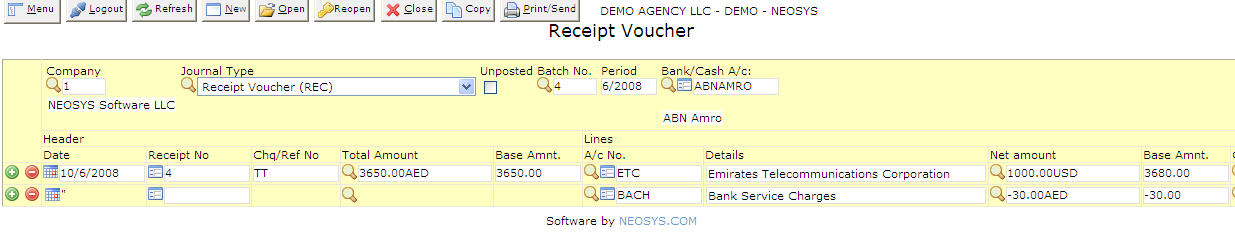

Exchange Losses & Gains on payment to Supplier Invoices

Sometimes the foreign exchange rate fluctuates and hence there is a difference in the invoice currency amount issued or received as compared to the actual payment received or paid.

Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c.

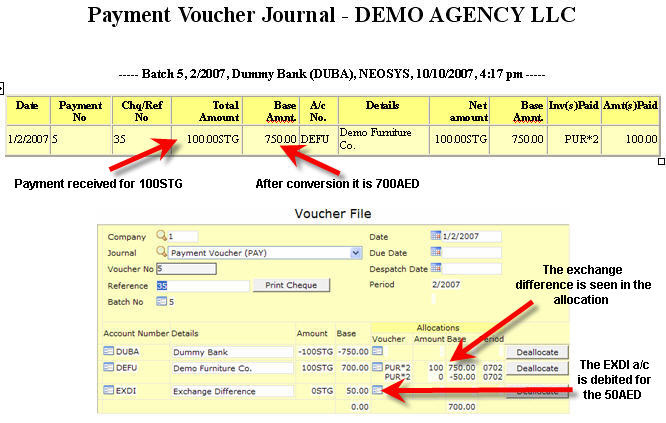

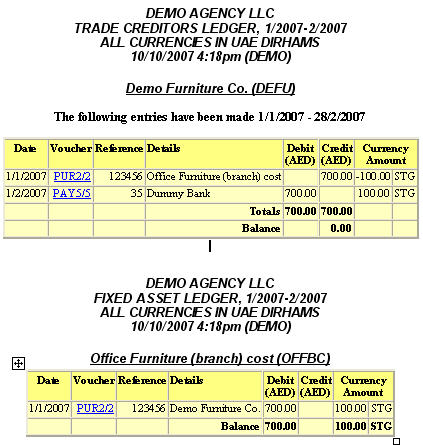

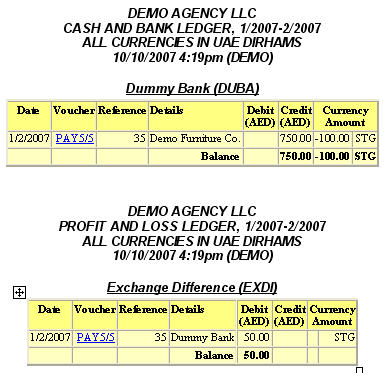

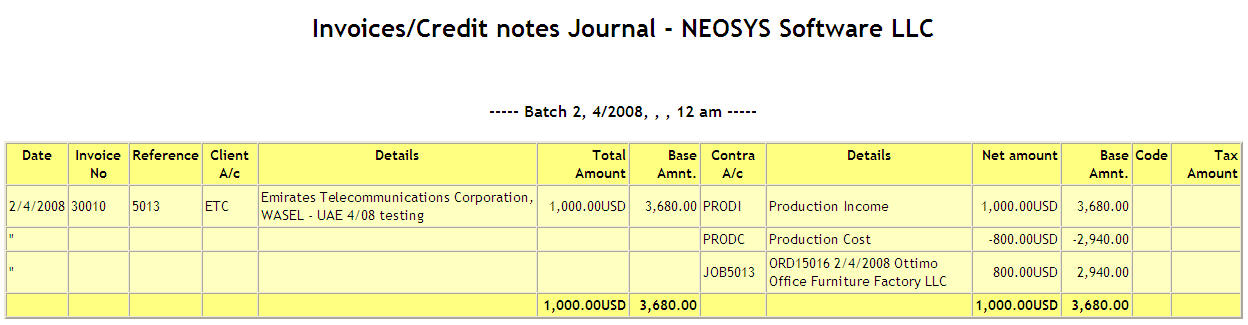

Below is an example of a sale which has been done:

A client is invoiced for 100STG on 1/1/2007. On this date the exchange rate was 1 STG=7 AED

The client makes a payment for this invoice on 1/2/2007. However the exchange rate on this day has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following:

- Allocates the payment of 100STG (750AED) to the invoice in the client a/c

- Credits the 50AED from the allocation which is overallocated to the invoice

- Debits the Exchange Loss or Gain A/c (EXDI in this case)

The following are the ledger printouts of all the accounts which were involved in this transaction:

Avoiding Invoice and Credit Note combinations appearing on Client A/c Statements

Problem

After issuing invoice and credit notes combinations for a variety of internal reasons, if the original invoice has not been sent to the client we might want the invoice and credit note combination not to appear on the clients statement.

The obvious way is to simply not enter (or if generated by a NEOSYS billing system, delete) the pair of documents from the journals prior to posting. However it is strongly advisable to post all invoice numbers (whether generated by NEOSYS or not) otherwise auditors may question the reason for the gap in the invoice number sequence.

Another solution is to simply allocate the credit note to the invoice immediately so that neither show on the clients statement of outstanding items. However if and when the client requires a statement of all movements on their account then the offending invoice and credit note will still appear.

Solution

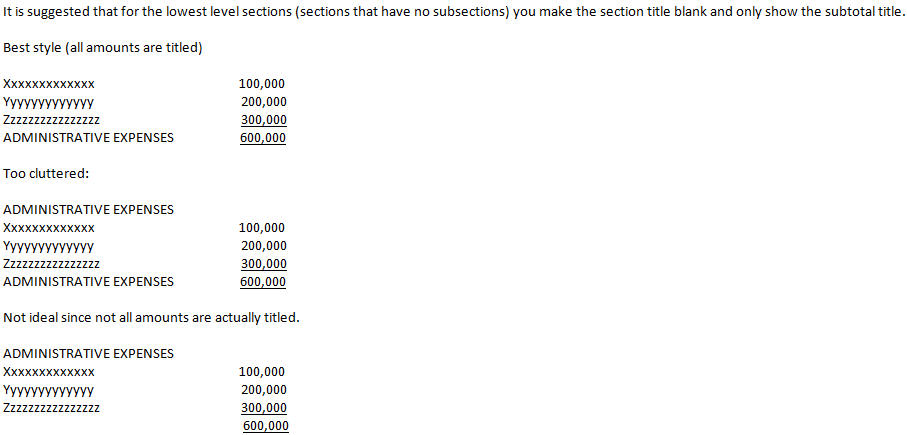

The best way to to modify the client a/c column in the journal for the invoice and credit notes to be a client suspense or "sundry" client account instead of the true client a/c number. This way there will be a record of the invoice number but the net balance will be zero and there will be no entries showing on the clients a/c. To do this you can either create a dummy client a/c with a suitable name like "Client Suspense" or use an existing general purpose client a/c like "Sundry Clients". You cannot use the normal suspense account (ZZZ999) here.