Using NEOSYS Job System: Difference between revisions

(→Costs) |

|||

| Line 68: | Line 68: | ||

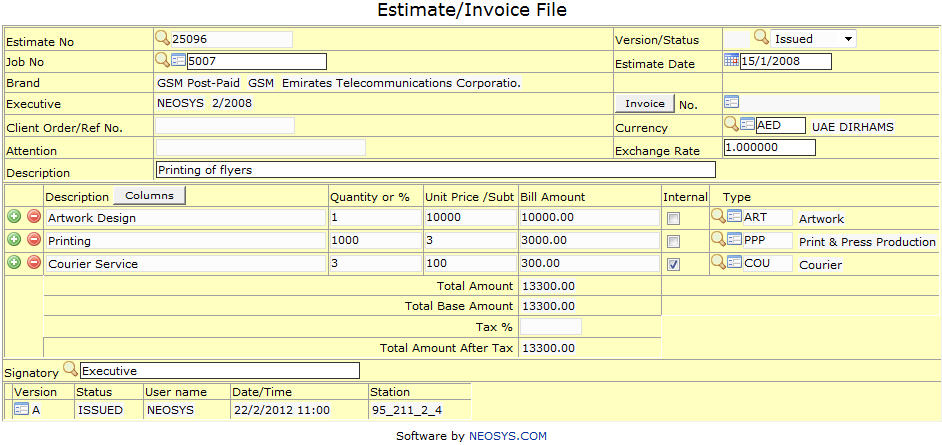

[[image:Estimateinvoicefile.jpg]] | [[image:Estimateinvoicefile.jpg]] | ||

===== | ===== Billing ===== | ||

This is where we raise estimates to the client and invoice the client from. The estimate has the quantity and unit price mentioned. | |||

How do I Invoice the client? | |||

On the estimate/invoice file we can click on ‘Invoice’ tab and view the proforma invoice and subsequently invoice the client. | |||

NOTE – for the changes made in the cost or billing section please click on ‘reopen’ for the changes to reflect. | NOTE – for the changes made in the cost or billing section please click on ‘reopen’ for the changes to reflect. | ||

Revision as of 08:09, 23 November 2008

Creating a job in production system

Production is used for BTL advertising, a job file consists detailed information about the job. Information such as the client, brand, market, bill and cost, etc. is mentioned in the job file. So we shall go ahead and look at the steps involved in creating a job –

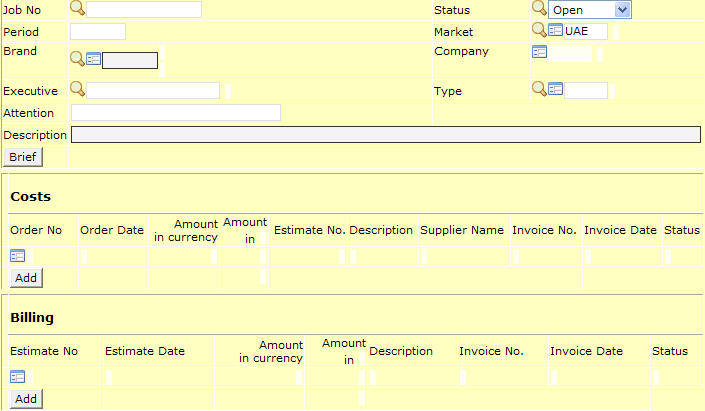

What we see above is what the job file looks like. We can broadly divide it into two main divisions, one which contains the information about the job and the second division is where the cost and billing information is to be entered.

We will begin with a step by step tutorial for the first half of the job file -

Job No.

As we press ‘enter’ the system would automatically generate the job number and if you wish to have a specific job number it can be entered manually, the system would then give the option of either creating a new job or copying from an existing job. NOTE – this feature is common throughout NEOSYS and also applies to ‘costs’ (PO/PI) and ‘billing’ (estimate/invoice) file.

Period

This would mention the current month and year and would be updated automatically.

Brand

This would mention the client and brand data. We can press F7 to choose the brand from the existing list or press F6 and create a new brand.

Company

This would mention the code of the company which is represented by the executive preparing the job file.

Status

This would mention the status of the job which by default is ‘open’ and could otherwise be ‘closed’ and ‘reopened’.

NOTE – not all users are given the authority to alter the status of the job file.

Type

This would mention the medium chosen for advertising which can be selected from an existing list of option after pressing F7 or a new type can be created after pressing F6.

Executive

This would be the user ID which was used to sign into NEOSYS.

Attention

This would mention the name of the client representative.

Description

It is a sort of a header, usually between one or two words, to the detailed information which is entered in the following column.

Brief

This contains detailed technical information regarding the type of media chosen for the advertising. We also have the option of copying the ‘brief’ to the estimate or the purchase invoice. The details mentioned in the brief can also used later for reference purposes.

NOTE – the nature of information entered in the ‘brief’ may differ based on the mode of functioning of the agency.

NOTE – at all times please press F9 to save the data before moving on to another window.

COSTS & BILLING SECTION

Costs

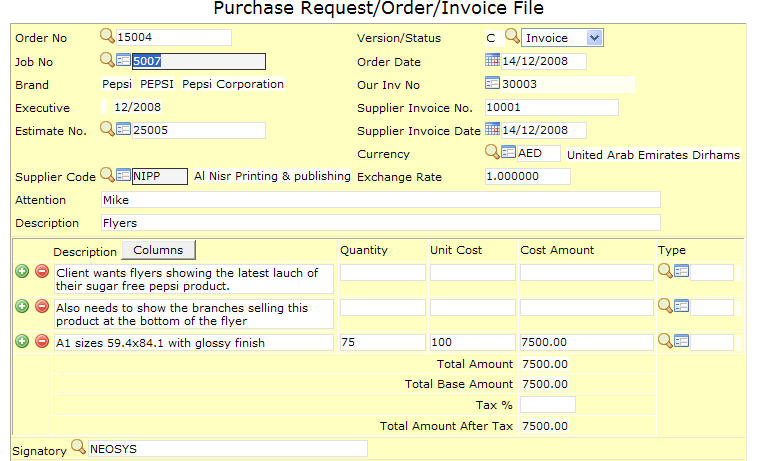

The purchase order has information about the costs involved and supplier details. When the supplier invoice is received we can change the status to ‘invoice’ and mention the invoice details.

Billing

This is where we raise estimates to the client and invoice the client from. The estimate has the quantity and unit price mentioned.

How do I Invoice the client?

On the estimate/invoice file we can click on ‘Invoice’ tab and view the proforma invoice and subsequently invoice the client.

NOTE – for the changes made in the cost or billing section please click on ‘reopen’ for the changes to reflect.

Issuing Credit Notes in production

What is a credit note?

A credit note is the opposite of invoice. It is issued by a seller to a purchaser to record the reduction of bill possibly due to a discount, return or cancellation.

How do I issue a credit note in production?

Once the client is invoiced another estimate can be made with the desired amount in negative and a credit note of the same will be issued directly.

Accounting entries created by the Production system

Raising purchase orders/invoices to/from SUNDRY SUPPLIERS

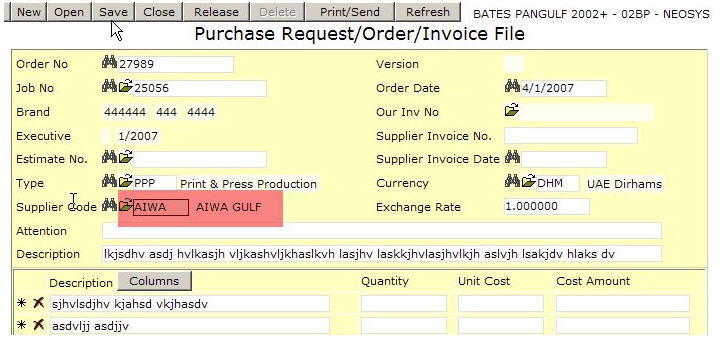

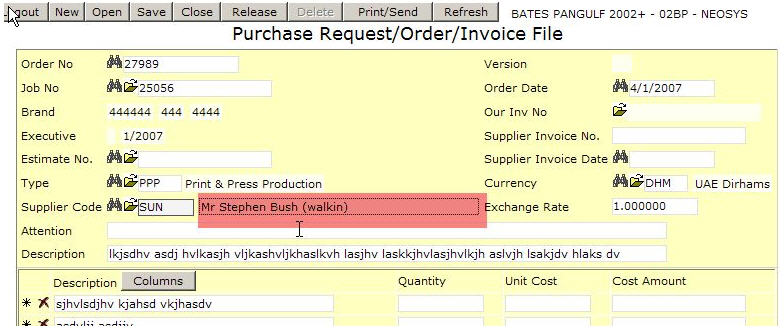

1. PO/PI with a normal supplier

2. PO/PI with a sundry supplier. An extra box popups up if the supplier name starts with the letters SUNDRY (case insensitive). The operator must type in something.

To do this you need to first create a supplier with name something like "Sundry Suppliers"

Why does NEOSYS reverse PO/repost PI on the cost a/c even when the PO/PI amounts agree?

This is a common question but NEOSYS practice has prevailed for some very good reasons.

- So that ALL purchase invoices show in the cost account. This makes life much easier for accountants to find information and auditors to verify the cost a/c.

- The reversal reflects the fact that there is no longer an ESTIMATED cost in the cost a/c and that it has been replace by a REAL cost.

Dislike of the apparently unnecessary reversal and re-entry is generally based on:

- A lack of appreciation of the benefits mentioned above (usually overcome by explanation)

- A desire to be like manual accounting where one would save staff time by not doing the reversal (irrelevant if totally automated)

- A desire for the cost a/c to be shorter especially if most PI match PO (less important these days now paper records are less used)

One can also apply the principle of not varying policy without good reason. In this case, making completely different accounting entries just because a PI varied by one current unit from its PO could be viewed as illogical.

Switching from manual costing to automatic NEOSYS Job Costing

Assuming that jobs are numbered sequentially just start from any particular job number and ensure that all costs that relate to that job number ("new jobs") and beyond are handled through the new automated NEOSYS practice and not through the old manual procedures.

All cost entries that relate to jobs prior to that number ("old jobs") must be continue to be handled in the old way and it and entries are generated by NEOSYS for these old jobs then those entries must be deleted and not posted.

NEOSYS will automatically create job account in a chart with code "WIPxx" where xx is the current year like "WIP08".

You must create the initial chart (e.g. with code "WIP08") yourself and then NEOSYS will create all future year charts for you. When creating the initial chart make it an open item type chart and you will have to put a control A/c. The control A/c for a WIP ledger is normally in the current assets section of the General Ledger. If you do not have a WIP control A/c (or you have an WIP account but it is not a control account and has any journals passed against it) then you will have to create a new account in the GL called something like WIP Control A/c.

If there are too many jobs in one chart then NEOSYS will create "WIP082", "WIP083" etc.

Correcting Incorrect Invoices

You cannot reverse an invoice once it is issued from NEOSYS. There is no way to be sure that someone has not (or will not) send out the incorrect invoice therefore if the system allow modifications there could be two or more different invoices in existence with exactly the same number. This is not good practice.

Therefore NEOSYS requires you to issue a credit note and another invoice as follows:

In the Job Module

- If the job is closed and you are not authorised to change closed jobs, reopen it using Job File. If you are not authorised to reopen jobs, then get an authorised person to do this.

- Create another estimate by copying the original wrongly invoiced estimate and change all the amounts to be negative.

- "Invoice" this new estimate in the usual way and you will get a credit note.

- Create another estimate by copying the originally wrongly invoiced estimate and modify that and/or invoice it as and when you like.

In the Finance Module

- All the journals generated including the original wrong invoice and the credit note MUST be posted otherwise auditors will question the missing invoice numbers.

- Allocate the invoice to credit note or vice versa so that they do not show as outstanding on the client's statement of outstanding items.

- If you really dont want the invoice and credit note showing on the movement account of the client then create a suspense a/c in the clients ledger and modify the journals Client A/c column before you post.