Using NEOSYS Finance System

OLD VERSION Special:PermanentLink/6014

Importing Accounts and Addresses

WARNING: You should trial out importing in test database first.

Before you start importing anything make sure that you use the clearing procedure to clear down any old data first.

You can either have accounts and addresses columns in a single file or separate files. Whichever way you go, importing accounts and addresses is a two step process and addresses can only be imported after accounts.

The import file must be in tab delimited text format and its name must be a maximum of eight characters with no spaces and a three character extension.

The import is done in the NEOSYS maintenance mode using F5 and all NEOSYS listening processes must be shutdown.

ACCOUNT columns

- ACCOUNT NO - required, alphanumeric plus "/" or "-" characters only.

- ACCOUNT NAME - required

- LEDGER CODE - required, must exist in Chart of Accounts File

- ACCOUNT TERMS - optional positive integer days to to pay 0 for Cash, 30, 60, 90 etc

- CURRENCY CODE - optional, must exist in Currency File

- TAX CODE - optional, must exist in Taxes File

ADDRESS columns

- ACCOUNT NO - required, must preexist in a chart of accounts

- ACCOUNT NAME - required

- ADDRESS - required, should be up in one column containing to four lines in quotes and separated by cr/lf characters

OR four columns "ADDRESS 1" ... "ADDRESS 4". - COUNTRY - required, no restrictions

- TEL - optional, free format so you can put multiple numbers and comments, appears on statements and forecast of payments.

- EMAIL - optional (ditto)

- FAX - optional (ditto)

- COMPANY REG NO - optional

- COMPANY TAX NO - optional

In the following example the account and address data columns exist in a single file called ACCOUNTS.TXT.

Importing Accounts

First verify that accounts can be imported and correct any errors before proceeding.

IMPORTX D:\ACCOUNTS.TXT ACCOUNTS

Actually import the accounts with the C option (Create).

IMPORTX D:\ACCOUNTS.TXT ACCOUNTS (C)

Option O can be used to overwrite (destroy!) existing records. Use with extreme caution and at your own risk.

Use NEOSYS, Finance, Ledgers, Chart of Accounts to check that the above has created accounts in the expected chart of accounts.

Importing Addresses

First verify the addresses can be imported and correct any errors before proceeding. Can only be done after importing the accounts.

IMPORTX D:\ACCOUNTS.TXT ADDRESSES

Actually import the addresses with the C (Create) option.

IMPORTX D:\ACCOUNTS.TXT ADDRESSES (C)

Option O can be used to overwrite (destroy!) existing records. Use with extreme caution and at your own risk.

Migrating Data from old system to NEOSYS

Strategy

In the process of migration, we are not going to import all the previous year's finance data as this would be near to impossible to replicate each receipt, payment, journal etc. which was done in the past. Moreover there is no way you will discard your earlier finance package immediately because it contains some critical information which will be required by auditors in the years to come. Hence in your old system you will close the books on a particulate date and generate a detailed balance sheet with closing items and balances which will be imported into NEOSYS as opening items and balances. This is the best way to move to a fresh, specialized finance package like NEOSYS and is an accepted practice for migrating to new finance packages.

Preparation of information which needs to be imported for Finance

First step is to close your books in the old finance package on a particular date. It is not necessary that you have to wait till your year-end closing date to migrate to NEOSYS and can rather just mid way during the year or anytime depending on your choice decide to move to NEOSYS and you will still be able to do your year-end closing absolutely perfectly.

For example if you decide to move to NEOSYS from 1st of May, 2009; you will close your books (after invoicing and entering all transactions up-to 30th April, 2009) and generate a balance sheet on 1st May. The balance sheet should have the following information:

- For each client – an outstanding statement (all items o/s for the client and not just a balance)

- For each supplier – an outstanding statement (all items o/s for the supplier and not just a balance)

- For all other account heads – (eg Furniture, Bank Balance etc) just a balance per account head

This information will be entered into NEOSYS as Opening Items and Opening Balances. For more information on this refer to Entering Opening Balances & Items

Preventing posting in prior years and periods

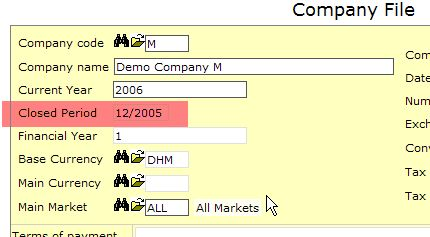

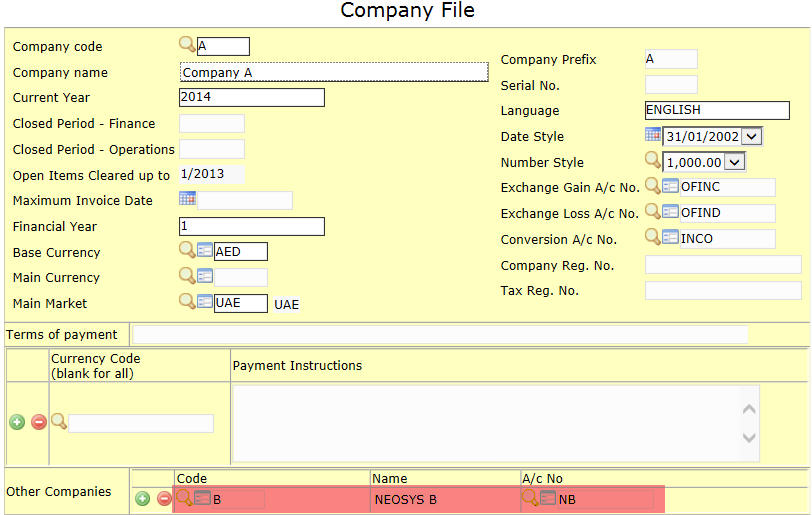

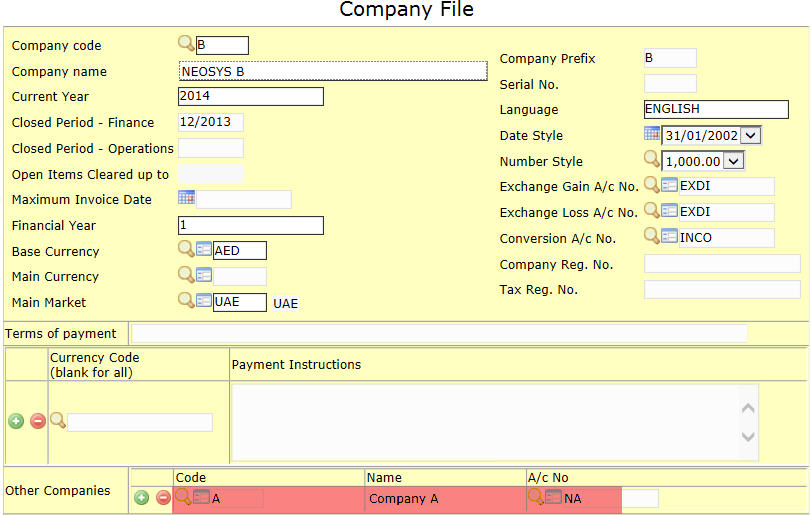

In the company file you can change the closed period to whatever you want. You have to do this on each company separately.

Anybody who can update the company file is allowed to change the closed period except that reopening prior year and periods can be further restricted by placing locks on the following tasks in the Authorisation File

In the Authorisation File, tasks section:

Consolidating Reporting

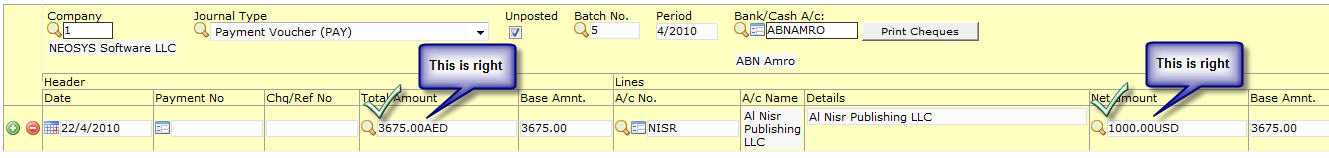

Consolidating Financial Statements

These are Trial Balances, Profit and Loss, Balance sheets etc showing balances, movement etc per account.

Data is always aggregated and never shows any individual transactions.

Differing account numbers between datasets can be handled by using NEOSYS mapping procedure.

Technically these reports just require inter-database access to the NEOSYS BALANCES file

Works in NEOSYS now

Consolidating Billing Analysis Reports

These are reports of total billing, costs etc by client, supplier, type and market etc.

Data is always aggregated and never shows any individual transactions

Technically these reports just require inter-database access to the NEOSYS ANALYSIS file and reference files.

Doesnt work in NEOSYS now but it will be eventually

Consolidating Ledger Statements

These require access to individual transactions and are unlikely to be provided by NEOSYS in the future since they can be done happily within a database.

If a client wants a separate database to do their own thing then there is this price to pay. NEOSYS does not support all three consolidations because there is too little demand to justify the programming when there is an alternative for the client.

Performing Essential Maintenance of NEOSYS Finance Module

Clearing Open Items

On systems with heavy loads of transactions on open item accounts, it is essential to do the NEOSYS maintenance task of "Clear Open Items" on the Finance, maintenance menu every month, clearing up to three months prior except that you should not clear up to 31/12/XXXX of the previous year, until you have closed XXXX and taken final statements of outstanding items as at 31/12/XXXX. Failure to do this for a long period of time would lead to "Cross Check Balance" errors. Although we may NOT clear open items up to date 31/12/XXXX until you have closed the year XXXX, we CAN definitely clear open items until 30/11/XXXX without closing the year XXXX i.e. we clear open items until the penultimate month of the year.

Opening a new financial year

Before you can enter any financial journals into a new year, either posted or unposted, you have to perform the "Open New Year" process on the NEOSYS Financial Maintenance menu. Opening the new year does not close the old year and you can continue to work in the old year as well as the new year at the same time without any restriction. You can continue to get all financial statements for the old year as if the new year had not been opened.

Contrary to common practice with many financial packages, it is possible and best practice in NEOSYS to open the new year immediately on the 1st January. Therefore you can post into the new year immediately and get up to date accounts without a break and without relying on temporary manual accounting systems for essential accounts like banks.

To restate this, in NEOSYS, opening a new year has nothing to do with closing an old year.

Closing a financial year

Closing a year in NEOSYS prevents anyone from posting further entries into it regardless of their level of authorisation

However, authorised staff can reopen closed periods and years temporarily if further postings are required, eg. posting some final year-end auditors journals. Closing is therefore a convenient "switch" which can be closed and re-opened at will if a user has sufficient authority.

Closing is done by entering or changing the "Closed Period" on the Company File. Opening the new year does not automatically close the old year.

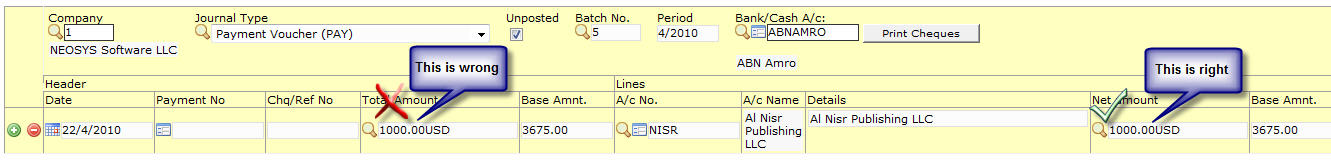

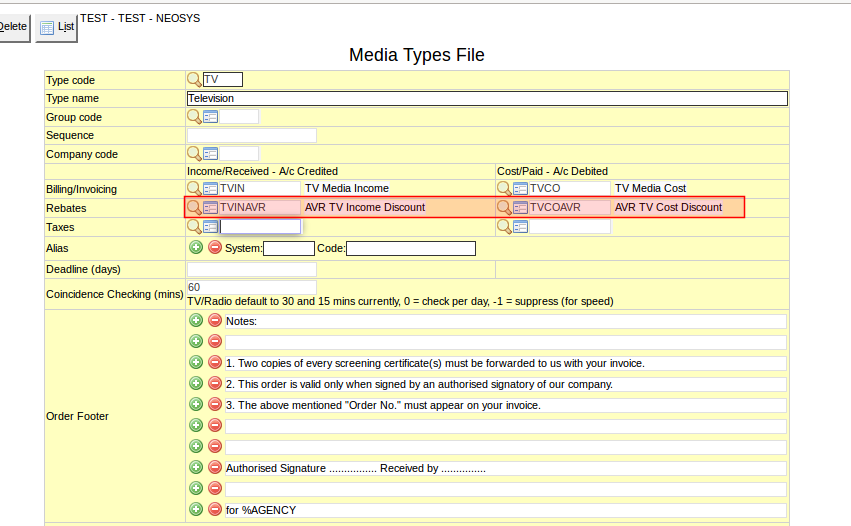

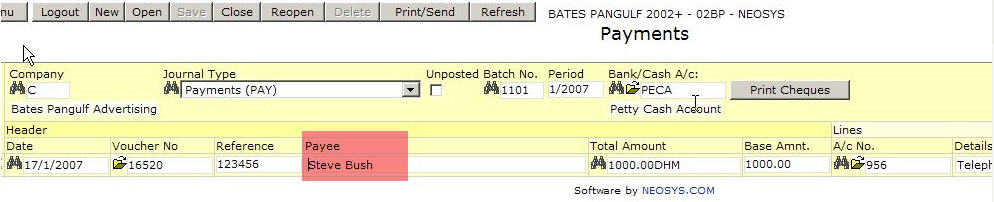

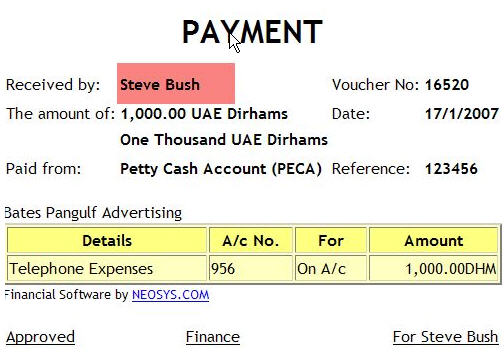

How to enter and get payee name on payment vouchers

One needs to be able to enter the exact payee when the account name is not the payee. This is usually the case when generally posting to an expense or asset account and not for creditors.

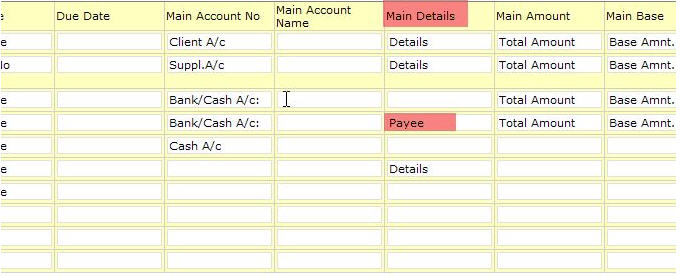

To be able to enter the exact payee on payment vouchers data entry, in Journal setup you have to specify some title for the "Main Details" column of the Payments Journal (hidden off to the right of the the Journal Setup screen).

then you will be able to enter Payee in the Payments journal ...

and get whatever you enter on the payment voucher ...

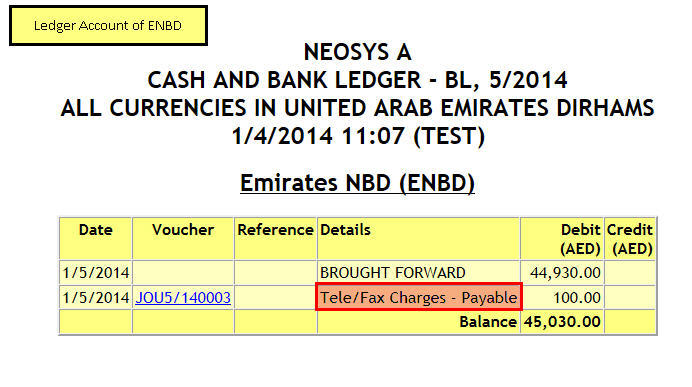

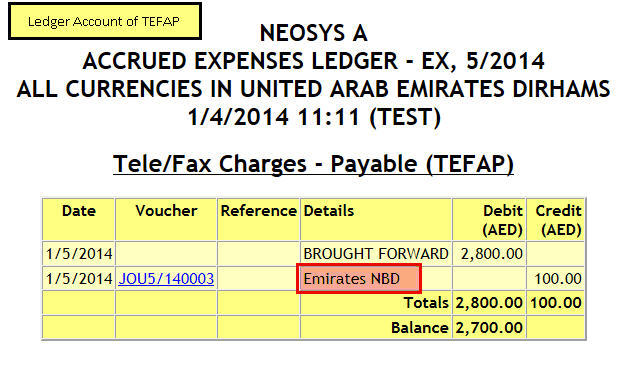

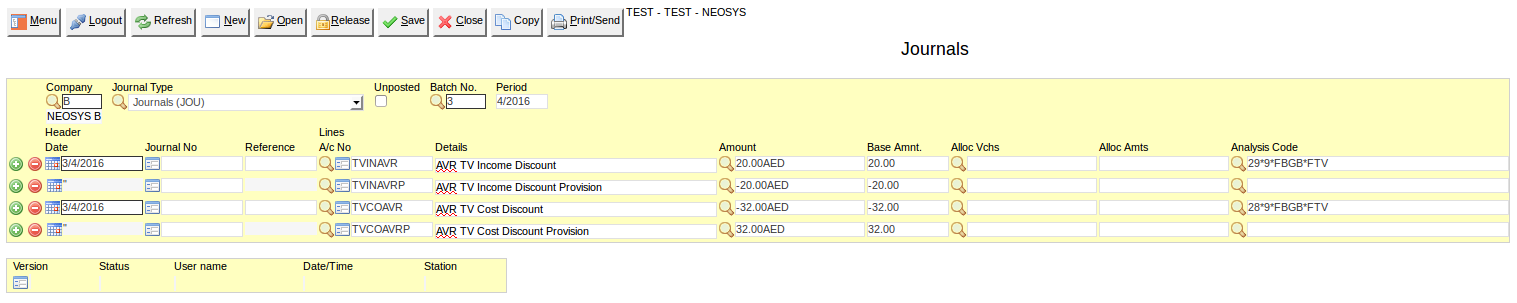

Automatic Details on Ledger Account

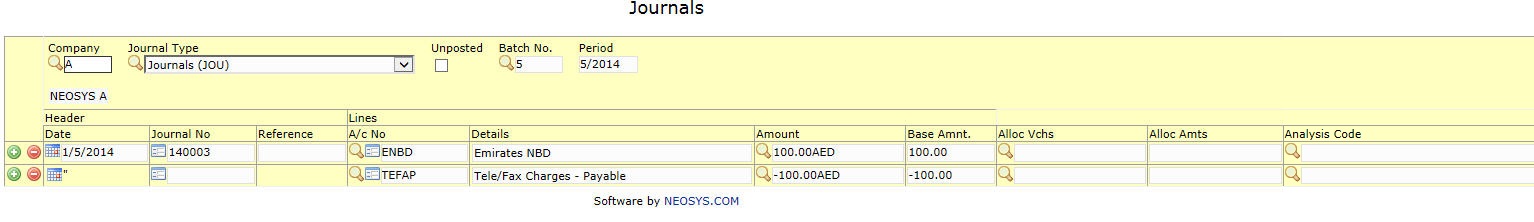

There is a simple concept in NEOSYS that allows the details on ledger accounts to come automatically. This can considerably reduce the amount of typing on Journal data entry.

The idea is that the details or account name on the other side of the voucher are interesting information. Each account therefore refers to the other.

If you do not want the automatic details concept then simply enter precisely the details you want to show on the account on each line of the voucher.

Put simply, if you credit bank account 1 and debit expense account 2 telephones then if there are no specific transaction related details entered on the journal then the details on the ledger account of bank account 1 shows the name of the expense account 2 - telephones and the details on the ledger account of the expense account 2 telephones shows the name of the bank account 1 as shown in the screenshots below.

In order for this trick to work, simply leave the account name in the details column and do not change it. If you do change it and want to get back to the original state then either blank the details so the account name returns or retype the account name precisely.

Note that NEOSYS puts the account name in the details column by default in Journal Entry screen. Since it is pointless to show the account name in the details of the same account then NEOSYS suppresses it on the ledger account. Therefore if you leave the account name in the details and add nothing, it is as if you put no details in the journal data entry. So if you add no details NEOSYS puts on the ledger account the details of the other account.

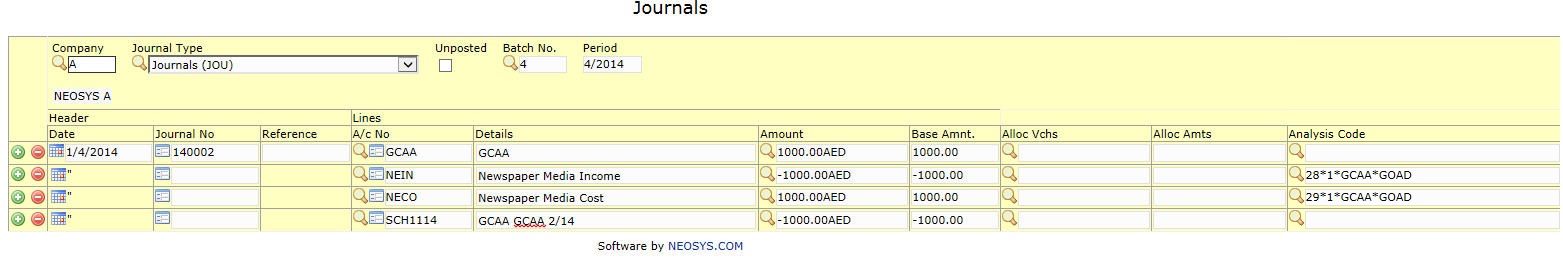

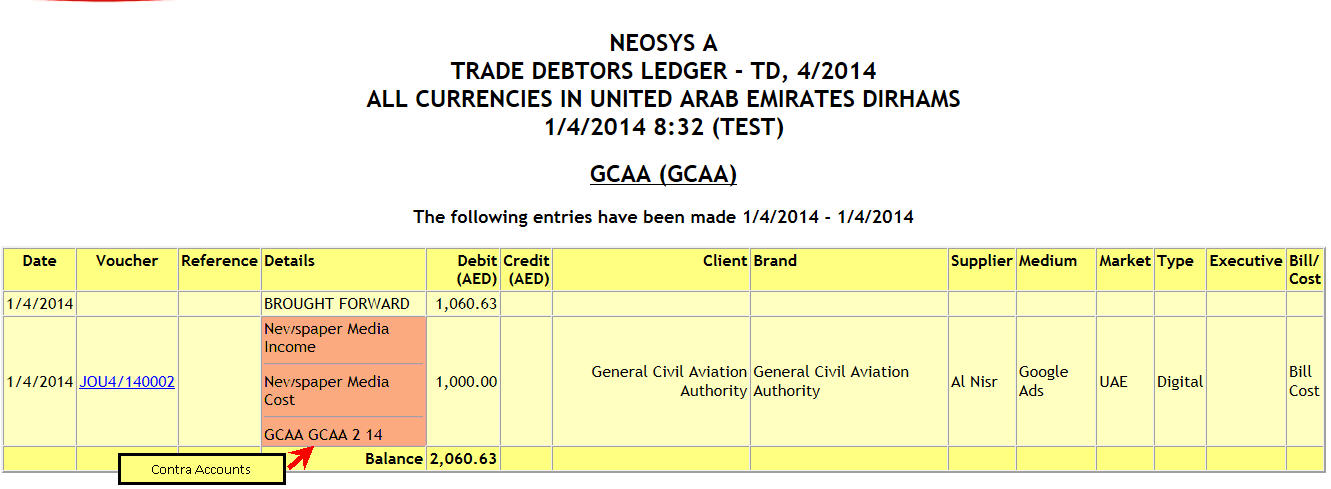

Vouchers with 3 or more lines

NEOSYS defaults to assuming that the FIRST line of a voucher is considered to be the main posting and all the other lines are "contra" or "bifurcations" of the first. Virtually every voucher falls into this ONE MAIN+ONE OR MORE CONTRAS concept.

Therefore, if you debit account 1 and credit/debit accounts 2, 3 and 4 then on account 1 the names of accounts 2, 3 and 4 will show as shown in the screenshots below. On accounts 2, 3 and 4 only the account name of account 1 will show.

Warning: Forget any concept of always putting the debits first followed by credits. When entering general journals of more than one line make sure that you put the "main" account first followed by the balancing debits/credits, regardless of whether it is debit or credit.

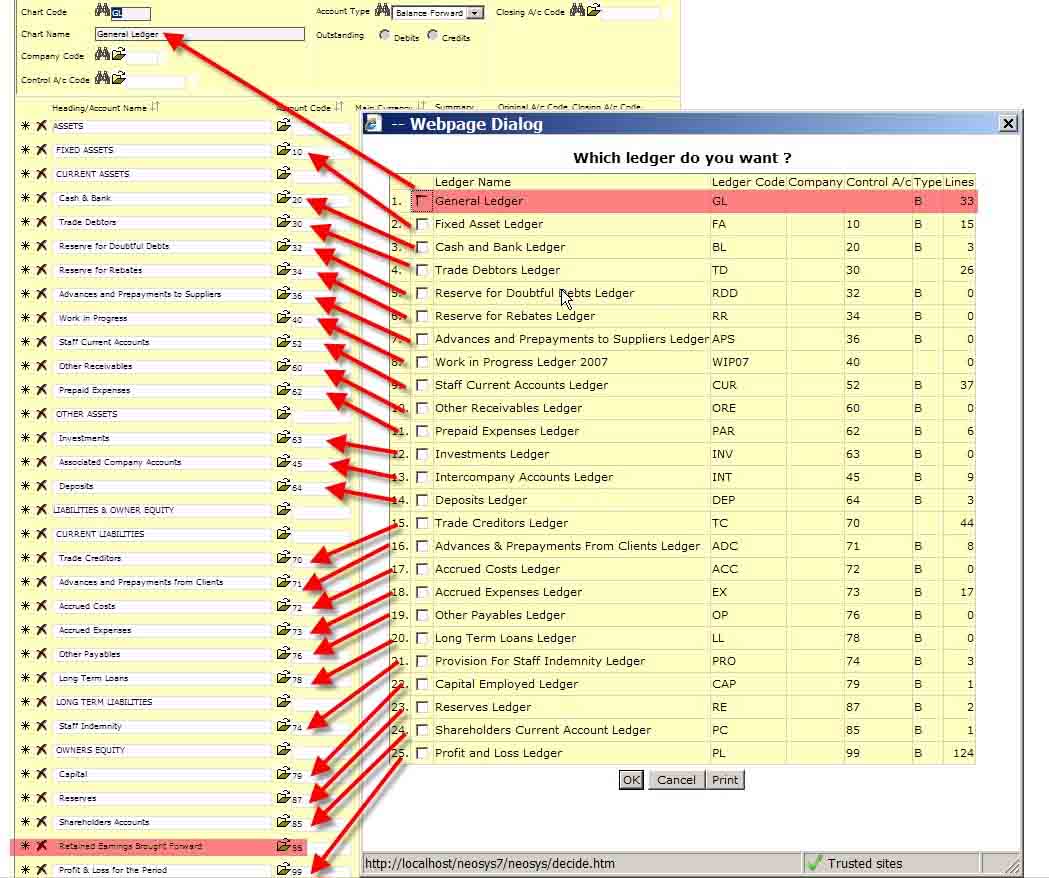

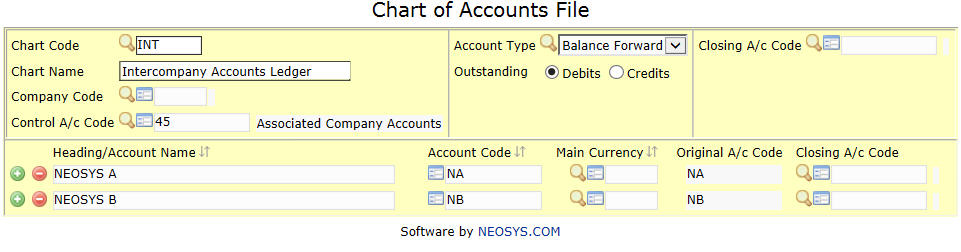

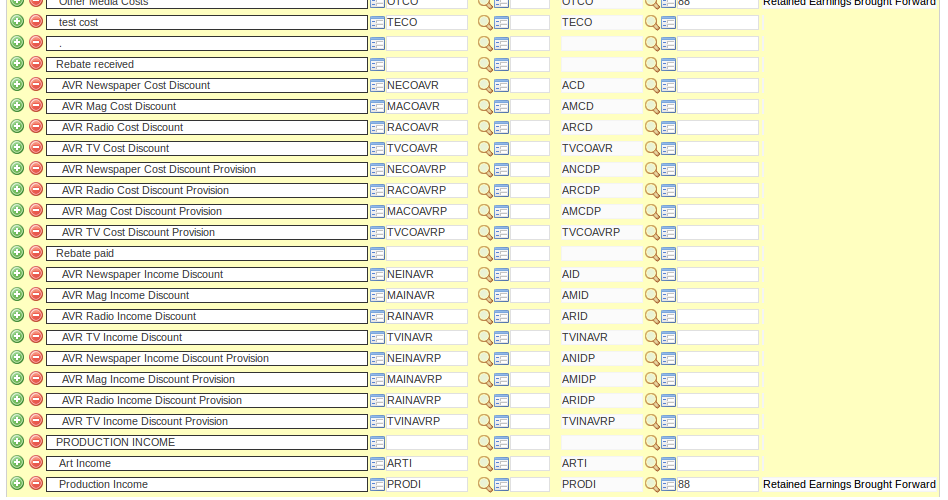

Chart of Accounts

Understanding the Chart of Accounts

Here you see the chart of accounts for the GL ledger underneath and an almost perfect one to one correlation with the popup list of charts (ledgers)

You need to deeply understand this in order to grasp the beautiful simplicity of having one master chart of accounts (GL) which contains only control accounts which are represented by a series of subsidiary chart of accounts which contain the actual accounts that you can post to. You cannot post to control accounts.

Check for yourself that the control account of each ledger matches to one account in the GL account. Only one ledger in the list of ledgers (charts) has no control a/c and this is the master or top level chart of accounts (GL).

There needs to be one real (ie not control account) account in the master chart of accounts and this is called retained earnings brought forward. This account is the "closing account" of all the P&L accounts.

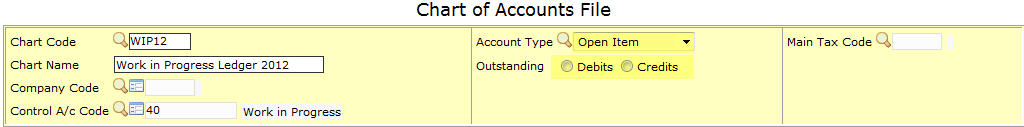

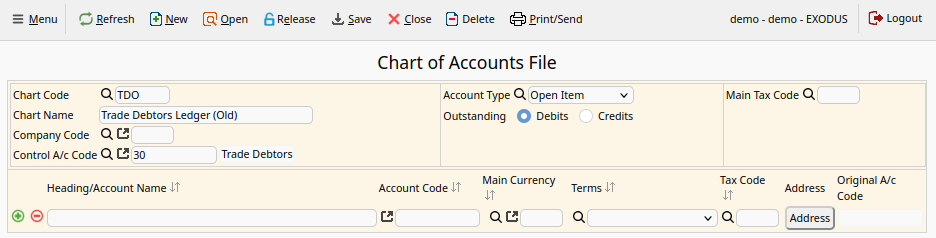

Outstanding

This can only be entered for charts with Account Type: “Open Item”. It has no meaning for balance forward accounts.

Select either “Debit” or “Credit” to indicate, for the accounts in this chart, whether either unallocated debits or credits are to be considered as invoices for the purposes of aged balances reports and allocation. Items of the opposite sign (e.g. unallocated payments or credit notes) will be totaled in the “Unallocated” column.

For asset ledgers, like Accounts Receivables and Clients, “Outstanding” should be “Debit” since outstanding unpaid invoices are debits.

For liability ledgers, like Account Payables and Suppliers, “Outstanding” should be “Credit” since outstanding unpaid invoices are credits.

If left unspecified, NEOSYS tries to determine the sign automatically by checking if the chart code is listed in the “Main Accounts” column of the Journal Setup for journals of type “Sales Invoice” or “Purchase Invoice”.

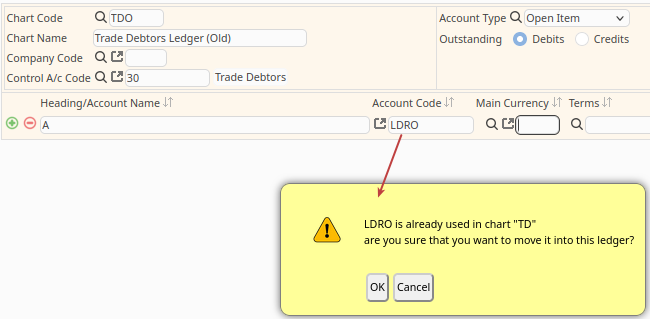

Moving Accounts between subsidiary charts

You can only move accounts between charts which have the same control account.

A workaround in this case is that you will have to create a new account and create a journal to move the balance from the old account to the new account. To prevent any future postings on the old account add the word <stop> with the <> brackets to the old account AFTER you do the journal.

Financial Years and Periods

Configuring Start of Year and Financial Periods

Nearly all NEOSYS clients financial year follows the calendar year (1st January to 31st December) but there are a few that are different eg 1st April to 31st March, 1st July to 30th Jun etc.

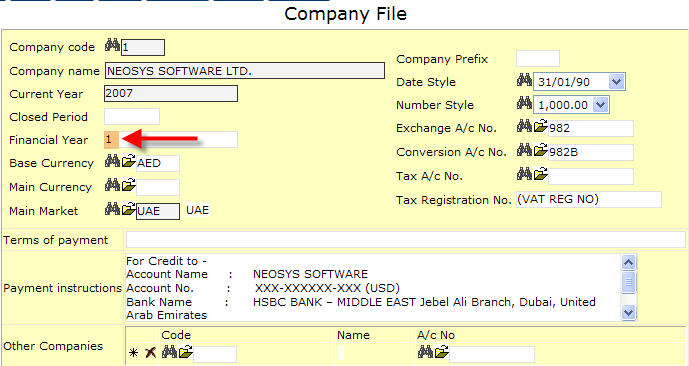

The configuration of Financial Periods are done in the Company File under Finance

In the above screen the financial period has been set to 1 which means January to December. In case the company follows the April to March financial period, than it would be set to 4. You can configure this to start at any month (i.e. 1=Jan, 2=Feb etc)

Using Financial Periods

We always need to remember and inform clients that the PERIOD referred to in the finance system is always a financial period. (all examples are taken wherein the current financial year is 2007)

For eg:

Period 1/2007 would be January/2007 in case the financial period is Jan to Dec. Period 1/2007 would be April/2007 in case the financial period is Apr to Mar Period 10/2007 would be October/2007 incase of financial period Jan to Dec Period 10/2007 would be January/2007 incase of financial period Apr to Mar

Also if you are posting opening item journals for the previous financial year, note the following:

Period 12/2006 would be December/2006 incase of financial period Jan to Dec Period 12/2006 would be March/2007 incase of financial period Apr to Mar

How to Open New Year

Management approval is mandatory to proceed

To open a new year, go to Menu > Finance > Maintenance > Open New Year.

Select the company for which you wish to open the new year.

Now select the desired year from the drop-down list and click on "View Logs". This would show a log that contains information about when the last new year was opened and by whom, etc.

Now click "Open New Year" and follow instructions.

Entering Opening Balances & Items

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS

A suspense account is required in most of the following procedures. This account will end up as zero at the end of the procedure. NEOSYS support will generally create an account called "Suspense Account" with account code "ZZZ999" and place it somewhere in the General Ledger or Profit and Loss Ledger.

General Ledger/Balance Sheet

You do not have to enter the opening balances before starting to use the system. You can enter them later.

You may enter provisional opening balances and later enter opening balance adjustments.

GL opening balances do not need to be entered when starting up a new company since new companies dont have any opening balances.

It is very easy to get confused and end up with a suspense account balance if you do not keep a clear head. Accountants know than you cannot have only one error in a trial balance so if you end up with a balance in the suspense account at the end of entering opening balances then you can be sure that it means you have an error somewhere else.

Closing Balances

First acquire a closing trial balance from the old system. Ideally it should be in spreadsheet format to enable checking and control.

Use a calculator or spreadsheet to ensure that the closing trial balance totals to zero. It is rare but not unknown that closing trial balances do not actually balance so this should possibility should be eliminated. You may choose to postpone this check and only do it if needed because you cannot get the NEOSYS system opening balances to balance to zero after completing all the stages of entering opening balances.

Preparation

If the NEOSYS account numbers are not the same as the old system account numbers, add a column to the closing trial balance to represent the NEOSYS account number as follows.

For each account in the old GL/BS identify the corresponding new account(s) in the new NEOSYS GL chart of accounts:

If two or more old accounts match to the same GL account in NEOSYS then put the new NEOSYS account number more than once. Do not club them together; leave them as separate lines so they can be reconciled more easily. The balance of the new account will be the total or net of the old accounts.

If an account in the old GL/BS is split into two or more new NEOSYS GL accounts then you must decide the amounts and create two or more lines in the closing trial balance. The old account number will be duplicated and the new NEOSYS account number will be different.

Posting

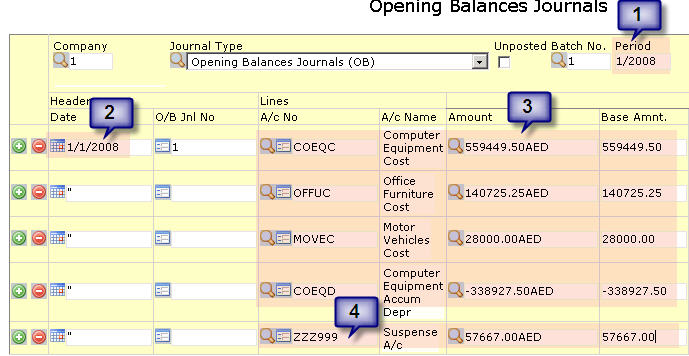

Create a single NEOSYS Opening Balance Journal (OBJ) with one line for each line in the prepared old closing trial balance.

Such a journal can be clearly be very easily reconciled to the old system. The journal and the new GL/BS will clearly balance since the total of all accounts in a GL/BS is always zero according to accounting rules.

The financial period of the journal MUST be 1/9999.

The journal date should be 1/1/9999 where 9999 is the current financial year.

Post the closing balances from the prepared closing trial balance.

OBJ Journals do not show as movements on the ledger accounts so if you post two opening balance journals to the same account, you will see the net balance in the account.

Control Accounts

You are NOT allowed to post directly into control accounts in NEOSYS. Whenever you are blocked from doing so when entering the Opening Balance Journal, enter the NEOSYS standard Suspense A/c number (ZZZ999) INSTEAD of the NEOSYS control a/c number.

The balance in the ZZZ999 account will be reversed by the entry of the opening balances of the subledgers described elsewhere. Once all the subledgers have their opening balances or items entered and all is 100% correct then the ZZZ999 account balance will be zero.

Quick Option

In practice, nearly all of the accounts in the standard NEOSYS chart of accounts for GL are control accounts. Therefore, since control accounts opening balances are all posted into A/c ZZZ999, you may save time on data entry by clubbing them together into a single journal line (or if not 1, at at least not exactly one line per control A/c).

This is NOT recommended unless you are very familiar with the whole process and have the closing balances in a spreadsheet to make the clubbing together easy - for the following reasons:

- It is harder to reconcile the journal to the source closing balances because you will not have one line per GL/BS account.

- It easy to accidentally club and post NON-control accounts balances into the ZZZ999 suspense account - leaving those accounts WITHOUT an opening balance and the suspence account WITH a pending balance.

Subsidiary Balance Forward Ledgers

Balance Forward Ledgers are for example Bank Ledger, Sundry Payables/Receivables, Staff Loans Ledger etc.

You can, but probably do not want to, treat Clients/Receivables & Suppliers/Payables as balance forward accounts since you would not then be able to get a statement of outstanding items.

For each Balance Forward ledger, create a single Opening Balance Journal with one line per account and an additional contra/closing entry/line to the Suspense A/c (ZZZ999). The additional line must agree with the balance of the ledger in question and can be used as a control check before posting that all the other accounts/amounts have not been mistyped.

The period of the Opening Balance Journals should be the first new accounting period. The journal date does not matter as these do not show as movements (unless you are posting opening balances" on open item accounts) but you are advised to put the first date of the journal period.

Regardless of the period within a financial year that opening balances are posted into NEOSYS always updates the opening balances of the financial year. If you are starting in the middle of the year this doesnt really make any difference.

If you are starting in the middle of a year then for the P&L ledger you might prefer to post a normal Journal instead of an Opening Balance Journal and into one of the old periods in order that the entry shows as a movement of the year instead of an opening balance for the year. This makes no difference to the closing balances of the P&L accounts, but some financial report may be specifically designed to show movements during the year which would exclude exclude opening balances.

Subsidiary Open Item Ledgers

For open item accounts you should enter opening items if you want to see all the outstanding items one by one on the statement but if you want to have a single outstanding item as the total sum of all then you can enter opening balances only. Therefore entering both opening items AS WELL AS opening balances is not necessary and this will create DOUBLE opening balances if you do.

According to the well known NEOSYS rule, entering any journal in a prior year results in the opening balances of the following years being updated. Therefore the entering of opening items in the last period of the prior year when setting up the system will clearly result in the opening balances of the current year being created.

Entering open balances may be done for selected accounts. It is quicker to startup and saves work of entering all the opening items one by one. But then the opening items are not visible in NEOSYS and all you can see is one lump sum as a single outstanding item representing all outstanding items. In this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients.

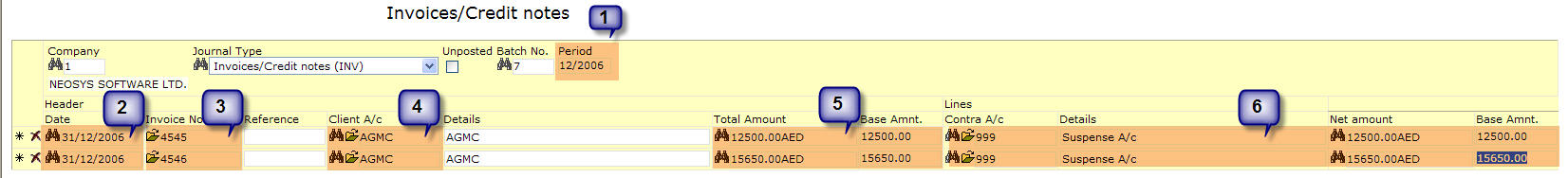

Alternatively, you can Enter Outstanding items as follows

- Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). Press F9 to make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED.

- Enter 1 Batch of outstanding invoices in the Invoices Journal for all the smaller/remaining a/c's with relatively few items. No check is possible unless all accounts for one ledger are in one batch then Press F9 to check if total matches open balance of the ledger.

- Enter batches of receipts and/or payments for any unallocated payments and receipts.

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. Refer to Opening Items entry

Posting of foreign currency items and accounts

Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL.

What are Opening Balances?

Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system.

For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account.

How to enter Opening Balances

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below:

- Enter period 1 and the year that you are interested in. Putting any other period but 1 makes no difference since NEOSYS always puts them in period 1.

- Put date 1/1 of the same year. Since opening balances DONT show as entries on the account it doesnt matter what you put here.

- Enter all the account numbers for one ledger (eg bank accounts) into one batch/journal voucher, putting a - (negative sign) for credit balances.

- The last line of the journal voucher "closes" the balance of the journal to the Suspense Account which usually is ZZZ999 or 999. You can check that the last line agrees with the total balance of the ledger before posting to ensure that no mistakes have been made.

- Repeat the above steps for each ledger that has to be opened.

There are some special considerations for posting the opening balances of the General Ledger:

- For control a/c, replace the a/c number with that of the Suspense Account. This is because NEOSYS will not allow you to post the control a/c balances directly because the control a/c balance will be posted automatically from the postings to the accounts in its subsidiary ledger.

- Remember that it is not neccessary that all accounts in the GL is a control a/c and the above step applies only to control a/c.

- For non-control a/c in the GL, enter the a/c number.

- There is no closing line since the total of the General Ledger A/c is zero if it properly balances.

What are Opening Items?

When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding (unpaid) items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening items are unpaid invoices and perhaps a few unallocated receipts or payments.

Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology.

How to enter Opening Items?

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Enter the ORIGINAL invoice date for each invoice (not the closing date of the prior period as shown in the example)

- Enter each invoice details i.e. the invoice number

- Select the Client/Supplier account

- Enter the invoice amount

- The contra account must be the suspense account which usually is ZZZ999 or 999.

- Is it advisable to stop and post the batch once per large account because you can then check that the batch total agrees with the balance of the account to prevent mistakes before posting.

Working of Inter Currency Conversion

-- NEOSYS SUPPORT --: NEOSYS, behind the scenes mostly, keeps a complete double entry trial balance and set of accounts for each currency independently.

there is an interesting concept that should perhaps illustrate something to you

you know how double entry book keeping stops accountants from making mistakes

by ensuring that if they do make a mistake than they make TWO mistakes

eg fail to enter correct income amount .. then the client account is also wrong

-- CLIENT --: yes

-- NEOSYS SUPPORT --: double entry accounting works by implementing a CONTROL

control means checking versus something else

In NEOSYS the same trick is done with currency

NEOSYS keeps TWO sets of double entry books

one in pure currency per currency

and one in pure base currency per currency

complete two sets of books for the whole company

in parallel

many financial software systems do not keep separately balancing double entry accounts per currency and lack this secondary control that is present in NEOSYS

in order to do this NEOSYS ensures that in every journal voucher, not only the base currency amount balances but so does every currency on the transaction balance to zero

-- CLIENT --: thats in the current system

ok

-- NEOSYS SUPPORT --: this is any company using NEOSYS and trading in currency

well the currency books can be checked versus the client/supplier/bank etc

then NEOSYS revaluation checks that the base books agree with the currency balances AT THE LATEST RATES

and and discrepancy is chucked into the GAIN AND LOSSES account somewhere in the P&L where it causes a lot pain if wrong because it hits profit/loss

-- CLIENT --: aha. ok

-- NEOSYS SUPPORT --: initially there are a lot of queries about NEOSYS generating exchange gains and losses

but in the end NEOSYS has always proved to be correct

in some companies which are not sophisticated currency-wise, the currency books and the base currency books are never really compared

this allows their finance team to DEAL ONE WAY WITH THEIR CLIENTS IN ANOTHER WAY WHEN REPORTING TO THEIR MANAGEMENT

client/suppliers/banks only care about currency

boss/management only care about base currency since they want ONE set of reports eg balance sheet and profit and loss that represents the whole picture of all currencies

accountants must be schizophrenic.

on one hand they have to deal with real currency with their clients/suppliers/banks ... and the base equivalent is IRRELEVENT to operations

and on the other hand they have to prepare reports to management/shareholders in pure base currency ,,, and the currency amount is IRRELEVENT to management/sholders

NEOSYS facilitates this necessary schizophrenic view but at the same time meticulously ensures that the two alternative views are reconcilable

-- CLIENT --: i get the concept

-- NEOSYS SUPPORT --: many accounting systems are only double entry in the base currency books

ie if you add up all the foreign currency from all the accounts .. it doesnt balance

in many financial systems, currency is just a comment except on accounts like client/supplier/banks

in NEOSYS we make sure that each and every currency is also balanced to zero using double entry accounting

this why if you debit one currency and credit another currency then you see NEOSYS adding two extra lines to REVERSE the currency amounts ... either into exchange gains and losses if the base amounts are not the same ... or to the special NEOSYS account called "Inter-currency Conversion"

four line voucher where you expected to see only two lines that you entered

imagine this ...

you can ask for NEOSYS financial reports for any single currency that you like and it will focus solely on transactions and balances for that currency you chose

ignoring all the other currency transactionsx

so not only does NEOSYS keep complete parallel double entry books for currency and base separately

it also keeps a separate set of books for each currency"

by default, NEOSYS presents all currencies to you as a consolidated position so you think you have one set of books

if you transact in 10 currencies ... NEOSYS keeps 20 separate books of accounts

each currency has a balancing set of books in currency amount and its base amount

-- CLIENT --: yes. 10 in the base and 10 in the foreign currency

same set

ok

-- NEOSYS SUPPORT --: so NEOSYS DOESNT MIX CURRENCIES AT ALL DEEP DOWN

as you would expec, NEOSYS will prepare financial reports for all currencies consolidated

that is the default reporting option but it isnt a fixed part of the system

in a NEOSYS client whose base currency is AED, in settings you can select USD only and option: UNCONVERTED

then you will see a SLICE of the company which is purely USD transactions

and the two sides of that slice are the USD amount and the base equivalent of those USD transactions alone.

-- CLIENT --: ok.

i noticed this while investigating ledger printouts in multi-currency

-- CLIENT --: when you send statements to clients from NEOSYS it will print the currency slices separately without any base currency showing

clients a) don't case about your base currency and b) expect to see a separate statement for each currency that they deal in with you EVEN IF YOU PUT ALL CURRENCIES INTO A SINGLE NEOSYS ACCOUNT

a common error that accountants new to NEOSYS make is to assume that you must open separate accounts for each currency that a client or supplier deals in

a true multi-currency accounting system like NEOSYS allows mixed currencies in one account number but automatically gives multiple statements for each currency that is discovered in the account at the time of preparing the statement

this ISOLATION of currencies from each other is the reason why you CANNOT ALLOCATE ONE CURRENCY TO ANOTHER DIRECTLY in NEOSYS

you cannot use USD receipt to pay off AED invoices directly

however you can happily post one currency into the bank and a different currency into the client in a single transaction

Intercurrency conversion WITHOUT gain/loss - Intercurrency Conversion Account

-- CLIENT --: ok. so while posting receipt we have to calculate the equivalent for the client and enter it and the actual amount to the bank.

-- NEOSYS SUPPORT --: Yes. NEOSYS doesnt insist that you balance the currencies in a single voucher since it will happily reverse everything into the exchange gains and losses or inter currency conversion a/c

-- NEOSYS SUPPORT --: bank a/c +1000USD (+3670base) client a/c -3670AED (-3670base) .... and NEOSYS adds two more voucher lines Intercurrency conversion account -1000USD (-3670) and Intercurrency conversion account +3670AED (+3670base)

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

and NEOSYS adds

3. Intercurrency conversion account -1000USD (-3670)

4. Intercurrency conversion account +3670AED (+3670base)

q1. what is the total amount of USD posted

q2. what is the total amount of AED posted

q3. what is the total amount of base currency posted to the intercurrency account (ie its balance after the above transaction assuming it was 0 to start with)

-- CLIENT --: the client account should be -1000USD (-3670base) . right?

-- NEOSYS SUPPORT --: no, The client account is credited in this example with -3670AED (-3670base)

in the above transaction we have decided to do a currency conversion for the client in order to pay off some AED invoices

presumably the clients account has some AED invoices to pay off

this is a receipt so we are increasing our bank balance by 1000USD and decreasing the amount the client owes us by 3670AED

we decide or agree with the client how much AED to give to the client in return for their payment of USD

we are acting as a currency exchange broker for the client

in the example given, we are converting the clients USD to AED at our standard accounting rate therefore there are no exchange gains and losses

This does not have to be the case though. We could have a agreement that USD receipts will be used to pay off AED invoices at some other rate

DR +bank

CR -client

-- CLIENT --: right, but doesnt he client a/c also have to be in USD?

-- NEOSYS SUPPORT --: no need and remember we already debited the client with some AED invoices in AED.

The USD is certainly information available on the receipt voucher but the entry on the clients account is formally AED.

-- CLIENT --: ok. got it.. sorry. you cannot use USD receipt to pay off AED invoices

-- NEOSYS SUPPORT --: you COULD do a two step process if you really want the USD to show as an entry in the client account but three entries would show in the end as follows:

ie credit the clients account with 1000USD as a first step

and then CONVERT the USD to AED in the clients account like this

1. client a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

this is a currency conversion transaction on the clients a/c

crediting and debiting the same a/c

no change in the base currency on the second stage (assuming we are not charging him an exchange commission)

but all this doesnt answer the questions I posed initially

-- CLIENT --: q1. what is the total amount of USD posted - 1000 USD to the Bank and 1000 USD to the Intercurrency conversion account

-- NEOSYS SUPPORT --: total means TOTAL .. not a list

single figure

-- CLIENT --: its only 1000 USD which gets posted

-- NEOSYS SUPPORT --:

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670)

4. Intercurrency conversion account +3670AED (+3670base)

what is the total USD posted

arithmetic total

-- CLIENT --: 2000USD

-- NEOSYS SUPPORT --: those DR/CR mean something, the + and - are a clue

-- CLIENT --: zero?

-- NEOSYS SUPPORT --: yes

what is DR1000 and CR1000 or in other words +1000 + -1000?

-- CLIENT --: 0

-- NEOSYS SUPPORT --: 0

double entry booking keeping

q2 and 3 should be easier now you understand that by total we mean simple arithmetic totals

-- CLIENT --: q2. what is the total amount of AED posted - 0 again

-- NEOSYS SUPPORT --: yes

double entry bookkeeping

-- CLIENT --: q3. what is the total amount of base currency posted to the intercurrency account - 3670

-- NEOSYS SUPPORT --: nope

1. bank a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670base)

4. Intercurrency conversion account +3670AED (+3670base)

-- CLIENT --: 0

-- NEOSYS SUPPORT --: yes

how do you feel about those answers

-- CLIENT --: the intercurrency conversion account is used as the contra account for the first 2 entries

-- NEOSYS SUPPORT --: q1. what is the total amount of USD posted .. answer zero

doesnt that feel strange to you?

sure the answers are arithmetically clear .. but if they dont feel strange then you missed the point

how is it possible to receive 1000USD yet the total posted into the books is zero ...

yet if you received 1000USD and put 1000USD against the clients account you would happily accept that according to double entry booking keeping that the total posted would be zero

-- CLIENT --: thats the principle of double entry accounting right?

oh. ok

-- NEOSYS SUPPORT --: basically intercurrency accounting in NEOSYS is turned into single currency accounting using an account called the "intercurrency conversion" account if the base amounts agree

or "exchange gains and losses" if the base amounts do not agree

we have to invent something called ICC (get it?) in order to reduce all multicurrency transactions to combinations of single currency transactions

-- CLIENT --: ok.

-- NEOSYS SUPPORT --: what seems like a complexity in the voucher turns out to have radically simplifying effect on the books

ie every currency will balance independently and can be viewed as standing alone from all other currencies

-- CLIENT --: ok

in case you had to directly post the USD to the client as well?

-- NEOSYS SUPPORT --: i gave the answer in detail already ...

-- CLIENT --:

1. bank a/c +1000USD (+3670base)

2. client a/c -1000USD (-3670base)

-- NEOSYS SUPPORT --: this can easily happen if you dont know what invoices the 1000USD is for ... so you dump it into the account as an unallocated credit to be sorted out later

-- CLIENT --: right. and do the journal to convert it to AED

-- NEOSYS SUPPORT --: all that happens thereafter is that you do the ORIGINAL voucher ... but the first line is the client a/c instead of the bank a/c

look back at the original transaction and subsitute mechanically and ponder the result

you can think that the client is your banker by the time of this second voucher

-- CLIENT --: you mean debit the client?

-- NEOSYS SUPPORT --: first voucher you debit (+) the bank

second voucher you debit (+) the client in the first line

look back at the original transaction and subsitute mechanically the bank for the client and ponder the result

-- CLIENT --: why would you debit the client if you receive the payment?

this is the next voucher after payment received?

-- NEOSYS SUPPORT --: yes

in case you credit client with 1000USD and LATER decide to use it to pay off AED invoices

LATER means another voucher to

a) convert the currency in the account - remove 1000USD and give them 3670AED

b) presumably to allocate all in one go

-- CLIENT --:

1. client a/c +1000USD (+3670base)

2. client a/c -3670AED (-3670base)

3. Intercurrency conversion account -1000USD (-3670base)

4. Intercurrency conversion account +3670AED (+3670base)

-- NEOSYS SUPPORT --: right

-- CLIENT --: perfect

-- NEOSYS SUPPORT --: exactly

the ICC lines appear to confuse unless you keep a clear mind that in base they have NO effect and are just there to ensure that each currency individually balances to zero all the time

-- CLIENT --: ok

Intercurrency conversion WITH gain/loss - Exchange Gain/Loss Account

-- NEOSYS SUPPORT --: if you are fairly clear on this I can tell you the more usual case where the base DOESNT agree exactly due to bank charges etc

-- CLIENT --: yes. i have began to understand this more

-- NEOSYS SUPPORT --: we would like to post this ...

1. bank a/c +1000USD (+3670base)

2. client a/c -3700AED (-3700base)

NEOSYS will add this:

3. GainLossA/c -1000USD (+3670base)

4. GainLossA/c +3700AED (+3700base)

all NEOSYS does is notes that the total base was not exacly zero therefore is doesnt want to do the old method of reversing into the Intercurrency Conversion A/c because the rule is that the ICC a/c base amount must always be zero (and not show in the financial reports which are base currency)

and it reverses them into a different a/c ... the famous Exchange Gains and Loss A/c

to grasp the significance of this you have to ask yourself the same three questions as before ...

which are:

q1. what is the total amount of USD posted

q2. what is the total amount of AED posted

q3. what is the total amount of base currency posted to the EXGA (ie its balance after the above transaction assuming it was 0 to start with)

-- CLIENT --:

3. GainLossA/c -1000USD (-3670base)

4. GainLossA/c +3700AED (+3700base)

right?

-- NEOSYS SUPPORT --: yes sorry

-- CLIENT --: q1 - 0

q2 - 0

-- NEOSYS SUPPORT --: yes ... cannot be anything else according to double entry rules

but the answer to q3 is very interesting

-- CLIENT --: q3 - 30 AED ?

-- NEOSYS SUPPORT --: read the question exactly

-- CLIENT --: yes. i have

-- NEOSYS SUPPORT --: the answer is 30base

-- CLIENT --: yes. i said 30

sorry. i didnt say 30base

-- NEOSYS SUPPORT --: you said 30 AED

-- CLIENT --: and presumed the base was AED

ok

-- NEOSYS SUPPORT --: you must never confuse the two

there is REAL AED and there is base that happens to be AED

the total AED posted to EXGA is 3700

the total base posted to EXGA is 30

so the answer is completely different

-- CLIENT --: ok

-- NEOSYS SUPPORT --: when we are talking about base we never mention its "sex"

we can say either 30 base or 30 "equalent in AED"

but never 30 AED because that sounds like we are talking about real chinkable AED coins

anyway the answer is as you say, 30 base

-- CLIENT --: ok

-- NEOSYS SUPPORT --: so in the case of multicurrency transactions where the base adds up to zero .. we get entries that have no effect on the consolidated base currency books

but in the case of multicurrency transactions where the base DOESNT quite add up to zero ... the NEOSYS "I DONT LIKE THIS SO I AM GOING TO REVERSE IT ALL" methodology neatly ends up with the DIFFERENCE showing in EXGA a/c although it is effected by TWO lines (+ and -) instead of a single 30base entru

the NEOSYS method of showing exchange gains and losses as a PAIR of entries in the EXGA a/c allow you to analyse the SOURCE of exchange gains and loss BY CURRENCY!

-- CLIENT --: ok

-- NEOSYS SUPPORT --: the one line exchange gain loss method a) hides the source currency of gain loss and b) means that currencies dont balance per currency

so NEOSYS method although apparently more complex has always eventually been proved an advance over the average accounting system which doesnt keep isolated slices of books for each currency

-- CLIENT --: ok.

Processing Post-dated Cheques

How do I process Post-dated Cheques RECEIVED in NEOSYS?

Setting up for PDC Received

Decide where the pdc assets are going to appear in the GL. Normally they will appear somewhere in current assets.

If you wish to age and list individual outstanding PDC then you need to create the account in an open item ledger like the Accounts Receivable or Documents Receivable.

Create an account “Postdated Cheques Received” in one of the following charts. You can create one a/c or one per client.

- Accounts Receivable Chart

- Cash and Bank Chart (not advisable because cannot be open item and therefore cannot be allocated)

- Documents Receivable/PDC Received Chart

Recording the Receipt

When postdated cheque is in hand:

Journal: Receipts Period: Current Date: Actual Date on Cheque (future) Debit: Postdated Cheques Received A/c (maybe one a/c or per client) Credit: A/R or Client A/c (may be allocated to invoices)

Recording the Deposit

When postdated cheque is deposited:

Journal: Receipts Period: Current at time of deposit in bank Date: Date deposited in the bank Debit: Bank A/c Credit: Postdated Cheques Received A/c (maybe one a/c or per client)

How do I process Post-dated Cheques ISSUED in NEOSYS?

Setting up for PDC Issued

Decide where the pdc liabilities are going to appear in the GL. Normally they will appear somewhere in current liabilities.

If you wish to age and list individual outstanding PDC then you need to create the account in an open item ledger like the Accounts Payable.

Create an account “Postdated Cheques Issued” in one of the following charts. You can create a single account for all PDC, or one per supplier/payee.

- Accounts Payable Chart

- Cash and Bank Chart (not advisable because cannot be open item and therefore cannot be allocated)

- Documents Payable/PDC Issued Chart

Recording the Receipt

When postdated cheque is delivered to recipient:

Journal: Payments Period: Current Date: Actual Date on Cheque (future) Credit: Postdated Cheques Issued A/c (maybe one a/c or one per supplier/payee) Debit: A/P or Supplier A/c (may be allocated to invoices)

Recording the Clearing

When postdated cheque is cleared/reconciled:

Journal: Payments Period: Current at time of clearing in bank Date: Date cleared in the bank Credit: Bank A/c Debit: Postdated Cheques Issued A/c (maybe one a/c or one per supplier/payee)

Handling Exchange Losses & Gains

NEOSYS posts all exchange gains or losses automatically. Users cannot enter amounts into this account but it is not needed since the system will post it.

We advise against posting exchange gains and losses manually because technically the currency amount on such transaction is zero. Users can just post currency amounts and let the system work it all out.

In one NEOSYS voucher, users may debit in one currency and credit in a different currency. The base amount will usually not agree by a small amount and the system will add a third line to the voucher to make the base currency balance. The account on the third line will be the Exchange Difference account.

NEOSYS knows a lot about currency conversion so with some patience, you should be able to learn how it works in NEOSYS. Alternatively, this can all be done manually but it is prone to user error.

Exchange Losses & Gains on receipts from Clients

Receipts are valued at the value of the invoices that they pay off. By value we mean the base equivalent is calculated from the invoice instead of from the usual currency file exchange rate or any manual attempt.

Note that the base amount (to the client / account) on the journal will be different than what it is in the voucher file or the ledger printout.

The journal shows the same exchange rate as to the amount in the bank account which is usually the exchange rate in the exchange rate file unless the user has overwritten the base rate, which would be unusual.

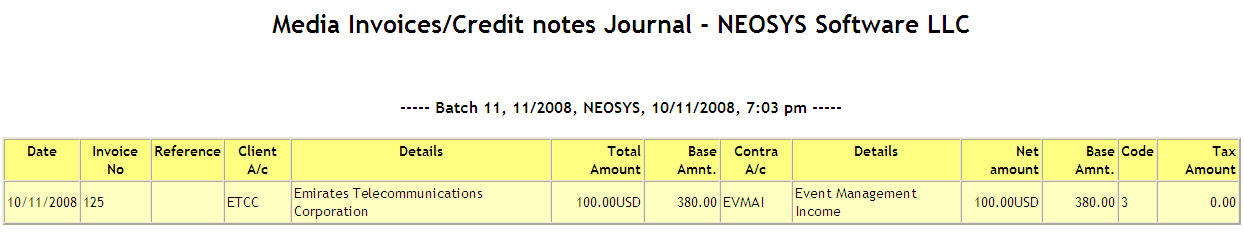

Losses on Receipts

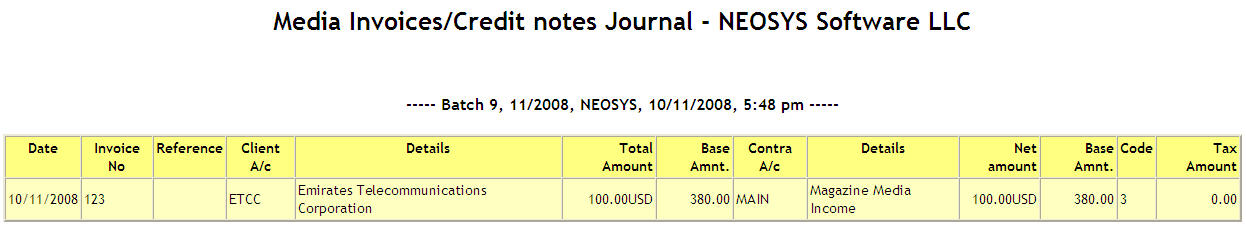

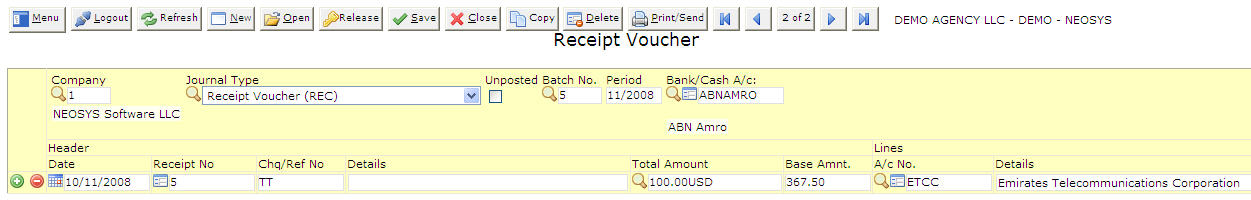

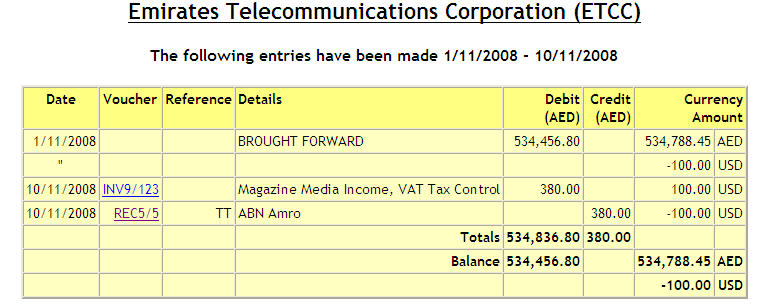

Invoice was issued for 100 USD / 380 base amount

Receipt was issued for 100 USD / 367.50 base amount

However when posted, the ledger printout shows that the amount recorded in the client account is 100 USD / 380 base amount

If you look at the voucher, you can see that the difference of 12.50 base amount shows as a Debit to the EXDI (Exchange Difference) A/c.

Note: In case of receiving 50% of the currency amount (eg 50 USD / 183.8 base amount) it takes the base amount to the client which is 50% of the value of the invoice (50 USD / 190 base amount). It will follow the same procedure and the amount to the client will be proportionate to the amount of invoice allocated.

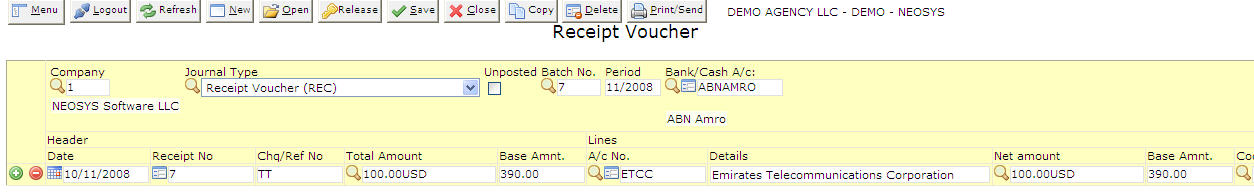

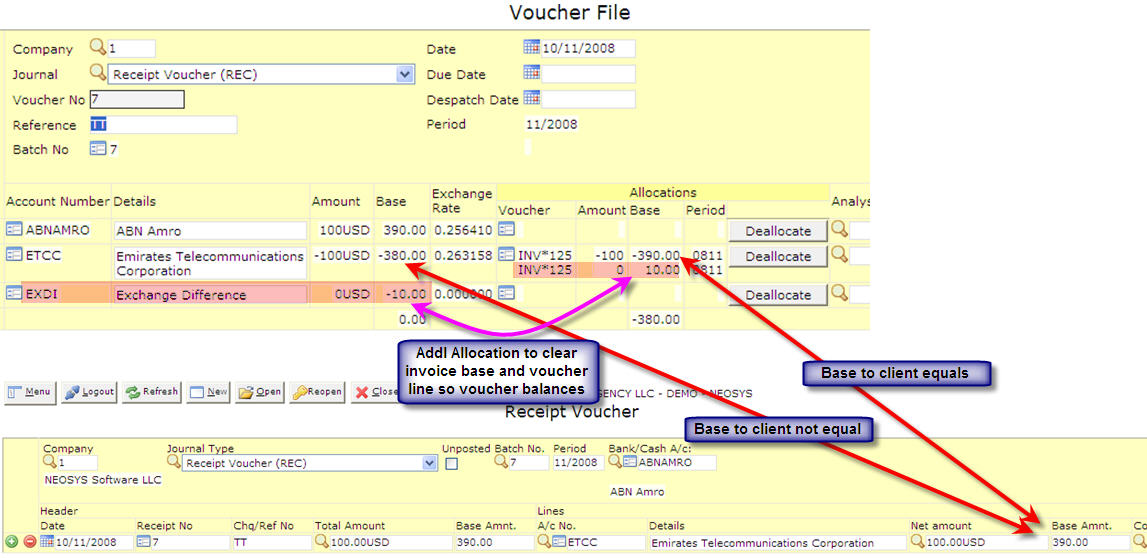

Gains on Receipts

Invoice was issued for 100 USD / 380 base amount

Receipt was issued for 100 USD / 390 base amount

However when posted, the voucher shows that the amount recorded in the client account is 100 USD / 380 base amount and the overpayment of 10 base amount is posted as a debit to the EXDI a/c.

Exchange Losses & Gains on payment to Supplier Invoices

Sometimes the foreign exchange rate fluctuates and hence there is a difference in the invoice currency amount issued or received as compared to the actual payment received or paid.

Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c.

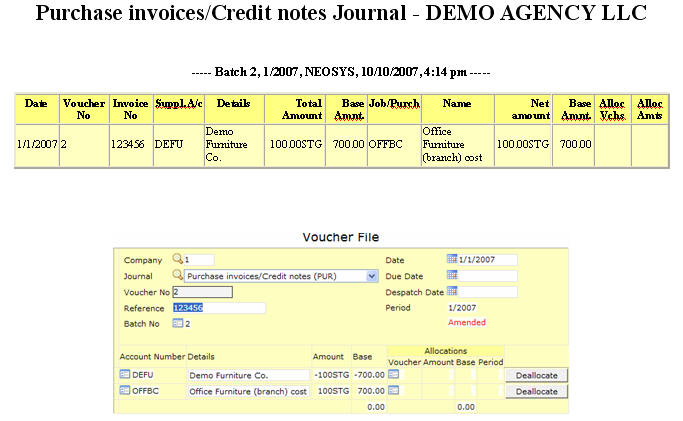

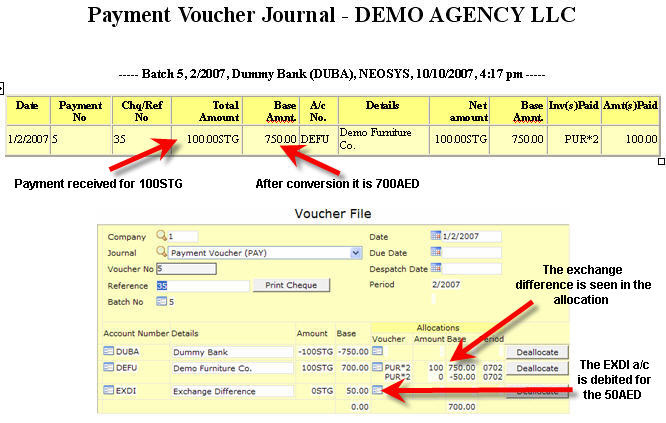

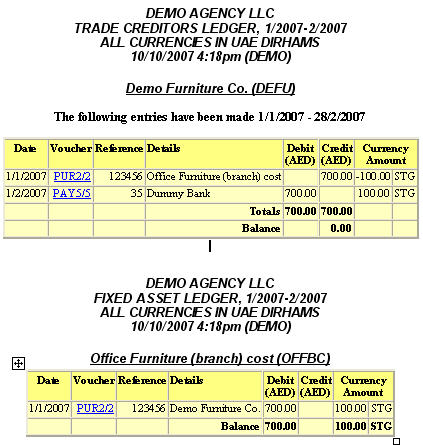

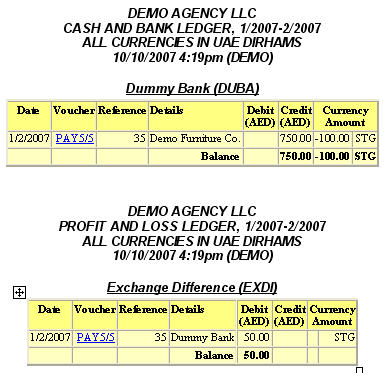

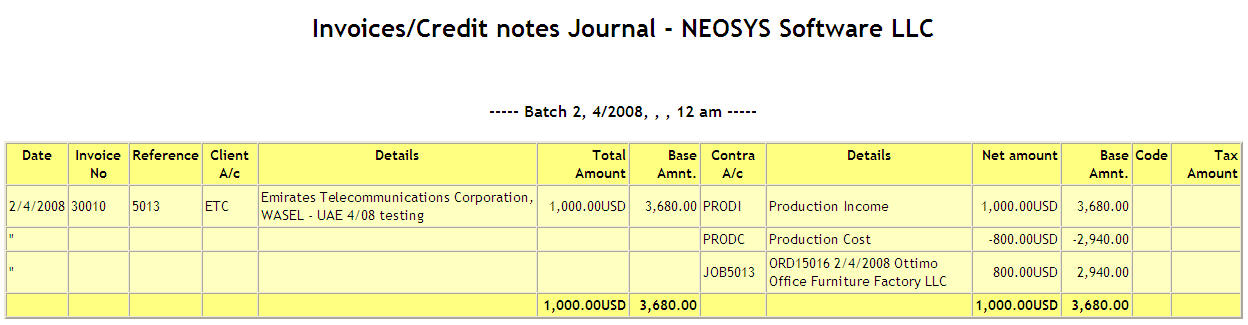

Below is an example of a sale which has been done:

A client is invoiced for 100STG on 1/1/2007. On this date the exchange rate was 1 STG=7 AED

The client makes a payment for this invoice on 1/2/2007. However the exchange rate on this day has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following:

- Allocates the payment of 100STG (750AED) to the invoice in the client a/c

- Credits the 50AED from the allocation which is overallocated to the invoice

- Debits the Exchange Loss or Gain A/c (EXDI in this case)

The following are the ledger printouts of all the accounts which were involved in this transaction:

Avoiding Invoice and Credit Note combinations appearing on Client A/c Statements

Problem

After issuing invoice and credit notes combinations for a variety of internal reasons, if the original invoice has not been sent to the client we might want the invoice and credit note combination not to appear on the clients statement.

The obvious way is to simply not enter (or if generated by a NEOSYS billing system, delete) the pair of documents from the journals prior to posting. However it is strongly advisable to post all invoice numbers (whether generated by NEOSYS or not) otherwise auditors may question the reason for the gap in the invoice number sequence.

Another solution is to simply allocate the credit note to the invoice immediately so that neither show on the clients statement of outstanding items. However if and when the client requires a statement of all movements on their account then the offending invoice and credit note will still appear.

Solution

The best way to to modify the client a/c column in the journal for the invoice and credit notes to be a client suspense or "sundry" client account instead of the true client a/c number. This way there will be a record of the invoice number but the net balance will be zero and there will be no entries showing on the clients a/c. To do this you can either create a dummy client a/c with a suitable name like "Client Suspense" or use an existing general purpose client a/c like "Sundry Clients". You cannot use the normal suspense account (ZZZ999) here.

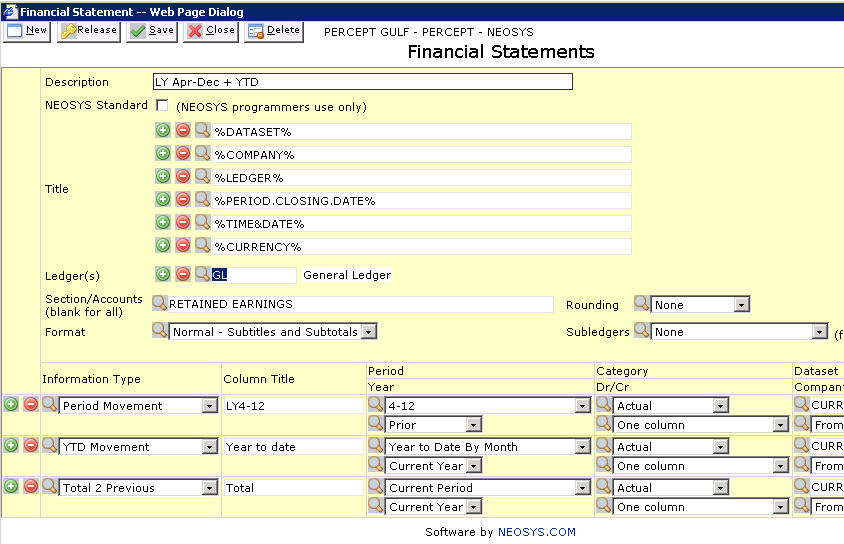

The difference between Detailed Ledger A/c and Statement of Account

"Detailed Ledger Account" is for internal use and "Statement of Account" is for external use to be sent to clients or suppliers etc.

"Ledger Account" and "Statement of Account" printouts both show movements AND outstanding items by default. In practice most people suppress the movement section when sending statements to clients or suppliers.

"Statement of Account" is like a simplified Ledger Printout except that it shows a separate account for each currency found in the account and it only shows the CURRENCY amounts - not the base amounts and therefore skips any base currency only entries, like revaluations, which the external party is not interested in.

Movements and outstanding items are totally different things. Both are equally applicable for the two styles of output "Ledger Account" and "Statement of Account".

In both type of account, the list of outstanding items shows all the items outstanding "as at" a specific date.

Period can mean a single period e.g. 3/2017 or a range of periods e.g. 1-3/2017

Finance > Maintenance > Clear open item statements - removes the ability to get outstanding items "as at" periods long ago.

It is an important feature of any good accounting system that you can get an account of outstanding items "as at" a date in the past, otherwise one is effectively prevented from working on new financial periods before prior periods have been closed.

Presenting Trial Balances and Financial Statements in a non-base currency

NEOSYS can produce Trial Balances and Financial Statements with all currencies converted to a non-base currency using the following method:

- Convert the opening balance at the rate applicable on the date of the opening balance

- Convert movements per month at the exchange rate applicable for each month

Note that NEOSYS does not simply take the base currency version of the report and convert every figure on it using a single "reporting" rate as could be done in say Excel.

You can prove this by printing a report for one year for a non-base currency which has more than one rate changes in the year. Compare it with the normal base currency report and you will see that it is not a converted with a single "reporting rate".

How do I show subsidiary charts in the main trial balance?

When asking for the Trial Balance choose the option "All except main subledgers".

If you do not want all subsidiary charts to appear in the main top level (GL) Trial Balance then in the Chart of Accounts File for the main (GL) chart mark the "Summary" column of the control a/cs of the unwanted charts as "Yes".

Also, very large subsidiary charts, for example Accrual/WIP ledgers with many jobs, must have their control accounts marked as "Summary" accounts. Otherwise you will get a message like this:

Control A/c "XYZ" in Ledger "GL" has too many subsidiary accounts to include in the main ledger. Please use Chart of Accounts File to mark the control account "XYZ" as a summary account"

Handling VAT/Sales Tax

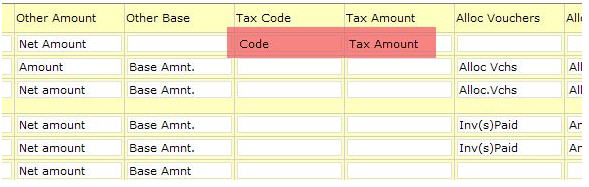

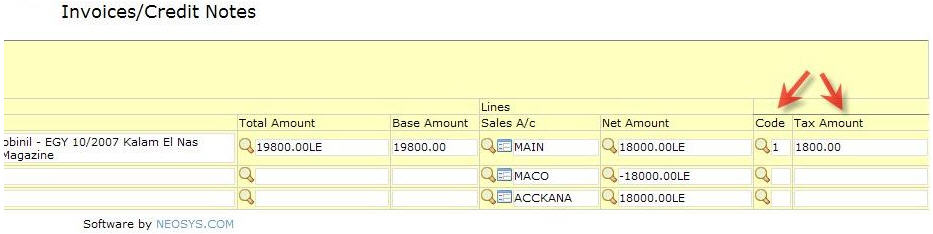

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

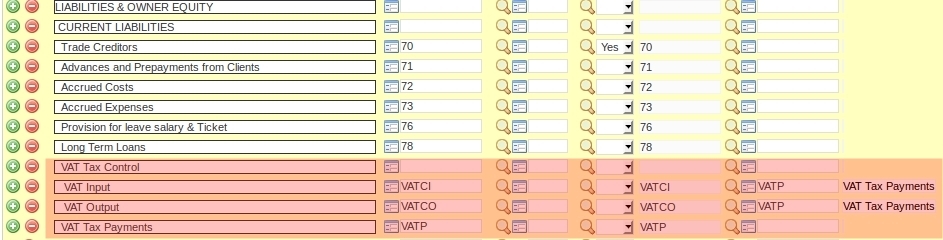

Creating "VAT Input", "VAT Output" and "VAT Tax Payments" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create THREE a/cs, one for the VAT Tax Control INPUT, which will represent the tax paid on purchases which are recoverable from tax authorities, one for VAT Tax Control OUTPUT, which will represent the tax collected and payable to the authorities, and one for the VAT Tax Payments which will represent the payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the VAT Tax Control A/cs. Manual journals will not be allowed so that the Tax column on journals can be verified against the VAT Tax Control A/cs.

All payments to the Tax authorities should be debited to the VAT Tax Payments A/c. Therefore the net of the three a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the VAT input and VAT output accounts is the VAT Tax Payments A/c (here VATP). Therefore, every year, the opening balance for the VAT Input and VAT Output A/cs will be zero and the VAT Tax Payments A/c will be the net tax payable from the prior year.

Defining the Tax Codes

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies.

VAT on sales (output) MUST be separated from VAT on purchases (input) using a blank line as shown below, so that the VAT statement report correctly identifies "VAT collected on outputs" and "VAT on inputs"

Setting up VAT/Tax Registration number

- The VAT/Tax Registration number should be entered in the Company file. This is done in order to get the VAT column in the journal entry page.

- Add VAT/Tax Registration number in the letterhead. This is also done in the Company file.

- Set VAT/Tax Registration number in the Client & Brand file to show Client TRN on invoices.

Making tax columns appear on the Journals

In order to get the VAT column in the journal entry page, make sure Tax Registration number is entered in the Company file.

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Whenever an accounting transaction is posted, at least two accounts are always affected. One account is debited while the other is credited.

The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance."

Invoice/Credit notes Journal

When you issue a Media invoice/Credit note or invoice a Job estimate, the automatic entries are generated in the INV or INP journal, respectively.

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6

Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

The amount charged to client is debited to the Client a/c with the VAT included in this amount. The amount excluding VAT is credited to the Income a/c and the VAT amount is credited separately to the Output VAT Control a/c.

The cost to Supplier is recorded as a debit to the Cost a/c and the Accrual account is temporarily credited here until the amount is actually paid to the Supplier. These amounts exclude VAT paid to the Supplier.

Purchase Invoice/Media Purchase Invoice Journal

The below entries are generated automatically in PUR journal when creating a Purchase order/issuing a Purchase invoice.

A media Purchase invoice will have to be manually entered when you receive the Supplier invoice.

Cost A/C Cr. - 100 Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100 VAT Control A/C Dr. + 5 Supplier A/c Cr. - 105

A reversal is first created to reverse the amounts which were debited to Cost a/c and credited to Accrual a/c when the Estimate invoice/Media invoice was issued.

Then, the cost to Supplier is debited to Cost a/c and the VAT amount is debited separately to the Input VAT control account. Correspondingly, total amount including VAT is credited to the Supplier a/c.

Receipt Journal

An REC journal entry is manually entered when payment from the Client is received.

Bank A/C Dr. + 126 Client A/C Cr. - 126

Once the payment from the client is received, the Agency will credit the amount to the Client a/c and debit the Bank a/c.

Payment Journal

A PAY journal entry is manually entered when the payment has been made to the Supplier.

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Once the payment has been made to the Supplier, the amount is credited to the Bank a/c and debited to the Supplier a/c.

Payment Journal

At the end of each VAT period, Agencies have to pay the Govt. the difference of the VAT received from Client and VAT paid to Supplier.

This is manually recorded in a PAY journal by debiting the VAT Payable a/c with the amount that you have to pay and crediting the same amount to the Bank a/c.

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1

This is assuming that the total VAT received from clients is higher than total VAT paid to suppliers. If the total VAT paid is higher than total VAT received, then the agency needs to receive from the govt. the difference of VAT paid and VAT received, which is recorded in a receipt (REC journal) as a debit to the Bank a/c and credit to the VAT payable a/c.

At the end of the VAT period, after the above PAY/REC transaction is posted, ledger account report for accounts VAT input, VAT output and VAT payable accounts together should show a total balance of 0.

VAT in NEOSYS

Media Module

- One tax code is used per schedule. Line items with a different tax code should be entered in a separate schedule.

- A default tax code can be set by NEOSYS so that users don't need to enter the tax code each time. For e.g. most clients in Dubai use OSD(VAT Std. Output 5%) as default.

- For assigning a default tax code per client or supplier see finance module section below.

- VAT tax% is applied to the total net amount of the schedule and not the net amount per vehicle line.

- The “Tax” column in the schedule file should not be used as invoicing will be blocked. Please use ‘Other’ column if necessary to use a different tax. (For e.g. you can enter “10% tax” in ‘Other’ column, which will be displayed in the printouts as well)

- When issuing a media booking order “Add Standard Tax” must be chosen to display 5% VAT in the booking order printout.

- To display Cost tax in Media Diary, refer to Report on Cost VAT Tax

Production Module

- In Estimate or Production Orders, you can enter different tax codes per line.

- NEOSYS can set a default tax code which will appear automatically in the Tax Code field. Any line items that don’t specify a tax code will use the default tax code defined at the bottom.

- For assigning a default tax code per client or supplier see finance module section below.

- Estimate use tax codes that begin with “O” to apply VAT tax on Outputs. (eg: OSB- Bahrain Std. VAT on Outputs)

- Purchase orders use tax codes that begin with “I” to apply VAT tax on Inputs. (eg: IS- Std. VAT on Inputs)

Finance Module

- TRN will be entered in the Company file.

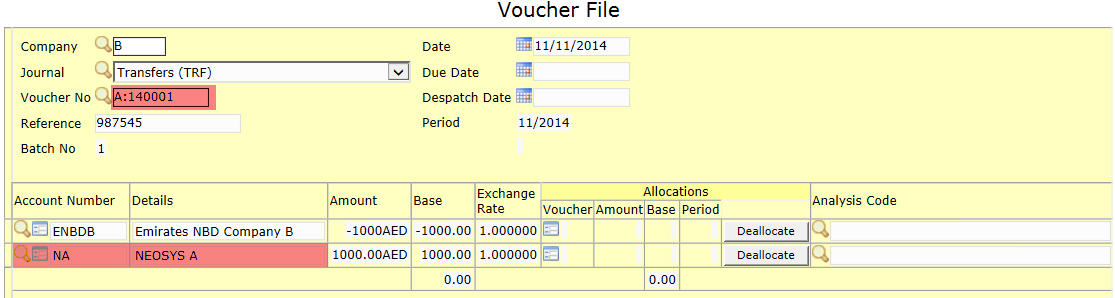

- The tax amount in intercompany transactions remain in the originating company making Tax audits easier. (http://userwiki.neosys.com/index.php/Finance_FAQ#Why_do_VAT_amounts_stay_in_originating_company_accounts.3F)

- Tax code will be filled automatically on generated journals.

- For assigning a default tax code per client or supplier, go to the 'Chart of Accounts' file, choose which ledger the client or supplier is in and enter the default tax code per account in the 'Tax Code" field.

Reports in NEOSYS

- Ledger account/ Statement of Account

You can use this report to check the balance of the different VAT accounts: VATCI, VATCO and VATP.

- Journal Audit Report

This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total.

This report can be used to get VAT tax summary of all VAT items used in any period.

You can cross-reference the Journal Audit report and the Tax/VAT return report to ensure that the amounts agree with each other.

Revaluing closing balances

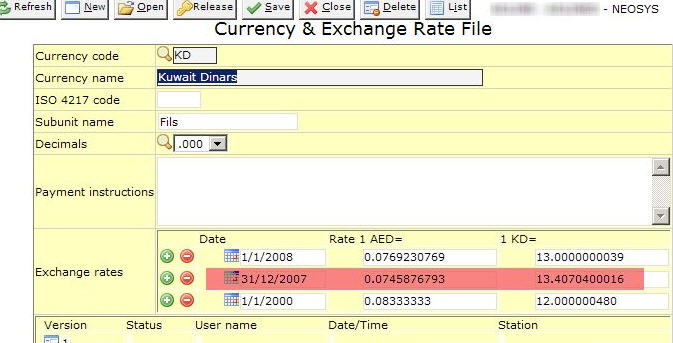

New Rules

According to the above screen shot the rate dated 31/12/2007 will be used for:

- normal transactions dated exactly 31/12/2007 and no later

- NEOSYS automatic revaluation procedure for period 12/2007

Transactions dated up to 30/12/2007 will use the rate effective from 1/1/2000.

Transaction dated from 1/1/2008 onwards will use the rate effective on the 1/1/2008.

All the above is fairly obvious, however, if there was no exchange rate on the 31/12/2007 then when you use the NEOSYS revaluation program to automatically revalue the closing balances of 2007 (as at 31/12/2007) NEOSYS would use the rate of the following day, in other words that of 1/1/2008.

This perhaps surprising procedure has the following logic:

- The currency file rates are considered to be effective from the START of the day in question

- Revaluation is logically at the END of the day

- The rate at the END of the day is logically the rate at the START of the following day

Old Rules

This applies to versions of NEOSYS dated prior to 20/4/2007.

According to the above screen shot the rate dated 31/12/2007 will be used only for normal transactions dated exactly 31/12/2007.

Transactions dated up to 30/12/2007 will use the rate effective from 1/1/2000.

Transaction dated from 1/1/2008 onwards will use the rate effective on the 1/1/2008.

All the above is fairly obvious, however, when you use the NEOSYS revaluation program to automatically revalue the closing balances of 2007 (as at 31/12/2007) NEOSYS will use the rate of the following day, in other words that of 1/1/2008.

This perhaps surprising procedure is actually logical because:

- The currency file rates are considered to be effective from the START of the day in question

- Revaluation is logically at the END of the day

- The rate at the END of the day is logically the rate at the START of the following day

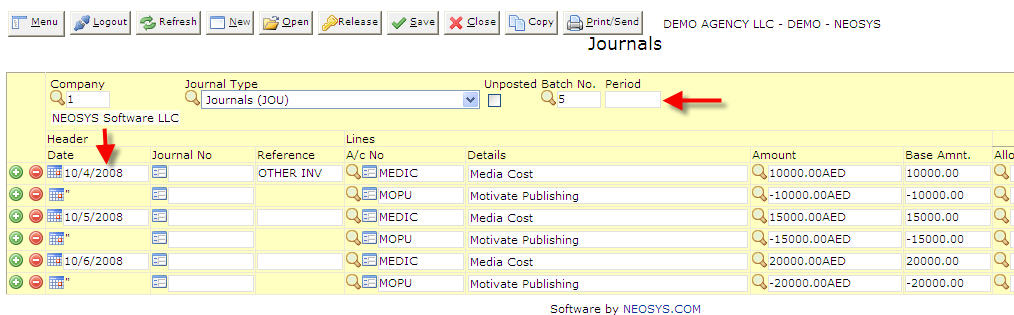

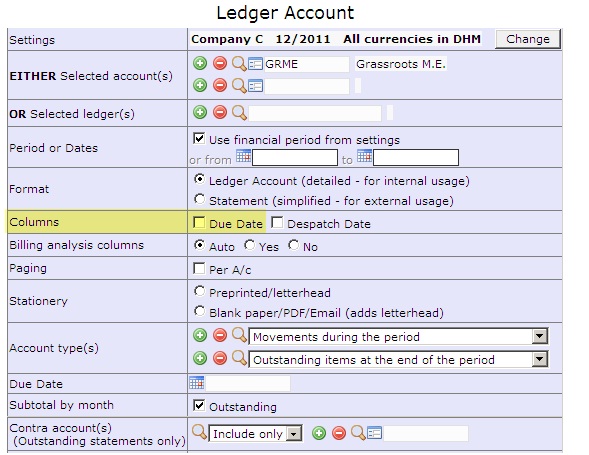

Posting Multi-period journal batches

You can post a multi-period journal batch in NEOSYS. On a Journal Entry screen, do not put any period in the period field and you can enter each voucher with a different date and the period will be determined by the voucher date.

In the below example you can see that there is no period, but each voucher has a date in a different month and NEOSYS will take the period 4/2008 for the voucher dated 10/4/2008, period 5/2008 for the voucher dated 10/5/2008 and so on.

All vouchers within one batch must fall within a single financial year.

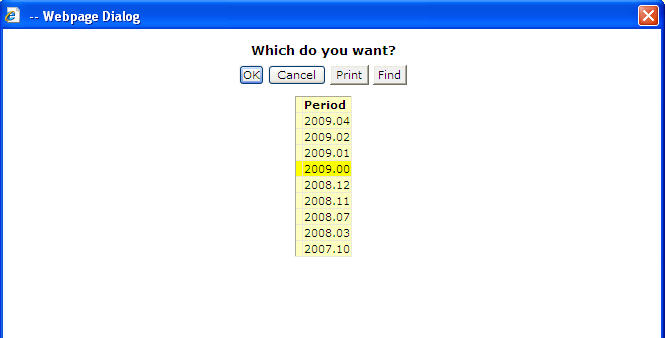

On the popup search for batches, batches without periods show as period zero (0) of the year that the vouchers dates all belong to.

Understanding the term ACCOUNT and its various statements

Abbreviations

- SOM - Statement of Movements

- SOOI - Statement of Outstanding Items

- OBJ - Opening Balance Journal

What does the term ACCOUNT mean?

Firstly an ACCOUNT is an idea and not a thing. It is:

- An idea - a line on a chart

- A balance that represents the debt between two companies

There is a real thing called statement of account, of which there are two kinds - Statement of outstanding items and Statement of movements.

Two important aspects:

- Account HAS a statement

- Account IS a balance

How many types of ACCOUNTS can be there?

Two types:

- Open Item Account - which is a balance at a point of time for which you can obtain a SOM or SOOI. Open Item Account has everything the Balance Forward Account has.

- Balance Forward Account - which is a balance at a point of time for which you can obtain a SOM.

What does the SOM contain?

- Opening Balance (may be zero also) at a point of time

- List of Transactions

- Closing Balance at a point of time

What does the SOOI contain?

- List of Outstanding Items / Transactions

How does an Opening Balance Journal affect the SOM?

An OBJ will amend / create an opening balance line in the SOM of either Open Item Account or Brought Forward Account

How does an Opening Balance Journal (OBJ) appear in an Open Item Account?

- Statement of movement: An OBJ will amend / create an opening balance line in the SOM of an Open Item Account.

- Statement of Outstanding Items: An OBJ will show as an outstanding item in the SOOI.

How does an Opening Balance Journal (OBJ) appear in a Brought Forward Account?

- Statement of movement: An OBJ will amend / create an opening balance line in the SOM of a Brought Forward Account.

How to close an account with multiple currencies

It is easy to prepare a journal which reduces all the currency balances to zero but it is not easy to know what base equivalent to post in parallel since a normal detailed ledger account doesnt show what the base equivalent balance is PER CURRENCY and only shows a total base currency balance for all the currencies in the account.

NEOSYS accounting system actually keeps the base equivalent balance PER CURRENCY internally and you can see this by selecting the individual currencies one by one in the settings and running the detailed ledger account or trial balance per currency.

Then you will know what base equivalent to post next to the currency amounts and override the suggested base equivalents.

NEOSYS Technical Support has a program CONVCURR2 which can convert all currency balances in an account or ledger to the currency of the base.

Handling receipts in one currency to pay off invoices in another currency

Invoice is in one currency but it is settled using a receipts in another currency

The problem

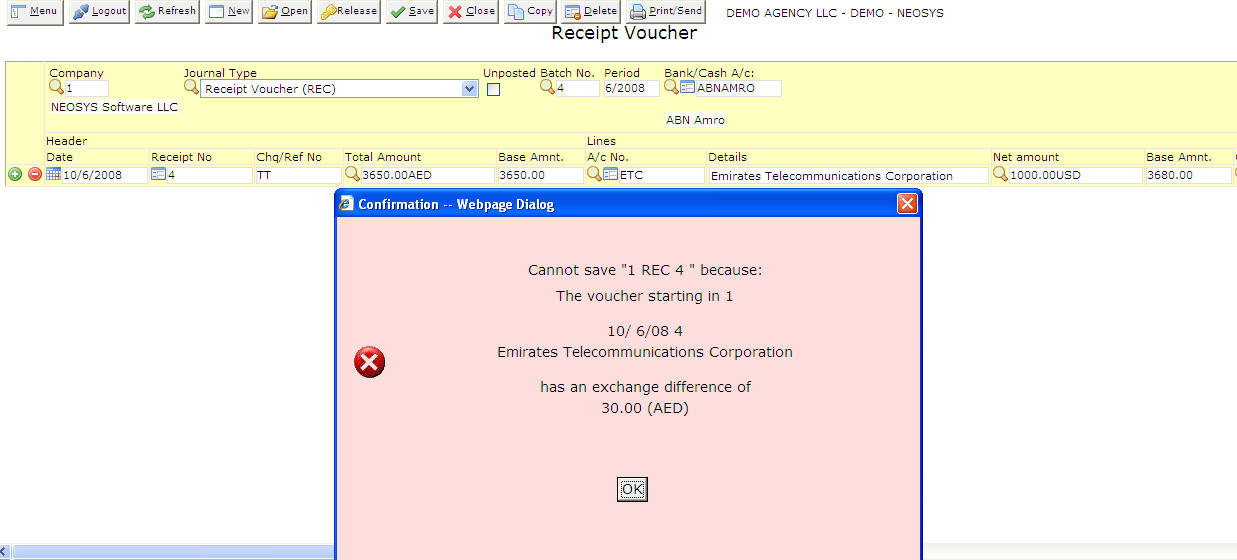

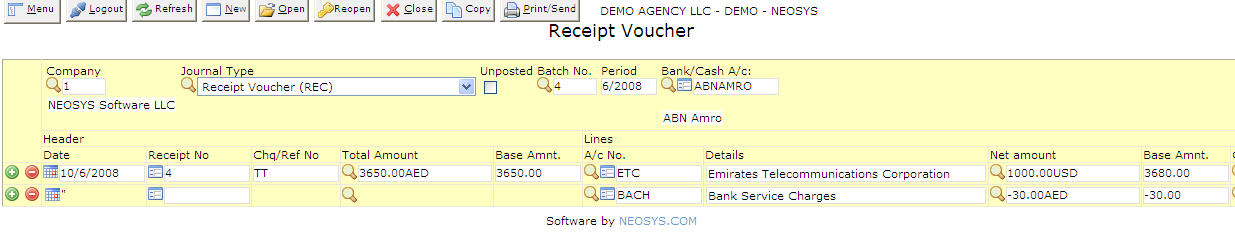

A client is issued an invoice of 1000 USD i.e. 3680 AED, but later on the client transfers amount/provides a cheque of 3650 AED due to a difference in the exchange rate and moreover the client wouldnt mention the USD amount as they would be having a local bank account and used their own exchange rate rather.

In this case the agency / NEOSYS user has to handle the difference in this amount.

The solution

There are two amount columns on the receipts journal. 1st is the amount into the bank which isnt in doubt and in this case 3650 AED. The 2nd is the amount credited to the client which has to match the invoices being paid off - and it is up to the user to decide how much USD currency (in this case) he is going to allow the client for the AED currency that he received. Receiving the wrong currency to pay off invoices is a very very common requirement in business.

If you had to pass a receipt now, you will have to pass the following journal which would give you an error message saying that there is a difference between the bank base amount and the client base amount.

You need to add an additional line (to credit the difference to the Bank Charges A/c) in order to balance this journal entry, as below:

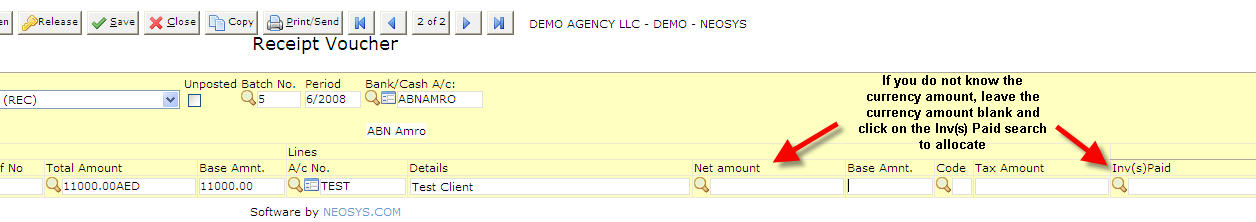

Invoice is in one currency but it is settled using receipts which are in multiple currencies

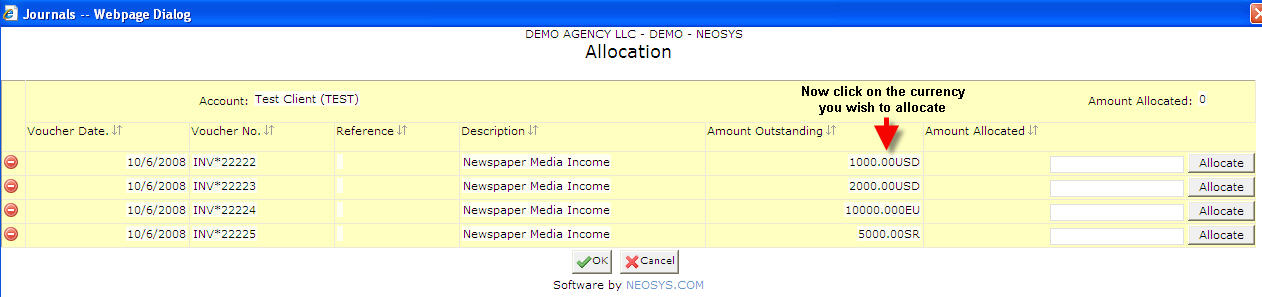

To settle invoices in multiple currencies, leave the second amount blank and go to allocate. The fact that the allocation screen will show you ALL outstanding currency invoices but as soon as you choose one currency line it will restrict you to only allocating items of the same currency - since you cannot allocate more than one currency in one go.

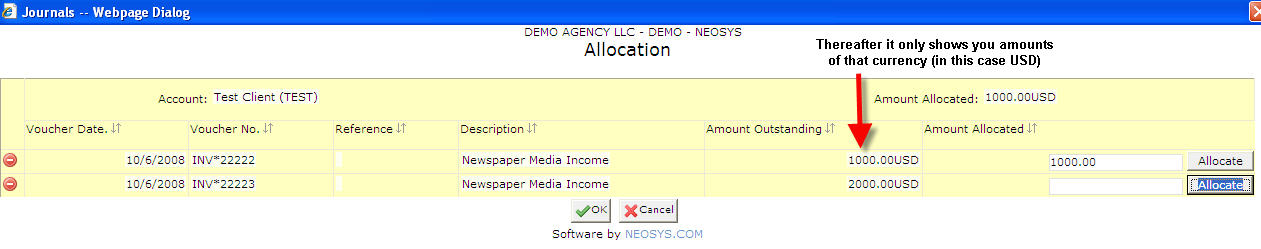

Thereafter the currency amount comes automatically, but you still need some idea of how much XYZ currency you are going to allow the clients for his AED payment.

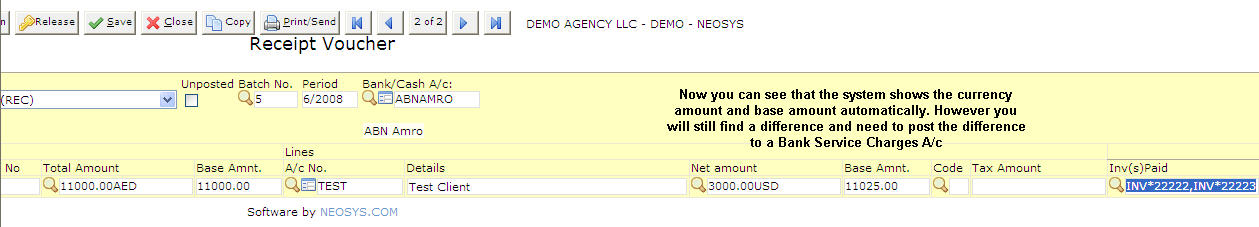

However you will still find a difference and need to post the difference to a Bank Service Charges A/c

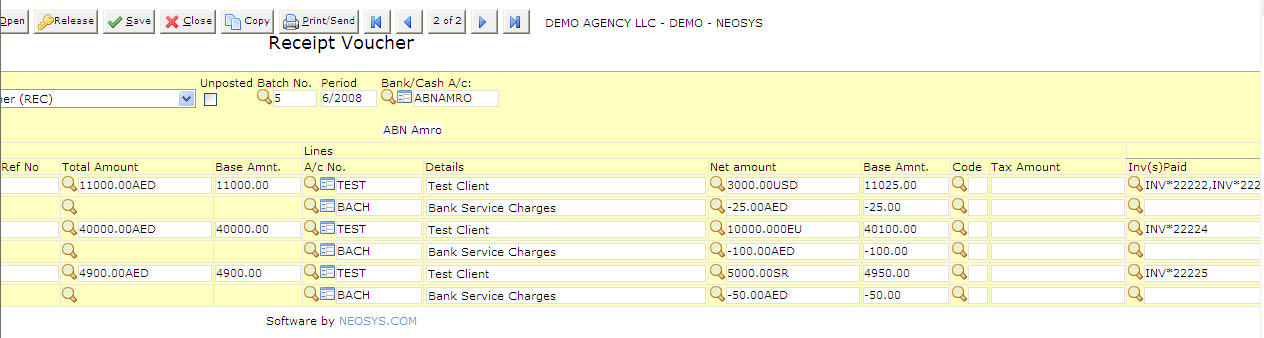

Invoices are in multiple currencies but it is settled using a receipt which is in one currency

If you receive a payment in one currency that is to pay off invoices in MIXED other currencies then you have to create one journal line per currency that you are going to pay off as follows.

Handling supplier invoices which are less then the accrual due to currency gains

to be edited:

Ashwin: check this scenario, incase a supplier sents you an invoice for 1000 USD / 3675 base currency, against a booking order of 400 BD / 3920 base currency (which is already there in the schedule a/c) - now when doing this entry, the balance of the amount I need to manually pass it to the EXLO a/c right? there isnt an automated way for NEOSYS to take this amount to the EXLO a/c as in the payments and receipts right?

_Steve_Neosys: firstly you are not allowed to post into the neosys automatic gain.loss a/c anymore so you have to make another gain/loss account for this posting

secondly, as for all journals which are not simply 2 line vouchers - you can create a second line in the journal for the third voucher libne

but you asked for automatic

_Steve_Neosys: actually neosys will dispose of (add 3rd/4th journal lines for) small exchange/gain losses if you are authorised but I think only well trained accountants can really handle automatic

Ashwin: but isnt it advisable to make the changes in the schedule in the cost and create a cost invoice? so that we can avoid this entry?

_Steve_Neosys: no - this is a gain loss on currency exchange theoretically and practically billing analysis does not include gain/loss unless you put the gain/loss account as one of the media types and therefore they are obliged to add an analysis code if you bill in xyz and the xyz rate falls when they pay you xyz ... all perfect amount you see ... you STILL have gains and losses because the value of the invoice is LESS than the value of the payment in our base currency - think about it

Sent at 4:35 PM on Thursday _Steve_Neosys: in the xyz example it is often not as bad as it seems if you are also billed in xyz by your supplier and pay him xyz ... you benefit from the drop in the xyz rate too effectively then assuming that you pay your supplier at around the same time as your client pays you (which can be a big if) then you lose out on the drop in xyz exchange rate only on your profit not the whole xyz amount that you billed - since your loss is partially offset by your gain on paying your supplier in xyz after the xyz rate has dropped

Understanding why NEOSYS doesn't allow intercurrency allocation

People sometimes think that lack of intercurrency allocation is a weakness in NEOSYS but it isn't.

1. Logically an account should have an entry in the movements that clearly and accurately represents the conversion of one currency into another so that there is no question of what has been done in a multi-currency account.