Using NEOSYS Agency System

This covers tasks common to both the NEOSYS Media System and the NEOSYS Job System.

Cancelling or Amending Incorrect Client Invoices

If you want to cancel an invoice, NEOSYS requires you to issue a credit note. If you want to amend an invoice, NEOSYS requires you to issue a credit note to cancel the original invoice and issue a new invoice with a new invoice number.

You cannot simply cancel an invoice once it is issued by NEOSYS.

You cannot modify and reissue an invoice with the same number in NEOSYS.

This might seem inconvenient and is not according to manual practice. However manual practice is uncontrolled and relies on the skill of the operator to avoid potentially creating a confusing mess of contradictory invoices. The NEOSYS system should provide a better guarantee of control over records and this is what it does.

NEOSYS makes it easy to cancel invoices or amend invoices so this is not really an issue, and, in the end, it is better to have a complete record of all cancellation or amendments in NEOSYS.

Why doesnt NEOSYS allow canceling or amendment of Invoices after issue?

This is done to maintain traceability in the system. It is quite possible that a booking order / invoice may be sent out immediately after generation. In such scenarios deletion of documents in the system, after the document are sent out, can lead to errors in accounting.

Once an invoice has been issued then it has an existence outside of the NEOSYS system in the form of files, printouts and emails etc.

There is no way to be sure that someone has not sent (and will not send) the cancelled invoice to the client.

Similarly, if you amend an invoice then there would be two or more possibly completely different invoices in existence with exactly the same number.

In the Finance Module

- All the journals generated including the original wrong invoice and the credit note MUST be posted otherwise auditors will question the missing invoice numbers.

- Allocate the invoice to credit note or vice versa so that they do not show as outstanding on the client's statement of outstanding items.

- If you really dont want the invoice and credit note showing on the movement account of the client then create a suspense a/c in the clients ledger and modify the journals Client A/c column before you post.

Putting Year in Document Numbers

The Configuration File allows you to define the format of document numbers instead of pure sequential numbers however this should be avoided.

The idea of having the year in the document number is usually based on prior manual numbering practices without consideration of automated procedures and is to be avoided for a number of practical and theoretical reasons.

Year in the number is often a good procedure when done manually but adds additional complexity which is difficult to automate.

Avoid doing it or expect lots of petty annoying problems. There are no perfect solutions to this issue other than avoiding it in the first place by using simple clear permanently incrementing numbers.

These problems do not apply to invoice numbers which can happily have the year in them without problem.

Problem controlling the year of a document

When you create new documents, NEOSYS will automatically use the CURRENT DATE to generate the year. This is a practical problem that may be overcome at some later date.

Problem of what year should be

When creating some forward looking documents like media schedules, the year that the schedule was created will be misleading if the schedule is for the following year.

You could have a job numbered 2006/9999 which has a purchase order 2007/99.

If you think that you could number the purchase orders with the year of the original job then you have the alternative problem of a purchase order numbered 2006/9999 which is dated in 2007

There is no escape from this logical issue.

Problem having to type a long document number

Practically as of now, if you want to access a document in NEOSYS you have to type the full document number including the year. NEOSYS might be changed to assume the current year but accessing prior year or future documents will still require more effort to type in the longer full document number.

Confusion about which document is meant

People will often refer to documents by the sequential number part only since they judge that the year is obvious. This can result in confusion. For example, does job number 1234 mean job number 1234 of 2006/2006 or job number 2007/1234. The confusion can always be resolved by checking on NEOSYS but takes time.

Problem with Ordering of Numbers

NEOSYS doesn't right justify numbers with leading zeros (egg 2007/001) so unless NEOSYS is changed to start numbers from say 1000 or 10000 each year you will have the following numbers which may confuse and may not sort correctly in NEOSYS reports or when exported into Excel etc.

<YEAR>/<NUMBER>

2007/1

2007/2

2007/3

etc

2007/10

2007/11

2007/12

How do I design my own columns for Billing Analysis?

Use Billing Analysis Column design to design the columns and then create Billing Analysis Reports which use those column designs.

There are many options available to control what appears in each column of a column design. You can look at and copy the pre-designed NEOSYS column designs to see how the standard NEOSYS billing analysis reports are done.

Defining Column Titles in Billing Analysis Column Design

You can simply type the text of the column heading that you want. For example "Budget".

If you have selected multiple information types or categories to be displayed then you either get automatic titles (see below) or you can indicate the titles for each one separated by ; characters. For example "Actual;Budget".

- HIDDEN

If you leave the title column blank (or select HIDDEN from the popup) then the column will not be shown on the report. Hidden columns are useful when you need to derive a calculated column from other columns that you do not want shown on the report. You might also want to hide a column temporarily on a design and then restore it later without having to retype it from scratch.

- %Category%

- %category%

- %CATEGORY%

- %Infotype%

- %infotype%

- %INFOTYPE%

You can select one item from each of the above groups to automatically generate the column title from the options that you have selected in the Information type and Category columns. This is useful when you choose multiple Information Types and Categories. The various forms of capitalisation allow you to choose the style as initial capitalisation, full capitalisation and all lower case.

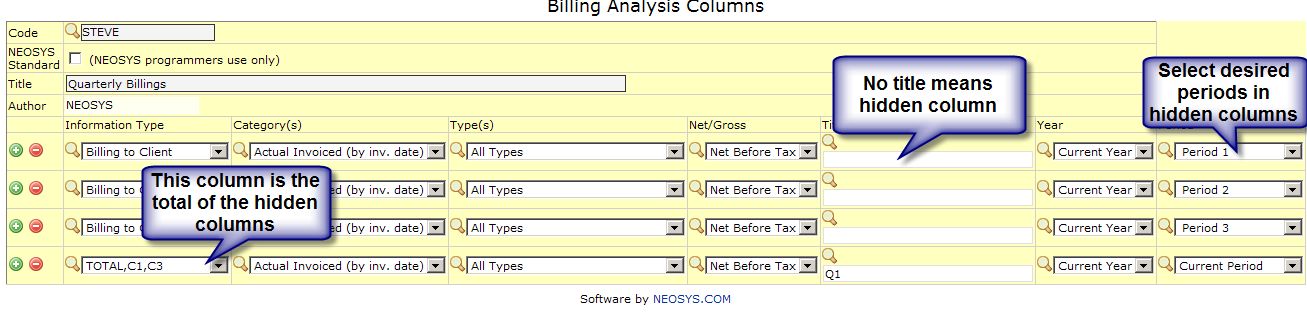

Designing multiperiod billing analysis columns

NEOSYS doesnt allow you select a period range but you can use hidden columns to achieve the same result

For example you might well want a quarterly billings analysis which would require 12 hidden columns plus 4 normal columns. This report would not be sensitive to the period selected at runtime since all the columns are fixed periods.

How does billing analysis code work?

A billing analysis code has multiple parts that identify all the possible break-downs of company revenue. Client & product, supplier & medium, market, type of business etc. By comparison, the P&L accounts are typically only broken by type of business.

If an particular account number in the finance module is mentioned in the job or media types file then that account is considered to be a P&L billing or cost account. The NEOSYS finance module imposes a restriction that all postings to P&L billing and cost accounts must have an analysis code. This restriction applies at a low level and is therefore regardless of the journal type or the source being automatic or manually entered. By comparison, postings to any other account NEOSYS Finance module imposes a restriction that they cannot have an analysis code. The end result is that the billing and cost section of the NEOSYS Profit and Loss report will always agree, to the cent, with the NEOSYS billing analysis reports.

NEOSYS billing analysis reports are, by default, based on actual posted vouchers on income and cost accounts in the finance module. Such postings are usually generated by the various billing modules of NEOSYS but can also be entered manually directly into the finance journals for adjustments and billing or cost matters not handled by NEOSYS billing modules like annual discounts

NEOSYS billing analysis reports can also be customized to show billings at prior stages like budget/forecast/plan/scheduled/invoiced billings etc. However this discussion is related to analysis codes here and that is relevant only to posted vouchers.

Finance entries generated by the NEOSYS billing modules typically appear in the finance module as unposted journals and are only posted by finance staff when they are ready. Generally it is a bad idea for finance to amend the generated journals before posting because this results in discrepancies between financial reports and operational reports.

It is also possible to configure NEOSYS to post all generated finance journals immediately. There may be cases where the posting cannot be done immediately because of finance validation issues and in this case NEOSYS falls back to leave the problematic journals unposted for manual invention prior to posting.