Understanding VAT/Sales Tax in the NEOSYS finance module

Understanding VAT/Sales Tax in NEOSYS Finance Module

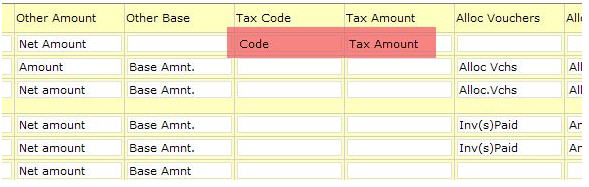

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

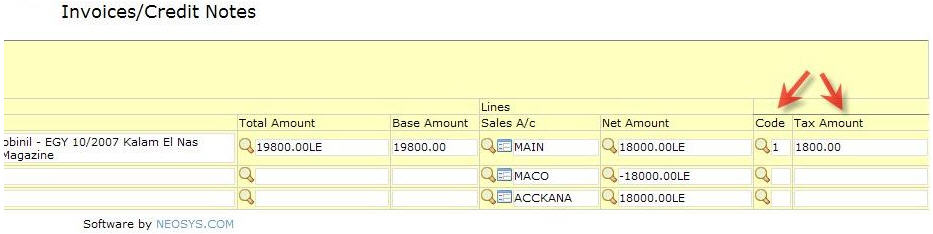

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

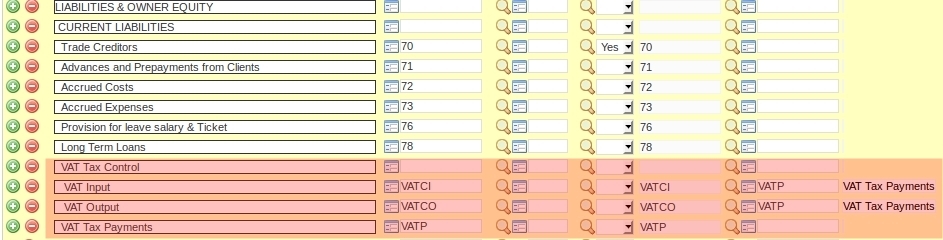

Creating "Sales Tax Control" and "Sales Tax Paid" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create TWO a/cs, one for the Sales Tax Control A/c which will represent the tax invoiced YTD, and one for the Sales Tax Payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the Sales Tax Control A/c. Manual journals will not be allowed so that the Sales Journal Tax column can be verified against the Sales Tax Control A/c.

All payments to the Tax authorities should be debited to the Sales Tax Payments A/c. Therefore the net of the two a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the Sales Tax Payments A/c (the last column) is the Sales Tax Control A/c. (here VATC). Therefore, every year, the opening balance for the Sales Tax Payable A/c will be zero and the Sales Tax Control A/c will be the net tax payable from the prior year.

Defining the Sales Tax A/c

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies:

Set VAT/Tax registration number in Company file

Set VAT/Tax registration number on letter head

Making tax columns appear on the Journals

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Invoice/Credit notes Journal

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6 Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

Purchase Invoice/Media Purchase Invoice Journal

Cost A/C Cr. - 100

Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100

VAT Control A/C Dr. + 5

Supplier A/c Cr. - 105

Receipt Journal

Bank A/C Dr. + 126 Client A/C Cr. - 126

Payment Journal

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Payment Journal

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1