Understanding VAT/Sales Tax in the NEOSYS finance module: Difference between revisions

| (22 intermediate revisions by 3 users not shown) | |||

| Line 35: | Line 35: | ||

[[image:vatfinance2.jpg]] | [[image:vatfinance2.jpg]] | ||

==== | ====Setting up VAT/Tax Registration number==== | ||

*The VAT/Tax Registration number should be entered in the Company file. This is done in order to get the VAT column in the journal entry page. | |||

*Add VAT/Tax Registration number in the letterhead. This is also done in the [[Configuring_Letterhead#Setting_up_letterhead_in_Company_File|Company file]]. | |||

*Set VAT/Tax Registration number in the Client & Brand file to show [[Agency_FAQ#How_is_Client_Address_on_invoices_obtained.3F|Client TRN on invoices]]. | |||

==== Making tax columns appear on the Journals ==== | ==== Making tax columns appear on the Journals ==== | ||

In order to get the VAT column in the journal entry page, make sure Tax Registration number is entered in the Company file. | |||

In Journal Setup make sure the tax columns are suitably titled for the relevant journals. | In Journal Setup make sure the tax columns are suitably titled for the relevant journals. | ||

| Line 53: | Line 57: | ||

===Accounting entries === | ===Accounting entries === | ||

====Invoice/Credit notes Journal ==== | Whenever an accounting transaction is posted, at least two accounts are always affected. One account is debited while the other is credited. | ||

The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance." | |||

====Invoice/Credit notes Journal==== | |||

When you issue a Media invoice/Credit note or invoice a Job estimate, the automatic entries are generated in the INV or INP journal, respectively. | |||

Client A/C Dr. + 126 | Client A/C Dr. + 126 | ||

Income A/c Cr. - 120 | Income A/c Cr. - 120 | ||

VAT Control A/C Cr. - 6 | VAT Control A/C Cr. - 6 | ||

Cost A/C Dr. + 100 | Cost A/C Dr. + 100 | ||

Accrual A/C Cr. - 100 (Schedule/Job A/C) | Accrual A/C Cr. - 100 (Schedule/Job A/C) | ||

====Purchase Invoice/Media Purchase Invoice Journal ==== | The amount charged to client is debited to the Client a/c with the VAT included in this amount. The amount excluding VAT is credited to the Income a/c and the VAT amount is credited separately to the Output VAT Control a/c. | ||

The cost to Supplier is recorded as a debit to the Cost a/c and the Accrual account is temporarily credited here until the amount is actually paid to the Supplier. These amounts exclude VAT paid to the Supplier. | |||

====Purchase Invoice/Media Purchase Invoice Journal==== | |||

The below entries are generated automatically in PUR journal when creating a Purchase order/issuing a Purchase invoice. | |||

A media Purchase invoice will have to be manually entered when you receive the Supplier invoice. | |||

Cost A/C Cr. - 100 | Cost A/C Cr. - 100 | ||

Accrual A/C Dr. + 100 (Schedule/Job A/C) | Accrual A/C Dr. + 100 (Schedule/Job A/C) | ||

Cost A/C Dr. + 100 | Cost A/C Dr. + 100 | ||

VAT Control A/C Dr. + 5 | VAT Control A/C Dr. + 5 | ||

Supplier A/c Cr. - 105 | Supplier A/c Cr. - 105 | ||

==== Receipt Journal ==== | A reversal is first created to reverse the amounts which were debited to Cost a/c and credited to Accrual a/c when the Estimate invoice/Media invoice was issued. | ||

Then, the cost to Supplier is debited to Cost a/c and the VAT amount is debited separately to the Input VAT control account. Correspondingly, total amount including VAT is credited to the Supplier a/c. | |||

====Receipt Journal==== | |||

An REC journal entry is manually entered when payment from the Client is received. | |||

Bank A/C Dr. + 126 | Bank A/C Dr. + 126 | ||

Client A/C Cr. - 126 | Client A/C Cr. - 126 | ||

Once the payment from the client is received, the Agency will credit the amount to the Client a/c and debit the Bank a/c. | |||

====Payment Journal==== | ====Payment Journal==== | ||

A PAY journal entry is manually entered when the payment has been made to the Supplier. | |||

Bank A/C Cr. - 105 | |||

Supplier A/c Dr. + 105 | |||

Once the payment has been made to the Supplier, the amount is credited to the Bank a/c and debited to the Supplier a/c. | |||

====Payment Journal==== | |||

At the end of each VAT period, Agencies have to pay the Govt. the difference of the VAT received from Client and VAT paid to Supplier. | |||

This is manually recorded in a PAY journal by debiting the VAT Payable a/c with the amount that you have to pay and crediting the same amount to the Bank a/c. | |||

VAT Payable A/c Dr. + 1 | |||

Bank A/c Cr. - 1 | |||

This is assuming that the total VAT received from clients is higher than total VAT paid to suppliers. If the total VAT paid is higher than total VAT received, then the agency needs to receive from the govt. the difference of VAT paid and VAT received, which is recorded in a receipt (REC journal) as a debit to the Bank a/c and credit to the VAT payable a/c. | |||

At the end of the VAT period, after the above PAY/REC transaction is posted, ledger account report for accounts VAT input, VAT output and VAT payable accounts together should show a total balance of 0. | |||

===VAT in NEOSYS=== | |||

==== Media Module==== | |||

*One tax code is used per schedule. Line items with a different tax code should be entered in a separate schedule. | |||

*A default tax code can be set by NEOSYS so that users don't need to enter the tax code each time. For e.g. most clients in Dubai use OSD(VAT Std. Output 5%) as default. | |||

*For assigning a default tax code per client or supplier see finance module section below. | |||

*VAT tax% is applied to the total net amount of the schedule and not the net amount per vehicle line. | |||

*The “Tax” column in the schedule file should not be used as invoicing will be blocked. Please use ‘Other’ column if necessary to use a different tax. (For e.g. you can enter “10% tax” in ‘Other’ column, which will be displayed in the printouts as well) | |||

*When issuing a media booking order “Add Standard Tax” must be chosen to display 5% VAT in the booking order printout. | |||

*To display Cost tax in Media Diary, refer to [http://userwiki.neosys.com/index.php/Using_NEOSYS_Media_System#Report_on_Cost_VAT_Tax Report on Cost VAT Tax] | |||

====Production Module==== | |||

*In Estimate or Production Orders, you can enter different tax codes per line. | |||

*NEOSYS can set a default tax code which will appear automatically in the Tax Code field. Any line items that don’t specify a tax code will use the default tax code defined at the bottom. | |||

*For assigning a default tax code per client or supplier see finance module section below. | |||

*Estimate use tax codes that begin with “O” to apply VAT tax on Outputs. (eg: OSB- Bahrain Std. VAT on Outputs) | |||

*Purchase orders use tax codes that begin with “I” to apply VAT tax on Inputs. (eg: IS- Std. VAT on Inputs) | |||

====Finance Module==== | |||

*TRN will be entered in the Company file. | |||

*The tax amount in intercompany transactions remain in the originating company making Tax audits easier. (http://userwiki.neosys.com/index.php/Finance_FAQ#Why_do_VAT_amounts_stay_in_originating_company_accounts.3F) | |||

*Tax code will be filled automatically on generated journals. | |||

*For assigning a default tax code per client or supplier, go to the 'Chart of Accounts' file, choose which ledger the client or supplier is in and enter the default tax code per account in the 'Tax Code" field. | |||

====Reports in NEOSYS==== | |||

*Ledger account/ Statement of Account | |||

You can use this report to check the balance of the different VAT accounts: VATCI, VATCO and VATP. | |||

*Journal Audit Report | |||

This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total. | |||

*[[Tax/VAT_Return_Report|Tax/VAT Return Report]] | |||

This report can be used to get VAT tax summary of all VAT items used in any period. | |||

You can cross-reference the Journal Audit report and the Tax/VAT return report to ensure that the amounts agree with each other. | |||

Latest revision as of 11:52, 31 October 2023

Handling VAT/Sales Tax

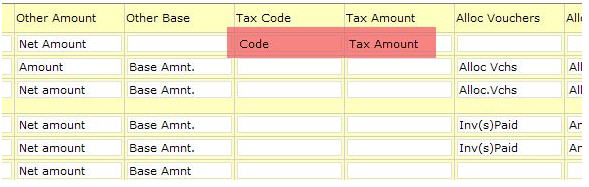

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

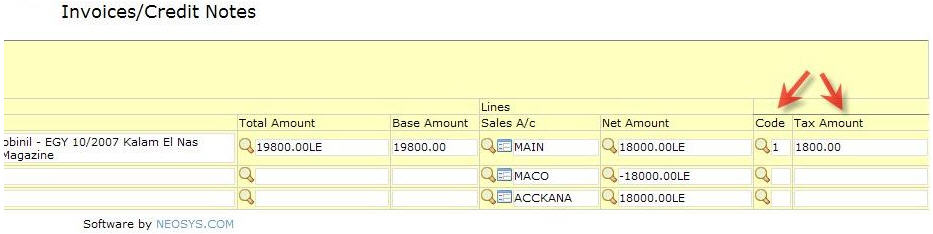

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

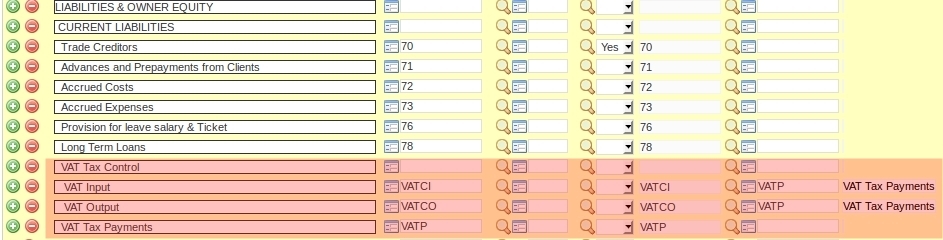

Creating "VAT Input", "VAT Output" and "VAT Tax Payments" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create THREE a/cs, one for the VAT Tax Control INPUT, which will represent the tax paid on purchases which are recoverable from tax authorities, one for VAT Tax Control OUTPUT, which will represent the tax collected and payable to the authorities, and one for the VAT Tax Payments which will represent the payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the VAT Tax Control A/cs. Manual journals will not be allowed so that the Tax column on journals can be verified against the VAT Tax Control A/cs.

All payments to the Tax authorities should be debited to the VAT Tax Payments A/c. Therefore the net of the three a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the VAT input and VAT output accounts is the VAT Tax Payments A/c (here VATP). Therefore, every year, the opening balance for the VAT Input and VAT Output A/cs will be zero and the VAT Tax Payments A/c will be the net tax payable from the prior year.

Defining the Tax Codes

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies.

VAT on sales (output) MUST be separated from VAT on purchases (input) using a blank line as shown below, so that the VAT statement report correctly identifies "VAT collected on outputs" and "VAT on inputs"

Setting up VAT/Tax Registration number

- The VAT/Tax Registration number should be entered in the Company file. This is done in order to get the VAT column in the journal entry page.

- Add VAT/Tax Registration number in the letterhead. This is also done in the Company file.

- Set VAT/Tax Registration number in the Client & Brand file to show Client TRN on invoices.

Making tax columns appear on the Journals

In order to get the VAT column in the journal entry page, make sure Tax Registration number is entered in the Company file.

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Whenever an accounting transaction is posted, at least two accounts are always affected. One account is debited while the other is credited.

The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance."

Invoice/Credit notes Journal

When you issue a Media invoice/Credit note or invoice a Job estimate, the automatic entries are generated in the INV or INP journal, respectively.

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6

Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

The amount charged to client is debited to the Client a/c with the VAT included in this amount. The amount excluding VAT is credited to the Income a/c and the VAT amount is credited separately to the Output VAT Control a/c.

The cost to Supplier is recorded as a debit to the Cost a/c and the Accrual account is temporarily credited here until the amount is actually paid to the Supplier. These amounts exclude VAT paid to the Supplier.

Purchase Invoice/Media Purchase Invoice Journal

The below entries are generated automatically in PUR journal when creating a Purchase order/issuing a Purchase invoice.

A media Purchase invoice will have to be manually entered when you receive the Supplier invoice.

Cost A/C Cr. - 100 Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100 VAT Control A/C Dr. + 5 Supplier A/c Cr. - 105

A reversal is first created to reverse the amounts which were debited to Cost a/c and credited to Accrual a/c when the Estimate invoice/Media invoice was issued.

Then, the cost to Supplier is debited to Cost a/c and the VAT amount is debited separately to the Input VAT control account. Correspondingly, total amount including VAT is credited to the Supplier a/c.

Receipt Journal

An REC journal entry is manually entered when payment from the Client is received.

Bank A/C Dr. + 126 Client A/C Cr. - 126

Once the payment from the client is received, the Agency will credit the amount to the Client a/c and debit the Bank a/c.

Payment Journal

A PAY journal entry is manually entered when the payment has been made to the Supplier.

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Once the payment has been made to the Supplier, the amount is credited to the Bank a/c and debited to the Supplier a/c.

Payment Journal

At the end of each VAT period, Agencies have to pay the Govt. the difference of the VAT received from Client and VAT paid to Supplier.

This is manually recorded in a PAY journal by debiting the VAT Payable a/c with the amount that you have to pay and crediting the same amount to the Bank a/c.

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1

This is assuming that the total VAT received from clients is higher than total VAT paid to suppliers. If the total VAT paid is higher than total VAT received, then the agency needs to receive from the govt. the difference of VAT paid and VAT received, which is recorded in a receipt (REC journal) as a debit to the Bank a/c and credit to the VAT payable a/c.

At the end of the VAT period, after the above PAY/REC transaction is posted, ledger account report for accounts VAT input, VAT output and VAT payable accounts together should show a total balance of 0.

VAT in NEOSYS

Media Module

- One tax code is used per schedule. Line items with a different tax code should be entered in a separate schedule.

- A default tax code can be set by NEOSYS so that users don't need to enter the tax code each time. For e.g. most clients in Dubai use OSD(VAT Std. Output 5%) as default.

- For assigning a default tax code per client or supplier see finance module section below.

- VAT tax% is applied to the total net amount of the schedule and not the net amount per vehicle line.

- The “Tax” column in the schedule file should not be used as invoicing will be blocked. Please use ‘Other’ column if necessary to use a different tax. (For e.g. you can enter “10% tax” in ‘Other’ column, which will be displayed in the printouts as well)

- When issuing a media booking order “Add Standard Tax” must be chosen to display 5% VAT in the booking order printout.

- To display Cost tax in Media Diary, refer to Report on Cost VAT Tax

Production Module

- In Estimate or Production Orders, you can enter different tax codes per line.

- NEOSYS can set a default tax code which will appear automatically in the Tax Code field. Any line items that don’t specify a tax code will use the default tax code defined at the bottom.

- For assigning a default tax code per client or supplier see finance module section below.

- Estimate use tax codes that begin with “O” to apply VAT tax on Outputs. (eg: OSB- Bahrain Std. VAT on Outputs)

- Purchase orders use tax codes that begin with “I” to apply VAT tax on Inputs. (eg: IS- Std. VAT on Inputs)

Finance Module

- TRN will be entered in the Company file.

- The tax amount in intercompany transactions remain in the originating company making Tax audits easier. (http://userwiki.neosys.com/index.php/Finance_FAQ#Why_do_VAT_amounts_stay_in_originating_company_accounts.3F)

- Tax code will be filled automatically on generated journals.

- For assigning a default tax code per client or supplier, go to the 'Chart of Accounts' file, choose which ledger the client or supplier is in and enter the default tax code per account in the 'Tax Code" field.

Reports in NEOSYS

- Ledger account/ Statement of Account

You can use this report to check the balance of the different VAT accounts: VATCI, VATCO and VATP.

- Journal Audit Report

This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total.

This report can be used to get VAT tax summary of all VAT items used in any period.

You can cross-reference the Journal Audit report and the Tax/VAT return report to ensure that the amounts agree with each other.