Understanding VAT/Sales Tax in the NEOSYS finance module: Difference between revisions

No edit summary |

|||

| Line 94: | Line 94: | ||

===The duality (double) principle.=== | ===The duality (double) principle.=== | ||

First thing to understand is, companies will keep their own accounts of | First thing to understand is, companies will keep their own accounts of both sides of a transaction with every party they transact with. <br> E.g Client A/cs and Supplier A/cs. For example company management must be able to know how much a client owes or how much the company owes a supplier without having to rely on the other party. | ||

In following examples, our company will be refereed to as AgencyX. | In following examples, our company will be refereed to as AgencyX. | ||

Revision as of 11:05, 23 July 2018

Handling VAT/Sales Tax

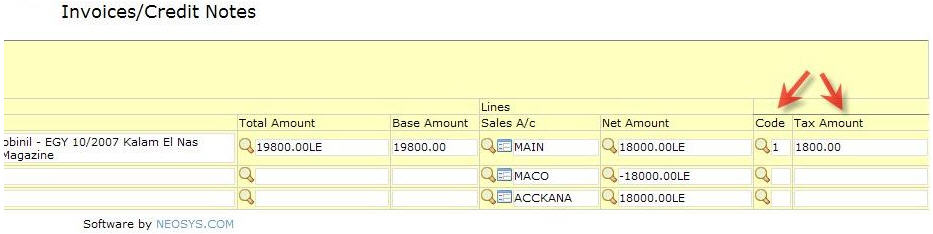

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

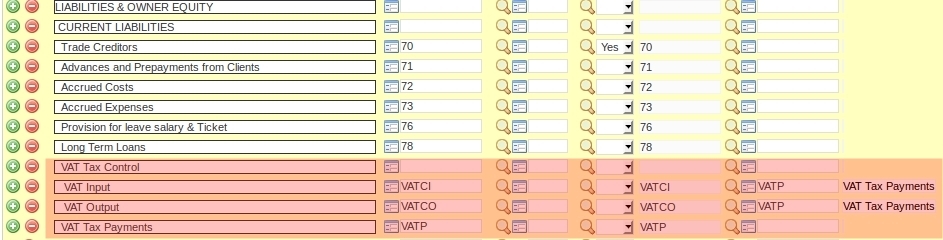

Creating "VAT Input", "VAT Output" and "VAT Tax Payments" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create THREE a/cs, one for the VAT Tax Control INPUT, which will represent the tax paid on purchases which are recoverable from tax authorities, one for VAT Tax Control OUTPUT, which will represent the tax collected and payable to the authorities, and one for the VAT Tax Payments which will represent the payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the VAT Tax Control A/cs. Manual journals will not be allowed so that the Tax column on journals can be verified against the VAT Tax Control A/cs.

All payments to the Tax authorities should be debited to the VAT Tax Payments A/c. Therefore the net of the three a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the VAT input and VAT output accounts is the VAT Tax Payments A/c (here VATP). Therefore, every year, the opening balance for the VAT Input and VAT Output A/cs will be zero and the VAT Tax Payments A/c will be the net tax payable from the prior year.

Defining the Tax Codes

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies.

VAT on sales (output) MUST be separated from VAT on purchases (input) using a blank line as shown below, so that the VAT statement report correctly identifies "VAT collected on outputs" and "VAT on inputs"

Set VAT/Tax registration number in Company file

Set VAT/Tax registration number on letter head

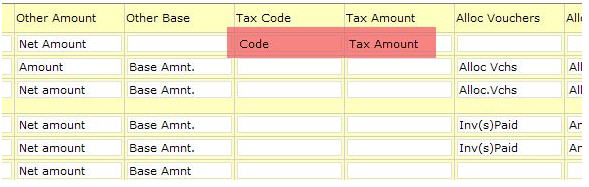

Making tax columns appear on the Journals

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Invoice/Credit notes Journal

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6 Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

Purchase Invoice/Media Purchase Invoice Journal

Cost A/C Cr. - 100

Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100

VAT Control A/C Dr. + 5

Supplier A/c Cr. - 105

Receipt Journal

Bank A/C Dr. + 126 Client A/C Cr. - 126

Payment Journal

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Payment Journal

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1

Understanding Double-Entry Accounting

Aimed at staff with little or no prior experience in accounting.

Cardinal Double Entry Accounting Rules:

The duality (double) principle.

First thing to understand is, companies will keep their own accounts of both sides of a transaction with every party they transact with.

E.g Client A/cs and Supplier A/cs. For example company management must be able to know how much a client owes or how much the company owes a supplier without having to rely on the other party.

In following examples, our company will be refereed to as AgencyX.

Every transaction must effect at least two accounts. E.g A supplier gives productA and receives $50 and conversely AgencyX receives productA and pays $50.

Supplier A/c = +$50. AgencyX A/c = -$50.

For every debit there must be an equal credit

The previous example illustrates. If you increase an account by +500 (e.g Client A/c) then another account must have decreased by -500. (e.g Inventory A/c).

Debits are Positive & Credits are Negative. (*Need to revisit*)

You might be inclined to think that the word "debit" is similar to "debt" and should also be viewed as bad/negative/owed. Credit should be viewed as good/positive/owned. This is not the case in accounting.

+Debit & -Credit describe the increase or decrease in the overall amount of the givers account.

E.g AccountX = $500 and AgencyX credits that account by $200 they the balance of AccountX is now $300. Where as if Agency debits that account the balance is $700.

Assets = Liabilities + Equity

This formula represents the relationship between the assets, liabilities, and owners' equity of a business.

Assets A/c record resources owned by the company. They have future economic value that can be measured and can be expressed in currency.

Examples a/cs include cash, investments, accounts receivable (money owed by clients), inventory, supplies, buildings, furniture and equipment. Assets = Liabilities + Equity

Liability A/c record monetary obligations the company own. They too are measured and can be expressed in currency. Examples a/cs include loans, accounts payable (money owed to suppliers), staff salaries and Income tax payable. Liabilities = Assets - Equity

Equity A/c record the owner/ shareholders interest in the company assets. In other words, upon liquidation after all the liabilities are paid off, the shareholders own the remaining assets. This is why equity is often referred to as "net assets" or "assets minus liabilities". Equity = Assets - Liabilities

Pending explanation of Journals, Ledgers, Chart of accounts. Easier error detection and the idea that you can account for anything, you can have an account for all items sold painted red. Also need to mention how crediting a liability account increase liability where as crediting asset account is decreasing the asset.

The total Debits and Credits must equate to zero. This means, the collective result of total debits will equal to total credits on all accounts in a ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having Debit balances will be equal to the aggregate balance of all accounts having Credit balances. This is one of the advantages to double entry accounting, a reliable way to check if there are any errors, because if the total credits and debits don't match then the golden rule was not followed.