Troubleshooting NEOSYS Finance System: Difference between revisions

No edit summary |

No edit summary |

||

| Line 7: | Line 7: | ||

[[Correcting mistakes in postings]] | [[Correcting mistakes in postings]] | ||

== You Cannot Post 0 Currency Amounts to Open Item Accounts == | |||

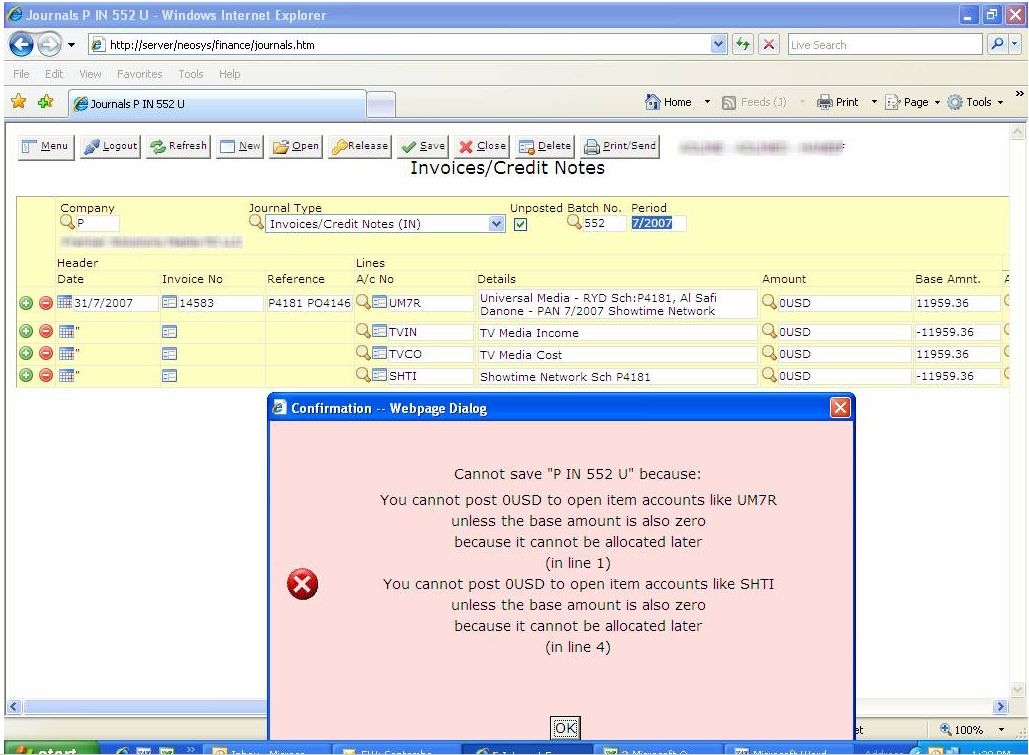

While trying to post journal entries in NEOSYS, you may come across the following errors: | |||

ERROR MESSAGE: | |||

CANNOT SAVE "P IN 552 U" because: | |||

You cannot post 0USD to open items account like UM7R | |||

unless the base amount is also zero | |||

because it cannot be allocated later | |||

(in line 1) | |||

[[image:Financecurrencyamounts.jpg]] | |||

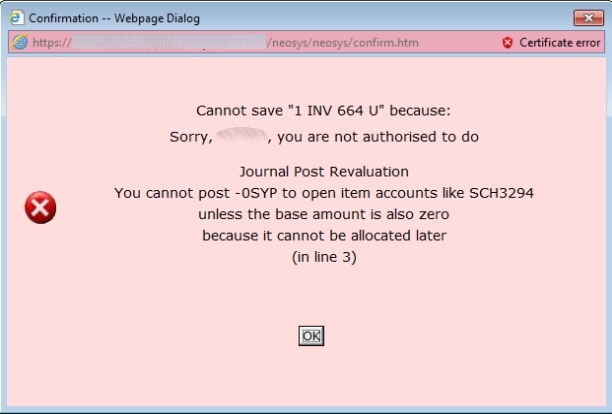

ERROR MESSAGE: | |||

CANNOT SAVE "1 INV 664 U" because: | |||

Sorry, you are not authorized to do | |||

Journal Post Revaluation | |||

You cannot post -0SYP to open item accounts like SCH3294 | |||

unless the base amount is also zero | |||

because it cannot be allocated later | |||

(in line 3) | |||

[[image:REVALUATIONJOURNALS.jpg]] | |||

As the messages say, you cannot post zero currency amounts to open item accounts unless the base amount is also zero because it cannot be allocated later. | |||

In order to understand this issue, observe that having a outstanding item of zero amount on an open item account (in any currency) logically means that the outstanding base equivalent of that outstanding item should be zero too. | |||

Logically, all items posted to open item accounts need to be eventually allocated to other items in order to remove them from the list of outstanding items for the account. However the NEOSYS allocation process only allows allocation of real currency amounts since it ensures that the equivalent base amounts are proportionate to the currency amounts and automatically makes entries to the exchange gains and losses accounts to reflect this. | |||

Having a base amount outstanding when the currency amount outstanding is clearly not correct in the final analysis and NEOSYS is currently programmed to prevent journals like this from being manually entered. | |||

=== Cause === | |||

The situation can arise due journal entries generated by NEOSYS when the exchange rate is adjusted after invoicing and a debit or credit note is issued to account for the difference. In this case the currency amount to be posted in finance is zero while the base amount is not zero. | |||

=== Solution === | |||

#Open the appropriate journal | |||

#Change the account of the offending lines to the exchange gain/loss account. | |||

#*The exchange gain/loss account is not an open item account and hence it will accept “zero amount, base currency only journals”, otherwise known as revaluation journals. | |||

#Post the entry | |||

=== Alternative Solution === | |||

# Ask NEOSYS programmers to temporarily patch the software to allow the posting. If this situation turns out to be a recurring event then NEOSYS software will be patched to allow authorised finance users to post this type of transaction without involving NEOSYS programmers. | |||

# Post the entries | |||

# Run the NEOSYS revaluation program on the account to transfer the balance to the exchange gains and losses account. IF YOU ARE NOT SKILLED AT REVALUATION DO THIS ON TESTDATA FIRST! | |||

''Note -'' NEOSYS software versions from Feb 2012 generate journals automatically with exchange gain/loss account where appropriate. | |||

Revision as of 07:11, 28 April 2014

Locating and correcting Exchange Gain/Loss A/c errors

Resolving opening balances in P&L accounts where you fail to put a closing account on them

Correcting mistakes in postings

You Cannot Post 0 Currency Amounts to Open Item Accounts

While trying to post journal entries in NEOSYS, you may come across the following errors:

ERROR MESSAGE:

CANNOT SAVE "P IN 552 U" because: You cannot post 0USD to open items account like UM7R unless the base amount is also zero because it cannot be allocated later (in line 1)

ERROR MESSAGE:

CANNOT SAVE "1 INV 664 U" because: Sorry, you are not authorized to do Journal Post Revaluation You cannot post -0SYP to open item accounts like SCH3294 unless the base amount is also zero because it cannot be allocated later (in line 3)

As the messages say, you cannot post zero currency amounts to open item accounts unless the base amount is also zero because it cannot be allocated later.

In order to understand this issue, observe that having a outstanding item of zero amount on an open item account (in any currency) logically means that the outstanding base equivalent of that outstanding item should be zero too.

Logically, all items posted to open item accounts need to be eventually allocated to other items in order to remove them from the list of outstanding items for the account. However the NEOSYS allocation process only allows allocation of real currency amounts since it ensures that the equivalent base amounts are proportionate to the currency amounts and automatically makes entries to the exchange gains and losses accounts to reflect this.

Having a base amount outstanding when the currency amount outstanding is clearly not correct in the final analysis and NEOSYS is currently programmed to prevent journals like this from being manually entered.

Cause

The situation can arise due journal entries generated by NEOSYS when the exchange rate is adjusted after invoicing and a debit or credit note is issued to account for the difference. In this case the currency amount to be posted in finance is zero while the base amount is not zero.

Solution

- Open the appropriate journal

- Change the account of the offending lines to the exchange gain/loss account.

- The exchange gain/loss account is not an open item account and hence it will accept “zero amount, base currency only journals”, otherwise known as revaluation journals.

- Post the entry

Alternative Solution

- Ask NEOSYS programmers to temporarily patch the software to allow the posting. If this situation turns out to be a recurring event then NEOSYS software will be patched to allow authorised finance users to post this type of transaction without involving NEOSYS programmers.

- Post the entries

- Run the NEOSYS revaluation program on the account to transfer the balance to the exchange gains and losses account. IF YOU ARE NOT SKILLED AT REVALUATION DO THIS ON TESTDATA FIRST!

Note - NEOSYS software versions from Feb 2012 generate journals automatically with exchange gain/loss account where appropriate.

Solving Error: Index overflow - run Finance, Maintenance, "Clear Open Items"

Cause

For low and medium volume of transaction this only occurs after many years of using NEOSYS. In this case the only possible problem is that ledger and statements of accounts of open items "as at" ancient periods will be missing items.

For high volume accounts this occurs when the Clear Open Item procedure is not performed regularly. In this case, older unallocated items may be missing from ledger accounts/statements causing "cross check balances" which have to be dealt with by technical support using CHK.ALLOC.

For more information see the Clear Open Item screen and, if and when it becomes available, documentation for why, when and how the "Clear Open Items" procedure must be run.

Solution

Perform a normal "Clear Open Items" procedure in the Finance, Maintenance Menu. (NB normal web interface - NOT Maintenance Mode)

Proactive Checking if Clear Open Items needs to be performed

To find out which accounts are more than 50% "full", in maintenance mode press F5 and type the following command

LIST VOUCHER.INDEX SIZE WITH SIZE > 32000

The maximum size is around 65500.

Converting Balance Forward Accounts to Open Item

Problem explained

Users cannot change the type of a chart of accounts from Balance Forward Account to Open Item after any postings have been made, but it is possible in maintenance mode IF AND ONLY IF the users are prepared to see EVERY ITEM EVER POSTED ON EVERY ACCOUNT IN THE CHART AS OUTSTANDING.

NEOSYS has no way to match and allocate the old items to each other automatically so, after conversion, this MUST be done manually and can be time consuming and EFFECTIVELY IMPOSSIBLE for chart of accounts with many account or large accounts. In this case the ONLY solution is to create a new chart of accounts (with the same control account) and start from scratch with new accounts perhaps transferring the balance of the old accounts to the new accounts.

Solution

The solution involves editing the LEDGER and CHARTS file (in Maintenance mode) to change the type, saving the chart once again, and then running F5 CHK.ALLOC to add items missing from open item indexed.

After this the account will be an Open Item account and all items will show as outstanding. One easy way to knock off these items is to find out the balance of this account (eg. 45000 AED) and then pass a Journal into the account to allocate and clear all the old items and that journal itself would be the open item of the new account i.e. +45000 DR -45000 CR

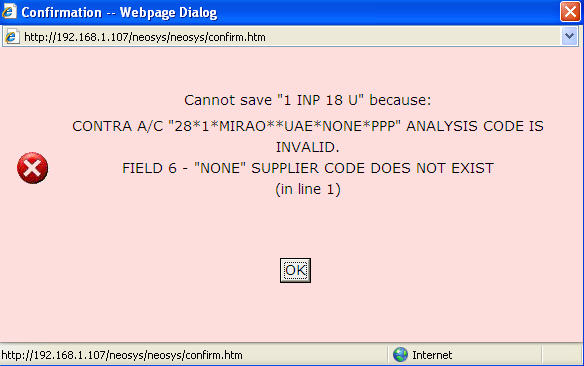

Resolving the "NONE supplier does not exist" message on invoice postings

When posting an automated invoice journal from NEOSYS you may encounter a message which which says "Cannot save XXXX because NONE supplier does not exist". The error message will look something like this

Error Message: Cannot save "1 INP 18 U" because: CONTRA A/C "28*1*MIRAO**UAE*NONE*PPP" ANALYSIS CODE IS INVALID FIELD 6 - "NONE" SUPPLIER CODE DOES NOT EXIST (in Line 1)

This error appears because there was no cost related to this invoice and as such for billing analysis NEOSYS takes the supplier code as NONE in the billing analysis code. To avoid this message create a supplier code NONE in the supplier file (the supplier name is irrelevant and could be NONE aswell) and then post this invoice. This is a one time setup per client.

Problem: Batches “missing” from selected periods

NEOSYS allows you to clear the default batch period during data entry. Then the posting period is determined by the voucher date and there may be different periods posted within a single batch.

Such batches are listed in period 0 and not in the period of any specific voucher in the batch. This applies even if all the vouchers in the batch happen to be in the same period.

Problem: Account number does not exist

User can find this message while passing/positing any entry in finance.

Explanation:

This error means that the account for which a user is trying to post an entry does not exist in finance ledgers.

NEOSYS allows users to put the accounts manually in their respective chart but all the provision/accrual accounts are automatically created in their respective chart. There can be a scenario in which the accrual accounts are not created automatically as explained below:

Problem:

Clients who are using an older version of neosys and have entered a schedule number which begins with a non-numeric character, face a problem that accrual accounts are not automated and receive the message "Account number does not exist" while posting an supplier invoice before creating an Invoice to client.

Troubleshoot this message:

- All accrual accounts are created in ACC20XX ledger after the schedule is approved. So check if the schedule is approved, if not ask user to approve the schedule.

Solution:

- This problem was fixed in 04th July 2011 version of neosys. So first step is to upgrade a client database. Upgrade will prevent in causing the problem again for future schedules.

- Now the solution to this problem is to save the schedule again without doing any changes/amendment on a schedule. This can be done by changing something and changing it back before saving.

Solving ALLOCATION EXCEEDS BASE AMOUNT error

This message may come when running the CHK.ALLOC maintenance procedure.

Under normal circumstances, the total amount and base amount allocated to other vouchers cannot exceed the amount and base amount on the voucher. In other words, you cannot allocate a payment of 1000 to invoices totaling 1100. However the situation can arise in some circumstances on currency amounts that have been revalued. If you cancel manual allocations on currency amounts and there have been some revaluations (since the original manual allocation) that resulted in an INCREASE in the amount outstanding.

Solution: Run the revaluation program since its job is to amend outstanding base amount to agree with the outstanding currency amount at the prevailing exchange rate.