Tax/VAT Return Report: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

No edit summary |

No edit summary |

||

| Line 10: | Line 10: | ||

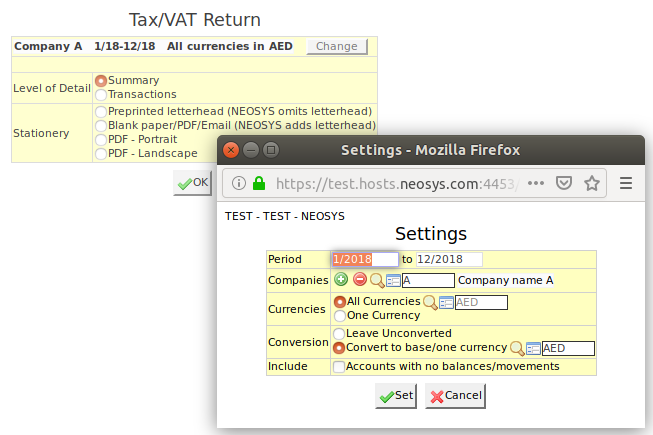

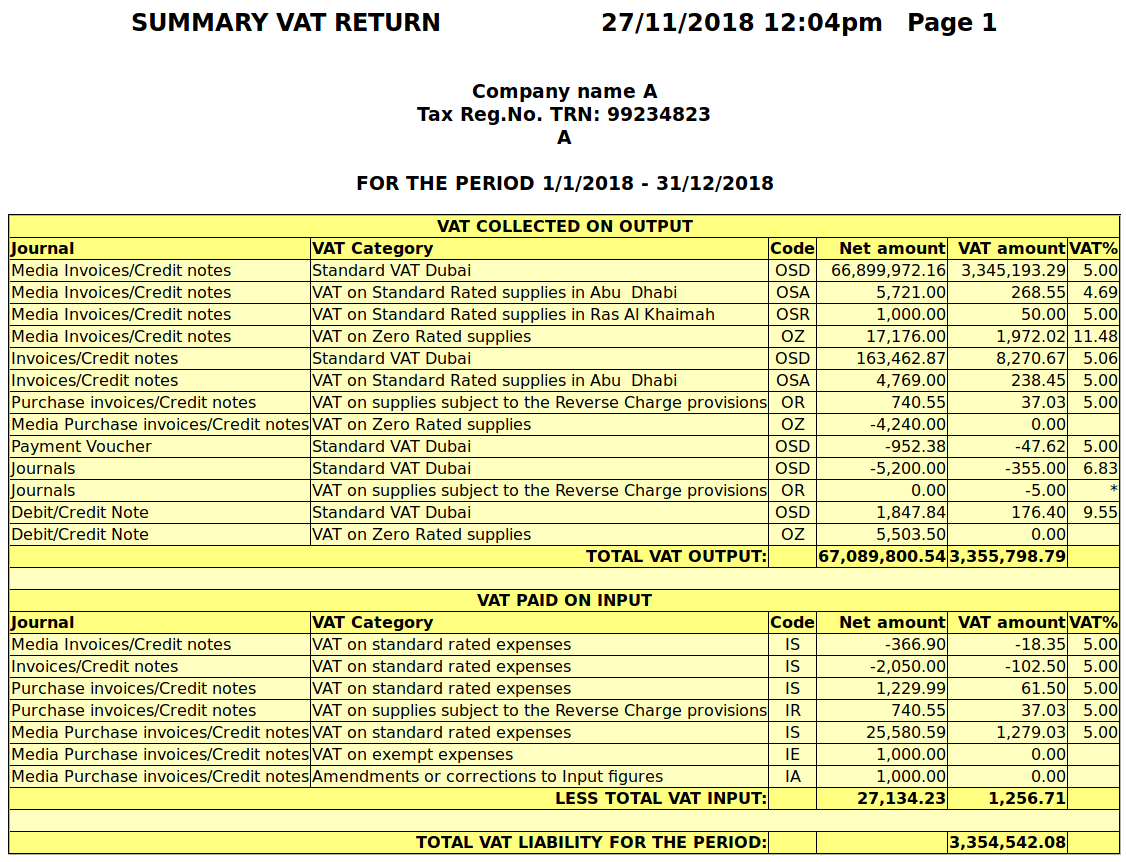

===Summary level of detail=== | ===Summary level of detail=== | ||

Displays basic details of the different types of VAT used in the different types of journals for both Tax on Input and Output. | |||

[[image:VatReturn1.png|900px]] | [[image:VatReturn1.png|900px]] | ||

| Line 16: | Line 16: | ||

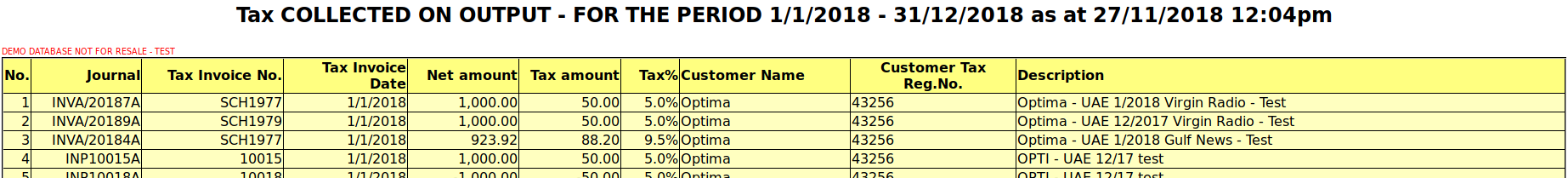

===Transactions level of detail=== | ===Transactions level of detail=== | ||

Displays a detailed report on Tax collected on Input and paid on Output with columns like Journal batch no., Invoice no. and date, Customer Name and TRN etc. | |||

[[image:VatReturn2.png|1300px]] | [[image:VatReturn2.png|1300px]] | ||

Revision as of 11:21, 27 November 2018

Tax/Vat Return report

The Tax/Vat report is used to get a tax summary of all VAT items used in the specified period.

You can choose the level of detail you require i.e. either Summary or Transaction level.

Summary level of detail

Displays basic details of the different types of VAT used in the different types of journals for both Tax on Input and Output.

Transactions level of detail

Displays a detailed report on Tax collected on Input and paid on Output with columns like Journal batch no., Invoice no. and date, Customer Name and TRN etc.