Tax/VAT Return Report: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

(Created page with 'image:TAXVATStatement_2011.jpg') |

mNo edit summary |

||

| (4 intermediate revisions by one other user not shown) | |||

| Line 1: | Line 1: | ||

[[image: | [[image:VatReturn3.png|600px]] | ||

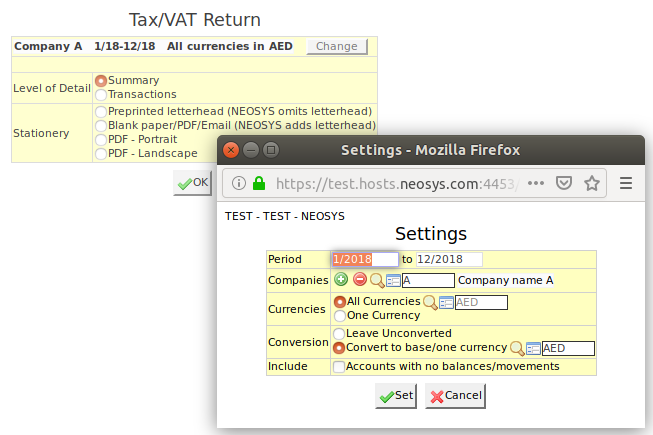

== Tax/Vat Return report == | |||

The Tax/Vat Return report is used to get a tax summary of all VAT items used in the specified period. | |||

This report can be cross-checked with the [[Journal_Audit/Export|Journal Audit]] report to ensure that the amounts agree with each other. | |||

You can choose the level of detail you require i.e. either Summary or Transaction level. | |||

===Summary level of detail=== | |||

Displays net amount, VAT amount and VAT % summarised by Journal type by VAT code. | |||

[[image:VatReturn1.png|900px]] | |||

===Transactions level of detail=== | |||

Displays a detailed report on Tax collected on Input and paid on Output with details including Journal batch no., Invoice no. and date, Customer Name and TRN etc. | |||

[[image:VatReturn2.png|1300px]] | |||

Latest revision as of 12:43, 6 December 2018

Tax/Vat Return report

The Tax/Vat Return report is used to get a tax summary of all VAT items used in the specified period.

This report can be cross-checked with the Journal Audit report to ensure that the amounts agree with each other.

You can choose the level of detail you require i.e. either Summary or Transaction level.

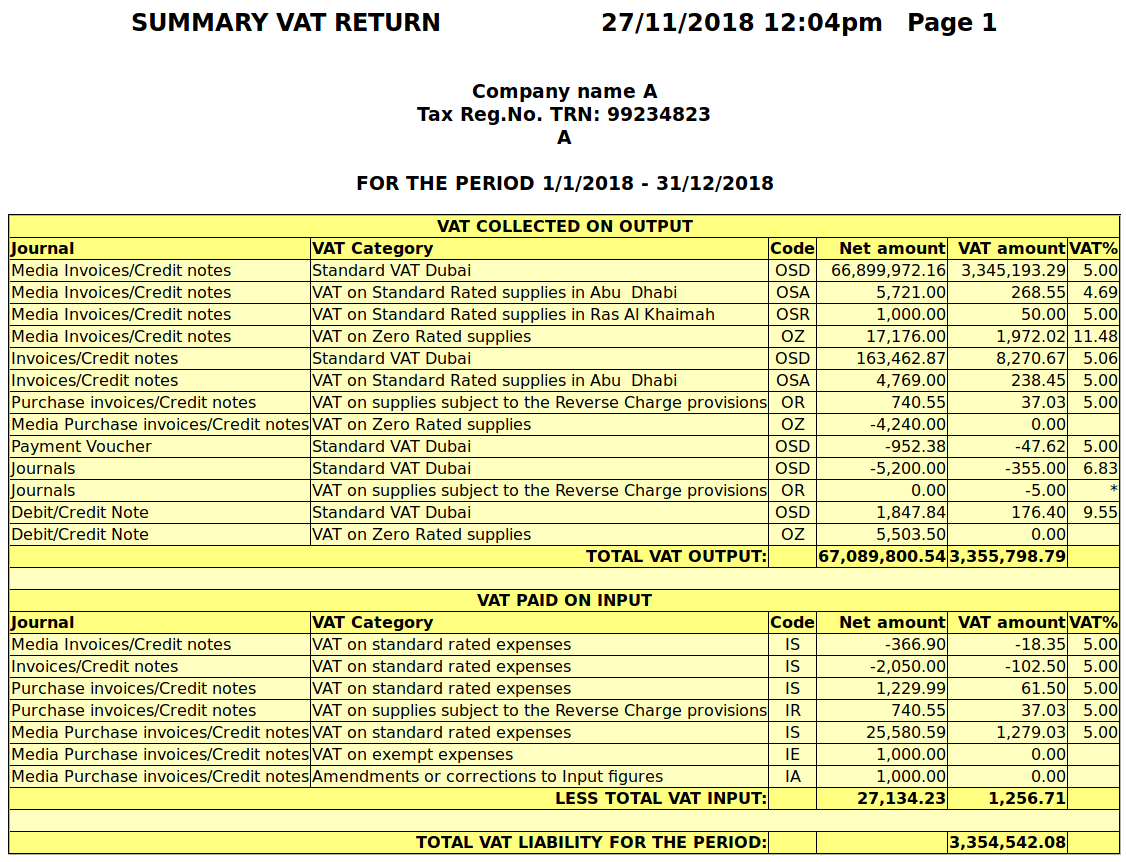

Summary level of detail

Displays net amount, VAT amount and VAT % summarised by Journal type by VAT code.

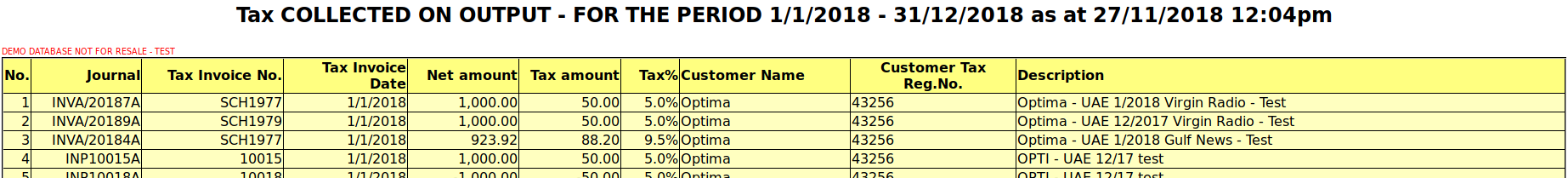

Transactions level of detail

Displays a detailed report on Tax collected on Input and paid on Output with details including Journal batch no., Invoice no. and date, Customer Name and TRN etc.