NEOSYS Agency

Agency FAQ

Can I migrate Media and/or Jobs data from OLD system to NEOSYS?

As you already might have a management system in place for Media and/or Jobs or are doing the same word in Excel or Word, we are not going to look into migrating this information to NEOSYS as this information is outdated and will not make sense putting into a new specialized system like NEOSYS. We will allow this type of information to be stored separately in their existing structure for future reference and put all new information into NEOSYS (eg new media plans, schedules, jobs, estimates etc). i.e. if you decide to start off with NEOSYS on 1st of May, 2009; then you will do no more work in your old way and enter all new information into NEOSYS.

What are alias codes in NEOSYS?

Client and Brand, Supplier, Market, Currency, Media/Job Type and Vehicle Files have a field to enter "alias" codes which can be used to cross reference the same records in other external systems particularly when importing and exporting data.

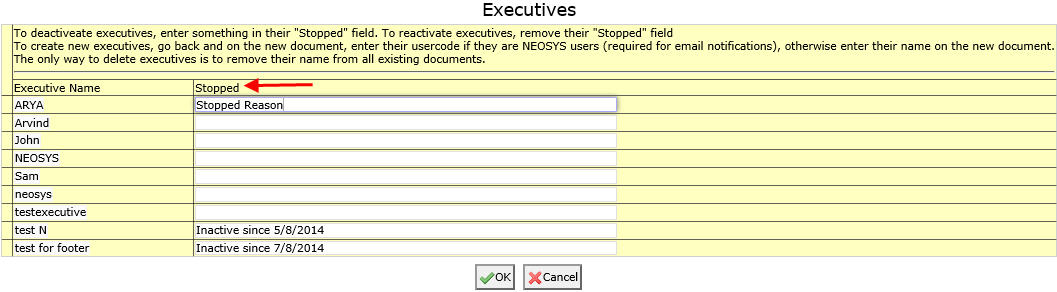

How do I remove executives that are no longer present or required in NEOSYS?

Inactive executives or duplicate names for an executive can be removed from the list of executives using the Edit button in the Schedule/job file. Add a reason for being stopped and save the executives file. All the executives saved with a reason in Stopped field will not appear in the list of Executives. You can reactivate an executive i.e make it re appear in the list by removing the Stopped reason from the file for that executive as shown in the screenshot below.

How is Client Address on invoices obtained?

Client & Brand files are created in the Media/Jobs module and their respective Client A/c Nos are created in Finance module and assigned to the Client & Brand files.

The Client & Brand file is often created first, to record information about the client, whereas Client A/c No often gets assigned afterwards.

The client address on invoices is obtained following these steps:

- If agency configuration file is set to use account name and address instead of client file details,

- In the client and brand file for the brand used, check if a/c no. is present in the brand line. If true and if the a/c no's address file has a recorded address, then use that.

- Else check if client a/c no. is present in the client and brand file. If true and if the a/c no's address file has a recorded address, then use that.

- Else use the address details found in the client and brand file

- Else use the address details found in the client and brand file

Configuration: Invoice uses A/c No & Address instead of client file details

How do I classify clients based on industry or parent company?

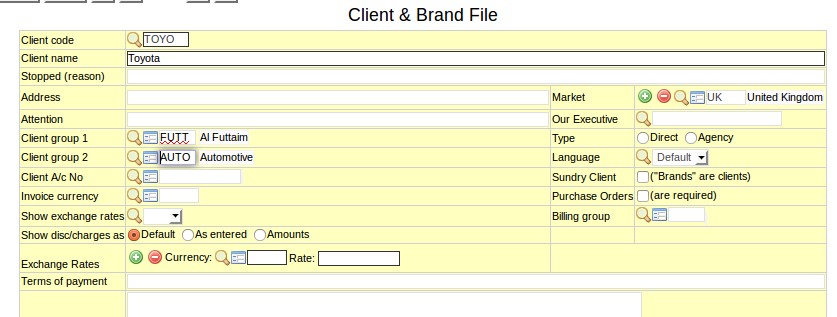

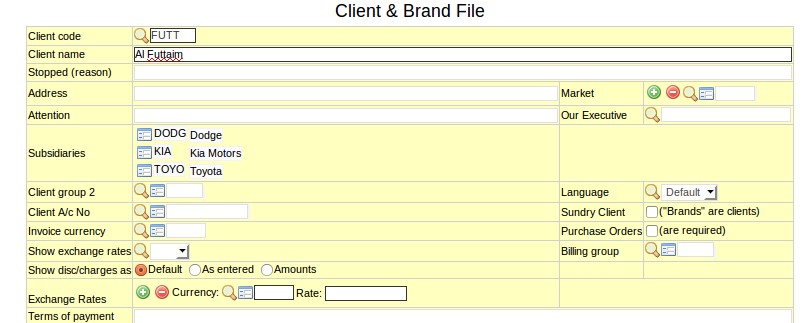

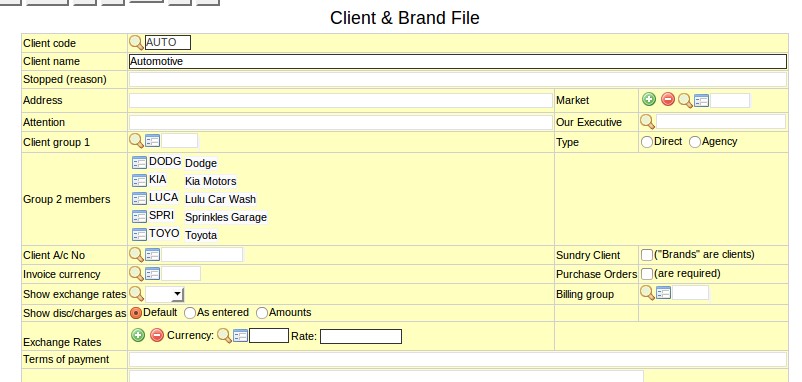

Client Group fields present in the Client and Brand file are used to classify clients according to industry, organisation size and/or parent company etc. You can classify clients using Client Group 1 or Client Group 2 or both or neither.

Classifying clients using client groups is not compulsory. However, doing so, allows you to take various reports using industry-wise, or parent company wise filters.

Example:

Toyota is a subsidiary of Al Futtaim that belongs to the Automotive industry. So in the Client and Brand File of Toyota, you can classify it as a member of Al Futtaim using Client Group 1 field and/or classify it as a member of Automotive group using the Client Group 2 field. It does not matter whether you classify Al Futtaim as Client Group 1 or Client Group 2 - same is the case for Automotive.

In the Client and Brand File of Al Futtaim, you can see Toyota as a subsidiary.

In the "fake" Client and Brand File called Automotive, you can see Toyota as one of the Group 2 members.

How to classify suppliers into groups?

If you have many suppliers that are part of a single "supplier group", then you can group these suppliers together. By doing so, you can generate reports for the whole supplier group.

Example:

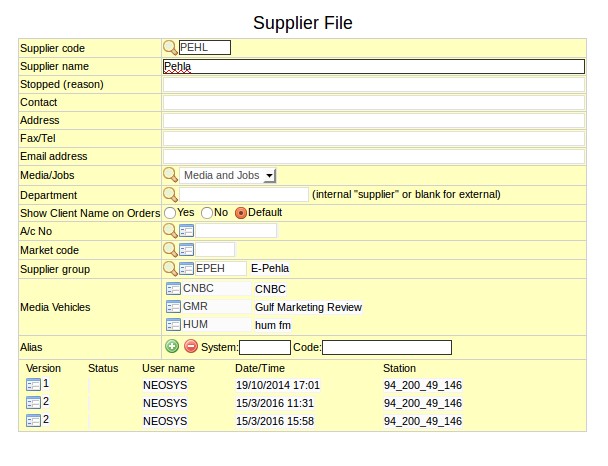

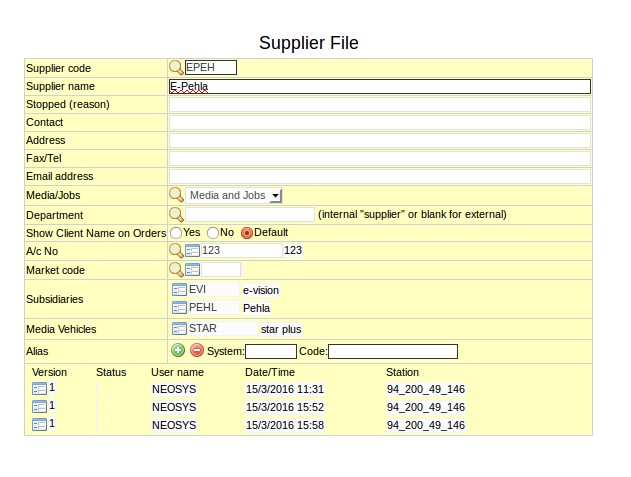

Pehla and E-vision are both suppliers of a large group call E-Pehla.

In the Supplier file of Pehla, you should enter E-Pehla as the Supplier Group. Same should be done for E-vision.

Pehla and E-vision will show as subsidiaries in the Supplier File of E-Pehla.

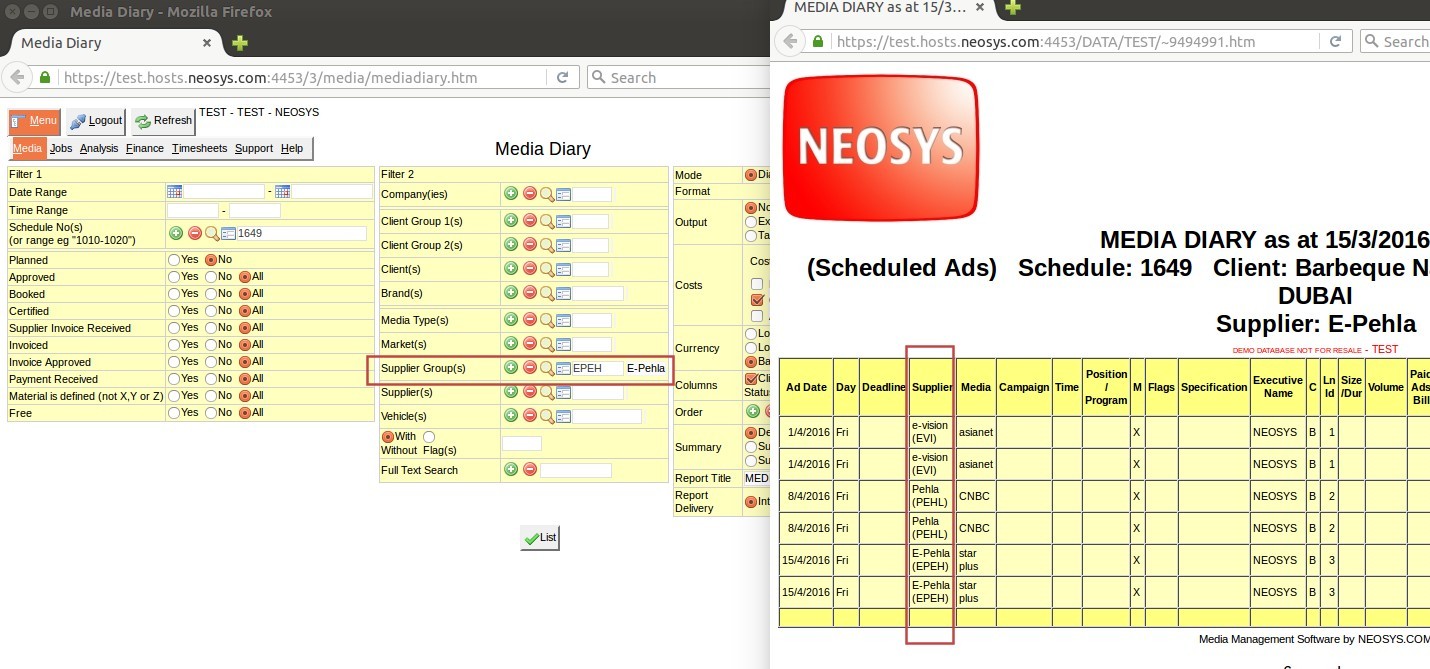

When taking reports, if E-Pehla is entered in the Supplier Group filter, information pertaining to ALL the suppliers in E-pehla group will be shown in the report:

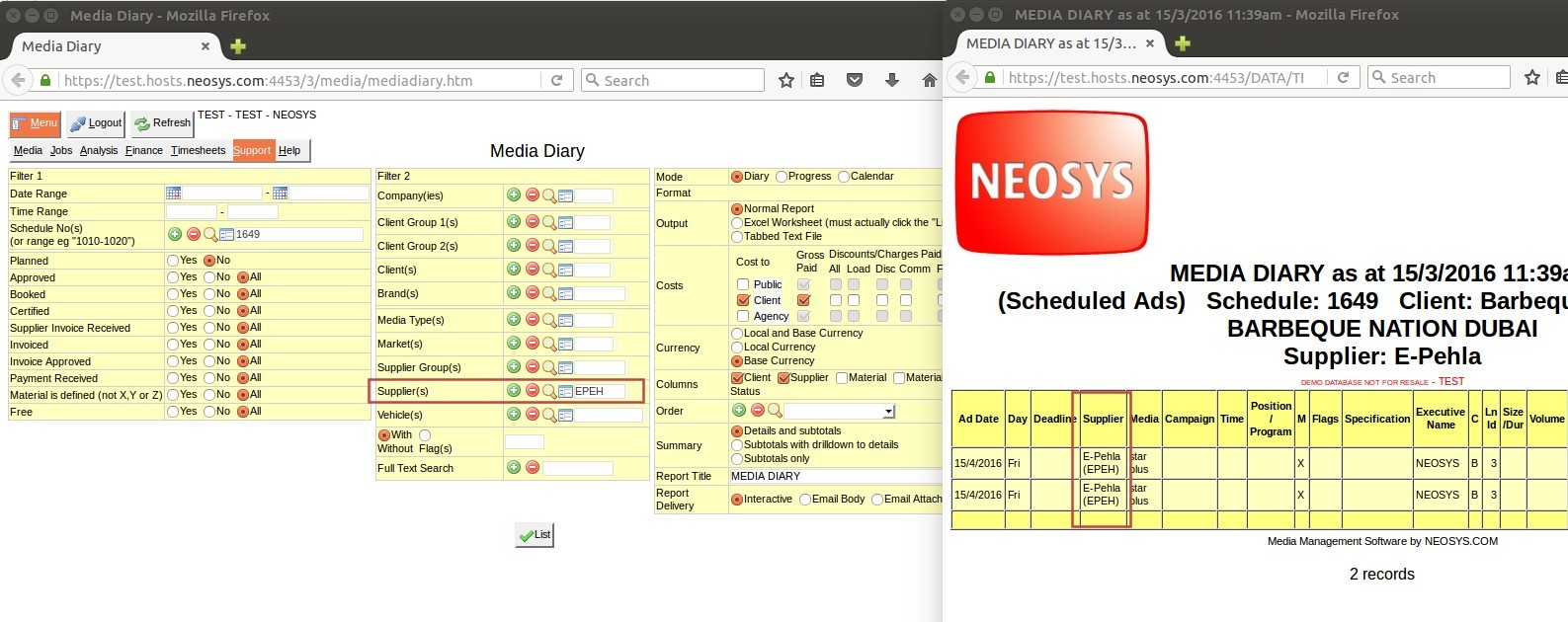

If E-Pehla is entered in the Supplier filter, informaton pertaining directly to E-Pehla only will be shown:

Why are text columns on printouts or pdfs very narrow taking up a lot of vertical space?

The problem:

This usually happens on printouts or on conversion to pdf. NEOSYS reports with many columns can appear quite squeezed in portrait mode using the default font and settings.

The cause:

- NEOSYS creates documents and reports in a format that is not biased to any one display or print size since what is suitable for one user is not suitable for another.

- NEOSYS does not attempt to predict the best column widths since the nicest column widths completely depend on the amount of text in any one column entered in practice.

- NEOSYS leaves the selection of column widths to the browser to auto-fit columns as best it can. This produces far better results in the vast majority of cases than could be achieved by choosing fixed column widths, but often could be better.

The solution:

If the browser defaults are not satisfactory, you can fine tune the exact configuration before printing or converting to pdf as follows:

- Choose a smaller font in your browser before printing/converting. This is easily done by doing "Alt+V, Text Size, Smaller/Larger" for Internet Explorer, "Alt+E, Preferences, Content, Fonts and colors" for Firefox, "Alt+E, Settings, Web content, Font size" for Chrome.

- Reduce the left and right margins

- Use landscape format

What is the difference between terms of payment and payment instructions?

The terms on which the supplier and client agree to make the payment for an invoice is mentioned in terms of payment, e.g. 60 days from the date of invoice.

Details entered in payment instruction consist of bank account and other transactional details required for payment transaction e.g. Bank account details, SWIFT code, bank charges etc.

Terms of payment and payment instruction if setup appear in the invoice.

Also refer to Configuring payment instructions and Specifying term of payment on Invoices

Using NEOSYS Agency System

This covers tasks common to both the NEOSYS Media System and the NEOSYS Job System.

Using full text search

This is a quick and easy way to find your documents. Just type in one or more words, or the start of any word, directly into the document no field, to get a list of documents that refer to all your given words.

Currently this applies to Media Plans, Media Schedules, Jobs, Purchase Orders and Estimates.

For example, to search for all jobs with Attention: Steve, and Campaign: Some Festival - type "STEV FEST" into the Job No. field and press the Enter or Tab key.

All punctuation is treated as spaces and what remains are "words" which includes normal words, numbers and codes. Unfortunately, this means that searching for "3/2018" is the same as searching for 3 and 2018 which is probably not what you expect. To search by period, enter something like "FESTIVAL 1801" where the period is in the format YYMM.

What is searched? Generally all text, numbers and codes in the document header and footer are searched. The body or lines of the document are *not* searched. To see the exact fields searched, search for something that does not exist and the error message will list all the fields that have beem searched.

Remember that is it not necessary to type the whole word. Save yourself some time by only typing the first few letters of the word, enough to make it unique.

Cancelling or Amending Incorrect Client Invoices

If you want to cancel an invoice in NEOSYS you must issue a credit note. If you want to amend an invoice in NEOSYS you must issue a credit note to cancel the original invoice and issue a new invoice with a new invoice number.

You cannot simply cancel an invoice once it is issued by NEOSYS.

You cannot modify and reissue an invoice with the same number in NEOSYS.

This might seem inconvenient and is not according to manual practice. However the manual practice is uncontrolled and relies on the skill of the operator to avoid potentially creating a confusing mess of contradictory invoices. The NEOSYS system should provide a better guarantee of control over records and this is what it does.

NEOSYS makes it easy to cancel invoices or amend invoices so this is not really an issue, and, in the end, it is better to have a complete record of all cancellation or amendments in NEOSYS.

Why doesn't NEOSYS allow cancelling or amendment of Invoices after issue?

This is done to maintain traceability in the system. It is quite possible that a booking order/invoice may be sent out immediately after generation. In such scenarios deletion of documents in the system, after the document are sent out, can lead to errors in accounting.

Once an invoice has been issued then it has an existence outside of the NEOSYS system in the form of files, printouts and emails etc.

There is no way to be sure that someone has not sent (and will not send) the cancelled invoice to the client.

Similarly, if you amend an invoice then there would be two or more possibly completely different invoices in existence with exactly the same number.

In the Finance Module

- All the journals generated including the original wrong invoice and the credit note MUST be posted otherwise auditors will question the missing invoice numbers.

- Allocate the invoice to credit note or vice versa so that they do not show as outstanding on the client's statement of outstanding items.

- If you really don't want the invoice and credit note showing on the movement account of the client then create a suspense a/c in the clients ledger and modify the journals Client A/c column before you post.

How to despatch an invoice?

Despatching an invoice is accomplished by:

- Entering a despatch date while creating invoices

- Entering a despatch date on the Old Invoices screen

- Preparing an Invoice Delivery Note

Any pre-existing invoice despatch and approval dates are not overwritten when setting them using a range of invoice numbers e.g. "1000-2000".

Also, See Despatch status in Media

Putting Year in Document Numbers

The Configuration File allows you to define the format of document numbers instead of pure sequential numbers however this should be avoided.

The idea of having the year in the document number is usually based on prior manual numbering practices without consideration of automated procedures and is to be avoided for a number of practical and theoretical reasons.

Year in the number is often a good procedure when done manually but adds additional complexity which is difficult to automate.

Avoid doing it or expect lots of petty annoying problems. There are no perfect solutions to this issue other than avoiding it in the first place by using simple clear permanently incrementing numbers.

These problems do not apply to invoice numbers which can happily have the year in them without a problem.

Refer link Changing Document numbering pattern

Problem controlling the year of a document

When you create new documents, NEOSYS will automatically use the CURRENT DATE to generate the year. This is a practical problem that may be overcome at some later date.

Problem of what year should be

When creating some forward-looking documents like media schedules, the year that the schedule was created will be misleading if the schedule is for the following year.

You could have a job numbered 2006/9999 which has a purchase order 2007/99.

If you think that you could number the purchase orders with the year of the original job then you have the alternative problem of a purchase order numbered 2006/9999 which is dated in 2007

There is no escape from this logical issue.

Problem having to type a long document number

Practically as of now, if you want to access a document in NEOSYS you have to type the full document number including the year. NEOSYS might be changed to assume the current year but accessing a prior year or future documents will still require more effort to type in the longer full document number.

Confusion about which document is meant

People will often refer to documents by the sequential number part only since they judge that the year is obvious. This can result in confusion. For example, does job number 1234 mean job number 1234 of 2006/2006 or job number 2007/1234. The confusion can always be resolved by checking on NEOSYS but takes time.

Problem with Ordering of Numbers

NEOSYS doesn't right justify numbers with leading zeros (egg 2007/001) so unless NEOSYS is changed to start numbers from say 1000 or 10000 each year you will have the following numbers which may confuse and may not sort correctly in NEOSYS reports or when exported into Excel etc.

<YEAR>/<NUMBER>

2007/1

2007/2

2007/3

etc

2007/10

2007/11

2007/12

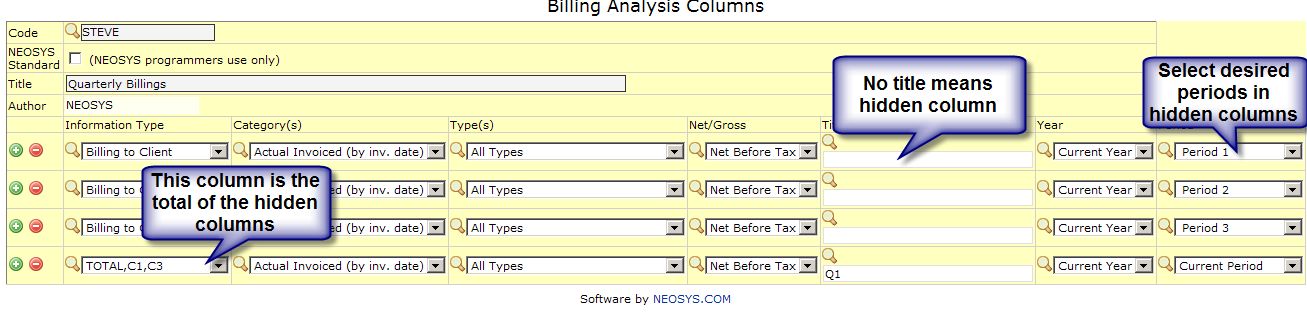

How do I design my own columns for Billing Analysis?

Use Billing Analysis Column Design to design the columns and then create Billing Analysis Reports using those column designs.

There are many options available to control what appears in each column of a column design. You can look at and copy the pre-designed NEOSYS column designs to see how the standard NEOSYS billing analysis reports are designed.

Defining Column Titles in Billing Analysis Column Design

You can simply type the text of the column heading that you want. For example "Budget".

If you have selected multiple information types or categories to be displayed then you either get automatic titles (see below) or you can indicate the titles for each one separated by; characters. For example "Actual;Budget".

- HIDDEN

If you leave the title column blank (or select HIDDEN from the popup) then the column will not be shown on the report. Hidden columns are useful when you need to derive a calculated column from other columns that you do not want shown on the report. You might also want to hide a column temporarily on a design and then restore it later without having to retype it from scratch.

- %Category%

- %category%

- %CATEGORY%

- %Infotype%

- %infotype%

- %INFOTYPE%

You can select one item from each of the above groups to automatically generate the column title from the options that you have selected in the Information type and Category columns. This is useful when you choose multiple Information Types and Categories. The various forms of capitalisation allow you to choose the style as initial capitalisation, full capitalisation and all lower case.

Designing billing analysis report to show 'Type' as columns

NEOSYS allows you to display Media or Job Types as column headings in Billing Analysis reports, by choosing the "Selected Type" option to choose a particular Type and entering the corresponding Type's name as the column's Title.

Designing multiperiod billing analysis columns

NEOSYS doesn't allow you select a period range but you can use hidden columns to achieve the same result

For example, you might well want a quarterly billings analysis which would require 12 hidden columns plus 4 normal columns. This report would not be sensitive to the period selected at runtime since all the columns are fixed periods.

How does billing analysis code work?

A billing analysis code has multiple parts as given below that identify all the possible break-downs of company revenue. Whereas the P&L accounts are typically only broken by type of business.

28/29*1*clientcode*marketcode*suppliercode*media/jobtype*?*?*?*executivename

28/29 stands for income/cost account.

Part 2 of the analysis code will always be 1. In future, it might be 1-7 to indicate gross/load/disc/comm/fee/tax/other fractions of income and costs.

If a particular account number in the finance module is mentioned in the job or media types file then that account is considered to be a P&L billing or cost account. The NEOSYS finance module imposes a restriction that all postings to P&L billing and cost accounts must have an analysis code. This restriction applies at a low level and is therefore regardless of the journal type or the source being automatic or manually entered. By comparison, postings to any other account NEOSYS Finance module imposes a restriction that they cannot have an analysis code. The end result is that the billing and cost section of the NEOSYS Profit and Loss report will always agree, to the cent, with the NEOSYS billing analysis reports.

NEOSYS billing analysis reports are, by default, based on actual posted vouchers on income and cost accounts in the finance module. Find more on why Billing Analysis reports are based on posted vouchers. Such postings are usually generated by the various billing modules of NEOSYS but can also be entered manually directly into the finance journals for adjustments and billing or cost matters not handled by NEOSYS billing modules like annual discounts

NEOSYS billing analysis reports can also be customized to show billings at prior stages like budget/forecast/plan/scheduled/invoiced billings etc. However, this discussion is related to analysis codes here and that is relevant only to posted vouchers.

Finance entries generated by the NEOSYS billing modules typically appear in the finance module as unposted journals and are only posted by finance staff when they are ready. Generally it is a bad idea for Finance to amend the generated journals before posting because this results in discrepancies between financial reports and operational reports.

It is also possible to configure NEOSYS to post all generated finance journals immediately. There may be cases where the posting cannot be done immediately because of finance validation issues and in this case NEOSYS falls back to leave the problematic journals unposted for manual invention prior to posting.

Why is NEOSYS billing analysis based by default on POSTED invoices and not ISSUED invoices

As a principle, billing analysis should agree with finance P&L continuously. If the one disagrees with the other at any point, then we can say that either one or the one is not a true statement of the facts, or that one of them is out of date. Neither option seems appealing.

However there is a far greater advantage to keeping the billing analysis in agreement with the P&L. If the operational departments can make the billing analysis say a different thing from the finance, then each department can do their own thing and this is uncontrolled behaviour. NEOSYS binds two departments loosely together and forces BOTH to become better organised and more up to date. This is a subtle and powerful advantage of using NEOSYS.

Operational departments and finance departments are often used to working independently but this is generally considered a bad idea in an integrated online world. They often expect and want to use NEOSYS to replicate what they were doing before using NEOSYS. However, NEOSYS is by default setup to encourage interdependence between operational departments and the finance team. This fosters good practices and mitigates old disjointed, uncontrolled, independent and duplicated work.

While departmental chief sometimes are not quite aware of the advantages of close cooperation, the overall managers and owners of many businesses typically value NEOSYS for acting as the glue and oil between the various departments of their company. Therefore when dealing with departmental heads, NEOSYS support staff should bear in mind NEOSYS' good working practices and discourage or at least not encourage the customisation and deformation of NEOSYS to handle old style procedures - despite the fact that NEOSYS is designed to be highly customisable and capable of doing so.

Note that in case NEOSYS finance module is not installed, all default billing analysis reports can be configured to work on issued invoices using a single configuration option. This is not recommended where NEOSYS finance module is operational, for the above reasons.

Note also that NEOSYS billing analysis of ISSUED INVOICES may be based on the operational dates rather than the invoice dates. Such a report is only useful for operational purposes, and little use for finance management or control.

Setting up and Configuring NEOSYS Agency System

Importing Clients

WARNING: You MUST trial out importing in test database first, otherwise you risk messing up your live database clients.

Before you start importing anything make sure that you use the clearing procedure to clear down any old data first.

In the NEOSYS system, clients are separate from accounts receivable because a client record may be created for preparing a quotation before accounts receivable account is opened for the client. Also, it is possible for more than one client to feed into a single account receivable. In other words "clients" are not necessarily one to one with accounts receivable in NEOSYS - although in most cases they are.

You can either prepare separate files for clients and accounts/addresses or a single file that contains all columns for both in one file.

The import file must be in tab-delimited text format and its name must be a maximum of eight characters with no spaces and a three character extension.

Import must currently be done on the server in NEOSYS maintenance mode and F5.

CLIENT columns

- CLIENT CODE - required

- CLIENT NAME or ACCOUNT NAME - required

- CLIENT ADDRESS - optional, one line "quick contact 'address'" to show on top of quotes, may not contain the full address and possibly is just a contact name and/or tel/email numbers instead of actual address.

- CLIENT EMAIL - optional

- MARKET CODE - required, must exist in Markets File

- ACCOUNT NO - optional, must exist in a chart of accounts

- EXECUTIVE - optional

- CURRENCY CODE - optional, usual currency of billings

- AGENCY FEE - optional, usual fee percent eg 12.5 or 12.5%

- CLIENT TERMS - optional, free format text to be put at the bottom of invoices, override computer generated terms text from account terms.

- CLIENT GROUP1 CODE - optional, client code must exist prior to importing. Could be manually entered or imported in a separate file if too many.

- CLIENT GROUP2 CODE - optional, client code must exist prior to importing. Could be manually entered or imported in a separate file if too many.

and optional links to other systems ...

- CLIENT ALIAS SYSTEM (a codeword to identify the other system eg SAP, ORACLE, OLD etc.)

- CLIENT ALIAS CODE (the id, number or code of the client for interfacing to other systems)

Multiple other systems can be represented as follows. For example, if a client is represented in a system called SAP by the code 1235123 and also in the old system by the code DE767676 then you would put the following information in the import file columns. The space before the 1,2 etc is mandatory but the colon must be omitted. The column name is not case sensitive.

- CLIENT ALIAS SYSTEM 1: SAP

- CLIENT ALIAS CODE 1: 1235123

- CLIENT ALIAS SYSTEM 2: OLD

- CLIENT ALIAS CODE 2: DE767676

Up to 9 aliases may be imported in this way.

Importing

In the following example, it is assumed that you have prepared a file called CLIENTS.TXT.

If you are going to link the clients to the accounts receivable (by filling in the account number on every client), you must first import the accounts. This simplest way to do this is to add accounts columns to the CLIENTS.TXT file as per instructions in the accounts module for importing accounts and import the CLIENTS.TXT file into the accounts module. See Importing Accounts and Addresses

First, verify that the clients can be imported and correct any errors before proceeding

IMPORTX D:\CLIENTS.TXT CLIENTS

Actually import the clients with the C option (Create)

IMPORTX D:\CLIENTS.TXT CLIENTS (C)

Option O can be used to overwrite (destroy!) existing records. Use with extreme caution and at your own risk.

Get a List of Clients to verify that the clients have been correctly imported.

Importing Suppliers

WARNING: You should trial out importing on the test database first.

Please follow the notes on importing clients except for the columns in the file.

If you are importing media suppliers then there is an alternative special procedure for importing suppliers and media vehicles that may be more helpful in that case. See Importing Suppliers and Vehicles

SUPPLIER COLUMNS

- SUPPLIER CODE - required

- SUPPLIER NAME - required

- SUPPLIER ADDRESS - optional, one line short address for orders

- MEDIA NONMEDIA - required, "M" for Media Supplier, "P" for Non-media Supplier, "MP" for suppliers that need to work in both the media and jobs module of NEOSYS.

- CONTACT NAME - optional, used for orders

- CONTACT NUMBERS - optional, used for orders

- CONTACT EMAIL - optional, used for orders

- ACCOUNT NO - optional, used for accrued costs if the system is configured to accrue by the supplier.

- SUPPLIER GROUP CODE - optional, supplier code must exist prior to importing. Could be manually entered or imported in a separate file if too many.

and optional links to other systems ...

- SUPPLIER ALIAS SYSTEM (a codeword to identify the other system eg SAP, ORACLE, OLD etc.)

- SUPPLIER ALIAS CODE (the id, number or code of the supplier for interfacing to other systems)

Multiple other systems can be represented as follows. For example, if a supplier is represented in a system called SAP by the code 1235123 and also in the old system by the code DE767676 then you would put the following information in the import file columns. The space before the 1,2 etc is mandatory but the colon must be omitted. The column name is not case sensitive.

- SUPPLIER ALIAS SYSTEM 1: SAP

- SUPPLIER ALIAS CODE 1: 1235123

- SUPPLIER ALIAS SYSTEM 2: OLD

- SUPPLIER ALIAS CODE 2: DE767676

Up to 9 aliases may be imported in this way.

Converting database to "invoice numbering per company"

On the Media/Jobs Configuration File the field "Invoice number sequence per company" cannot be changed after data has been entered in the database. In other words, it has to be pre-decided.

However, you may be able to change it as follows:

WARNING This program is not frequently used or recently tested and may have defects. The resultant database must be tested thoroughly otherwise severe loss of data may occur.

In maintenance mode with no other processes open on the same database

F5 AGP edit line 48 to be 1 (To confirm you are on field 48 press CTRL+E)

F5 CONVINVBYCOMP (U)

Check the conversion worked

ED INVOICES *

Look to see in the top centre of the screen it should say something like X999999**Z. The ** must be present and the Z will be one of your company codes.

Allowing separate job/order/estimate number sequences

Job, Order and Estimate numbers can only have separate sequential numbers per company if COMPANY is part of the number format in the Job Configuration File and.

- Verify you have Invoice Numbering by Company enabled

- Ensure that company code is part of the job/order/estimate number format

Converting database to "one invoice number sequence across all companies"

On the Media/Jobs Configuration File the field "Invoice number sequence per company" cannot be changed after data has been entered in the database. In other words, it has to be pre-decided.

However, you may be able to change it as follows:

WARNING This program is not frequently used or recently tested and may have defects. The resultant database must be tested thoroughly otherwise severe loss of data may occur.

In maintenance mode

F5 AGP edit line 48 to be blank or 0

F5 CONVINVBYCOMP UNDO

Changing Document Numbering Pattern

Principles of Document Numbering in NEOSYS

Structuring invoice and document numbers is good practice since the documents order correctly when sorted in NEOSYS and even when exported to other systems like Excel – and even when entered into third party systems at suppliers and clients where NEOSYS has no control.

There are a few principles which can help while deciding on the structure:

- Best practice is to only have sequential numbering

- Enter things that change least frequently (or not at all) more to the left of the structure.

- Items like sequential numbers must be separated with/from other parts of the structure because sequential numbers in NEOSYS generally do not have leading zeros and therefore can have a variable number of digits.

- To make easier to read and type, consider omitting the / character between parts of the structure that have constant number of characters like company code and two digit year

- Omit prefixes like SCH, JOB, EST, PO, INV etc while numbering documents as it is inconvenient having to enter those letters over and over again every time you want to access a document

For example, if we have company codes like A, B, C, the year 2012, number 1000 then a good numbering system will sort correctly in all cases while a poor format will not sort correctly in some cases. Refer link Putting year in Document Numbers

Good Format Examples:

- 1000 - Best practice

- X1000 - use when multi-company setup is used

- 12/1000 - use when year is required in document numbering

- X12/1000 – also ok, X and 12 are both fixed number of characters so don’t need / to separate X and 12

Poor Format Examples:

- X/121000 – sequential number should be separated from year by /

- X121000 – sequential number should be separated from year by /

- 12/X/1000 – year changes more frequently than company code X so it should be X/12

- X/1000/12 – 12 changes less frequently than 1000 so it should be 12/1000

- 1000/12/X – X changes least so it should be on the left. 1000 changes most so it should be on the right

- 12/1000/X – X changes least so it should be on the left

- EST1000 - Omit prefixes as it has to be entered every time while trying to access a document

Notes -

- Company prefix can be assigned to NEOSYS companies in the Company File. This is particularly useful if the company codes are digits and can be confused with the sequential numbers.

- Using letters for company codes or company prefix is better for sorting because one can omit the / separator character.

- Sequential numbers in NEOSYS generally have a variable number of digits and do not use leading zeros.

- In some places in NEOSYS when asked to enter document numbers, omit the company code and year and enter only the sequential number, NEOSYS will find the document based on the current company and year or search for the first existing document across all companies. The same applies with entering ranges of numbers. NEOSYS will attempt to add the missing company code and year.

How to Configure

This can only be configured for the whole system so that it can only be done only once all of the old invoices for previous years are done. You can also do it in the middle of the year if you are happy for the rest of the invoices for the current year to be in the new format and probably using a different invoice number sequence.

Examples:

<NUMBER> would give numbers like 1000

<COMPANY><NUMBER> would give numbers like X1000

<COMPANY><YEAR2>/<NUMBER> would give numbers like X12/1000

where,

<NUMBER> provides the usual sequence number ( NUMBER is set in Invoice Numbering file )

<COMPANY> provides the company code or company prefix from the company file

<YEAR> provides the year in 4 digit form e.g. 2012

IMPORTANT NOTES: (1) DOING THIS WOULD RE-CREATE THE INVOICE NUMBERS TO START FROM 1 (2) THE <YEAR>/<YEAR2> WOULD CHANGE TO THE NEXT YEAR ONLY WHEN YOU HAVE THE NEW INVOICES IN THE NEW YEAR DATE AND THE NUMBER WOULD RESET ITSELF TO START FROM 1

New option in the Configuration File, a Format called <YEARWISE> which allows you to specify a different starting number for each year. An invoice number format of <NUMBER><YEARWISE> means that while the year does not form part of the invoice number (as would be the case if the invoice number format was say <NUMBER>/<YEAR2>) you can use different ranges of invoice numbers for each year. This prevents the mixing up of invoice numbers between years.

Configuring Starting Numbers of Documents

How are wip/accrual ledgers structured ?

WIP/accrual accounts are usually automatically created per schedule or job although they can be configured to be per supplier or media vehicle.

The exact ledger code can be configured in Media Configuration File or Jobs Configuration File.

If there are many schedules or jobs then new WIP/accrual ledgers are automatically created when the current one gets too large (too many accounts).

Eg: For 2011 the ledger codes might be:

ACC11, ACC112, ACC113 Or WIP11, WIP112, WIP113

NEOSYS also opens up new year charts based on the old year charts ie same control a/c etc. Eg:

ACC12 from ACC11 or WIP12 from WIP11

Troubleshooting NEOSYS Agency System

Fixing unexpected entries in the Financial Ledger Accounts

Basic accounting theory says that if you have a query about an entry in an account, you look at the voucher that caused the entry since this will show you the other side of the entry.

All accounting vouchers generated by NEOSYS Agency System have corresponding entries in the List of Invoices report and Audit Invoices report so there is no doubt about what caused specific entries.

Until you have tracked the ledger account entry all the way back to the List of Invoices report then you do not have sufficient information to troubleshoot entries.

Fixing discrepancies between the standard Billing Analysis Reports and P&L Revenue A/cs

The billing analysis reports of NEOSYS are designed to analyse the income and costs in many ways (by client, supplier, market, type, sales executive etc. and in any combination) whereas the financial chart of accounts can only analyse the P&L in one fixed way - usually by type of income eg Press, TV etc for media and much more varied for non-media jobs.

Quick Reconciliation

The quickest way to reconcile any differences is to get the standard Billing Analysis report "BY ACCOUNT NUMBER" because this shows a break-down of the total in a comparable way.

Run the following commands in maintenance mode to get an idea of what is present in the analysis file:

FIND ANALYSIS XYZ LIST ANALYSIS

where XYZ is the media/job type code. This will generate a document containing all the analysis codes associated with that particular media/job type code, and corresponding Billings and Costs.

Additional or Missing Accounts

This is the commonest reason for discrepancy and is more an explanation rather than a problem that has to be solved.

Authorised finance users can insert additional income or cost related accounts in the P&L section. Therefore the *total* of the P&L section may not agree with the *total* of the billing analysis reports. By "additional income or cost related accounts" we mean accounts that are not linked to the NEOSYS billing modules ... and therefore do not have the analysis code on any postings to them ... and therefore are not included in the standard NEOSYS billing analysis reports.

Alternatively, some of the accounts that are related to NEOSYS billing module could be positioned or moved outside the income and cost section of the P&L. Therefore these accounts would be missing from total of the Bill/Cost section of the P&L whereas they would not be missed in the standard billing analysis report total.

Reconciling other reasons

Apart from additional or missing accounts discussed above, the standard NEOSYS billing analysis report totals should exactly match the turnover according to the NEOSYS P&L statement because of the following two facts imposed in NEOSYS.

- The reports are based *exactly and only* on posted journal lines which have billing analysis code entered.

- NEOSYS requires that analysis code is *always and only* entered on postings to the specific P&L accounts that are linked to billing types in the NEOSYS billing modules.

As already mentioned, to reconcile and track down the cause of any perceived discrepancies you need to run the Billing Analysis By A/c report because this report shows the billing analysis one for one with the P&L accounts.

You should run the comparison for individual months because any discrepancy is usually only in specific months.

Adding/Removing/Changing Billing Account Configuration

Mismatch between billing analysis and P&L can be caused by changing Media/Job Type File account number after billings have been made and posted.

After postings have been made (with analysis codes) the account number could be removed from the billing module (Media/Job Type File).

An account number that already has postings (without analysis code) could be added to the billing module configuration (Media/Job Type File).

Checking if this is the case:

To verify if this is the case run CHK.VOUCHERS procedure in maintenance mode. It checks the following:

- all postings to billing analysis accounts have analysis codes and therefore appear in billing analysis.

- all postings to none-billing analysis accounts DO NOT have analysis codes and therefore

Fixing this case:

Any vouchers which are discovered by CHK.VOUCHERS to be missing analysis codes (or to have analysis codes but should not) can have analysis codes added or removed in Voucher File on Finance menu.

Software Error

This always possible but unlikely and rarely observed so best to check the above first rigorously.

Fixing discrepancies between custom Billing Analysis (based on invoices) and P&L Revenue A/cs

Custom NEOSYS billing analysis based on media/job invoices raised may NOT match the turnover according to the NEOSYS P&L statement for the following reasons:

- You make any manual postings into the P&L Income or Cost accounts

- You modify, or delete, or simply don't post the invoice journals generated by NEOSYS

- Incorrect configuration of income and cost accounts on the Media/Job Types File.

- Error in the NEOSYS software

To track down the cause of any discrepancies you need to:

- Take the NEOSYS List of Invoices report and verify that its totals agree with your custom Billing Analysis report based on invoices raised. If they do not, see the section "Fixing discrepancies between Billing Reports and List of Invoices Reports".

- Reconcile the NEOSYS entries in the List of Invoices with the detailed ledger accounts one by one with the entries in the P&L income and costs accounts. Using "Account Analysis" in Financial Reports menu to analyse (subtotal) the income and cost accounts "By contra A/c" (i.e. client account) may help to narrow the reconciliation task to individual clients.

Why doesn’t the billing analysis for a particular client agree with the billings shown in the client’s ledger account?

The billing analysis (actual billings) is entirely and only based on the entries in the income and costs accounts (posted journal entries). This ensures that the billing analysis is always in agreement with the Profit and Loss Statement.

Read Why is NEOSYS billing analysis based by default on POSTED invoices and not ISSUED invoices for more information.

Although in most cases the entries in the income and cost accounts are one to one with entries in the client and supplier accounts it is possible to post income or costs journals or other entries which have no corresponding entry in the client/supplier accounts. Therefore the billing analysis (and, by extension, the profit and loss) may not always be in precise agreement with the total billings/costs recorded in the client/supplier accounts. In other words it is to be expected.

The way to check the billing analysis report for a particular client is not to check the client accounts but to check the income accounts as follows:

Take a detailed ledger account for all the income accounts for the period in question and then total up all the entries which refer to the client in question by looking at the analysis columns which show on the right hand side of all accounts for income and cost accounts. The total of the entries for the client will definitely agree with the billing analysis if NEOSYS is correctly configured and you have not skipped any income accounts.

Why does billing analysis report show "Unspecified Executive(s)" in place of executive name?

If a billing analysis report shows "Unspecified executives" where the executive name is expected to appear, this means that the executive name has not been entered in the Client & Brand file. NEOSYS first searches for the executive name entered in the brand level in the Client & Brand file. If not available, then it uses the executive name entered at the top of that Client & Brand file.

If an executive enters their name in a schedule/job file for a brand that already has another executive name entered in the Client and Brand file, billing analysis report will still show the executive name entered in the client and brand file, and not that entered in the schedule/job file.

Fixing discrepancies between Billing Reports and List of Invoices Reports

The standard NEOSYS Billing Analysis Reports will not always agree with the List of Invoices reports because since lately it picks up the figures from the vouchers and not the invoices.

If you need to run a Billing Analysis as per the invoices as in the Media/Job then the period in the Media/Job Configuration File > Billing Analysis should be a future one - so you need to enter a future period here to allow this to match and change it back to the current one later. Hopefully there will be a way to select either By Invoice or/and By Voucher specifically so that you can have a billing analysis with both the figures and compare any discrepancies.

At a minimum compare the following reports:

- List of Invoices: "By Client" option

- Billing Analysis: Billings By Client. Select either "Media Only" or "Non-Media Only" depending on which List of Invoices you are comparing.

- Billing Analysis: Margin by Client (ditto)

Notes:

- You will have to do this for Media and Non-Media separately as there is no combined List of Invoice option.

- Use the standard NEOSYS built-in billing analysis reports. Do not use custom reports.

- Compare the total for all client for a whole year initially and only examine particular months and clients to further locate any discrepancies.

- Errors in custom billing analysis reports should be assumed to be errors in their design unless the standard billing analysis reports also show wrong figures.

After locating and fixing the original problem, CREATEANALYSIS will regenerate the ANALYSIS file (on which the Billing Reports are generated) from the invoices and other files.

Generally there is no need to rerun CREATEANALYSIS more than once unless some time has passed since you last ran it and/or you fear server crashes have occurred since it was last run. You can always redo it as a last resort but it is unlikely to fix things if it didnt fix them recently. Running CREATEANALYSIS will rarely but sometimes fix software errors which can occur anytime of course.

F5 CREATEANALYSIS Enter year (upto 3 years back or depends on the clients need) Enter ALL

Can users compare totals of financial reports with totals of List of invoices?

Financials are not based on invoices they are based on vouchers posted. If they want to verify the list of invoices they can match them one by one with vouchers posted. There is no other way since each invoice makes complex postings.

NEOSYS staff can suggest other reports like billing analysis report.