Handling Exchange Losses & Gains in NEOSYS: Difference between revisions

(New page: Many a times, the foreign exchange rate fluctuates and hence there is a difference in the invoice currency amount issued or received as compared to the actual payment received or paid. He...) |

No edit summary |

||

| Line 3: | Line 3: | ||

Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c. | Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c. | ||

Below is an example: | Below is an example of a sale which has been done: | ||

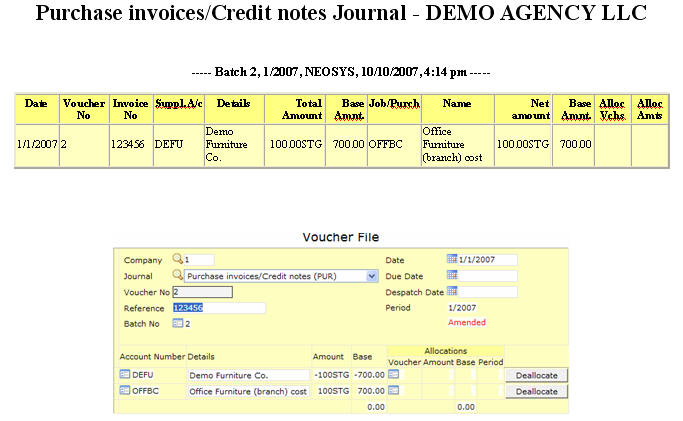

A client is invoiced for 100STG on 1/1/2007. On this date the exchange rate was 1 STG=7 AED | |||

[[Image:exdi1.jpg]] | [[Image:exdi1.jpg]] | ||

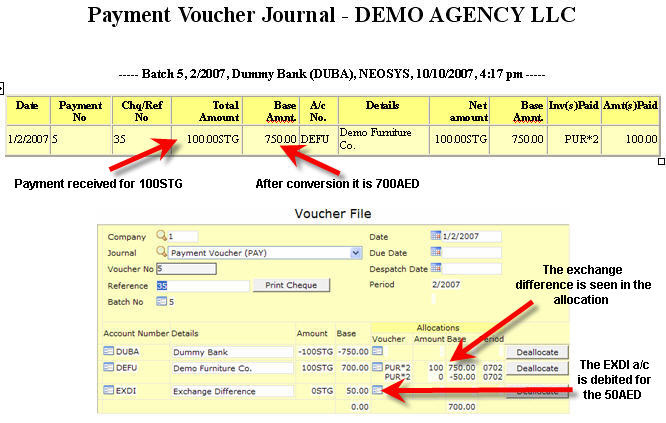

The client makes a payment for this invoice on 1/2/2007. However the exchange rate has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following: | The client makes a payment for this invoice on 1/2/2007. However the exchange rate on this day has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following: | ||

# Allocates the payment of 100STG | # Allocates the payment of 100STG (750AED) to the invoice in the client a/c | ||

# Credits the 50AED from the allocation which is overallocated to the invoice | # Credits the 50AED from the allocation which is overallocated to the invoice | ||

# Debits the Exchange Loss or Gain A/c (EXDI in this case) | # Debits the Exchange Loss or Gain A/c (EXDI in this case) | ||

[[Image:exdi2.jpg]] | |||

Revision as of 10:02, 17 November 2007

Many a times, the foreign exchange rate fluctuates and hence there is a difference in the invoice currency amount issued or received as compared to the actual payment received or paid.

Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c.

Below is an example of a sale which has been done:

A client is invoiced for 100STG on 1/1/2007. On this date the exchange rate was 1 STG=7 AED

The client makes a payment for this invoice on 1/2/2007. However the exchange rate on this day has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following:

- Allocates the payment of 100STG (750AED) to the invoice in the client a/c

- Credits the 50AED from the allocation which is overallocated to the invoice

- Debits the Exchange Loss or Gain A/c (EXDI in this case)

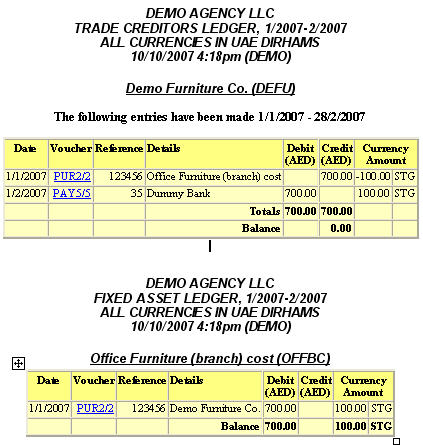

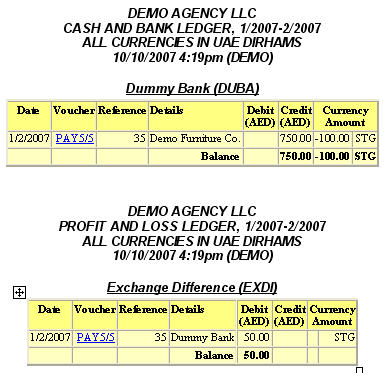

The following are the ledger printouts of all the accounts which were involved in this transaction: