Handling Exchange Losses & Gains in NEOSYS: Difference between revisions

No edit summary |

|||

| Line 1: | Line 1: | ||

=== Handling Exchange Losses & Gains on | === Handling Exchange Losses & Gains on receipts from Clients === | ||

Receipts are valued at the value of the invoices that they pay off. By value we mean the base equivalent is calculated from the invoice instead of from the usual currency file exchange rate or any manual attempt. | |||

Note that the base amount (to the client / account) on the journal will be different than what it is in the voucher file or the ledger printout. | |||

The journal shows the same exchange rate as to the amount in the bank account which is usually the exchange rate in the exchange rate file unless the user has overwritten the base rate, which would be unusual. | |||

Example: | |||

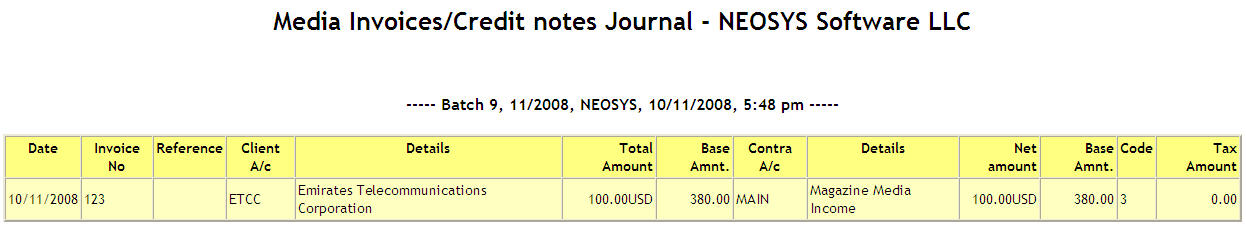

Invoice was issued for 100 USD / 380 base amount | |||

[[image:exgi-invoice.jpg]] | |||

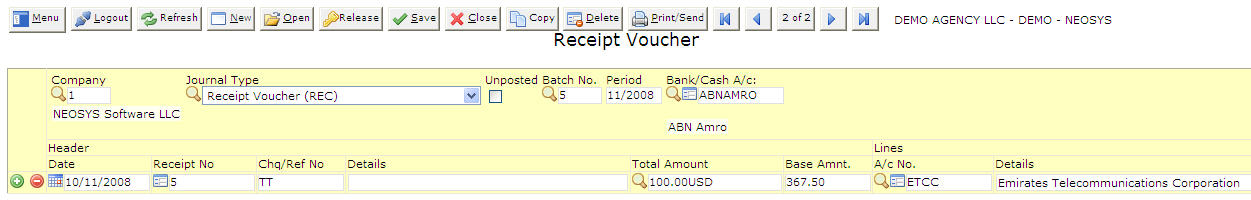

Receipt was issued for 100 USD / 367.50 base amount | |||

[[image:exgi-receipt.jpg]] | |||

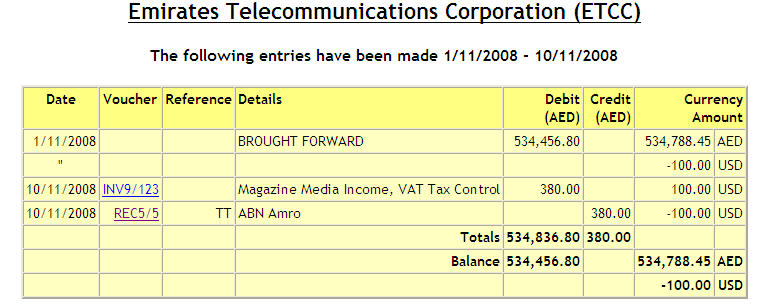

However when posted, the ledger printout shows that the amount recorded in the client account is 100 USD / 380 base amount | |||

[[image:exgi-ledger.jpg]] | |||

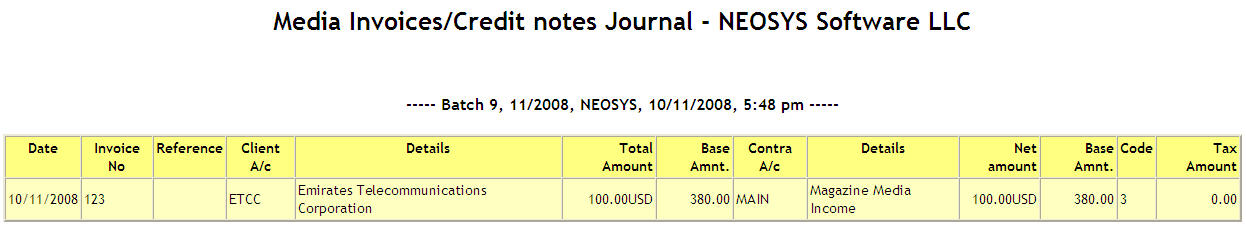

If you look at the voucher, you can see that the difference of 12.50 base amount shows as a Debit to the EXDI (Exchange Difference) A/c. | |||

[[image:exgi-invoice.jpg]] | |||

=== Handling Exchange Losses & Gains on payment to Supplier Invoices === | === Handling Exchange Losses & Gains on payment to Supplier Invoices === | ||

Revision as of 14:46, 10 November 2008

Handling Exchange Losses & Gains on receipts from Clients

Receipts are valued at the value of the invoices that they pay off. By value we mean the base equivalent is calculated from the invoice instead of from the usual currency file exchange rate or any manual attempt.

Note that the base amount (to the client / account) on the journal will be different than what it is in the voucher file or the ledger printout.

The journal shows the same exchange rate as to the amount in the bank account which is usually the exchange rate in the exchange rate file unless the user has overwritten the base rate, which would be unusual.

Example:

Invoice was issued for 100 USD / 380 base amount

Receipt was issued for 100 USD / 367.50 base amount

However when posted, the ledger printout shows that the amount recorded in the client account is 100 USD / 380 base amount

If you look at the voucher, you can see that the difference of 12.50 base amount shows as a Debit to the EXDI (Exchange Difference) A/c.

Handling Exchange Losses & Gains on payment to Supplier Invoices

Many a times, the foreign exchange rate fluctuates and hence there is a difference in the invoice currency amount issued or received as compared to the actual payment received or paid.

Hence NEOSYS handles these differences and allots the amount to a Exchange Loss or Gain A/c.

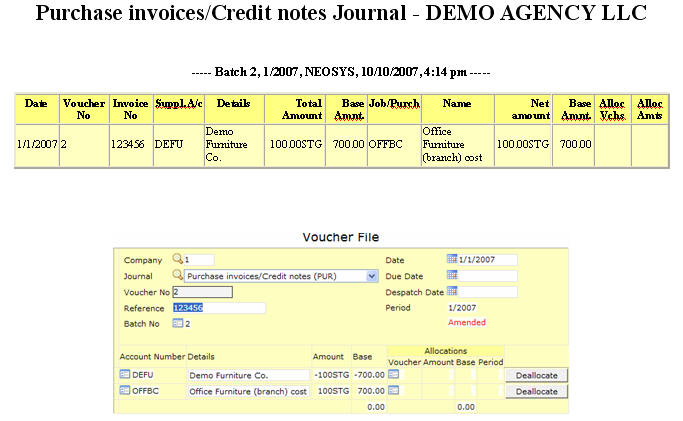

Below is an example of a sale which has been done:

A client is invoiced for 100STG on 1/1/2007. On this date the exchange rate was 1 STG=7 AED

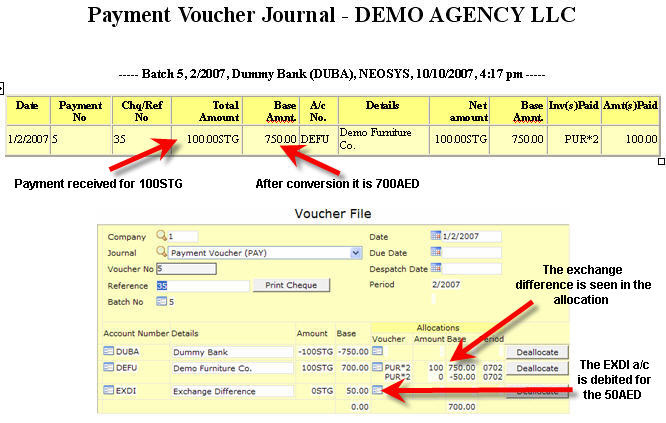

The client makes a payment for this invoice on 1/2/2007. However the exchange rate on this day has changed to 1 STG=7.5 AED. Hence there is a profit of 50 AED when we receive this payment. NEOSYS automatically notices this and does the following:

- Allocates the payment of 100STG (750AED) to the invoice in the client a/c

- Credits the 50AED from the allocation which is overallocated to the invoice

- Debits the Exchange Loss or Gain A/c (EXDI in this case)

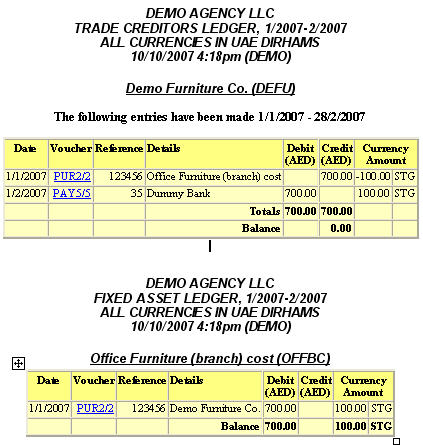

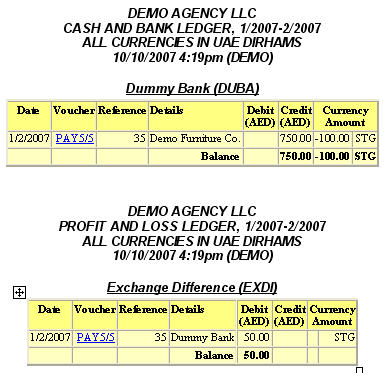

The following are the ledger printouts of all the accounts which were involved in this transaction: