Entering Opening Balances & Items: Difference between revisions

(New page: === What are Opening Balances? === Opening Balances is the balance of an account at the start of an accounting period. When we have new clients moving from their existing accounting system...) |

|

(No difference)

| |

Revision as of 12:30, 10 May 2007

What are Opening Balances?

Opening Balances is the balance of an account at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system.

NEOSYS later posts Opening Balances automatically to new accounting years within the system.

How to enter Opening Balances?

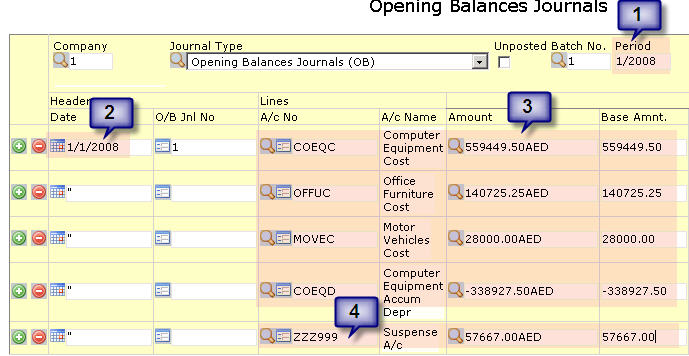

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Put any date as of the previous year.

- Enter all the items, line by line and put a - (negative sign) for any Credit items.

- The balance of the journal should be put to the suspense account which usually is ZZZ999 or 999.

What are Opening Items?

When companies move to any new accounting system (referred to as NEOSYS), they prefer enter outstanding items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening Items are actually a List of Invoices.

How to enter Opening Items?

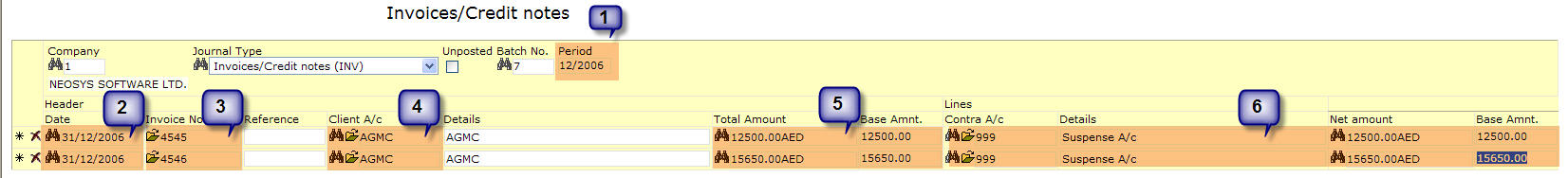

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Put any date as of the previous year.

- Enter each invoice details i.e. the invoice number

- Select the Client/Supplier account

- Enter the invoice amount

- The contra account would be the suspense account which usually is ZZZ999 or 999.