Chart of Accounts File: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

No edit summary |

|||

| Line 1: | Line 1: | ||

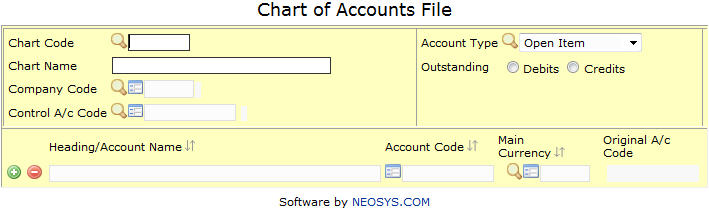

[[image:ChartofAccounts_2011.jpg]] | [[image:ChartofAccounts_2011.jpg]] | ||

===Chart Account Attributes=== | |||

[[image:Chart of Account Attributes.jpg]] | |||

====Heading/Account Name:==== | |||

Self Explanatory & can be changed later. | |||

====Account Code:==== | |||

Self Explanatory. Remember NEOSYS coding convention described in [[Using_NEOSYS_Generally#Codes_in_NEOSYS | Codes in NEOSYS]] | |||

====Main Currency:==== | |||

Set default currency used in journal entry and if changed by the user, the user will be warned. | |||

====Tax Code:==== | |||

Set default tax code and user not warned. | |||

====Summary:==== | |||

Select Yes to omit subsidiary charts from the top level GL Trial Balance report. A subsidiary chart contains accounts is used to track information at a very detailed level for certain types of transactions, such as include WIP, Media Accruals, Trade Debtors and Creditors. | |||

====Original A/c Code==== | |||

(TODO 13/9/18) | |||

====Closing A/c Code==== | |||

Used to declare what closing account will be used record the balance of that account at the end of year. | |||

Revision as of 12:27, 13 August 2018

Chart Account Attributes

Heading/Account Name:

Self Explanatory & can be changed later.

Account Code:

Self Explanatory. Remember NEOSYS coding convention described in Codes in NEOSYS

Main Currency:

Set default currency used in journal entry and if changed by the user, the user will be warned.

Tax Code:

Set default tax code and user not warned.

Summary:

Select Yes to omit subsidiary charts from the top level GL Trial Balance report. A subsidiary chart contains accounts is used to track information at a very detailed level for certain types of transactions, such as include WIP, Media Accruals, Trade Debtors and Creditors.

Original A/c Code

(TODO 13/9/18)

Closing A/c Code

Used to declare what closing account will be used record the balance of that account at the end of year.