Accounting entries created by the Production system

What are the different journal entries created by the NEOSYS job system

Listed below are scenarios where journal entries are made by the Production system in NEOSYS finance. Each scenario also specifies which Journal Type to check, to find the respective journal entries. Besides the following cases, all actions cause journal entries:

- Creating an estimate on a job regardless of whether it has no PO or has a PO but has not been converted to a PI or has a PO which is converted to a PI. In all cases creating an estimate raises no journal entries.

- Creating a PO on a job which has no estimate or has an estimate but is not invoiced

All income and cost accounts affected in the journal entries are determined by the job type/s per line of the estimate and PO or on the job file. If there are no job types set per line on the estimate and PO, only then the system picks up the main job type on the job file – however if there is no job type set on the job file then the system will not allow you to save the estimate and PO without setting job types on the lines. You have an option to set different job types per line of the document which thereby indicates that a particular line would affect a particular income or cost A/c (which are configured in the job types file).

NEOSYS does not book purchase orders into finance unless and until the invoice is raised to the client. Purchase orders by themselves have NO effect in finance. Only once an invoice is raised to the client on a job, then its purchase orders (if any PO remain outstanding i.e. without supplier invoices) are registered into finance. Not to do so would mean that the profit and loss statement will unreasonably show only income.

The rule of modern cost accounting is "You shall not post income without simultaneously posting actual OR *best estimate of* cost. To post income at the time of raising invoices to client, and cost at the time of receiving the supplier invoice is an old fashioned procedure.

PO (Purchase Order) to PI (Purchase Invoice) conversion merely means entering the supplier invoice details on the PO (i.e. change the status of the PO to Invoice and enter the supplier invoice number and date in the relevant fields).

In all scenarios we talk about an estimate and PO on the same job even thought it might not be stated everywhere.

What are the journal entries created upon invoicing an estimate?

Look in Journal type: Job Invoices/Credit Notes (INP) {the journal name might be different at some client installations}

Invoicing an estimate could basically involve the following scenarios:

Estimate is invoiced, but there is no PO on the job

In this scenario as there is no estimated cost, the system goes ahead and invoices the client with the corresponding entry affecting the respective income A/c

Client A/c DR (amount taken from the estimate) Income A/c CR (amount taken from the estimate)

Estimate is invoiced and there is a PO on the job or the PO has already been converted to a PI

This is one of the most common scenarios and is highly recommended as a practise. It is recommended that even though you might not have the exact cost, an approximate cost must be put on the PO for the purpose of invoicing.

Client A/c DR (amount taken from the estimate) Income A/c CR (amount taken from the estimate) Cost A/c DR (amount taken from the PO) WIP A/c CR (amount taken from the PO)

Estimate is invoiced as a credit note (i.e. negative amount estimate)

As NEOSYS does not allow you to modify an invoiced estimate; you will need to create a estimate with a negative amount to account for a reversal of the invoice (full credit note) or prepare a partial credit note. Creating a negative estimate / credit note to the client DOES NOT reverse the PO provision and you will have to go to the PO and mark it as cancelled for the reversal to be created

Income A/c DR (amount taken from the estimate) Client A/c CR (amount taken from the estimate)

What are the journal entries created by a PO to PI conversion?

Look in Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might be different at some client installations}

Even though the PO to PI conversion does not involve a change in the amount, NEOSYS still does a reversal of the earlier amount from the WIP and the Cost A/c and again re-enters the same amount in the Cost A/c – this is to keep an audit trial of estimated cost v/s actual cost received and auditors really love this feature.

PO is converted to a PI after the estimate is invoiced

This is the most common scenario where you receive the supplier invoice after invoicing the client (in this case we assume that the PO already existed when you invoiced the client and the provision for the cost was made at that time – refer to estimate invoicing scenario (b). This case could involve either the PI being of the same amount as the PO or a different one.

WIP A/c DR (initial provision cost reversed) Cost A/c CR (initial provision cost reversed) Cost A/c DR (with the new/actual cost) Supplier A/c CR (with the new/actual cost)

PO is converted to a PI before the estimate is invoiced

As mentioned in estimate invoicing scenario (b), there could be a case where you have to convert the PO to a PI before you invoice an estimate. The following entry would be created in this case.

WIP A/c DR (amount taken from the PO/PI) Supplier A/c CR (amount taken from the PO/PI)

PO is converted to a PI when there is no estimate

It may happen that at the time of recording the supplier invoice there is no estimate on the job which could be due to many reasons – most common of them is that the client has given a verbal go ahead or the job is an FOC one or the job is an internal one and isn’t to be billed to anyone. Below entries are no different from entering a PI in the same circumstance

*** MANUAL ENTRY NEEDS TO BE DONE TO TRANSFER THE AMT FROM WIP A/C TO COST A/C. WIP A/c DR (amount taken from the PO/PI) Supplier A/c CR (amount taken from the PO/PI)

Refer to Handling manual entires for jobs with internal cost and supplier invoice but no client invoice

PO is modified after the estimate is invoiced

As already stated in the introduction, creating PO’s or modifying them before you invoice an estimate causes no journal entry. However as soon as an estimate is invoiced, any modifications you do to the PO (even text modifications) causes a journal entry which reverses the earlier created provision (when you invoiced the client) and puts back the new/provision cost back.

WIP A/c DR (initial provision cost reversed) Cost A/c CR (initial provision cost reversed) Cost A/c DR (with the new provision cost) WIP A/c CR (with the new provision cost)

PO is cancelled after the estimate is invoiced

Similar to the above point a PO can be cancelled after you invoice an estimate and the system will create a reversal entry to cancel the provision which was made at the time of invoicing the estimate.

WIP A/c DR (initial provisioned cost reversed) Cost A/c CR (initial provisioned cost reversed)

Handling manual entries Jobs with internal cost and supplier invoice but no client invoice

For scenarios where a job is completed and closed with internal cost(PO->PI) only and no client invoice is raised, manual entry MUST be done in journal type: Job Purchase Invoices/Credit Notes (PUR) to transfer the amount from Wip A/c to Cost A/C. If not the balance of WIP will continue to reflect as WIP in Balance Sheet but in reality it is cost incurred for the company.

WIP A/c CR (amount taken from the PO/PI) Cost A/c DR (amount taken from the PO/PI)

Handling receipt of purchase invoice (against purchase order) after invoicing the client

Given below are scenarios which show how to handle receipt of purchase invoice against purchase orders after invoicing the client with reference to date of receipt.

Scenario 1 - What are the entries created when the purchase invoice is to be recorded after the invoice month?

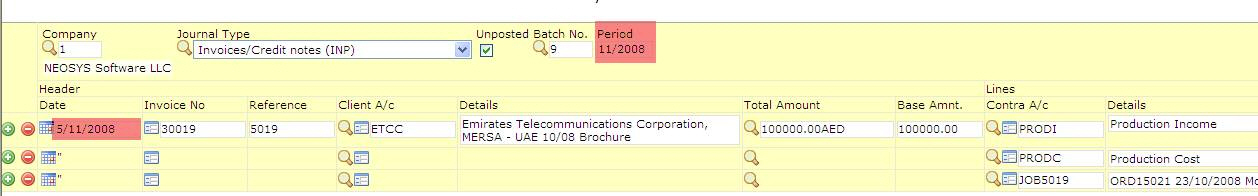

Eg. Purchase invoice is recorded on 05/11/2008 and the client was invoiced on 05/10/2008:

Scenario 2 - What are the entries created when the purchase invoice is to be recorded before the invoice month?

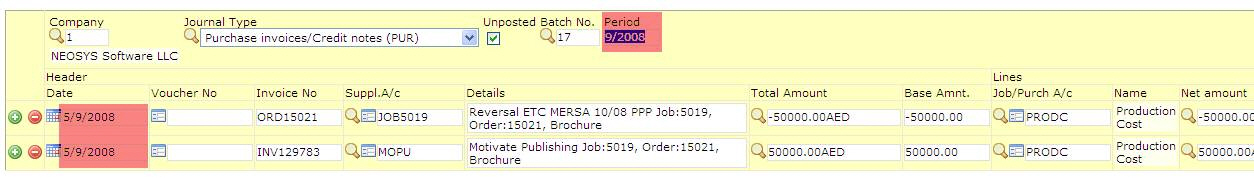

Eg. Purchase invoice is recorded on 05/09/2008 and the client was invoiced on 05/10/2008:

Scenario 3 - What are the entries created when the purchase invoice is slightly more than the purchase order (after invoicing the client)?

Eg. Purchase order was for 5000 AED, but the Purchase invoice was received for 5500 AED:

Scenario 4 - What are the entries created when the purchase invoice is slightly less than the purchase order (after invoicing the client)?

Eg. Purchase order was for 5000 AED, but the Purchase invoice was received for 4500 AED:

Understanding how a date change on a PO or conversion from PO to PI after invoicing the client affect the period of automatic journal

Scenario: Job created in 2/2009 Estimate raised on 4/2/2009 for 1000 AED PO raised on 4/2/2009 for 900 AED Invoice issued on 4/2/2009

Journal entry created upon client invoicing:

Period: 2/2009 Date: 4/2/2009 Client A/c Dr Income A/c Cr Cost A/c Dr WIP A/c Cr

NOTE: The period/date of the journal which is automatically created incase of client invoicing will depend on the date you input on the New Invoice selection screen – the estimate in this case will not overrule the invoice date you put on the invoice screen.

Journal entry created upon updating the PO with order date 4/2/2009 (current date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry WIP A/c Cr

Journal entry created upon updating the PO with order date 4/3/2009 (future date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 - reversal entry WIP A/c Dr Cost A/c Cr Period 3/2009 Date: 4/3/2009 - actual entry Cost A/c Dr WIP A/c Cr

Journal entry created upon updating the PO with order date 4/1/2009 (past date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 - reversal entry WIP A/c Dr Cost A/c Cr Period 1/2009 Date: 4/1/2009 - actual entry Cost A/c Dr WIP A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/2/2009 and PI date 4/2/2009 (current date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/2/2009 (current) and PI date 4/1/2009 (past date) – in Purchase Invoice Journal

Period: 1/2009 Date: 4/1/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/3/2009 (future) and PI date 4/3/2009 (future date) – in Purchase Invoice Journal

Period: 3/2009 Date: 4/3/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

NOTE: The period/date of the journal which is automatically created incase of conversion from PO to PI always will depend on the supplier invoice date you input – the PO date has no effect in this case and can be anything.