Accounting entries created by the Production system

Handling different scenarios of invoicing

Estimate Invoicing Scenarios

Scenario 1 – What are the journal entries created when an estimate is invoiced and there is no PO on the job?

Journal type: Job Invoices/Credit Notes (INP) {the journal name might different at some client installations}

Client A/C DR (amount taken from the estimate)

Income A/C CR (amount taken from the estimate)

Scenario 2 - What are the journal entries created when an estimate is invoiced and there is a PO on the job?

Journal type: Job Invoices/Credit Notes (INP) {the journal name might different at some client installations}

Client A/c DR (amount taken from the estimate)

Income A/c CR (amount taken from the estimate)

Cost A/c DR (amount taken from the PO)

WIP A/C CR (amount taken from the PO)

Scenario 3 - What are the journal entries created when an estimate is invoiced as a credit note (i.e. minus estimate)?

Note: Creating a minus estimate / credit note to the client DOES NOT reverse the PO provision and you will have to go to the PO and mark it as cancelled for the reversal to be created

Journal type: Job Invoices/Credit Notes (INP) {the journal name might different at some client installations}

Income A/c DR (amount taken from the estimate)

Client A/c CR (amount taken from the estimate)

Scenario 4 - What are the journal entries created when an estimate is invoiced after a PO is converted to a PI

Journal type: Job Invoices/Credit Notes (INP) {the journal name might different at some client installations}

Client A/C DR (amount taken from the estimate)

Income A/C CR (amount taken from the estimate)

Cost A/C DR (cost taken from the PI) WIP A/C CR (reverses the provision entry created)

PO to PI conversion scenarios

Scenario 1 - What are the journal entries created when you convert a PO to a PI after an estimate is invoiced?

Once you convert the PO to a PI i.e. by entering the supplier invoice details on the PO, and the following entries are created by NEOSYS (converting the PO to the PI means you record the supplier invoice in the supplier a/c and reverse the provision made earlier):

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

WIP A/C DR (initial provisioned cost reversed)

Cost A/C CR (initial provisioned cost reversed)

Cost A/C DR (with the new/original cost)

Supplier A/C CR (with the new/original cost)

Note- Even though the PO and PI are the same amount, the system will do a reversal and a re entry.

Scenario 2 – What are the journal entries created when a PO is converted to a PI before you invoice an estimate?

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

WIP A/C DR (amount taken from the PO/PI)

Supplier A/C CR (amount taken from the PO/PI)

Scenario 3 - What are the journal entries created when a PO is converted to a PI when there is no estimate?

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

Cost A/C DR (amount taken from the PO/PI)

Supplier A/C CR (amount taken from the PO/PI)

Scenario 4 - What are the entries made when you modify a PO after the estimate is invoiced?

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

WIP A/C DR (initial provisioned cost reversed)

Cost A/C CR (initial provisioned cost reversed)

Cost A/C DR (new amount taken from the PO)

WIP A/C CR (new amount taken from the PO)

Scenario 5 - What are the entries made when a PO is cancelled after the estimate is invoiced?

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

WIP A/C DR (initial provisioned cost reversed)

Cost A/C CR (initial provisioned cost reversed)

Scenario 6 - What are the entries made when the PO is converted to a PI but the amount of the PI is different from the PO (after the estimate is invoiced)?

Journal type: Job Purchase Invoices/Credit Notes (PUR) {the journal name might different at some client installations}

WIP A/C Dr (initial provisioned cost reversed)

Cost A/C Cr (initial provisioned cost reversed)

Cost A/C Dr (amount taken from the PI)

Supplier A/C Cr (amount taken from the PI)

Handling receipt of purchase invoice (against purchase order) after invoicing the client

In addition to the notes above, you need to take understand the various scenarios in handling the receipts of purchase invoice against purchase orders after invoicing the client with reference to date of receipt.

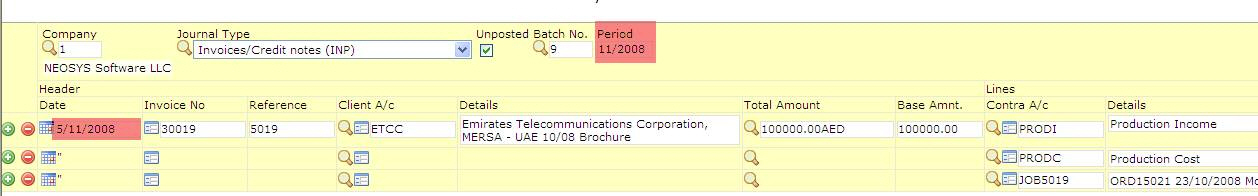

Scenario 1 - What are the entries created when the purchase invoice is to be recorded after the invoice month?

Eg. Purchase invoice is recorded on 05/11/2008 and the client was invoiced on 05/10/2008:

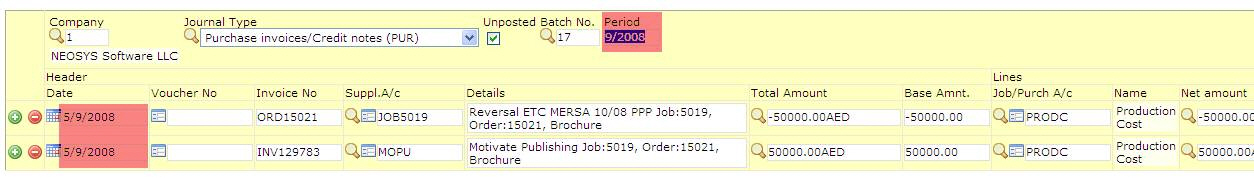

Scenario 2 - What are the entries created when the purchase invoice is to be recorded before the invoice month?

Eg. Purchase invoice is recorded on 05/09/2008 and the client was invoiced on 05/10/2008:

Scenario 3 - What are the entries created when the purchase invoice is slightly more than the purchase order (after invoicing the client)?

Eg. Purchase order was for 5000 AED, but the Purchase invoice was received for 5500 AED:

Scenario 4 - What are the entries created when the purchase invoice is slightly less than the purchase order (after invoicing the client)?

Eg. Purchase order was for 5000 AED, but the Purchase invoice was received for 4500 AED:

Understanding how a date change on a PO or conversion from PO to PI after invoicing the client affect the period of automatic journal

Scenario: Job created in 2/2009 Estimate raised on 4/2/2009 for 1000 AED PO raised on 4/2/2009 for 900 AED Invoice issued on 4/2/2009

Journal entry created upon client invoicing:

Period: 2/2009 Date: 4/2/2009 Client A/c Dr Income A/c Cr Cost A/c Dr WIP A/c Cr

NOTE: The period/date of the journal which is automatically created incase of client invoicing will depend on the date you input on the New Invoice selection screen – the estimate in this case will not overrule the invoice date you put on the invoice screen.

Journal entry created upon updating the PO with order date 4/2/2009 (current date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry WIP A/c Cr

Journal entry created upon updating the PO with order date 4/3/2009 (future date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 - reversal entry WIP A/c Dr Cost A/c Cr Period 3/2009 Date: 4/3/2009 - actual entry Cost A/c Dr WIP A/c Cr

Journal entry created upon updating the PO with order date 4/1/2009 (past date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 - reversal entry WIP A/c Dr Cost A/c Cr Period 1/2009 Date: 4/1/2009 - actual entry Cost A/c Dr WIP A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/2/2009 and PI date 4/2/2009 (current date) – in Purchase Invoice Journal

Period: 2/2009 Date: 4/2/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/2/2009 (current) and PI date 4/1/2009 (past date) – in Purchase Invoice Journal

Period: 1/2009 Date: 4/1/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

Journal entry created upon converting the PO to a PI with order date 4/3/2009 (future) and PI date 4/3/2009 (future date) – in Purchase Invoice Journal

Period: 3/2009 Date: 4/3/2009 WIP A/c Dr - reversal entry Cost A/c Cr Cost A/c Dr - actual entry Supplier A/c Cr

NOTE: The period/date of the journal which is automatically created incase of conversion from PO to PI always will depend on the supplier invoice date you input – the PO date has no effect in this case and can be anything.