Finance FAQ

How do I allocate open item amounts in NEOSYS?

While entering a journal

While entering a journal entry in the ALLOC VCHS Column hit F7 Key and it will pop-up list of allocatable items. Allocate the amount with the correct voucher no. and amount and click on OK.

By Vouchers Allocation file

Once the journal is posted without allocation you can only allocate from the Voucher Screen.

Go to Menu > Finance > Vouchers > Vouchers Allocation. Enter the account number or hit the F7 key on the Selected Account(s) field and select the relevant account from the particular subsidiary chart. Click OK and the system will popup the Voucher Allocation page.

If the account selected is a DEBITS outstanding type account (i.e. Trade Debtors), then all the allocable/unallocated CREDIT items (i.e. Receipts, Credit Notes etc.) will show up. Click on any item you wish to allocate Debit items against. After you click you will get a list of all DEBIT allocable/unallocated items which you can now select to be allocated against the CREDIT item you earlier selected.

Incase you have a selected a CREDITS outstanding type account (i.e. Trade Creditors), then the opposite happens i.e. DEBIT items show first (Payments, Debit Notes etc) and if you click on any of these items you can allocate them against CREDIT outstanding items.

For accounts that have neither CREDIT or DEBIT type selected, the CREDIT items show first.

Why can I not see ALL allocable items in the Allocation screen?

Open item accounts with a lot of transactions might face this issue. The allocation screen cannot handle an unlimited number of entries so it shows the oldest first and omits the newest.

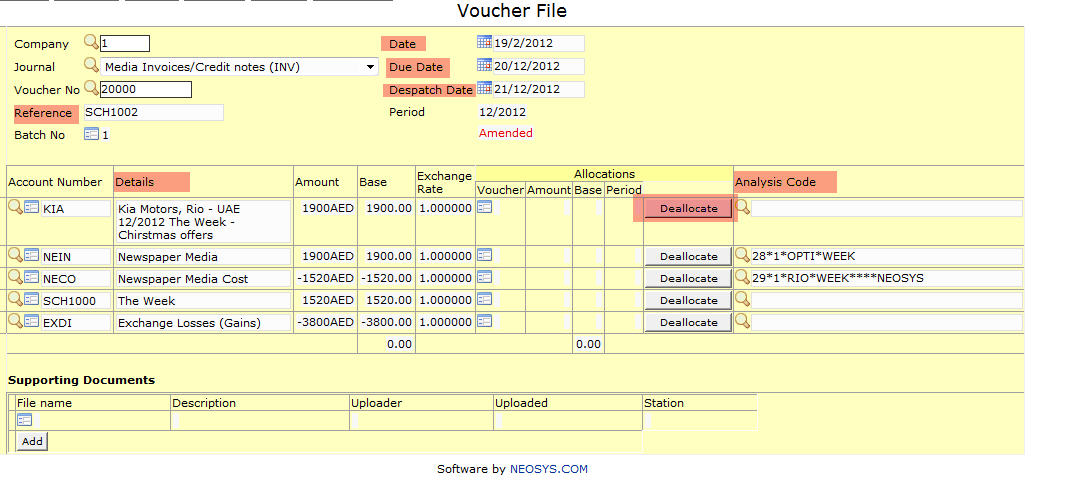

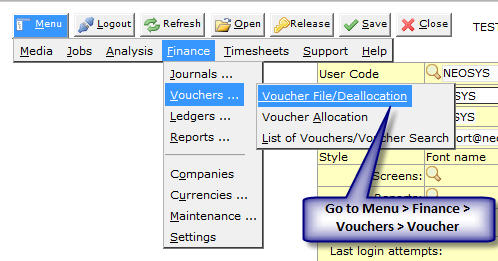

How do I deallocate already allocated vouchers?

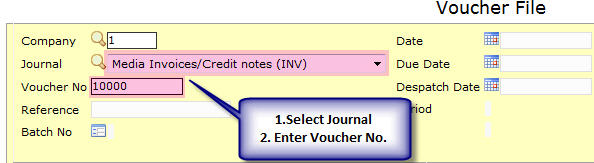

- Go to Menu > Finance > Vouchers > Vouchers file/Deallocation.

- Select the Journal type and enter the voucher number.

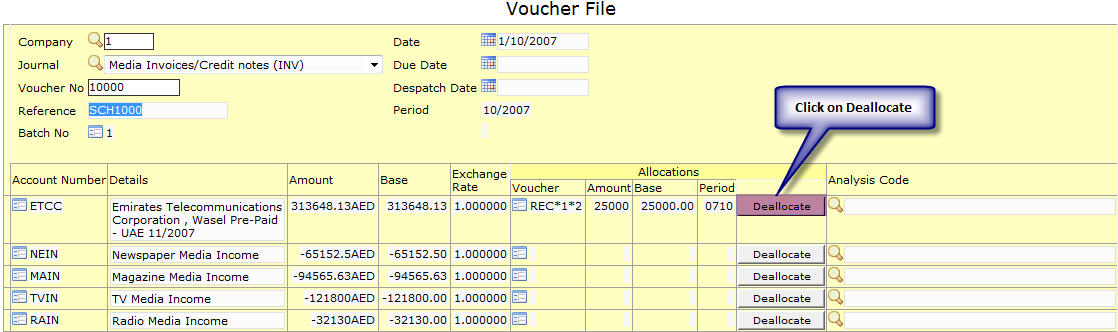

As you enter the voucher number system will show the all the vouchers allocated on the bottom right to that voucher. - Click on the Deallocation button.

- Select the Vouchers you want to deallocate and click OK.

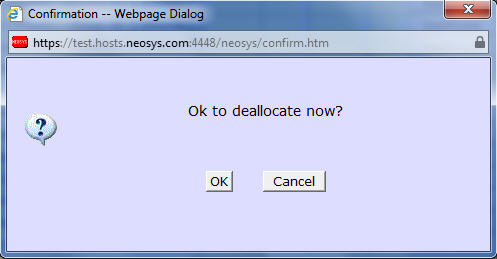

- As you click OK system will reconfirm your move by giving a pop up "Ok to deallocate now?" click on OK.

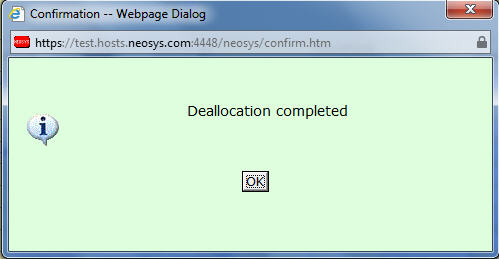

- You will see an another pop up "Deallocation Completed"

How do I enter supplier invoices for non media / non job items?

In due course of business you might need to purchase items which are not media nor job related.

The only way to enter this is:

- Go to Menu > Finance > Journals > Journal Entry / Query.

- Select JOURNAL (JOU) type and enter the relevant purchase entry here.

How do I enter supplier credit notes for non media / non job items?

The only way to enter this is:

- Go to Menu > Finance > Journals > Journal Entry / Query.

- Select JOURNAL (JOU) type and enter the reversal / credit note entry (exact reversal of the supplier invoice you entered initially with the particular amount).

How do I cancel an already issued/posted Payment/Receipt?

There is no way to delete any journal in NEOSYS, especially the Payment Voucher, to maintain record for auditors.

If you need to cancel an already posted Payment/Receipt voucher:

- Deallocate any items which you allocated at the time of entering the voucher.

(This frees up the Payment/Receipt voucher to be allocated against a reversal entry and also frees up the allocated item (Supplier/Client Invoice) to be allocated against another voucher) - Do a reversal entry of exactly the same Payment/Receipt voucher and allocated the same to the actual entry. Thereafter you can enter the new Payment/Receipt.

What happens if I post the same supplier invoice twice?

NEOSYS allows the same supplier invoice to be posted in two different ledgers.

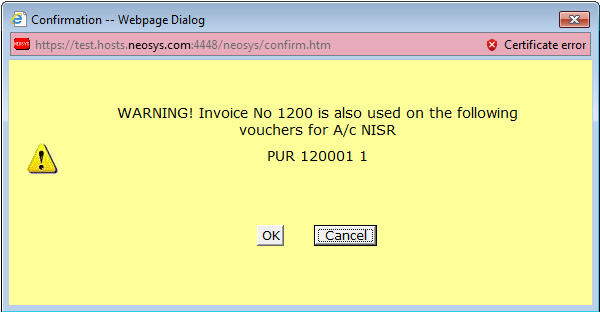

However, a warning message (shown below) is displayed, when you try to enter a purchase invoice number which is already existing in the same supplier a/c.

Can I allocate to unposted vouchers?

NEOSYS allows allocation to UNPOSTED vouchers (e.g. receipts to unposted invoices) but you can only save the batch (or receipts) as unposted until the unposted vouchers (invoices) have actually been posted.

While you are allocating you can see which vouchers are unposted because there is a * in the reference number. There is no way to avoid showing unposted vouchers at the moment.

Can I allocate vouchers within a batch?

Yes, you can allocate a voucher to another voucher which are in the same batch. In order to do so, post the batch and use the Voucher Allocation screen to allocate to the correct voucher. For example an Invoice and a Credit Note can be in the same batch and they can be allocated to each other after posting, via the Voucher Allocation screen.

Can I view a voucher file before the batch is posted?

Yes, you can view voucher files by saving a journal batch as unposted/unposted without validation, then clicking on the link in the Voucher column.

This will open the voucher that the system wants to generate. The actual voucher number will not be generated until the batch is posted.

If a journal batch cannot be saved due to an error, then you can save the batch by choosing "Save as Unposted Batch WITHOUT VALIDATION" option, then view the voucher file and possibly find the cause of the error.

How do I sort the Journal Audit Report according to Invoice Number?

The journal audit report is ordered as per the date and time of posting as per audit rules. Hence It cannot be sorted on any other fields.

If a simple list of invoices is required then please use the list of invoices from the media or job invoice menus. (See List of Invoices)

How do I amend / repost journal entries?

Posted entries cannot be modified except by NEOSYS under certain circumstances.

NEOSYS has a policy not to do corrections to postings except in special circumstances.

- Corrections to opening balances and opening items since those are a once off issue.

- Amendments requested by top management for exceptional adjustment of accounts that cannot be handled in any other way

- Vouchers are missing from posted batches. See Missing vouchers in posted batches

General errors in postings such as the financial period, account number and amounts must be corrected by reversal and correct journals.

The repercussions of granting permission to edit/repost journals would be as follows:

- NEOSYS Financial Module can no longer be trusted if postings are subject to modification

- It is not common practice to do such manipulations

- It can lead to possible errors in numbers

- Staff can become complacent and careless while posting entries and frequently ask for this permission

So, restricting users from editing/reposting journal entries promotes a more healthy and vigilant working environment where users verify each journal entry before posting it which effectively leads to good accounting practices.

The NEOSYS software for reposting journals appears to but does NOT work for posting which have already been allocated. It creates cross check balance errors in the open item accounts. To avoid this, any allocations can be de-allocated ESPECIALLY when the account number is being changed or the amount is being reduced or the currency changed.

The following information can be changed by authorised users even after posting. In the Voucher File and therefore on the detail ledger account/statement: Date, Due Date, Despatch Date, Reference, Details, Analysis Code and allocation. See What can I change in the finance voucher after posting?. Unfortunately the journal printout is unchanged by any amendments and remains as it was entered.

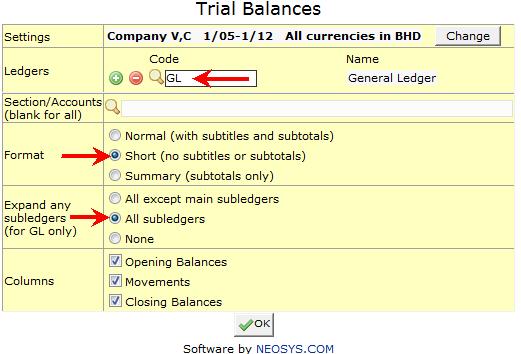

How do I print all accounts in one trial balance?

To print all accounts in a single trial balance you must print the General Ledger (GL) and select SHOW ALL SUBLEDGERS option. You can also make use of the SHORT VERSION option.

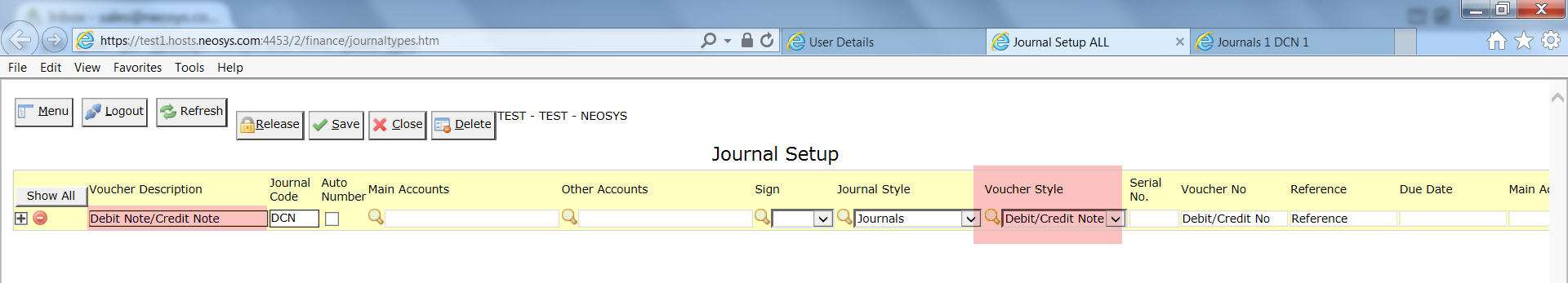

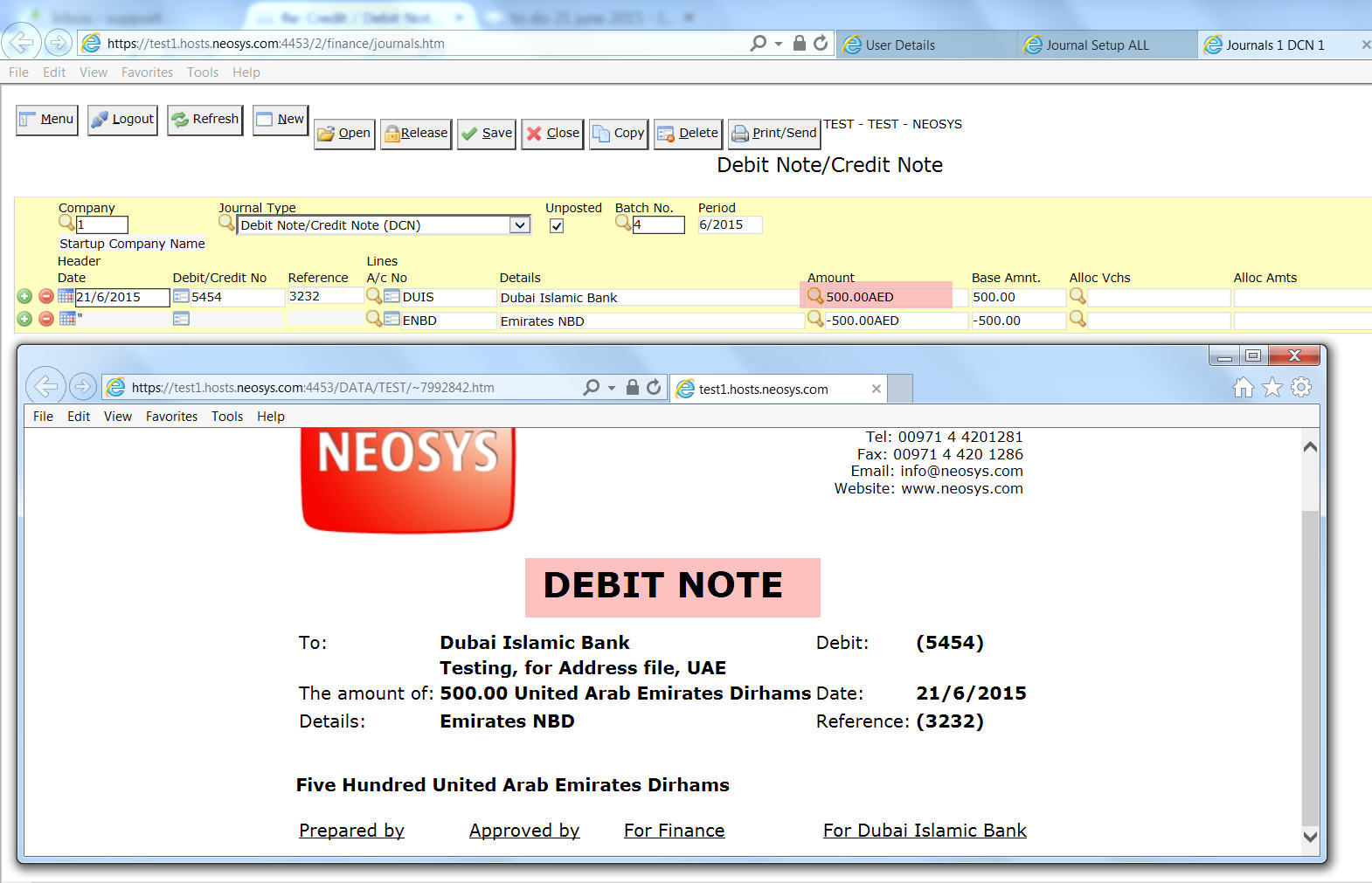

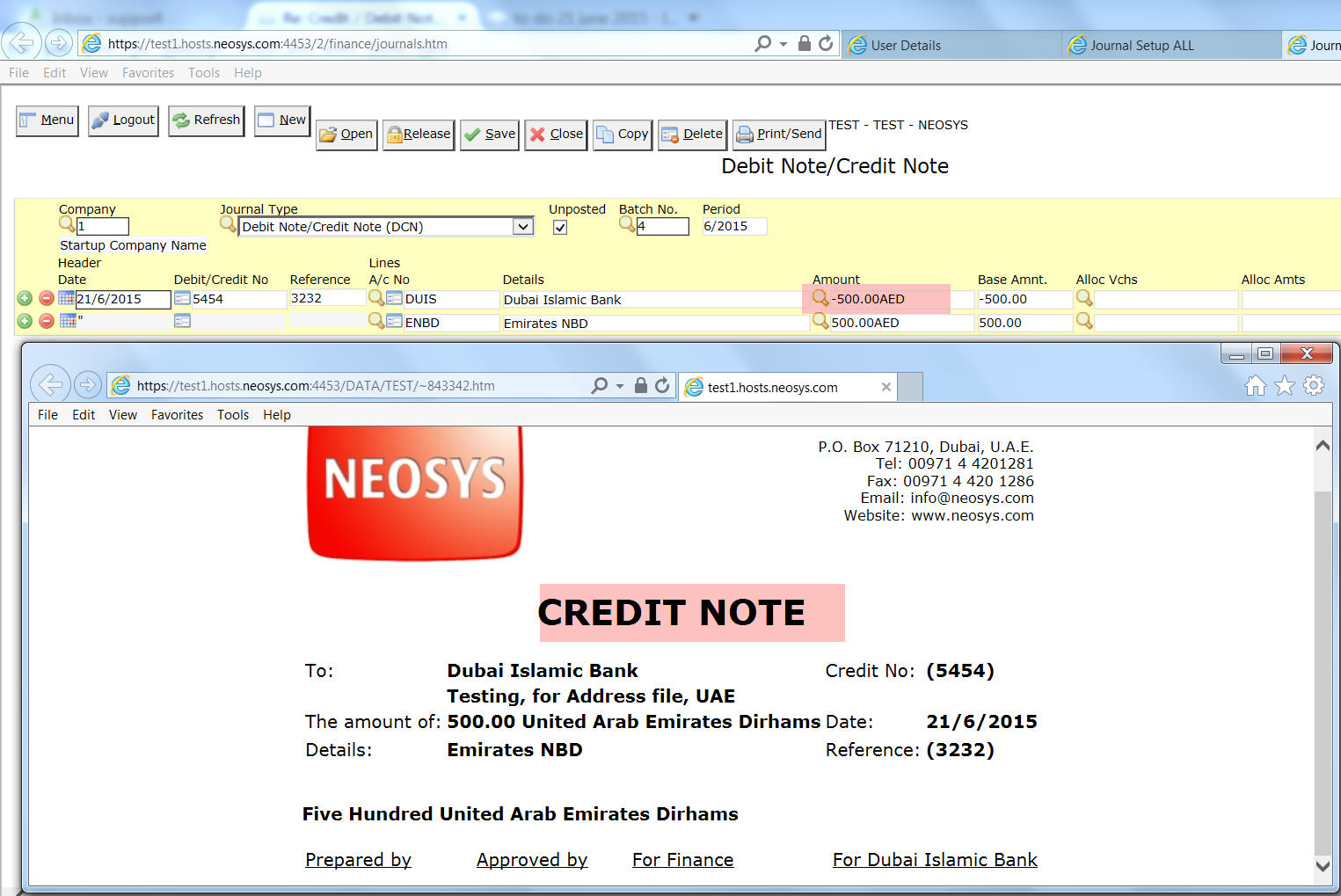

How do I issue Debit/Credit Note in Finance?

In Journal Setup, enter Voucher Description as "Debit/Credit Note" and select voucher style from the drop-down menu as "Debit/Credit Note". The "/" entered in the Voucher Description is used to give two alternate names for the same heading depending on whether the main account is debited or credited.

For example, for a voucher entered for this journal type, when the main account is DEBITED, when you click on the Print/Send button, the document generated will say "DEBIT NOTE".

Similarly, when the main account is CREDITED, when you click on the Print/Send button, the document generated will say "CREDIT NOTE".

The same trick is used for "Invoice/Credit Note", ie, simply enter Voucher Description as "Invoice/Credit Note" and select voucher style from the drop-down menu as "Debit/Credit Note". Depending on whether the main account is debited or credited, the Journal Print document will show either "Invoice" or "Credit Note" as the heading.

What is the “RV” allocation without a voucher number that shows in the Voucher File?

An allocation stating RV without any voucher number is caused by a revaluation process on open item accounts.

Revaluation of open item accounts is performed by calculating the base adjustment on each outstanding foreign currency item and posting ONE RV voucher PER ACCOUNT for the total. The RV voucher is allocated to the individual vouchers but unusually the voucher number does not show. The system was initially designed this way in order to avoid a potentially very long list of allocations on RV vouchers.

The lack of voucher number makes it hard to verify the allocation is correct, however you can trust that it is correct if the usual chain of checks and balances provided by the principle of the double entry proves the whole system is ok.

It is planned to change NEOSYS to show RV voucher numbers in all cases.

Why does voucher allocation shows nothing to allocate when there are debits and credits on the account?

In some abnormal circumstances there may be items outstanding on an account which have base amount outstanding but no currency amount outstanding. NEOSYS allocation procedure works only on outstanding currency amounts so these items cannot be allocated.

Solution: Run the revaluation program. Its job is to amend the outstanding base amount to agree with the outstanding currency amount at the prevailing exchange rate. Since the outstanding currency amount is zero, it will amend the outstanding base amount to be zero also.

Why is a revaluation journal posted in the prior year when I allocated some vouchers in the prior year?

It doesn't matter what time and date is on the clock when the allocation is done since you could be be working on 2017 accounts in 2018 and this is normal practice of course.

It matters what SETTINGS and options you choose when doing the allocation.

The allocation is done in a certain period, and any revaluation journal required and generated due to that allocation, is generated in the same period.

Note that the allocation/revaluation period cannot be up to the closed period in the Company File, so allocated vouchers in a closed year will be allocated/revalued in the first open period - or the open period that you select.

Which accounts can be revaluated?

Revaluation is only performed on foreign currency tangible assets and liabilities accounts, which are subject to changing exchange rates and have a value and therefore can be revalued.

Tangible assets and liability accounts represent real value such as debtors, creditors and bank accounts.

Whereas P&L accounts are merely totals of historical movements, they do not represent any asset or liability that has a value and therefore cannot be revalued.

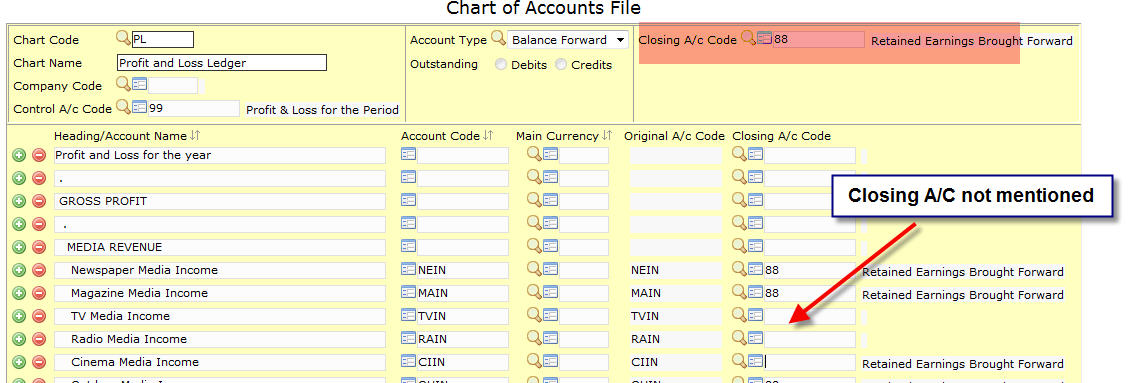

Why is closing account missing for some Profit & Loss accounts?

Retained Earnings account is the "closing account" of all the P&L accounts. This is a real account in the master chart of accounts.

If the closing A/C code is mentioned in the closing A/C field then all accounts under that ledger will automatically take the closing A/C detail even if the closing A/C code is not explicitly mentioned in each account.

What can I change on the finance vouchers even after posting?

Finance users can amend various fields in Voucher File after the entry is posted. On saving the changes Amended will appear on the voucher file.

Following fields can be amended: - Reference, Date, Due Date, Despatch Date, Details, Deallocate and Analysis Code.

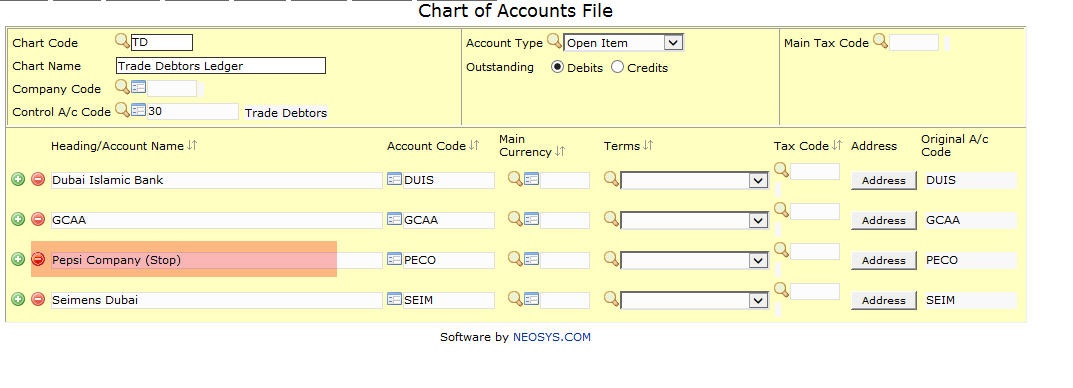

How do I stop users from posting journal entries to an Account in Finance?

Adding "(Stop)" on an account line in Chart of Accounts stops users from posting journal entries to the stopped account. If users wish to post journal entries to a stopped account remove "(Stop)" from the account line in Chart of Accounts. Users can take ledger printout for stopped accounts.

How does NEOSYS handle base and real currency balances?

The easiest way to understand NEOSYS is to imagine that it keeps completely separate double entry accounting systems for each currency and consolidates them on the fly to produce reports and ledgers for all currencies consolidated. It is easy to use NEOSYS menu settings to print reports and ledgers for individual currencies - ignoring all other currencies, or for all currencies consolidated - which is the default.

Every NEOSYS journal line has a currency code and amount. Each journal line also has (in parallel to the currency code and amount) the base currency equivalent amount of the currency amount. The base currency equivalent amount can be considered to be our best "valuation" of the currency amount when expressed in terms of the currency of our base currency.

In most cases the operator only has to enter the currency code and amount and the NEOSYS system uses its internal semi-static exchange rate files to determine the base currency equivalent amount or "value". In some cases however, for example, if there is no standard semi-static internal exchange rate for a currency, the operator is required to enter the base currency equivalent amount/value.

NEOSYS keep the base currency balance separate per currency and consolidates them on the fly to produce consolidated reports for "all currencies converted to base currency".

NEOSYS treats journals in the currency of the base currency as just another currency and not as some special currency. For example, if the base currency happens to be USD then NEOSYS can tell you a) the balances of each currency converted to USD separately b) the balance of all currencies converted to USD c) the balance of real USD excluding all other currencies. This is particular useful when the base currency is not the main operational currency of the system.

Why does NEOSYS Exchange Gains/Loss account not agree exactly with my auditor's parallel system?

If a client finds that the Exchange Gain/Loss account balances as per another parallel system is not in agreement with NEOSYS then they must sit and reconcile the two and notify NEOSYS support of anything that they discover is wrong in NEOSYS so that can fix it - otherwise we remain confident in NEOSYS without proof to the contrary.

In general:

- Locate the incorrect transactions: Take a ledger account of the Exchange Gain/Loss account in order to locate the incorrect transaction. Open the voucher that made this entry and look at all the base conversions on that voucher. If the exchange rate used was wrong, that could be the reason for the discrepancy.

- Try running the NEOSYS revaluation program on the journals menu. This will ensure that the NOMINAL base currency balance in all accounts is in exact agreement with the REAL currency balance in those accounts

- Rounding rules can be different in different systems so that may account for 1 or 2 cent differences per transaction and this can can add up to greater differences in total.

What do I do if I am not happy with the balance of an account?

The balance of any account is, under all circumstances, simply the arithmetic total of the journal lines posted to it, therefore self evidently, if you are not happy with the balance of an account, you must use one of the options on the NEOSYS JOURNAL MENU to post additional journal lines until the total of the journal lines for the desired account gives the balance that you desire for the account. There is no way to amend the balance of an account other than using one of the NEOSYS JOURNAL MENU options to post additional journals.

Why can I not adjust the balance of one account only?

In order to understand why this is not allowed you need to know the fundamental and unbreakable rule of double entry accounting

THE ARITHMETIC TOTAL OF THE BALANCES OF ALL ACCOUNTS MUST AT ALL TIMES BE EQUAL TO ZERO

In NEOSYS, the rule of double entry accounting is applied separately per currency. Therefore the total of base currency must equal zero at all times and the total of each individual currency must be zero at all times.

Given the above rule, adjusting the balance of one account alone is not allowed because it would break the rule ... because (obviously) it would result in the arithmetic total of all account balances no longer being zero.

The effect of the rule is that you cannot ever adjust the balance of one account without simultaneously making an equal an opposite adjustment in some other account or accounts.

What if I cannot determine any account to make an opposite adjustment into?

The opposite account is often some kind of a "write off" or "exchange gain/loss" account but it could be to any account depending on the case. Think long and hard about it and if you are still not clear then you must consult an accountant to help you determine which account to use.

Note that for NEOSYS revaluation journals the "exchange gain/loss" account, defined in the Company File, is used automatically as the opposite adjustment account.

How to correct wrong currencies present in NEOSYS reconciliation reports

NEOSYS reconciliation is strictly per currency amounts posted and does not provide any base currency reporting therefore any false currency balances (eg USD posted into an EUR bank account) must be corrected by journal.

Why is VAT column not appearing in journal entry page though it has been set up in Journal Setup?

It is necessary to put Tax Reg. No . on the Company File in order to get the VAT column in the journal entry page.

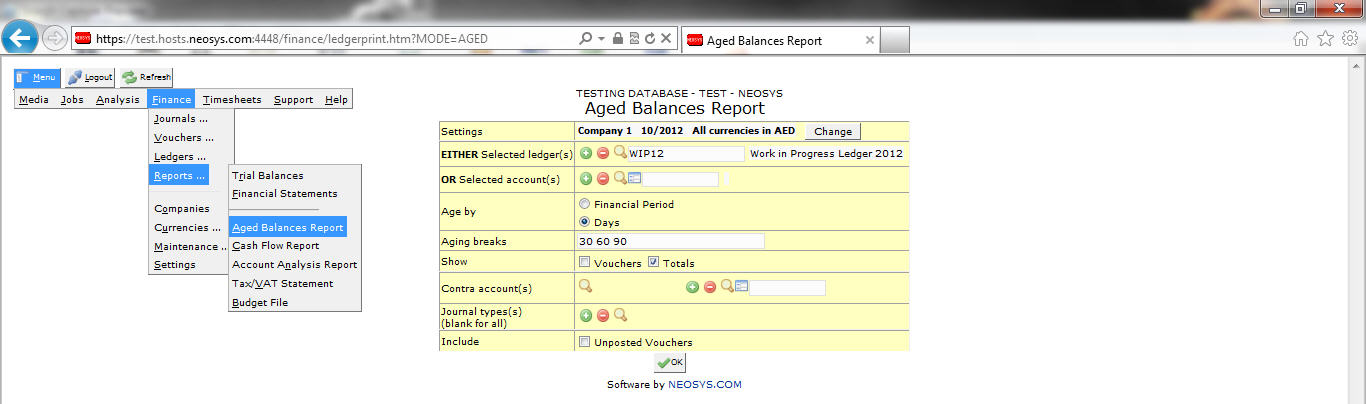

How do I get a break down of the WIP/ACCRUAL?

If you want a break-down of a control account you look in the subsidiary ledger. (This is the whole point of having a subsidiary ledgers in the first place)

If the subsidiary ledger happens to be open item ledger like client/supplier/wip/accrual then you can use the NEOSYS AGED BALANCE REPORT which can show you the breakdown either per account or per open item/translation

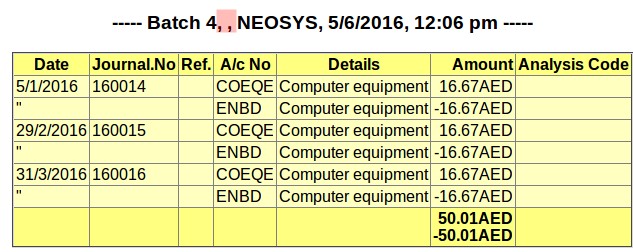

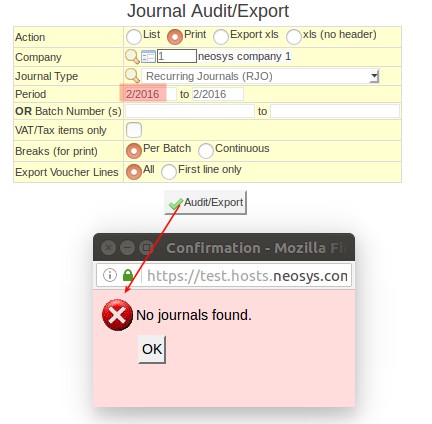

Why am I unable to find/print journal batches created using Recurring Journals?

Journal batches created using Recurring Journals Table do not have a period in the batch heading because multiple periods may be posted in the same batch. For such batches, only the period of the first voucher in that batch (in the case of recurring journals this is the earliest period in the batch) will be shown in any journal batch lookup.

In order to lookup or print such batches you need to enter the earliest period in that batch in the period filter. This holds true for any kind of batch lookup or printing like Journal Audit/Export, List of Unposted Journals etc.

For example, the heading of Journal Audit/Export print shows batch number and the period as blank (highlighted in the below screenshot) for a journal batch created using Recurring Journals Table.

The batch shown above contains an entry for period 2/2016. But if 2/2016 is entered in the period filter in Journal Audit/Export, this will give an error message "No journals found." as shown below. This is because there is currently no Recurring Journal batch whose earliest period is 2/2016. The earliest period of the batch shown above, i.e. 1/2016 must be entered in the period filter.

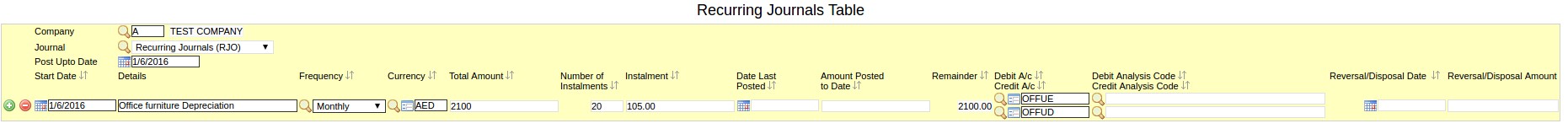

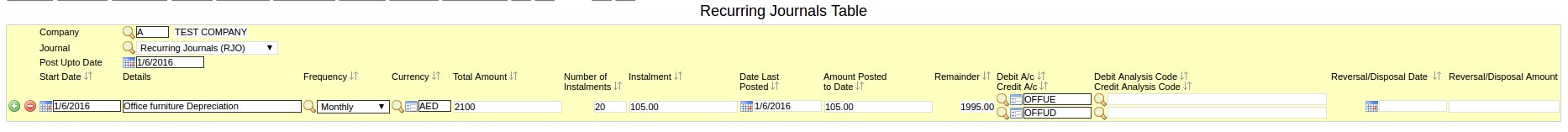

How to do depreciation using Recurring Journals

Recurring Journal entries can be used to post depreciation periodically.

As shown in the example below, Start date can be set as the beginning of a month. Details field will carry the description of the Asset. Frequency and Number of Instalments can be set as per company policy. Depending on the Total amount and Number of Instalments NEOSYS automatically calculates the Instalment and Remainder amounts.

Debit the Depreciation Account (PL ledger) and credit the Accumulated Depreciation Account (Fixed Assets Ledger).

On posting the Recurring journal other field details (Date Last Posted and Amount Posted to Date) appear automatically.

Before Posting

After Posting

Why is ledger printout truncating account name from voucher details field

If the account name is mentioned in the details column of the voucher, the system will automatically drop the account name from the details column while taking the account's ledger printout. This is done because there is no need to show the same account name over and over on all rows of the report when the account name is already mentioned in the report heading.