Tax/VAT Return Report: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

m Joel moved page TAX/VAT Statement to Tax/VAT Return Report: Tax/VAT Statement report name changed to Tax/VAT Return |

mNo edit summary |

||

| Line 6: | Line 6: | ||

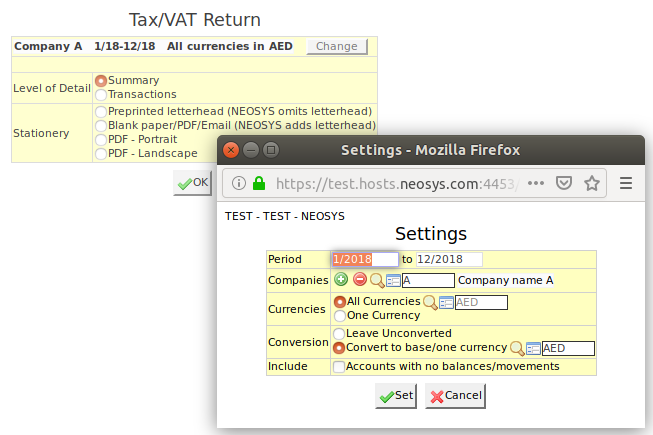

The Tax/Vat Return report is used to get a tax summary of all VAT items used in the specified period. | The Tax/Vat Return report is used to get a tax summary of all VAT items used in the specified period. | ||

This report can be cross- | This report can be cross-checked with the [[Journal_Audit/Export|Journal Audit]] report to ensure that the amounts agree with each other. | ||

You can choose the level of detail you require i.e. either Summary or Transaction level. | You can choose the level of detail you require i.e. either Summary or Transaction level. | ||

| Line 12: | Line 12: | ||

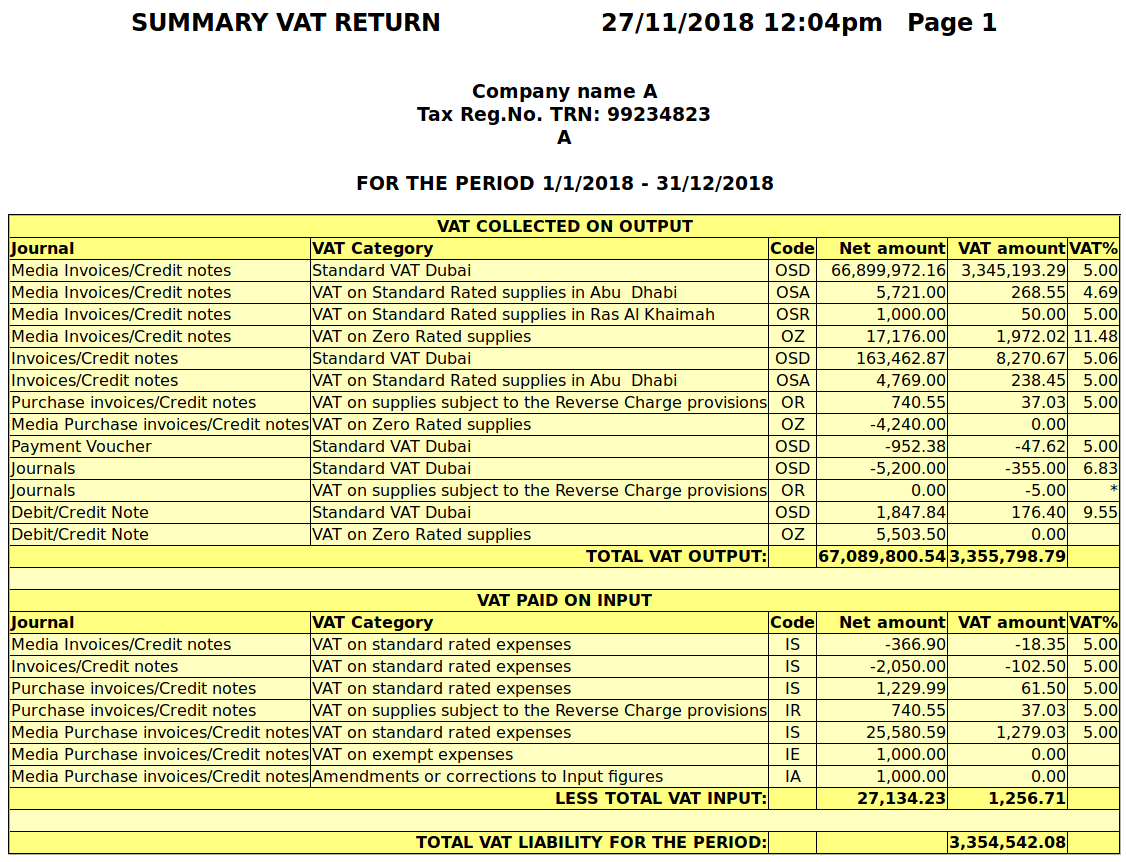

===Summary level of detail=== | ===Summary level of detail=== | ||

Displays | Displays net amount, VAT amount and VAT % summarised by Journal type by VAT code. | ||

[[image:VatReturn1.png|900px]] | [[image:VatReturn1.png|900px]] | ||

| Line 18: | Line 18: | ||

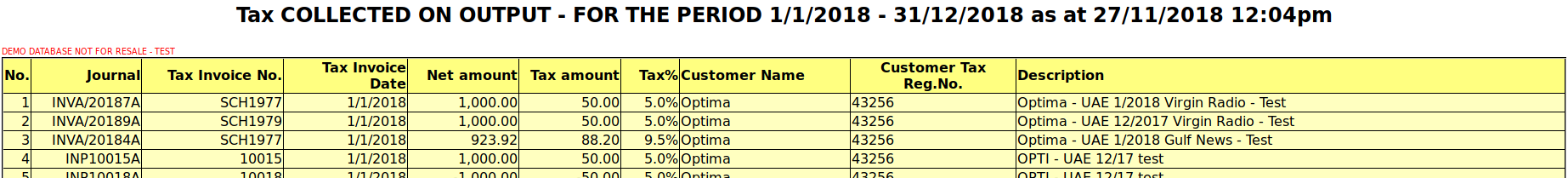

===Transactions level of detail=== | ===Transactions level of detail=== | ||

Displays a detailed report on Tax collected on Input and paid on Output with | Displays a detailed report on Tax collected on Input and paid on Output with details including Journal batch no., Invoice no. and date, Customer Name and TRN etc. | ||

[[image:VatReturn2.png|1300px]] | [[image:VatReturn2.png|1300px]] | ||

Latest revision as of 12:43, 6 December 2018

Tax/Vat Return report

The Tax/Vat Return report is used to get a tax summary of all VAT items used in the specified period.

This report can be cross-checked with the Journal Audit report to ensure that the amounts agree with each other.

You can choose the level of detail you require i.e. either Summary or Transaction level.

Summary level of detail

Displays net amount, VAT amount and VAT % summarised by Journal type by VAT code.

Transactions level of detail

Displays a detailed report on Tax collected on Input and paid on Output with details including Journal batch no., Invoice no. and date, Customer Name and TRN etc.