Understanding VAT/Sales Tax in the NEOSYS finance module: Difference between revisions

| Line 122: | Line 122: | ||

This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total. | This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total. | ||

*[[ | *[[Tax/VAT_Return_Report|Tax/VAT Return Report]] | ||

This report can be used to get VAT tax summary of all VAT items used in any period. | This report can be used to get VAT tax summary of all VAT items used in any period. | ||

You can cross-reference the Journal Audit report and the Tax/VAT return report to see if the amounts agree with each other, which they always should. | You can cross-reference the Journal Audit report and the Tax/VAT return report to see if the amounts agree with each other, which they always should. | ||

Revision as of 11:43, 27 November 2018

Handling VAT/Sales Tax

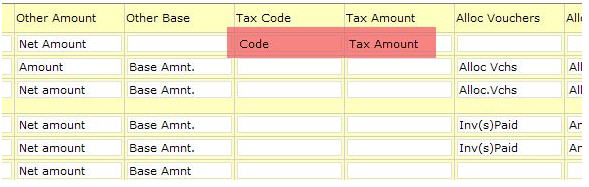

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

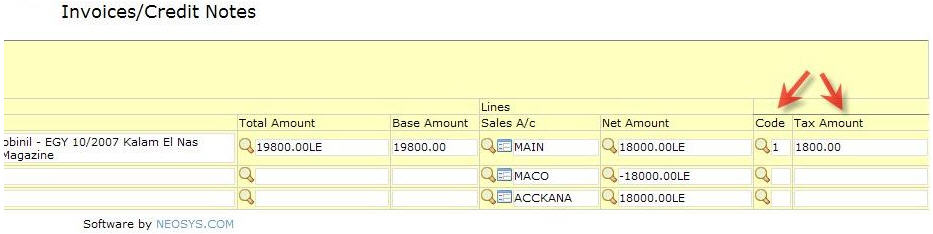

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

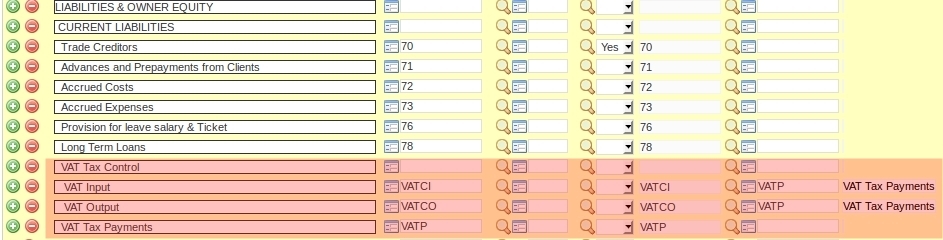

Creating "VAT Input", "VAT Output" and "VAT Tax Payments" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create THREE a/cs, one for the VAT Tax Control INPUT, which will represent the tax paid on purchases which are recoverable from tax authorities, one for VAT Tax Control OUTPUT, which will represent the tax collected and payable to the authorities, and one for the VAT Tax Payments which will represent the payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the VAT Tax Control A/cs. Manual journals will not be allowed so that the Tax column on journals can be verified against the VAT Tax Control A/cs.

All payments to the Tax authorities should be debited to the VAT Tax Payments A/c. Therefore the net of the three a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the VAT input and VAT output accounts is the VAT Tax Payments A/c (here VATP). Therefore, every year, the opening balance for the VAT Input and VAT Output A/cs will be zero and the VAT Tax Payments A/c will be the net tax payable from the prior year.

Defining the Tax Codes

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies.

VAT on sales (output) MUST be separated from VAT on purchases (input) using a blank line as shown below, so that the VAT statement report correctly identifies "VAT collected on outputs" and "VAT on inputs"

Setting up VAT/Tax Registration number

- The VAT/Tax Registration number should be entered in the Company file. This is done in order to get the VAT column in the journal entry page.

- Add VAT/Tax Registration number in the letterhead. This is also done in the Company file.

- Set VAT/Tax Registration number in the Client & Brand file to show Client TRN on invoices.

Making tax columns appear on the Journals

In order to get the VAT column in the journal entry page, make sure Tax Registration number is entered in the Company file.

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Invoice/Credit notes Journal

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6 Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

Purchase Invoice/Media Purchase Invoice Journal

Cost A/C Cr. - 100

Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100

VAT Control A/C Dr. + 5

Supplier A/c Cr. - 105

Receipt Journal

Bank A/C Dr. + 126 Client A/C Cr. - 126

Payment Journal

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Payment Journal

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1

VAT in NEOSYS

Media Module

- One tax code is used per schedule. Line items with a different tax code should be entered in a separate schedule.

- A default tax code can be set by NEOSYS so that users need not enter the tax code each time. For e.g. most clients in Dubai use OSD(VAT Std. Output 5%) as default.

- VAT tax% is applied to the total net amount of the schedule and not per vehicle line.

- The “Tax” column in the schedule file should not be used as invoicing will be blocked. Please use ‘Other’ column if necessary to use a different tax. (For e.g. you can enter “10% tax” in ‘Other’ column, which will be displayed in the printouts as well)

- When issuing a media booking order “Add Standard Tax” must be chosen to display 5% VAT in the booking order printout.

- To display Cost tax in Media Diary, refer to Report on Cost VAT Tax

Production Module

- In Estimate or Production Orders, you can enter different tax codes per line.

- NEOSYS can set a default tax code which will appear automatically in the Tax Code field. Any line items that don’t specify a tax code will use the default tax code defined at the bottom.

- Estimate use tax codes that begin with “O” to apply VAT tax on Outputs. (eg: OSB- Bahrain Std. VAT on Outputs)

- Purchase orders use tax codes that begin with “I” to apply VAT tax on Inputs. (eg: IS- Std. VAT on Inputs)

Finance Module

- TRN will be entered in the Company file.

- The tax amount in intercompany transactions remain in the originating company making Tax audits easier. (http://userwiki.neosys.com/index.php/Finance_FAQ#Why_do_VAT_amounts_stay_in_originating_company_accounts.3F)

- Tax code will be filled automatically on generated journals.

Reports in NEOSYS

- Ledger account/ Statement of Account

You can use this report to check the balance of the different VAT accounts: VATCI, VATCO and VATP.

- Journal Audit Report

This report will give a brief summary of VAT items used in each journal, a VAT analysis for each journal and an analysis on the Grand Total.

This report can be used to get VAT tax summary of all VAT items used in any period.

You can cross-reference the Journal Audit report and the Tax/VAT return report to see if the amounts agree with each other, which they always should.