Account Reconciliation: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

m Page title to appear on "Using NEOSYS Finance System" page |

mNo edit summary |

||

| Line 8: | Line 8: | ||

For example verify invoice amounts on a client account to payments by the client made to the company bank account. | For example verify invoice amounts on a client account to payments by the client made to the company bank account. | ||

Tick the checkbox “Show reconciled items” if you wish to see reconciled items along with non-reconciled items as well. This setting is applicable for items in the latest period only. | |||

#Clicking OK displays a pop-up screen which will show the list of items to be reconciled. | #Clicking OK displays a pop-up screen which will show the list of items to be reconciled. | ||

Latest revision as of 05:18, 18 September 2018

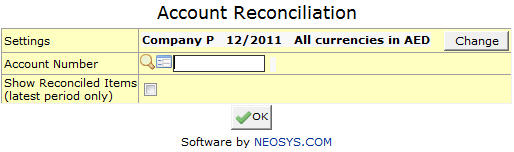

Account Reconciliation

Menu > Finance > Ledger > Account Reconciliation.

Account Reconciliation is used to verify balances of an account against the balances on statements from other sources e.g. Bank statement.

For example verify invoice amounts on a client account to payments by the client made to the company bank account.

Tick the checkbox “Show reconciled items” if you wish to see reconciled items along with non-reconciled items as well. This setting is applicable for items in the latest period only.

- Clicking OK displays a pop-up screen which will show the list of items to be reconciled.

- Click on the reconciled button to copy the figure under Amount column to the field under Amount reconciled. The All/None button can be used to do this action for all transactions or clear all reconciliations

- Click OK at the bottom of the page to generate the Reconciliation statement of the specific account.

- This statement shows the Closing Balance in Books followed by unreconciled debits and credits and Closing Balance in Statement. (debits are subtracted and credits are added to the Closing Balance in Books)