Understanding VAT/Sales Tax in the NEOSYS finance module: Difference between revisions

No edit summary |

|||

| Line 85: | Line 85: | ||

VAT Payable A/c Dr. + 1 | VAT Payable A/c Dr. + 1 | ||

Bank A/c Cr. - 1 | Bank A/c Cr. - 1 | ||

===Understanding Double-Entry Accounting=== | |||

Journal .... | |||

Ledger ... | |||

Account ... | |||

Golden Rule: “for every debit there must be an equal credit” | |||

In the double-entry accounting system, at least two accounting entries are required to record each financial transaction. | |||

E.g in a journal of receipts, where the client pays for your services and you clear the debt they have to you, you would see: Debt Bank A/c +5000 = Credit Client A/c -5000. | |||

Recording a debit amount to one or more accounts must be matched with an equal credit amount to one or more accounts: | |||

E.g in a journal of Invoices, where you create temporary debt for the client until they pay you, you would see: Debit Client A/c +1000 = (Credit Income A/c -950) + (Credit 5%VAT A/c -50) | |||

The total Debits and Credits must equate to zero. This means, the collective result of total debits will equal to total credits on all accounts in a ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having Debit balances will be equal to the aggregate balance of all accounts having Credit balances. This is one of the advantages to double entry accounting, a reliable way to check if there are any errors, because if the total credits and debits don't match then the golden rule was not followed. | |||

Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail. The accounting entries are recorded in the "Books of Accounts". Regardless of which accounts and how many are impacted by a given transaction, the fundamental accounting equation of assets equal liabilities plus capital will hold. | |||

Golden rule 2: “There are no positives or negatives in book keeping.” | |||

Forget that quite widely held belief that debits are positive and credits are negative. | |||

Invoices/Credit notes: | |||

Invoices document declaring a client owes you money. A credit note is a document that records the reversal of a invoice. | |||

E.g you do some work for a client, and you charge $1000, but they dispute the quality of work and you agree to lower the price. Actions taken are, invoice, credit note and then re invoice revised amount. | |||

Basic Invoice journal Entry | |||

Client A/C Dr. + 126 | |||

Income A/c Cr. - 120 | |||

Revision as of 14:11, 9 July 2018

Handling VAT/Sales Tax

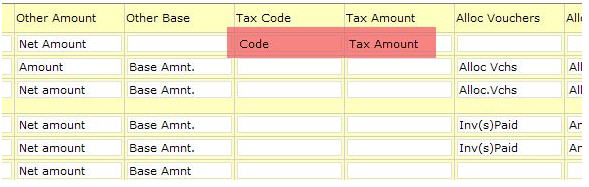

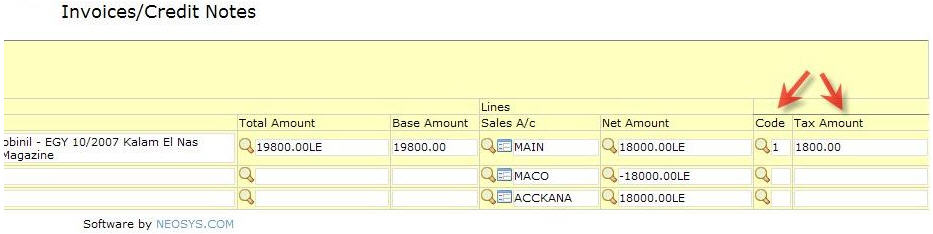

VAT and/or Sales tax is handled in NEOSYS Finance Module by an additional pair of columns on any of the Journals. These two columns are "Tax Code" and "Tax Amount".

On sales journals and cash receipt journals these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals these columns represent VAT tax paid on purchases, which is recoverable from tax authorities.

The amounts in these additional columns are posted as an additional separate line on the vouchers and into a fixed VAT/Tax Control A/c, which is defined in the Chart of Accounts.

NEOSYS billing systems automatically create journals with the correct tax codes and amounts in these additional columns.

NEOSYS has a special VAT/Tax report that shows the total amount of tax per journal and per tax code per period. This report provides a breakdown analysis of the VAT/Tax A/c movements and also can be checked versus the VAT/Tax summary, which is printed at the bottom of all the journal audit reports. There is therefore a three level verifiable control over the tax transactions and reports, which cannot be broken by operator error.

Configuring NEOSYS to handle VAT/Sales Tax

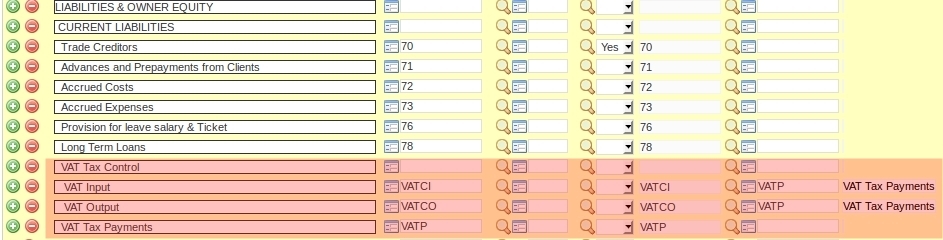

Creating "VAT Input", "VAT Output" and "VAT Tax Payments" A/cs

These should be somewhere in the Current Liabilities section of the chart of accounts.

You must create THREE a/cs, one for the VAT Tax Control INPUT, which will represent the tax paid on purchases which are recoverable from tax authorities, one for VAT Tax Control OUTPUT, which will represent the tax collected and payable to the authorities, and one for the VAT Tax Payments which will represent the payments made to the authorities YTD.

NEOSYS billing systems will automatically post all tax into the VAT Tax Control A/cs. Manual journals will not be allowed so that the Tax column on journals can be verified against the VAT Tax Control A/cs.

All payments to the Tax authorities should be debited to the VAT Tax Payments A/c. Therefore the net of the three a/cs is the current tax liability.

Make sure that the "Closing A/c Code" of the VAT input and VAT output accounts is the VAT Tax Payments A/c (here VATP). Therefore, every year, the opening balance for the VAT Input and VAT Output A/cs will be zero and the VAT Tax Payments A/c will be the net tax payable from the prior year.

Defining the Tax Codes

This is to be done in Finance > Files > Tax Rate File and is applicable to all companies.

VAT on sales (output) MUST be separated from VAT on purchases (input) using a blank line as shown below, so that the VAT statement report correctly identifies "VAT collected on outputs" and "VAT on inputs"

Set VAT/Tax registration number in Company file

Set VAT/Tax registration number on letter head

Making tax columns appear on the Journals

In Journal Setup make sure the tax columns are suitably titled for the relevant journals.

NOTE: On sales journals and cash receipt journals, these columns represent Sales or VAT collected and payable to tax authorities. On purchase or journals or cash payment journals, these columns represent VAT tax paid on purchases which are recoverable from tax authorities.

Check the columns now exist on the relevant journal(s).

Accounting entries

Invoice/Credit notes Journal

Client A/C Dr. + 126 Income A/c Cr. - 120 VAT Control A/C Cr. - 6 Cost A/C Dr. + 100 Accrual A/C Cr. - 100 (Schedule/Job A/C)

Purchase Invoice/Media Purchase Invoice Journal

Cost A/C Cr. - 100

Accrual A/C Dr. + 100 (Schedule/Job A/C)

Cost A/C Dr. + 100

VAT Control A/C Dr. + 5

Supplier A/c Cr. - 105

Receipt Journal

Bank A/C Dr. + 126 Client A/C Cr. - 126

Payment Journal

Bank A/C Cr. - 105 Supplier A/c Dr. + 105

Payment Journal

VAT Payable A/c Dr. + 1 Bank A/c Cr. - 1

Understanding Double-Entry Accounting

Journal ....

Ledger ...

Account ...

Golden Rule: “for every debit there must be an equal credit”

In the double-entry accounting system, at least two accounting entries are required to record each financial transaction.

E.g in a journal of receipts, where the client pays for your services and you clear the debt they have to you, you would see: Debt Bank A/c +5000 = Credit Client A/c -5000.

Recording a debit amount to one or more accounts must be matched with an equal credit amount to one or more accounts:

E.g in a journal of Invoices, where you create temporary debt for the client until they pay you, you would see: Debit Client A/c +1000 = (Credit Income A/c -950) + (Credit 5%VAT A/c -50)

The total Debits and Credits must equate to zero. This means, the collective result of total debits will equal to total credits on all accounts in a ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having Debit balances will be equal to the aggregate balance of all accounts having Credit balances. This is one of the advantages to double entry accounting, a reliable way to check if there are any errors, because if the total credits and debits don't match then the golden rule was not followed.

Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail. The accounting entries are recorded in the "Books of Accounts". Regardless of which accounts and how many are impacted by a given transaction, the fundamental accounting equation of assets equal liabilities plus capital will hold.

Golden rule 2: “There are no positives or negatives in book keeping.”

Forget that quite widely held belief that debits are positive and credits are negative.

Invoices/Credit notes:

Invoices document declaring a client owes you money. A credit note is a document that records the reversal of a invoice.

E.g you do some work for a client, and you charge $1000, but they dispute the quality of work and you agree to lower the price. Actions taken are, invoice, credit note and then re invoice revised amount.

Basic Invoice journal Entry

Client A/C Dr. + 126 Income A/c Cr. - 120