Chart of Accounts: Difference between revisions

m →Chart Account Attributes: Removed to put into Chart of Account Reference Page |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 30: | Line 30: | ||

A workaround in this case is that you will have to create a new account and create a journal to move the balance from the old account to the new account. To prevent any future postings on the old account add the word <stop> with the <> brackets to the old account AFTER you do the journal. | A workaround in this case is that you will have to create a new account and create a journal to move the balance from the old account to the new account. To prevent any future postings on the old account add the word <stop> with the <> brackets to the old account AFTER you do the journal. | ||

Latest revision as of 12:27, 13 August 2018

Chart of Accounts

Understanding the Chart of Accounts

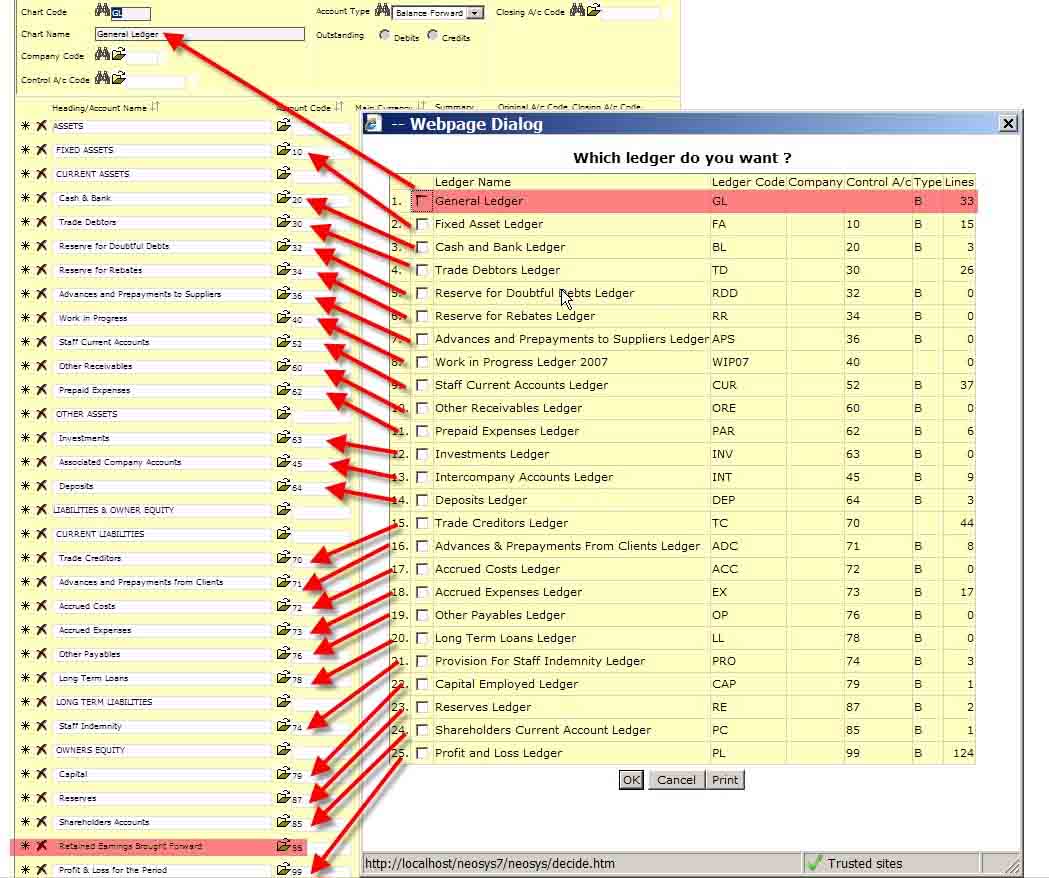

Here you see the chart of accounts for the GL ledger underneath and an almost perfect one to one correlation with the popup list of charts (ledgers)

You need to deeply understand this in order to grasp the beautiful simplicity of having one master chart of accounts (GL) which contains only control accounts which are represented by a series of subsidiary chart of accounts which contain the actual accounts that you can post to. You cannot post to control accounts.

Check for yourself that the control account of each ledger matches to one account in the GL account. Only one ledger in the list of ledgers (charts) has no control a/c and this is the master or top level chart of accounts (GL).

There needs to be one real (ie not control account) account in the master chart of accounts and this is called retained earnings brought forward. This account is the "closing account" of all the P&L accounts.

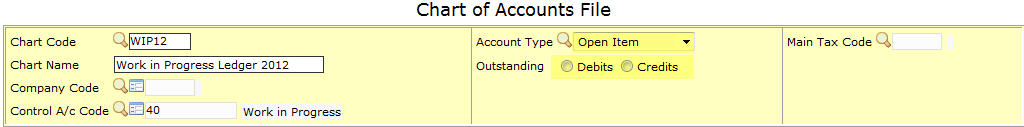

Outstanding

This can only be entered for charts with Account Type: “Open Item”. It has no meaning for balance forward accounts.

Select either “Debit” or “Credit” to indicate, for the accounts in this chart, whether either unallocated debits or credits are to be considered as invoices for the purposes of aged balances reports and allocation. Items of the opposite sign (e.g. unallocated payments or credit notes) will be totaled in the “Unallocated” column.

For asset ledgers, like Accounts Receivables and Clients, “Outstanding” should be “Debit” since outstanding unpaid invoices are debits.

For liability ledgers, like Account Payables and Suppliers, “Outstanding” should be “Credit” since outstanding unpaid invoices are credits.

If left unspecified, NEOSYS tries to determine the sign automatically by checking if the chart code is listed in the “Main Accounts” column of the Journal Setup for journals of type “Sales Invoice” or “Purchase Invoice”.

Moving Accounts between subsidiary charts

You can only move accounts between charts which have the same control account.

A workaround in this case is that you will have to create a new account and create a journal to move the balance from the old account to the new account. To prevent any future postings on the old account add the word <stop> with the <> brackets to the old account AFTER you do the journal.