Vehicle Costs File: Difference between revisions

From NEOSYS User Support Wiki

Jump to navigationJump to search

m 8 revisions |

No edit summary |

||

| Line 2: | Line 2: | ||

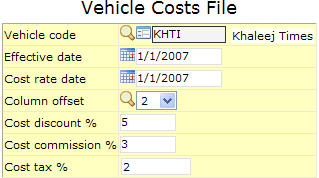

==== Vehicle code ==== | ==== Vehicle code ==== | ||

Vehicle whose cost information is to be entered. | |||

Enter vehicle code. | |||

==== Effective date ==== | ==== Effective date ==== | ||

Updated automatically with the current year. | |||

==== Cost rate date ==== | ==== Cost rate date ==== | ||

Updated automatically with the effective date on the vehicle rate card. | |||

==== Column Offset ==== | ==== Column Offset ==== | ||

The column number which you want to show as the cost on the media schedule. A vehicle rate card can have various rate columns. | |||

Select the column number which you want to show as the cost on the media schedule depending on the specification chosen. | |||

=== Standard deductions and additions applicable to the vehicle === | === Standard deductions and additions applicable to the vehicle === | ||

==== Cost discount ==== | ==== Cost discount ==== | ||

The standard percentage of discount on the cost line | |||

Enter the discount rate. | |||

==== Cost commission ==== | ==== Cost commission ==== | ||

The standard percentage of deduction on the cost as commission on the cost line | |||

Enter the commission rate. | |||

==== Cost tax ==== | ==== Cost tax ==== | ||

The standard percentage of addition on the cost as cost tax. | |||

Enter tax rate. | |||

Latest revision as of 11:08, 11 January 2012

Vehicle code

Vehicle whose cost information is to be entered.

Enter vehicle code.

Effective date

Updated automatically with the current year.

Cost rate date

Updated automatically with the effective date on the vehicle rate card.

Column Offset

The column number which you want to show as the cost on the media schedule. A vehicle rate card can have various rate columns.

Select the column number which you want to show as the cost on the media schedule depending on the specification chosen.

Standard deductions and additions applicable to the vehicle

Cost discount

The standard percentage of discount on the cost line

Enter the discount rate.

Cost commission

The standard percentage of deduction on the cost as commission on the cost line

Enter the commission rate.

Cost tax

The standard percentage of addition on the cost as cost tax.

Enter tax rate.