Entering Opening Balances & Items: Difference between revisions

| (4 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

== | |||

== Entering Opening Balances & Items == | |||

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS | STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS | ||

| Line 76: | Line 77: | ||

=== Subsidiary Open Item Ledgers === | === Subsidiary Open Item Ledgers === | ||

Enter Outstanding items as follows | For open item accounts you should enter opening items if you want to see all the outstanding items one by one on the statement but if you want to have a single outstanding item as the total sum of all then you can enter opening balances only. Therefore entering both opening items AS WELL AS opening balances is not necessary and this will create DOUBLE opening balances if you do. | ||

According to the well known NEOSYS rule, entering any journal in a prior year results in the opening balances of the following years being updated. Therefore the entering of opening items in the last period of the prior year when setting up the system will clearly result in the opening balances of the current year being created. | |||

Entering open balances may be done for selected accounts. It is quicker to startup and saves work of entering all the opening items one by one. But then the opening items are not visible in NEOSYS and all you can see is one lump sum as a single outstanding item representing all outstanding items. In this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients. | |||

Alternatively, you can Enter Outstanding items as follows | |||

#Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). Press F9 to make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED. | #Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). Press F9 to make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED. | ||

| Line 83: | Line 90: | ||

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. Refer to [http://userwiki.neosys.com/index.php/Entering_Opening_Balances_%26_Items#What_are_Opening_Items.3F Opening Items entry ] | Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. Refer to [http://userwiki.neosys.com/index.php/Entering_Opening_Balances_%26_Items#What_are_Opening_Items.3F Opening Items entry ] | ||

=== Posting of foreign currency items and accounts === | === Posting of foreign currency items and accounts === | ||

Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL. | Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL. | ||

== What are Opening Balances? == | === What are Opening Balances? === | ||

Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system. | Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system. | ||

For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account. | For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account. | ||

=== How to enter Opening Balances === | ==== How to enter Opening Balances ==== | ||

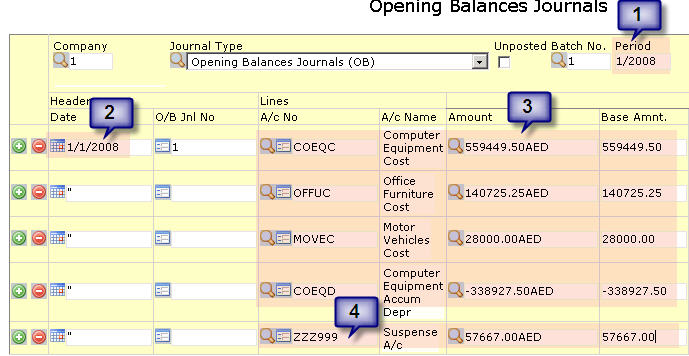

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below: | To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below: | ||

| Line 110: | Line 115: | ||

There are some special considerations for posting the opening balances of the General Ledger: | There are some special considerations for posting the opening balances of the General Ledger: | ||

# | # For control a/c, replace the a/c number with that of the Suspense Account. This is because NEOSYS will not allow you to post the control a/c balances directly because the control a/c balance will be posted automatically from the postings to the accounts in its subsidiary ledger. | ||

# Remember that it is not neccessary that all accounts in the GL is a control a/c and the above step applies only to control a/c. | |||

# For non-control a/c in the GL, enter the a/c number. | |||

# There is no closing line since the total of the General Ledger A/c is zero if it properly balances. | # There is no closing line since the total of the General Ledger A/c is zero if it properly balances. | ||

== What are Opening Items? == | === What are Opening Items? === | ||

When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding ( | When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding (unpaid) items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening items are unpaid invoices and perhaps a few unallocated receipts or payments. | ||

Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology. | Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology. | ||

=== How to enter Opening Items? === | ==== How to enter Opening Items? ==== | ||

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below: | To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below: | ||

Latest revision as of 12:29, 31 July 2018

Entering Opening Balances & Items

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS

A suspense account is required in most of the following procedures. This account will end up as zero at the end of the procedure. NEOSYS support will generally create an account called "Suspense Account" with account code "ZZZ999" and place it somewhere in the General Ledger or Profit and Loss Ledger.

General Ledger/Balance Sheet

You do not have to enter the opening balances before starting to use the system. You can enter them later.

You may enter provisional opening balances and later enter opening balance adjustments.

GL opening balances do not need to be entered when starting up a new company since new companies dont have any opening balances.

It is very easy to get confused and end up with a suspense account balance if you do not keep a clear head. Accountants know than you cannot have only one error in a trial balance so if you end up with a balance in the suspense account at the end of entering opening balances then you can be sure that it means you have an error somewhere else.

Closing Balances

First acquire a closing trial balance from the old system. Ideally it should be in spreadsheet format to enable checking and control.

Use a calculator or spreadsheet to ensure that the closing trial balance totals to zero. It is rare but not unknown that closing trial balances do not actually balance so this should possibility should be eliminated. You may choose to postpone this check and only do it if needed because you cannot get the NEOSYS system opening balances to balance to zero after completing all the stages of entering opening balances.

Preparation

If the NEOSYS account numbers are not the same as the old system account numbers, add a column to the closing trial balance to represent the NEOSYS account number as follows.

For each account in the old GL/BS identify the corresponding new account(s) in the new NEOSYS GL chart of accounts:

If two or more old accounts match to the same GL account in NEOSYS then put the new NEOSYS account number more than once. Do not club them together; leave them as separate lines so they can be reconciled more easily. The balance of the new account will be the total or net of the old accounts.

If an account in the old GL/BS is split into two or more new NEOSYS GL accounts then you must decide the amounts and create two or more lines in the closing trial balance. The old account number will be duplicated and the new NEOSYS account number will be different.

Posting

Create a single NEOSYS Opening Balance Journal (OBJ) with one line for each line in the prepared old closing trial balance.

Such a journal can be clearly be very easily reconciled to the old system. The journal and the new GL/BS will clearly balance since the total of all accounts in a GL/BS is always zero according to accounting rules.

The financial period of the journal MUST be 1/9999.

The journal date should be 1/1/9999 where 9999 is the current financial year.

Post the closing balances from the prepared closing trial balance.

OBJ Journals do not show as movements on the ledger accounts so if you post two opening balance journals to the same account, you will see the net balance in the account.

Control Accounts

You are NOT allowed to post directly into control accounts in NEOSYS. Whenever you are blocked from doing so when entering the Opening Balance Journal, enter the NEOSYS standard Suspense A/c number (ZZZ999) INSTEAD of the NEOSYS control a/c number.

The balance in the ZZZ999 account will be reversed by the entry of the opening balances of the subledgers described elsewhere. Once all the subledgers have their opening balances or items entered and all is 100% correct then the ZZZ999 account balance will be zero.

Quick Option

In practice, nearly all of the accounts in the standard NEOSYS chart of accounts for GL are control accounts. Therefore, since control accounts opening balances are all posted into A/c ZZZ999, you may save time on data entry by clubbing them together into a single journal line (or if not 1, at at least not exactly one line per control A/c).

This is NOT recommended unless you are very familiar with the whole process and have the closing balances in a spreadsheet to make the clubbing together easy - for the following reasons:

- It is harder to reconcile the journal to the source closing balances because you will not have one line per GL/BS account.

- It easy to accidentally club and post NON-control accounts balances into the ZZZ999 suspense account - leaving those accounts WITHOUT an opening balance and the suspence account WITH a pending balance.

Subsidiary Balance Forward Ledgers

Balance Forward Ledgers are for example Bank Ledger, Sundry Payables/Receivables, Staff Loans Ledger etc.

You can, but probably do not want to, treat Clients/Receivables & Suppliers/Payables as balance forward accounts since you would not then be able to get a statement of outstanding items.

For each Balance Forward ledger, create a single Opening Balance Journal with one line per account and an additional contra/closing entry/line to the Suspense A/c (ZZZ999). The additional line must agree with the balance of the ledger in question and can be used as a control check before posting that all the other accounts/amounts have not been mistyped.

The period of the Opening Balance Journals should be the first new accounting period. The journal date does not matter as these do not show as movements (unless you are posting opening balances" on open item accounts) but you are advised to put the first date of the journal period.

Regardless of the period within a financial year that opening balances are posted into NEOSYS always updates the opening balances of the financial year. If you are starting in the middle of the year this doesnt really make any difference.

If you are starting in the middle of a year then for the P&L ledger you might prefer to post a normal Journal instead of an Opening Balance Journal and into one of the old periods in order that the entry shows as a movement of the year instead of an opening balance for the year. This makes no difference to the closing balances of the P&L accounts, but some financial report may be specifically designed to show movements during the year which would exclude exclude opening balances.

Subsidiary Open Item Ledgers

For open item accounts you should enter opening items if you want to see all the outstanding items one by one on the statement but if you want to have a single outstanding item as the total sum of all then you can enter opening balances only. Therefore entering both opening items AS WELL AS opening balances is not necessary and this will create DOUBLE opening balances if you do.

According to the well known NEOSYS rule, entering any journal in a prior year results in the opening balances of the following years being updated. Therefore the entering of opening items in the last period of the prior year when setting up the system will clearly result in the opening balances of the current year being created.

Entering open balances may be done for selected accounts. It is quicker to startup and saves work of entering all the opening items one by one. But then the opening items are not visible in NEOSYS and all you can see is one lump sum as a single outstanding item representing all outstanding items. In this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients.

Alternatively, you can Enter Outstanding items as follows

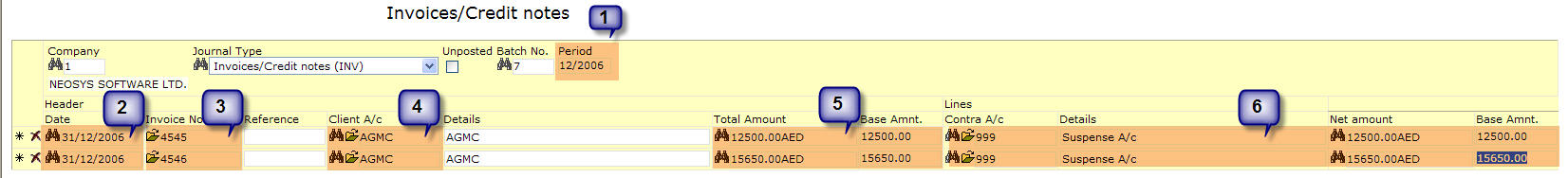

- Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). Press F9 to make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED.

- Enter 1 Batch of outstanding invoices in the Invoices Journal for all the smaller/remaining a/c's with relatively few items. No check is possible unless all accounts for one ledger are in one batch then Press F9 to check if total matches open balance of the ledger.

- Enter batches of receipts and/or payments for any unallocated payments and receipts.

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. Refer to Opening Items entry

Posting of foreign currency items and accounts

Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL.

What are Opening Balances?

Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system.

For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account.

How to enter Opening Balances

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below:

- Enter period 1 and the year that you are interested in. Putting any other period but 1 makes no difference since NEOSYS always puts them in period 1.

- Put date 1/1 of the same year. Since opening balances DONT show as entries on the account it doesnt matter what you put here.

- Enter all the account numbers for one ledger (eg bank accounts) into one batch/journal voucher, putting a - (negative sign) for credit balances.

- The last line of the journal voucher "closes" the balance of the journal to the Suspense Account which usually is ZZZ999 or 999. You can check that the last line agrees with the total balance of the ledger before posting to ensure that no mistakes have been made.

- Repeat the above steps for each ledger that has to be opened.

There are some special considerations for posting the opening balances of the General Ledger:

- For control a/c, replace the a/c number with that of the Suspense Account. This is because NEOSYS will not allow you to post the control a/c balances directly because the control a/c balance will be posted automatically from the postings to the accounts in its subsidiary ledger.

- Remember that it is not neccessary that all accounts in the GL is a control a/c and the above step applies only to control a/c.

- For non-control a/c in the GL, enter the a/c number.

- There is no closing line since the total of the General Ledger A/c is zero if it properly balances.

What are Opening Items?

When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding (unpaid) items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening items are unpaid invoices and perhaps a few unallocated receipts or payments.

Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology.

How to enter Opening Items?

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Enter the ORIGINAL invoice date for each invoice (not the closing date of the prior period as shown in the example)

- Enter each invoice details i.e. the invoice number

- Select the Client/Supplier account

- Enter the invoice amount

- The contra account must be the suspense account which usually is ZZZ999 or 999.

- Is it advisable to stop and post the batch once per large account because you can then check that the batch total agrees with the balance of the account to prevent mistakes before posting.