Recurring Journals: Difference between revisions

| Line 1: | Line 1: | ||

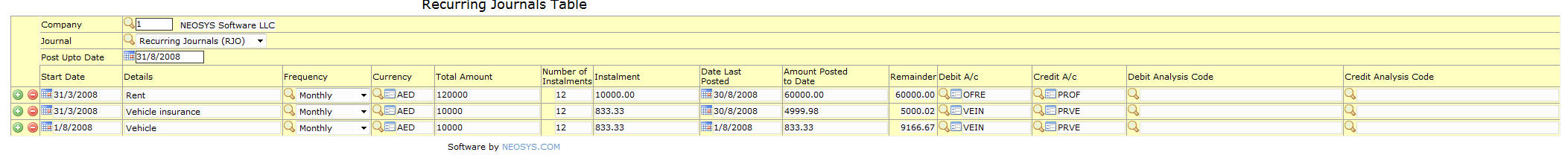

[[file:recuringjournal.jpg|center|frame|Recurring Journals Table]] | [[file:recuringjournal.jpg|center|frame|Recurring Journals Table]] | ||

==Recurring Journals Table== | |||

===Company=== | |||

Company in Finance>Settings is chosen automatically. Manually enter the company code or use the search icon to choose from list of existing companies. | |||

===Journal=== | |||

Choose the journal type for the recurring postings from drop down | |||

===Post Upto Date=== | |||

Enter date upto which recurring journals must be posted. | |||

===Start Date=== | |||

Enter start date for the recurring journal | |||

===Details=== | |||

Enter details for the specific recurring journal | |||

===Frequency=== | |||

Enter frequency of posting journal (daily, every period, monthly, quarterly, annually and every time) | |||

#Choose <b>Daily</b> to post entries on each day between the Start date and Post upto date. All the entries will be in a single batch | |||

#Choose <b>Every period</b> to post entries on the last day of the period | |||

#Choose <b>Monthly</b> to post entries on the same date as start date, every month. Similarly choose <b>Quarterly</b> for every quarter and <b>Annually</b> for every year. | |||

#Choose <b>Everytime</b> to post entries on the Start date and Post Upto date only | |||

===Currency=== | |||

Manually enter currency code OR choose currency using search icon | |||

===Total Amount=== | |||

Total amount i.e. sum of all installments in the recurring journal | |||

===Number of instalments=== | |||

Specify number of installments | |||

===Instalment=== | |||

Single installment amount based on total amount and number of instalments. | |||

Changing any one of the above three fields re-calculates the other two. | |||

===Date Last Posted=== | |||

Date the last posting was made, which is on or before the Post Upto date, depending on the frequency chosen. | |||

===Amount posted to date=== | |||

Total of Amount of instalments posted upto the Date Last Posted | |||

===Remainder=== | |||

Remaining amount to be posted automatically calculated | |||

===Debit A/c and Credit A/c=== | |||

Specify Account code of the debit account and credit account manually or using search icon | |||

===Debit Analysis code and Credit Analysis code=== | |||

Analysis code is must and only required for accounts which are defined as a bill or cost account on billing analysis type | |||

Revision as of 12:41, 4 June 2014

Recurring Journals Table

Company

Company in Finance>Settings is chosen automatically. Manually enter the company code or use the search icon to choose from list of existing companies.

Journal

Choose the journal type for the recurring postings from drop down

Post Upto Date

Enter date upto which recurring journals must be posted.

Start Date

Enter start date for the recurring journal

Details

Enter details for the specific recurring journal

Frequency

Enter frequency of posting journal (daily, every period, monthly, quarterly, annually and every time)

- Choose Daily to post entries on each day between the Start date and Post upto date. All the entries will be in a single batch

- Choose Every period to post entries on the last day of the period

- Choose Monthly to post entries on the same date as start date, every month. Similarly choose Quarterly for every quarter and Annually for every year.

- Choose Everytime to post entries on the Start date and Post Upto date only

Currency

Manually enter currency code OR choose currency using search icon

Total Amount

Total amount i.e. sum of all installments in the recurring journal

Number of instalments

Specify number of installments

Instalment

Single installment amount based on total amount and number of instalments.

Changing any one of the above three fields re-calculates the other two.

Date Last Posted

Date the last posting was made, which is on or before the Post Upto date, depending on the frequency chosen.

Amount posted to date

Total of Amount of instalments posted upto the Date Last Posted

Remainder

Remaining amount to be posted automatically calculated

Debit A/c and Credit A/c

Specify Account code of the debit account and credit account manually or using search icon

Debit Analysis code and Credit Analysis code

Analysis code is must and only required for accounts which are defined as a bill or cost account on billing analysis type