Entering Opening Balances & Items: Difference between revisions

| Line 1: | Line 1: | ||

== Procedure for companies to move to NEOSYS accounting system == | == Procedure for companies to move to NEOSYS accounting system == | ||

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME | STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS | ||

=== General Ledger/Balance Sheet === | |||

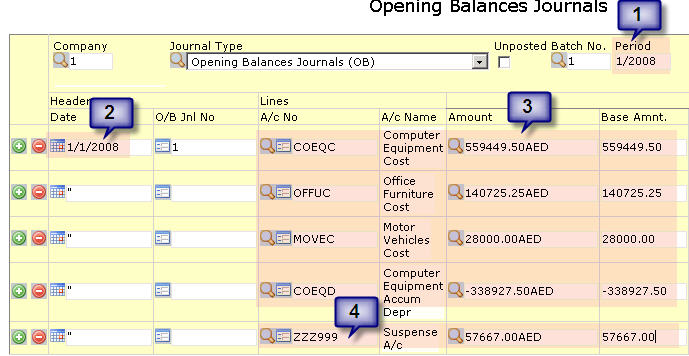

Opening | Create a single Opening Balance Journal with one line for each A/c in the General Ledger/Balance Sheet. Post the closing balance from the old accounting system. You are not allowed to post directly to control accounts in NEOSYS so simply us the Suspense A/c number (ZZZ999) instead. The total of any GL/BS must be zero so the journal will balance and can be posted. | ||

=== Subsidiary Balance Forward Ledgers === | |||

Balance Forward Ledgers are for example Bank Ledger, Sundry Payables/Receivables, Staff Loans Ledger etc. | |||

You can, but probably do not want to, treat Clients/Receivables & Suppliers/Payables as balance forward accounts since you would not then be able to get a statement of outstanding items. | |||

For each Balance Forward ledger, create a single Opening Balance Journal with one line per account and an additional contra/closing entry/line to the Suspense A/c (ZZZ999). The additional line must agree with the balance of the ledger in question and can be used as a control check before posting that all the other accounts/amounts have not been mistyped. | |||

The period of the Opening Balance Journals should be the first new accounting period. The journal date does not matter as these do not show as movements (unless you are posting opening balances" on open item accounts) but you are advised to put the first date of the journal period. | |||

Regardless of the period within a financial year that opening balances are posted into NEOSYS always updates the opening balances of the financial year. If you are starting in the middle of the year this doesnt really make any difference. | |||

If you are starting in the middle of a year then for the P&L ledger you might prefer to post a normal Journal instead of an Opening Balance Journal and into one of the old periods in order that the entry shows as a movement of the year instead of an opening balance for the year. This makes no difference to the closing balances of the P&L accounts, but some financial report may be specifically designed to show movements during the year which would exclude exclude opening balances. | |||

=== Subsidiary Open Item Ledgers === | |||

Enter Outstanding items as follows | |||

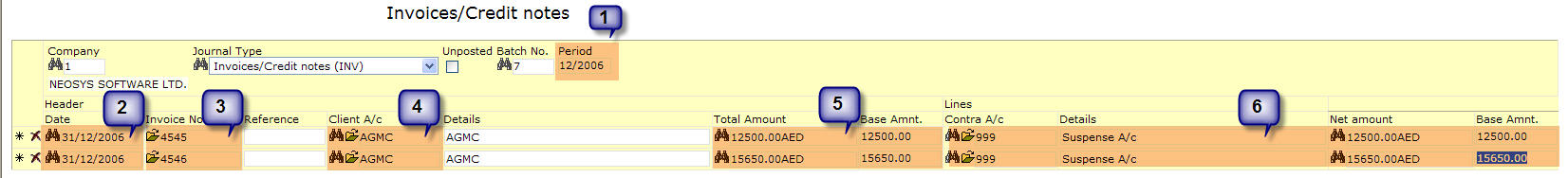

#Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). You make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED. | |||

#Enter 1 Batch of outstanding invoices in the Invoices Journal for all the smaller/remaining a/c's with relatively few items. | |||

#Enter batches of receipts and/or payments for any unallocated payments and receipts. | |||

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items. | |||

Alternatively, to save the work of entering all the opening items one by one you can treat receivable/payable accounts as balance forward ledgers. It this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients. | |||

=== Posting of foreign currency items and accounts === | === Posting of foreign currency items and accounts === | ||

Revision as of 12:36, 1 June 2008

Procedure for companies to move to NEOSYS accounting system

STEPS DO NOT NEED TO BE CARRIED OUT IN ORDER OR ALL AT THE SAME TIME OR BEFORE YOU START ENTERING CURRENT TRANSACTIONS

General Ledger/Balance Sheet

Create a single Opening Balance Journal with one line for each A/c in the General Ledger/Balance Sheet. Post the closing balance from the old accounting system. You are not allowed to post directly to control accounts in NEOSYS so simply us the Suspense A/c number (ZZZ999) instead. The total of any GL/BS must be zero so the journal will balance and can be posted.

Subsidiary Balance Forward Ledgers

Balance Forward Ledgers are for example Bank Ledger, Sundry Payables/Receivables, Staff Loans Ledger etc.

You can, but probably do not want to, treat Clients/Receivables & Suppliers/Payables as balance forward accounts since you would not then be able to get a statement of outstanding items.

For each Balance Forward ledger, create a single Opening Balance Journal with one line per account and an additional contra/closing entry/line to the Suspense A/c (ZZZ999). The additional line must agree with the balance of the ledger in question and can be used as a control check before posting that all the other accounts/amounts have not been mistyped.

The period of the Opening Balance Journals should be the first new accounting period. The journal date does not matter as these do not show as movements (unless you are posting opening balances" on open item accounts) but you are advised to put the first date of the journal period.

Regardless of the period within a financial year that opening balances are posted into NEOSYS always updates the opening balances of the financial year. If you are starting in the middle of the year this doesnt really make any difference.

If you are starting in the middle of a year then for the P&L ledger you might prefer to post a normal Journal instead of an Opening Balance Journal and into one of the old periods in order that the entry shows as a movement of the year instead of an opening balance for the year. This makes no difference to the closing balances of the P&L accounts, but some financial report may be specifically designed to show movements during the year which would exclude exclude opening balances.

Subsidiary Open Item Ledgers

Enter Outstanding items as follows

- Enter 1 Batch of Outstanding invoices in the Invoices Journal per account (either Client or Supplier) with many outstanding items / invoices and as you post it with the contra a/c as the Suspense A/c (ZZZ999). You make sure the balance / batch totals match the balance of the A/c. Eg. Client XYZ balance is 100,000 AED and the batch total should be 100,000 AED.

- Enter 1 Batch of outstanding invoices in the Invoices Journal for all the smaller/remaining a/c's with relatively few items.

- Enter batches of receipts and/or payments for any unallocated payments and receipts.

Date each entry as per the original invoice/document but the journal period should be the period before the opening period. For example, if you are starting the new financial year on 1/2008, then the period will be 12/2007. This is done so that invoices dont show as movements in the current financial period and show as Opening items.

Alternatively, to save the work of entering all the opening items one by one you can treat receivable/payable accounts as balance forward ledgers. It this case their statements will show a single outstanding item representing the total of the outstanding items. It is more common to do this for suppliers/payables than clients/receivables since you do not have to send suppliers statements of outstanding items like you do for clients.

Posting of foreign currency items and accounts

Accountants should give foreign currency and base currency statements. Sometimes accountants give the Balance sheet in base currency which is at a particular exchange rate, but the accounts in subsidiary ledgers show in foreign currency (eg clients) and the exchange rate is only know to them. Hence this causes a problem as NEOSYS might value at its own rates and the control a/c will not tally with the subsidiary ledger. Every account in the subsidiary ledgers should total up and match the Control A/c in the GL.

What are Opening Balances?

Opening Balances are the balance of accounts at the start of an accounting period. When we have new clients moving from their existing accounting system to the NEOSYS accounting system, they need to enter Opening Balances of various heads of the General Ledger which are actually the Closing Balances of the previous accounting system.

For subsequent years, NEOSYS automatically carries the closing balances forward to become the opening balances of the following years - except for P&L accounts which are closed to the Retained Earning account.

How to enter Opening Balances

To enter the Opening Balances, go to Finance > Journal > Journal Entry and select the Opening Balances Journal and follow the below:

- Enter period 1 and the year that you are interested in. Putting any other period but 1 makes no difference since NEOSYS always puts them in period 1.

- Put date 1/1 of the same year. Since opening balances DONT show as entries on the account it doesnt matter what you put here.

- Enter all the account numbers for one ledger (eg bank accounts) into one batch/journal voucher, putting a - (negative sign) for credit balances.

- The last line of the journal voucher "closes" the balance of the journal to the Suspense Account which usually is ZZZ999 or 999. You can check that the last line agrees with the total balance of the ledger before posting to ensure that no mistakes have been made.

- Repeat the above steps for each ledger that has to be opened.

There are some special considerations for posting the opening balances of the General Ledger:

- Replace the a/c number of any control a/c with that of the Suspense Account. NEOSYS will not allow you to post the control a/c balances directly because the control a/c balance will be posted automatically from the postings to the accounts in its subsidiary ledger.

- There is no closing line since the total of the General Ledger A/c is zero if it properly balances.

(the following image needs correcting to show the period and date as per notes above)

What are Opening Items?

When companies move to any new accounting system (referred to as NEOSYS), they usually prefer to enter the outstanding (unpoad) items of the Trade Creditors & Trade Debtors, rather than entering opening balances. Opening items are unpaid invoices and perhaps a few unallocated receipts or payments.

Opening items is a NEOSYS term that corresponds to the "opening balances" of open items accounts in normal financial terminology.

How to enter Opening Items?

To enter the Opening Items, go to Finance > Journal > Journal Entry and select the respective Journal i.e. to enter Client opening items select Media Invoices/Invoices or for Supplier opening items select Purchase Invoices/Media Purchase Invoices and follow the below:

- Enter any period prior to the new first period so they show as opening items in the first period.

- Enter the ORIGINAL invoice date for each invoice (not the closing date of the prior period as shown in the example)

- Enter each invoice details i.e. the invoice number

- Select the Client/Supplier account

- Enter the invoice amount

- The contra account must be the suspense account which usually is ZZZ999 or 999.

- Is it advisable to stop and post the batch once per large account because you can then check that the batch total agrees with the balance of the account to prevent mistakes before posting.